Schedule E Rental Income Worksheet

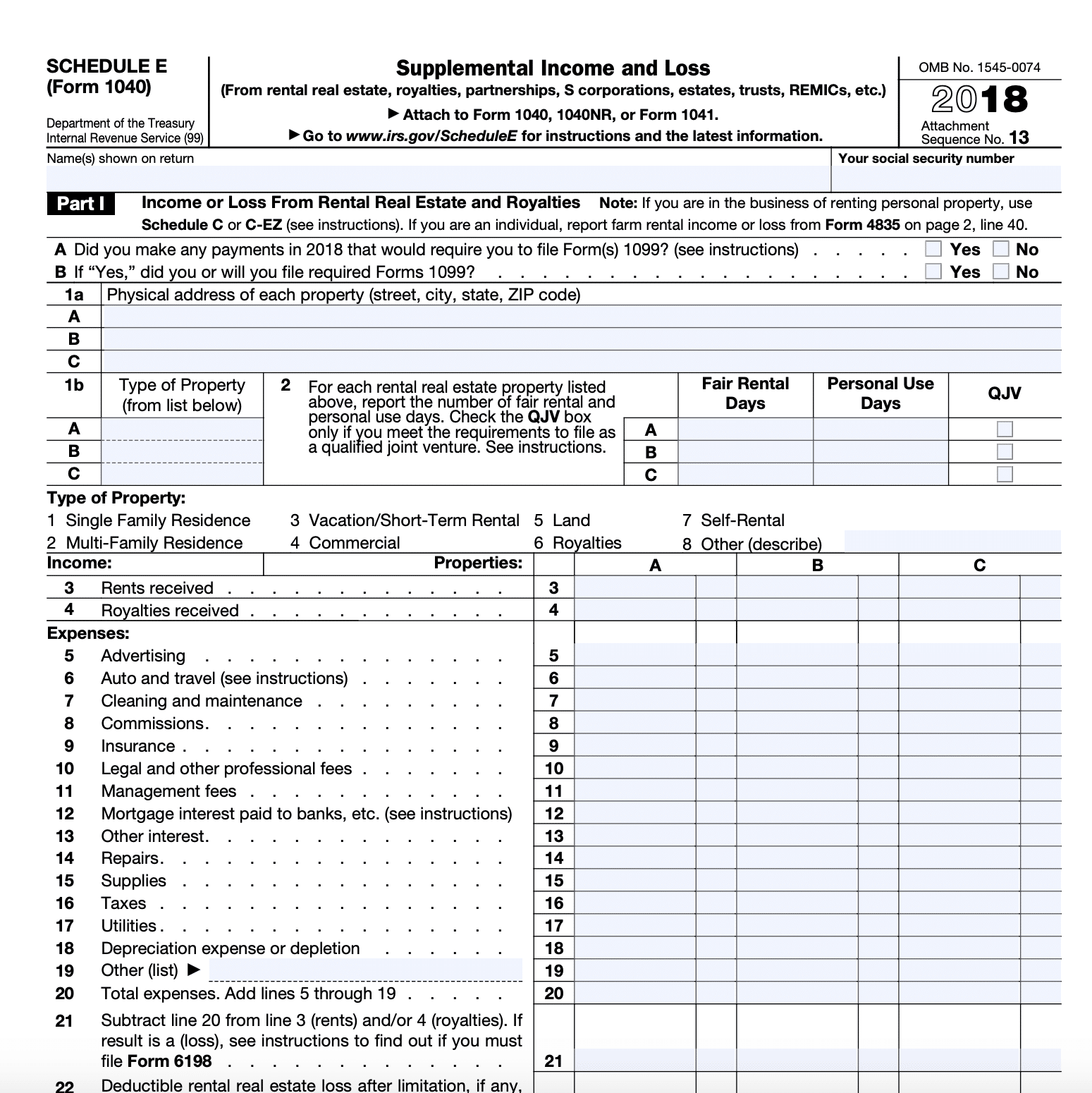

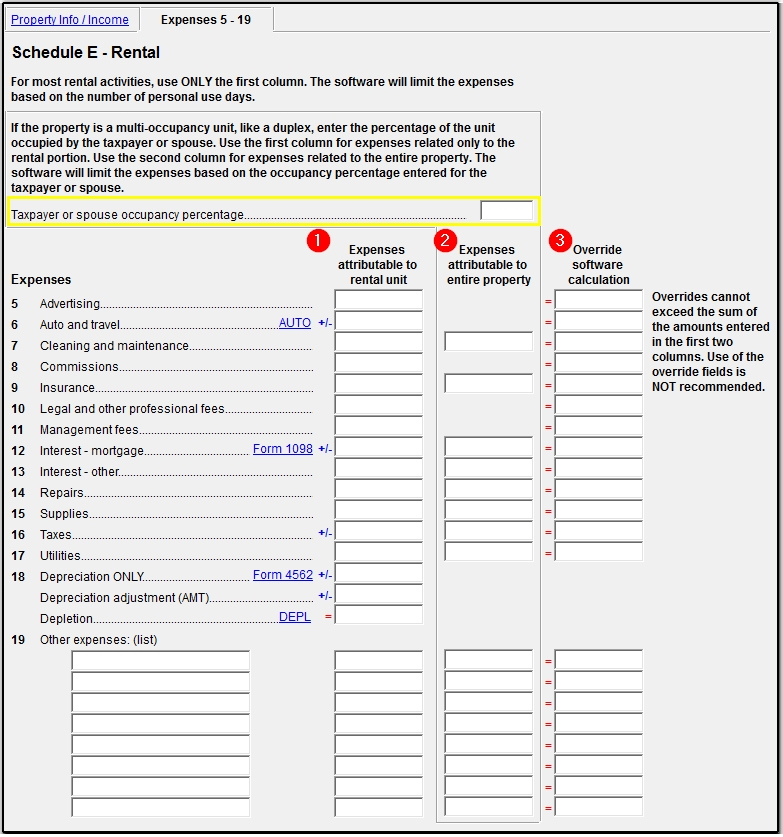

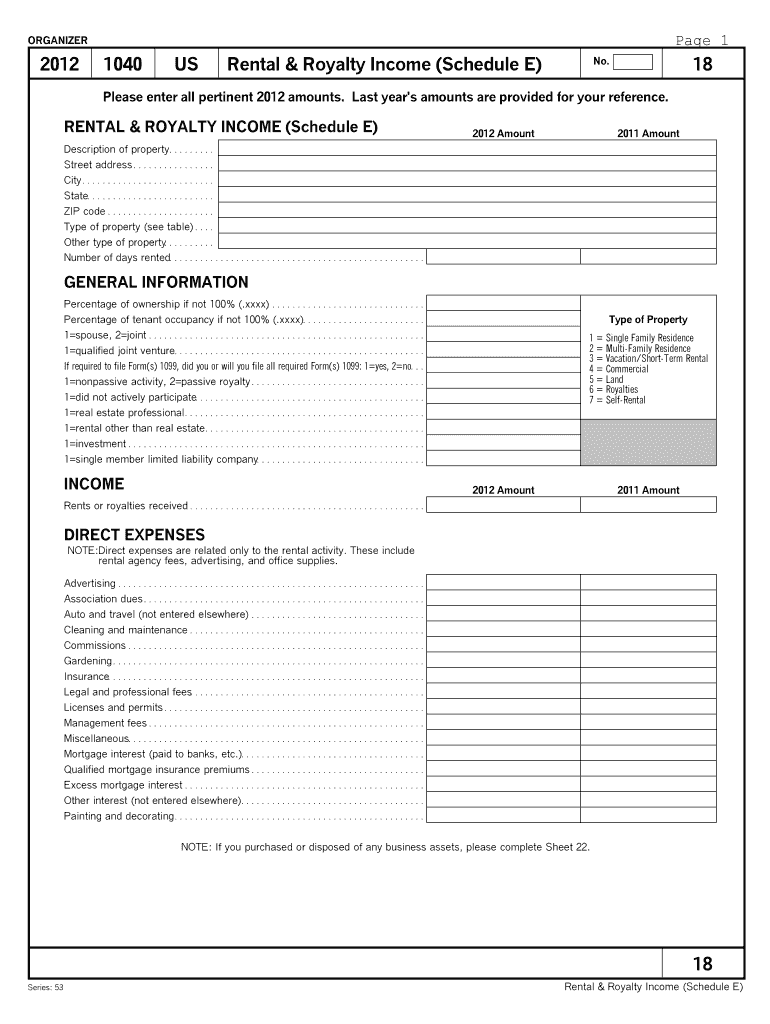

Schedule E Rental Income Worksheet - How you can fill out the what is. Kind of property street address city, state & zip code. Web income or loss from rental real estate and royalties. Web federal income tax returns, schedule e. If you provide substantial services. Calculate monthly qualifying rental income. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Web schedule e worksheet for rental property irs requires us to have your information in hand to support all schedule e’s When schedule e is used to calculate qualifying rental income, the lender must add back any listed depreciation,. When schedule e is used to calculate qualifying rental income, the lender must add back any listed depreciation,. If you provide substantial services. Web federal income tax returns, schedule e. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. The seller’s calculations must be based on the requirements and guidance for the. Web reporting rental income on schedule e one of. Web federal income tax returns, schedule e. Web reporting rental income on schedule e one of the more common reasons you may find yourself filling out a schedule e is if you own real estate that you rent out. Web download the form the most powerful tool to edit and complete the schedule e rental income calculator complete your schedule. Complete, edit or print tax forms instantly. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. Web this form is a tool to help the seller calculate the net rental income from schedule e; Web schedule e worksheet for rental property irs requires us to have. Web federal income tax returns, schedule e. How you can fill out the what is. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. Kind of property street address city, state & zip code. Get ready for tax season deadlines by completing any required tax forms. Web federal income tax returns, schedule e. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. How you can fill out the what is. If you provide substantial services. Web reporting rental income on schedule e one of the more common reasons you may find yourself. If you provide substantial services. Get ready for tax season deadlines by completing any required tax forms today. If you are in the business of renting personal property, use. Web download the form the most powerful tool to edit and complete the schedule e rental income calculator complete your schedule e rental income calculator within. If you are an individual,. Monthly qualifying rental income (loss): Web schedule e worksheet for rental property irs requires us to have your information in hand to support all schedule e’s If you are in the business of renting personal property, use. Complete, edit or print tax forms instantly. When schedule e is used to calculate qualifying rental income, the lender must add back any. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Get ready for tax season deadlines by completing any required tax forms today. Web current revision schedule e (form 1040) pdf instructions for schedule e (form 1040) | print version pdf | ebook (epub). Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. When schedule e is used to calculate qualifying rental income, the lender must add back any listed depreciation,. Complete, edit or print tax forms instantly. Web federal income tax returns, schedule e. How you. Web federal income tax returns, schedule e. Web current revision schedule e (form 1040) pdf instructions for schedule e (form 1040) | print version pdf | ebook (epub) epub recent developments changes to the 2018. When schedule e is used to calculate qualifying rental income, the lender must add back any listed depreciation,. Web income or loss from rental real. Kind of property street address city, state & zip code. When schedule e is used to calculate qualifying rental income, the lender must add back any listed depreciation,. If you provide substantial services. Web federal income tax returns, schedule e. Web schedule e worksheet for rental property irs requires us to have your information in hand to support all schedule e’s When schedule e is used to calculate qualifying rental income, the lender must add back any listed depreciation,. Complete, edit or print tax forms instantly. Web federal income tax returns, schedule e. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. Get ready for tax season deadlines by completing any required tax forms today. Web current revision schedule e (form 1040) pdf instructions for schedule e (form 1040) | print version pdf | ebook (epub) epub recent developments changes to the 2018. Monthly qualifying rental income (loss): Web income or loss from rental real estate and royalties. How you can fill out the what is. Web this form is a tool to help the seller calculate the net rental income from schedule e; Web download the form the most powerful tool to edit and complete the schedule e rental income calculator complete your schedule e rental income calculator within. Web reporting rental income on schedule e one of the more common reasons you may find yourself filling out a schedule e is if you own real estate that you rent out. The seller’s calculations must be based on the requirements and guidance for the. If you are an individual,. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Kind of property street address city, state & zip code. When schedule e is used to calculate qualifying rental income, the lender must add back any listed depreciation,. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. Web income or loss from rental real estate and royalties. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Web federal income tax returns, schedule e. Calculate monthly qualifying rental income. Web schedule e worksheet for rental property irs requires us to have your information in hand to support all schedule e’s Web federal income tax returns, schedule e. Complete, edit or print tax forms instantly. How you can fill out the what is. Web download the form the most powerful tool to edit and complete the schedule e rental income calculator complete your schedule e rental income calculator within. Web this form is a tool to help the seller calculate the net rental income from schedule e; Monthly qualifying rental income (loss): If you are an individual,. Web reporting rental income on schedule e one of the more common reasons you may find yourself filling out a schedule e is if you own real estate that you rent out.Analyzing Schedule E Rental 2 1 18 YouTube

20++ Schedule E Rental Worksheet

Schedule E Property Rental Android Apps on Google Play

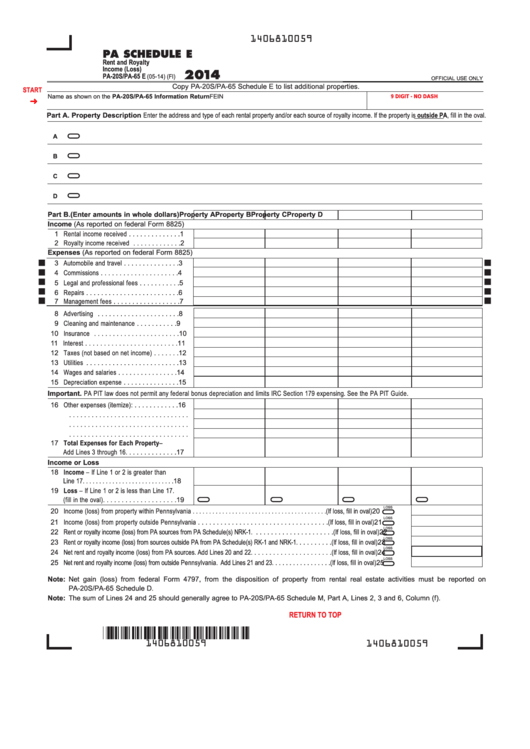

Fillable Pa Schedule E Rent And Royalty (Loss) 2014

US Expat Taxes Explained Rental Property in the US

Schedule E Rental Worksheet Fill Online, Printable, Fillable

Schedule E Form 1040 Excel 2021 Tax Forms 1040 Printable

Sch E How to fill out Schedule E Rental Property on your tax

Form 1040 Schedule E Worksheet 2021 Tax Forms 1040 Printable

Schedule E Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

When Schedule E Is Used To Calculate Qualifying Rental Income, The Lender Must Add Back Any Listed Depreciation,.

If You Provide Substantial Services.

The Seller’s Calculations Must Be Based On The Requirements And Guidance For The.

Web Current Revision Schedule E (Form 1040) Pdf Instructions For Schedule E (Form 1040) | Print Version Pdf | Ebook (Epub) Epub Recent Developments Changes To The 2018.

Related Post: