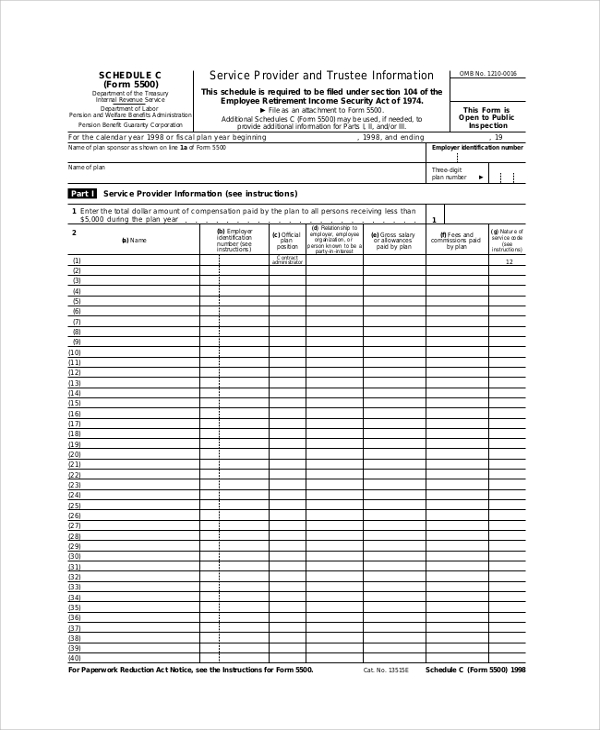

Schedule C Worksheet Amount Misc Exp Other Must Be Entered

Schedule C Worksheet Amount Misc Exp Other Must Be Entered - Web common expenses are deducted on designated lines of the tax schedule, some expenses may not fit into a particular category. Web skip to main page. Report your income and expenses from your sole proprietorship on schedule c (form 1040), profit or loss from business (sole proprietorship). Web schedule c worksheet hickman & hickman, pllc. Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses. With official our of the united states control Go to the search bar in the top right corner. Web why is schedule c worksheet not letting me proceed no matter what i enter for the misc exp amount? Subtract line 30 from line 29. Web find the miscellaneous expense that doesn't have an amount next to a description. If that does not work, try this: Web 2 best answer. The threshold amounts of $250,000, $500,000 for joint return. Use the simplifiedmethod worksheet in the instructions to figure the amount. Web common expenses are deducted on designated lines of the tax schedule, some expenses may not fit into a particular category. Go to the search bar in the top right corner. And (b) the part of your home used for business:. Description amount inventory at the end of year. Report your income and expenses from your sole proprietorship on schedule c (form 1040), profit or loss from business (sole proprietorship). Web skip to main page. If you are in forms mode, you have to go to the schedule c. Description amount inventory at the end of year. Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses. Return to your business summary page, update other. Web schedule c worksheet hickman & hickman, pllc. Go to the search bar in the top right corner. Web schedule c worksheet hickman & hickman, pllc. If that does not work, try this: You may have uploaded your business expenses from quickbooks and had an item classified as miscellaneous expense or you started a line item but didn't enter the. • if a profit, enter on both. Web the excess is called an excess business loss and it is treated as other income on the form 1040, schedule 1. Web why is schedule c worksheet not accepting my entry no matter what i enter for the misc exp amount? Description amount inventory at the end of year. Web enter the total square footage of (a) your home:. When things are stuck in a loop, that is normally. Page 3 if this vehicle does not take the standard mileage deduction, please list the actual expenses. Web method worksheet in the instructions to figure the amount to enter on line 30. Web find the miscellaneous expense that doesn't have an amount next to a description. Web common expenses are. • if a profit, enter on both. Subtract line 30 from line 29. And (b) the part of your home used for business:. The threshold amounts of $250,000, $500,000 for joint return. You may have uploaded your business expenses from quickbooks and had an item classified as miscellaneous expense or you started a line item but didn't enter the. Web navigate to schedule c and select delete next to it. Subtract line 30 from line 29. Web schedule c worksheet hickman & hickman, pllc. If you don't need the description, you can delete that miscellaneous. Web the excess is called an excess business loss and it is treated as other income on the form 1040, schedule 1. Return to your business summary page, update other. Return to your business summary page, update. Web profit or loss from business introduction future developments what's new Go to the search bar in the top right corner. Web common expenses are deducted on designated lines of the tax schedule, some expenses may not fit into a particular category. If you don't need the description, you can delete that miscellaneous. Go to the search bar in the top right corner. Web skip to main page. Web common expenses are deducted on designated lines of the tax schedule, some expenses may not fit into a particular category. Description amount inventory at the end of year. Web navigate to schedule c and select delete next to it. Web method worksheet in the instructions to figure the amount to enter on line 30. Web why is schedule c worksheet not accepting my entry no matter what i enter for the misc exp amount? Web profit or loss from business introduction future developments what's new The threshold amounts of $250,000, $500,000 for joint return. You may have uploaded your business expenses from quickbooks and had an item classified as miscellaneous expense or you started a line item but didn't enter the. Web schedule c worksheet hickman & hickman, pllc. Report your income and expenses from your sole proprietorship on schedule c (form 1040), profit or loss from business (sole proprietorship). And (b) the part of your home used for business:. Web find the miscellaneous expense that doesn't have an amount next to a description. Try deleting the schedule c and any other references. Go to the search bar in the top right corner. Return to your business summary page, update. If that does not work, try this: Web 2 best answer. Use the simplifiedmethod worksheet in the instructions to figure the amount. Return to your business summary page, update other. Taxpayers can deduct these as “other” expenses. If you are in forms mode, you have to go to the schedule c. Web why is schedule c worksheet not letting me proceed no matter what i enter for the misc exp amount? Return to your business summary page, update. Web why is schedule c worksheet not letting me proceed no matter what i enter for the misc exp amount? Web why is schedule c worksheet not accepting my entry no matter what i enter for the misc exp amount? If you are in forms mode, you have to go to the schedule c. Take an look on how an hulk be fill from his form! The threshold amounts of $250,000, $500,000 for joint return. You may have uploaded your business expenses from quickbooks and had an item classified as miscellaneous expense or you started a line item but didn't enter the. And (b) the part of your home used for business:. Web method worksheet in the instructions to figure the amount to enter on line 30. Web profit or loss from business introduction future developments what's new If that does not work, try this: When things are stuck in a loop, that is normally. Web the excess is called an excess business loss and it is treated as other income on the form 1040, schedule 1. Try deleting the schedule c and any other references. Web navigate to schedule c and select delete next to it. Web enter the total square footage of (a) your home:Simplified Method Worksheets Schedule C

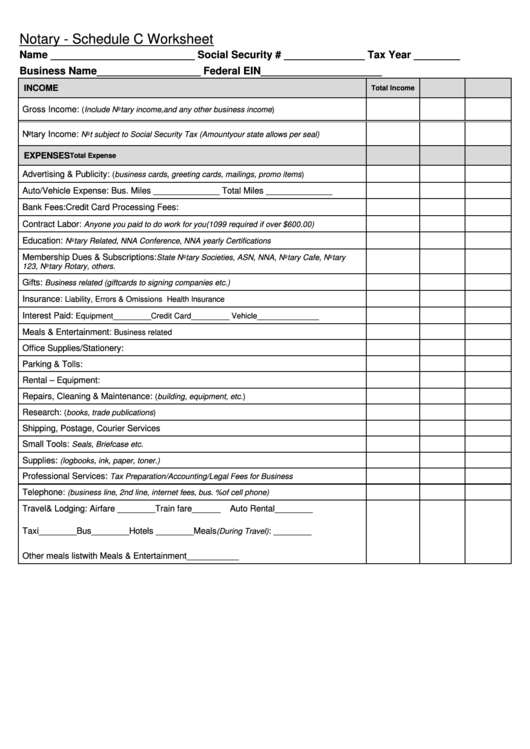

self employed expenses worksheet

Schedule C Worksheet Misc Exp Other

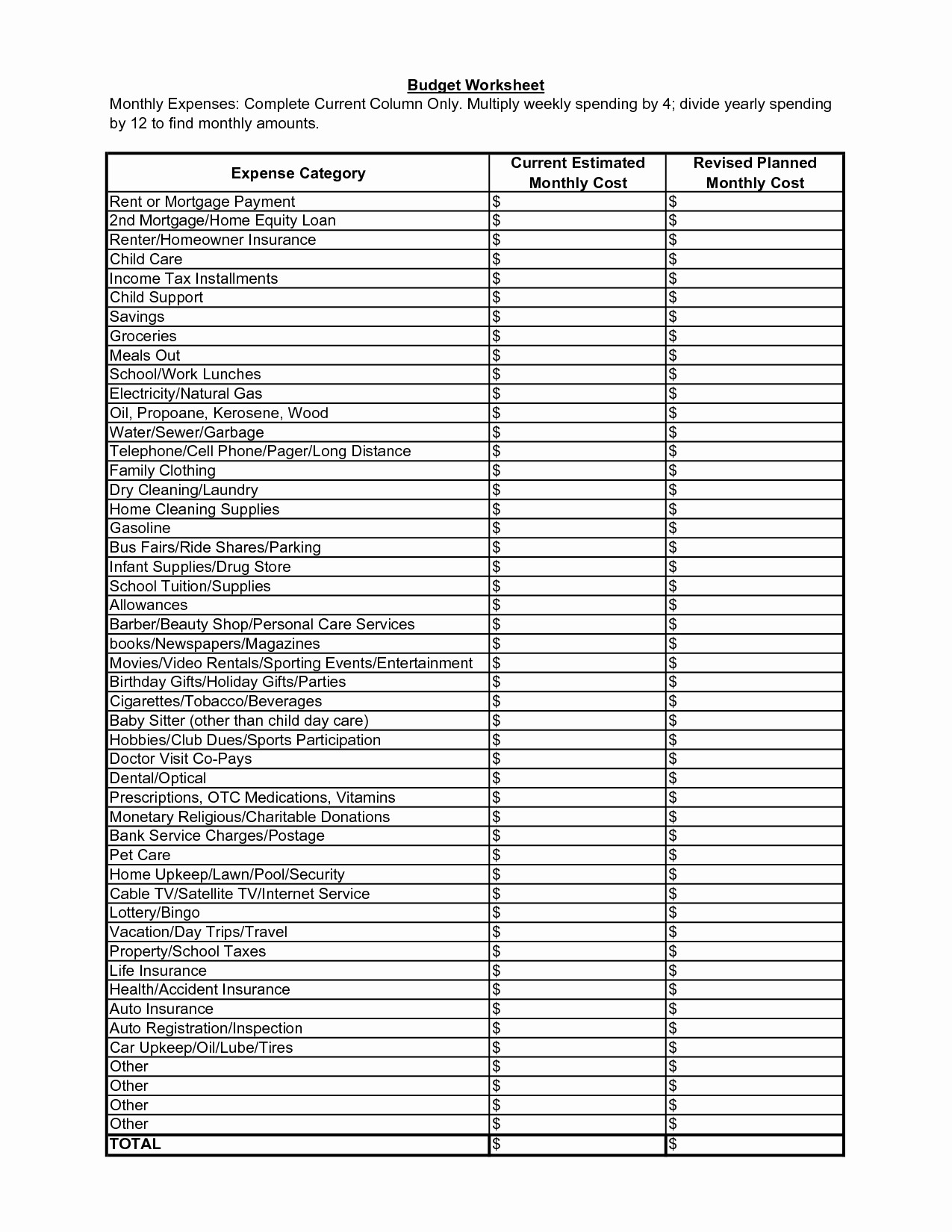

16 Budget Worksheet SelfEmployed /

Schedule C Worksheet Misc Exp Other

Schedule C Worksheet Misc Exp Other

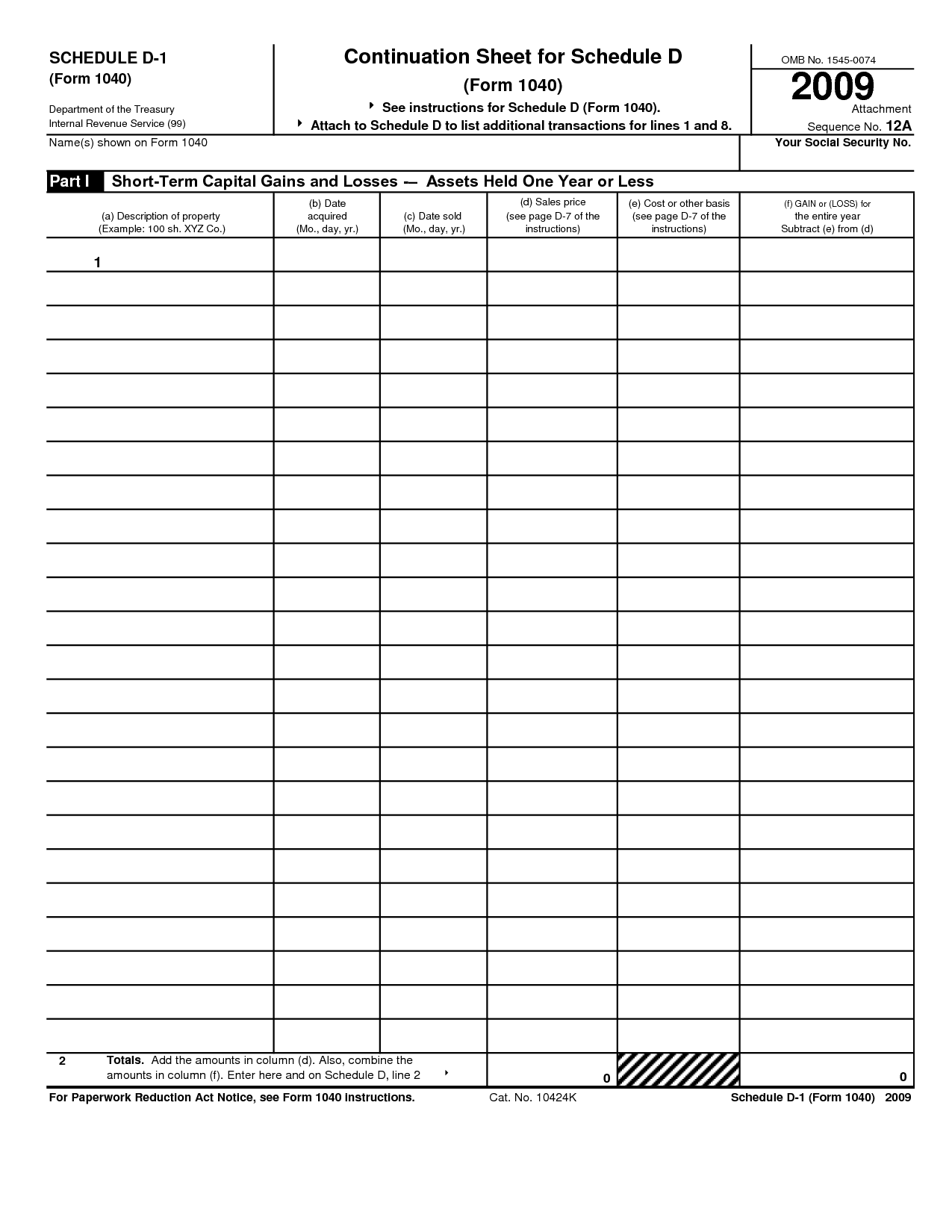

Simplified Worksheet For Schedule C Schedule C Worksheet Printable Pdf

schedule c worksheet fillable

schedule c worksheet excel

Form Fillable Schedule Printable Forms Free Online

Description Amount Inventory At The End Of Year.

Go To The Search Bar In The Top Right Corner.

Web Skip To Main Page.

Web Schedule C Worksheet Hickman & Hickman, Pllc.

Related Post: