Schedule C Worksheet

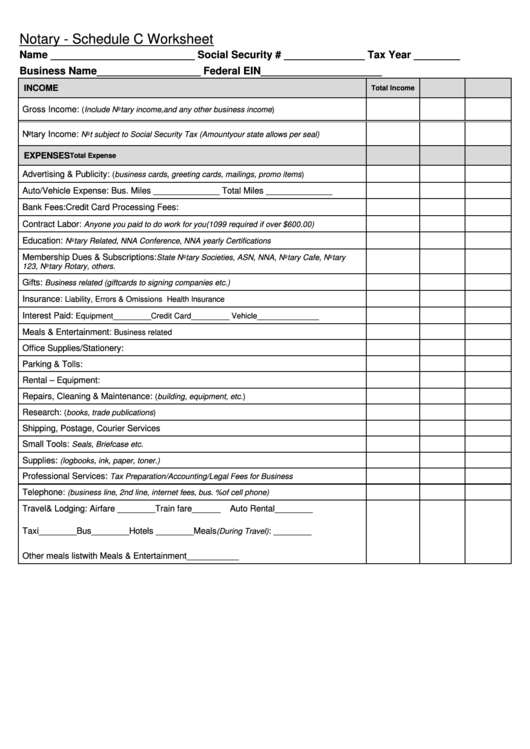

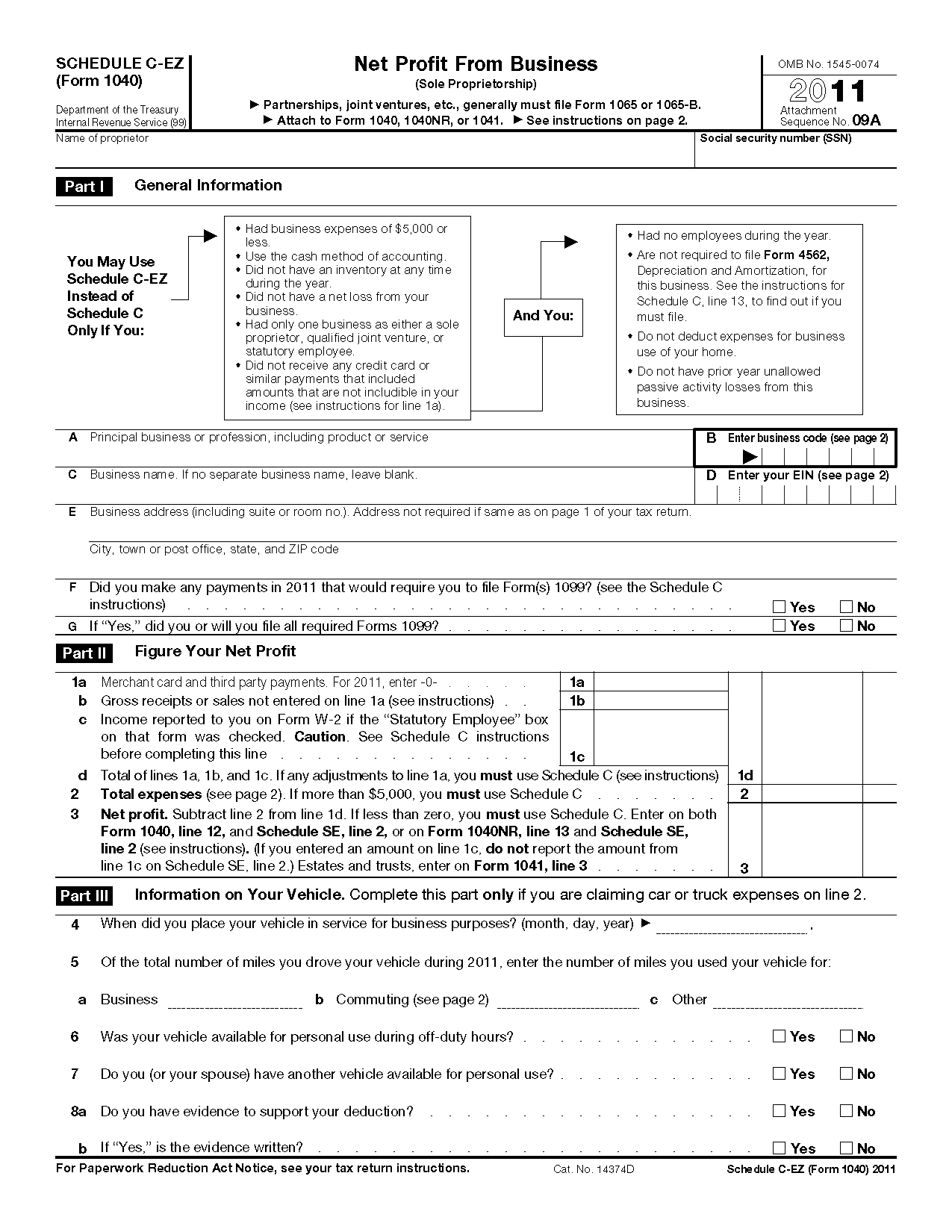

Schedule C Worksheet - Get everything done in minutes. Web • schedule c income in round numbers • schedule c cash businesses as the only income on a return claiming eitc • schedule c with little or no expenses when expenses would. Web updated on january 23, 2023 reviewed by khadija khartit fact checked by lars peterson in this article who uses schedule c for business taxes? Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Web form 11652 (january 2021) questionnaire and supporting documentation form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records. You may also need form 4562 to claim depreciation or. Web schedule c calculate the monthly qualifying income for a borrower who is a sole proprietor. Web go to www.irs.gov/schedulec for instructions and the latest information. Web usually, people who file a schedule c tax form will also have to file a schedule se tax form: Partnerships must generally file form 1065. 2021 schedue c & e worksheets.xlsx author: Web example joe, a schedule c sole proprietor, will have $100,000 net profit on his 2019 schedule c (after deducting all schedule c expenses, including a 10% retirement plan. An activity qualifies as a business if your. You fill out schedule c at tax time and attach it to or file it electronically. Web schedule c calculate the monthly qualifying income for a borrower who is a sole proprietor. Web go to www.irs.gov/schedulec for instructions and the latest information. You fill out schedule c at tax time and attach it to or file it electronically with form 1040. You may also need form 4562 to claim depreciation or. Get everything done in minutes. Web updated on january 23, 2023 reviewed by khadija khartit fact checked by lars peterson in this article who uses schedule c for business taxes? Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. An activity qualifies as a business if: You fill out schedule c at tax time and. Web • schedule c income in round numbers • schedule c cash businesses as the only income on a return claiming eitc • schedule c with little or no expenses when expenses would. Web irs schedule c is a tax form for reporting profit or loss from a business. You fill out schedule c at tax time and attach it. Web usually, people who file a schedule c tax form will also have to file a schedule se tax form: Web form 11652 (january 2021) questionnaire and supporting documentation form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records. You fill out schedule c at tax time and attach it to or file it. An activity qualifies as a business if: Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Web updated on january 23, 2023 reviewed by khadija khartit fact checked by lars peterson in this article who uses schedule c for business taxes? Get everything done. Web • schedule c income in round numbers • schedule c cash businesses as the only income on a return claiming eitc • schedule c with little or no expenses when expenses would. An activity qualifies as a business if your. You may also need form 4562 to claim depreciation or. Web usually, people who file a schedule c tax. An activity qualifies as a business if your. You fill out schedule c at tax time and attach it to or file it electronically with form 1040. Web example joe, a schedule c sole proprietor, will have $100,000 net profit on his 2019 schedule c (after deducting all schedule c expenses, including a 10% retirement plan. Web use schedule c. Web go to www.irs.gov/schedulec for instructions and the latest information. Web irs schedule c is a tax form for reporting profit or loss from a business. Get everything done in minutes. Web updated on january 23, 2023 reviewed by khadija khartit fact checked by lars peterson in this article who uses schedule c for business taxes? An activity qualifies as. Web irs schedule c is a tax form for reporting profit or loss from a business. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your. Web example joe, a schedule c sole proprietor, will have $100,000. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Get everything done in minutes. Web usually, people who file a schedule c tax form will also have to file a schedule se tax form: An activity qualifies as a business if: Web form 11652 (january 2021) questionnaire and supporting documentation form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records. Web irs schedule c is a tax form for reporting profit or loss from a business. You may also need form 4562 to claim depreciation or. Web go to www.irs.gov/schedulec for instructions and the latest information. Partnerships must generally file form 1065. An activity qualifies as a business if your. Web schedule c calculate the monthly qualifying income for a borrower who is a sole proprietor. You fill out schedule c at tax time and attach it to or file it electronically with form 1040. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web • schedule c income in round numbers • schedule c cash businesses as the only income on a return claiming eitc • schedule c with little or no expenses when expenses would. Web example joe, a schedule c sole proprietor, will have $100,000 net profit on his 2019 schedule c (after deducting all schedule c expenses, including a 10% retirement plan. 2021 schedue c & e worksheets.xlsx author: Web updated on january 23, 2023 reviewed by khadija khartit fact checked by lars peterson in this article who uses schedule c for business taxes? Get everything done in minutes. Web updated on january 23, 2023 reviewed by khadija khartit fact checked by lars peterson in this article who uses schedule c for business taxes? Web • schedule c income in round numbers • schedule c cash businesses as the only income on a return claiming eitc • schedule c with little or no expenses when expenses would. 2021 schedue c & e worksheets.xlsx author: Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web usually, people who file a schedule c tax form will also have to file a schedule se tax form: You fill out schedule c at tax time and attach it to or file it electronically with form 1040. An activity qualifies as a business if your. Partnerships must generally file form 1065. Web form 11652 (january 2021) questionnaire and supporting documentation form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records. Web schedule c calculate the monthly qualifying income for a borrower who is a sole proprietor. Web example joe, a schedule c sole proprietor, will have $100,000 net profit on his 2019 schedule c (after deducting all schedule c expenses, including a 10% retirement plan. An activity qualifies as a business if: Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor.Schedule C Worksheet printable pdf download

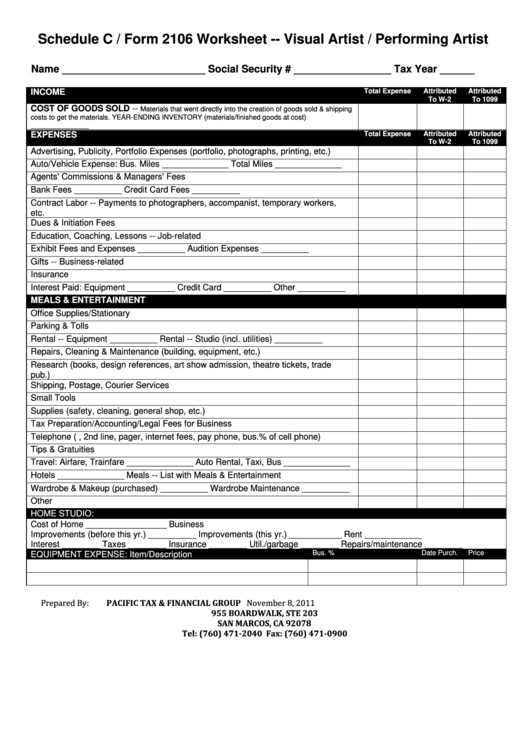

Schedule C / Form 2106 Worksheet Visual Artist / Performing Artist

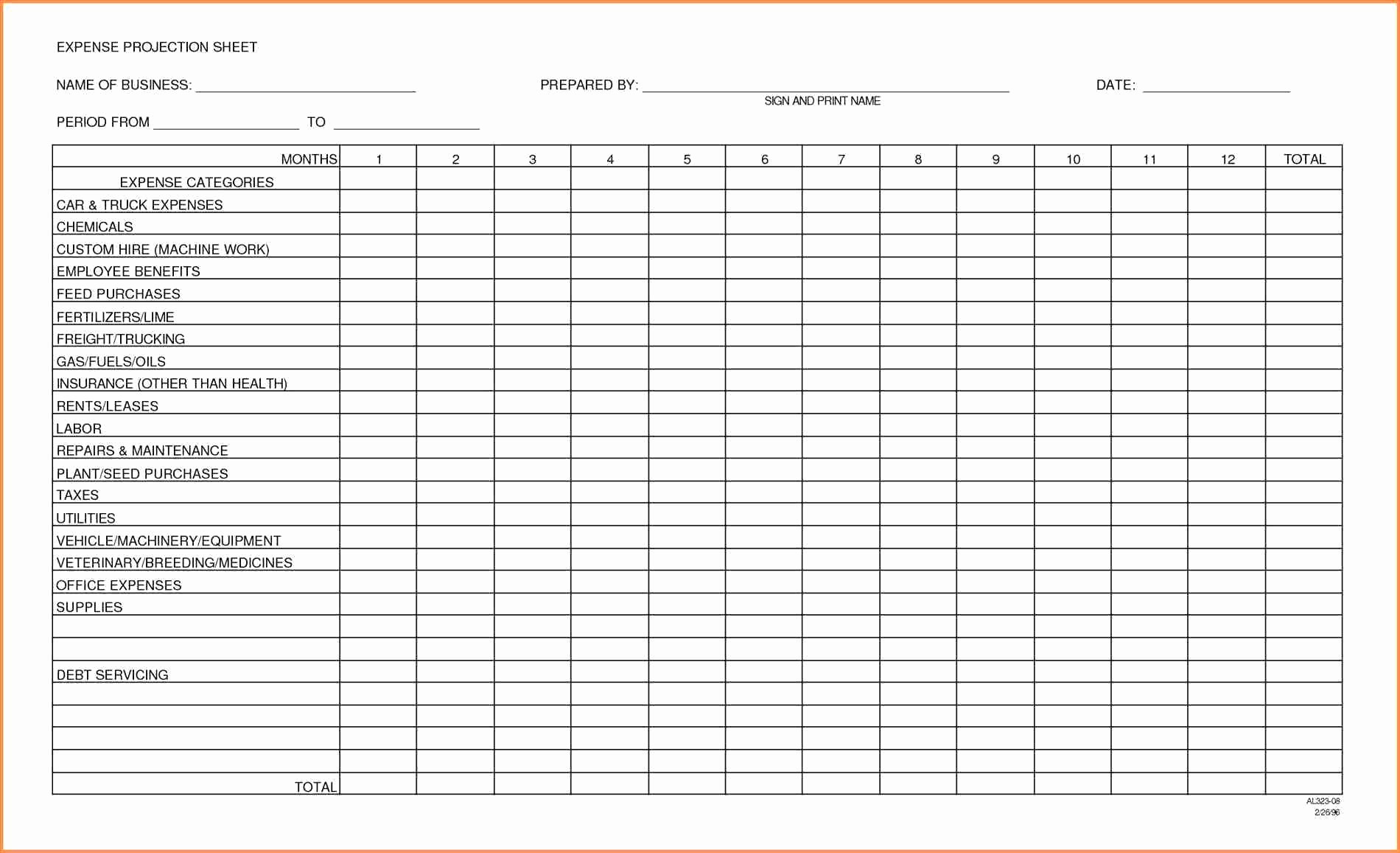

Schedule C Worksheet Excel

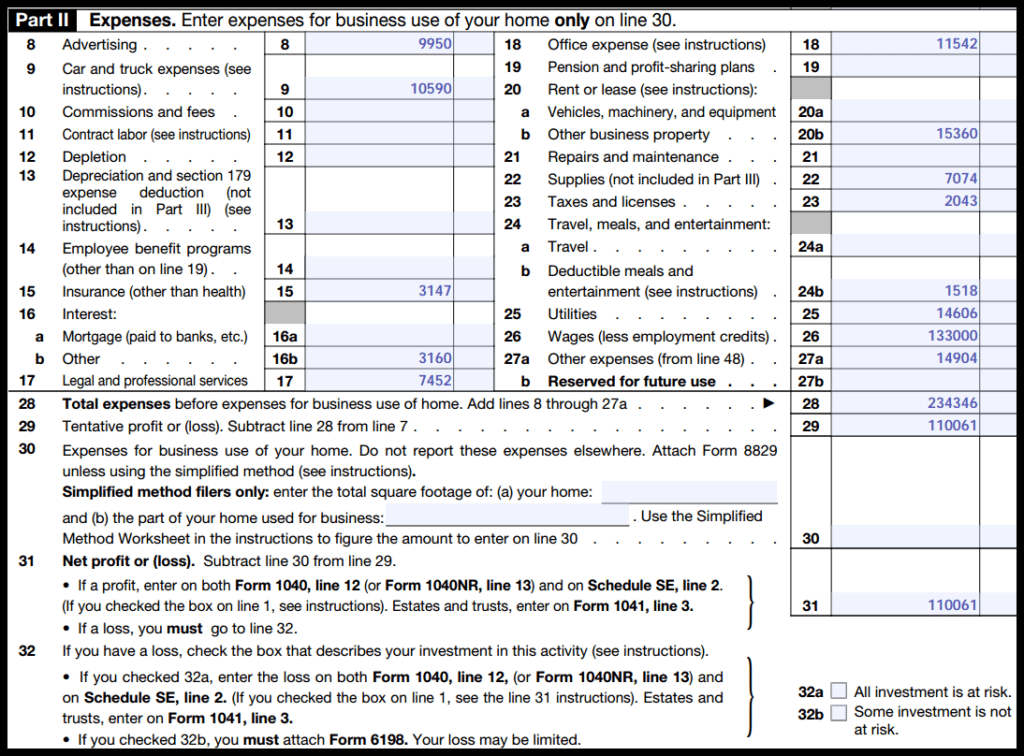

Us Gov Forms Schedule C Fill Online, Printable, Fillable, Blank

Form 1040 Schedule C Line 9 2021 Tax Forms 1040 Printable

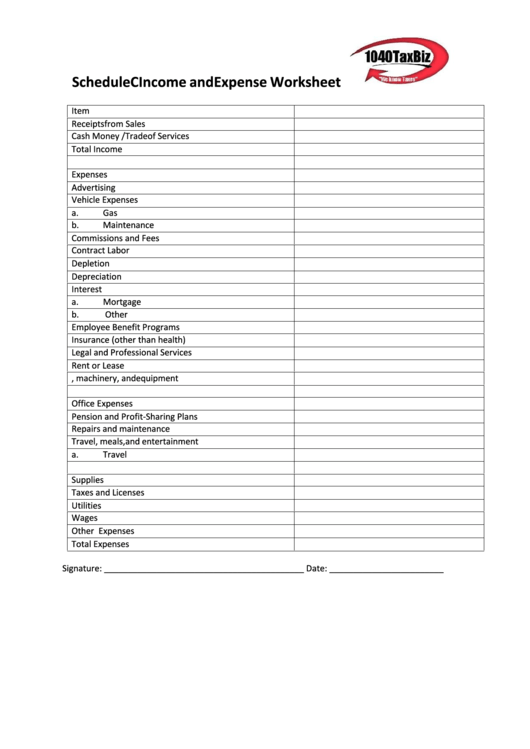

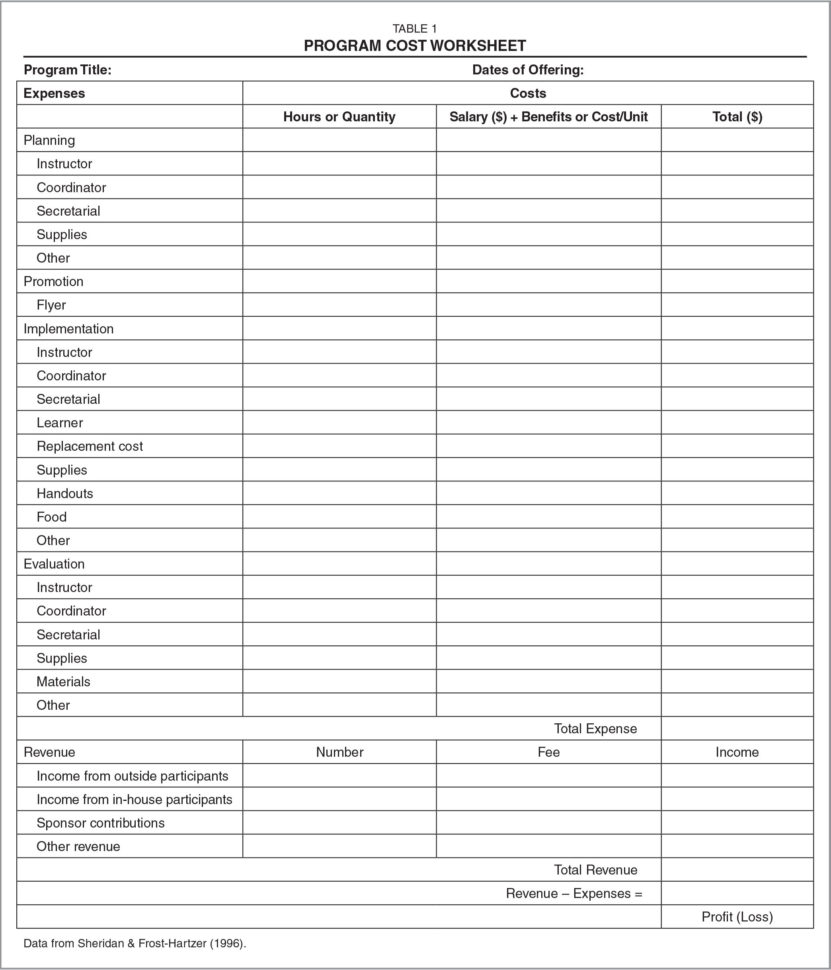

Schedule C And Expense Worksheet printable pdf download

Schedule C Expenses Worksheet Home Design Ideas Home —

12 IRS Schedule C Worksheet /

Schedule C Worksheet Yooob —

Schedule C Car And Truck Expenses Worksheet Awesome Driver —

Check Out How Easy It Is To Complete And Esign Documents Online Using Fillable Templates And A Powerful Editor.

Web Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

Web Irs Schedule C Is A Tax Form For Reporting Profit Or Loss From A Business.

You May Also Need Form 4562 To Claim Depreciation Or.

Related Post: