Schedule E Worksheet For Rental Property

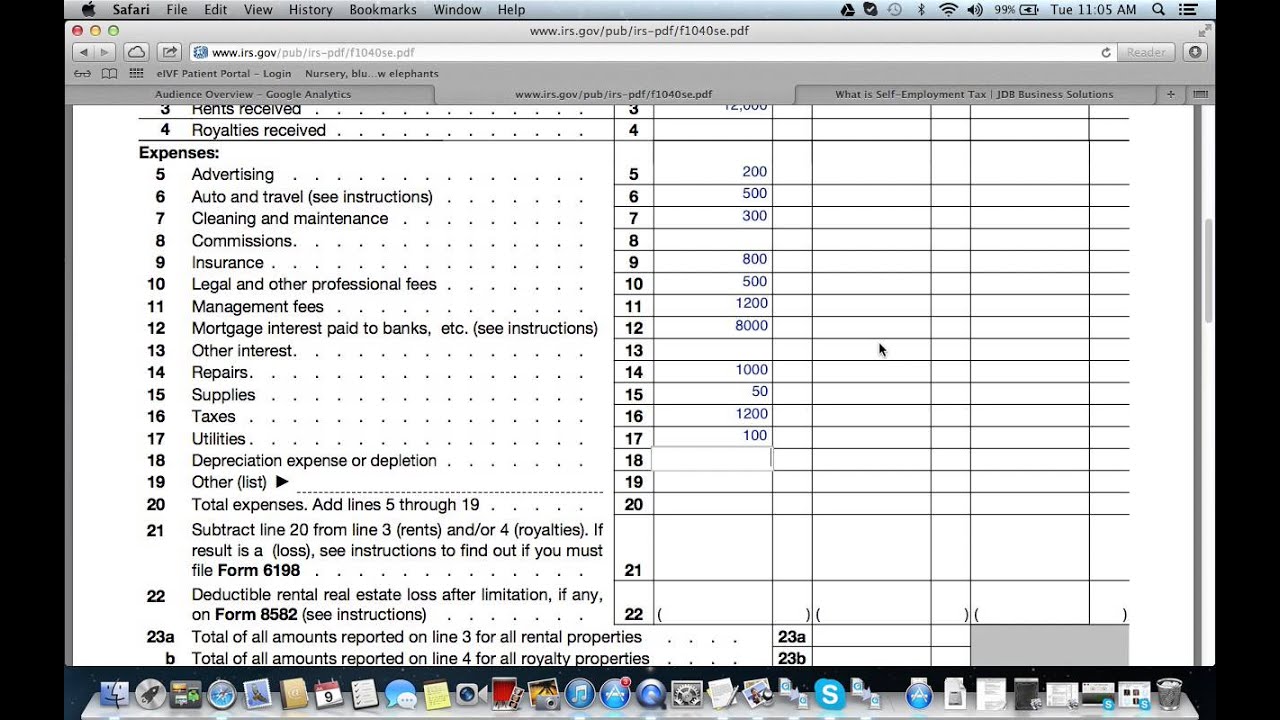

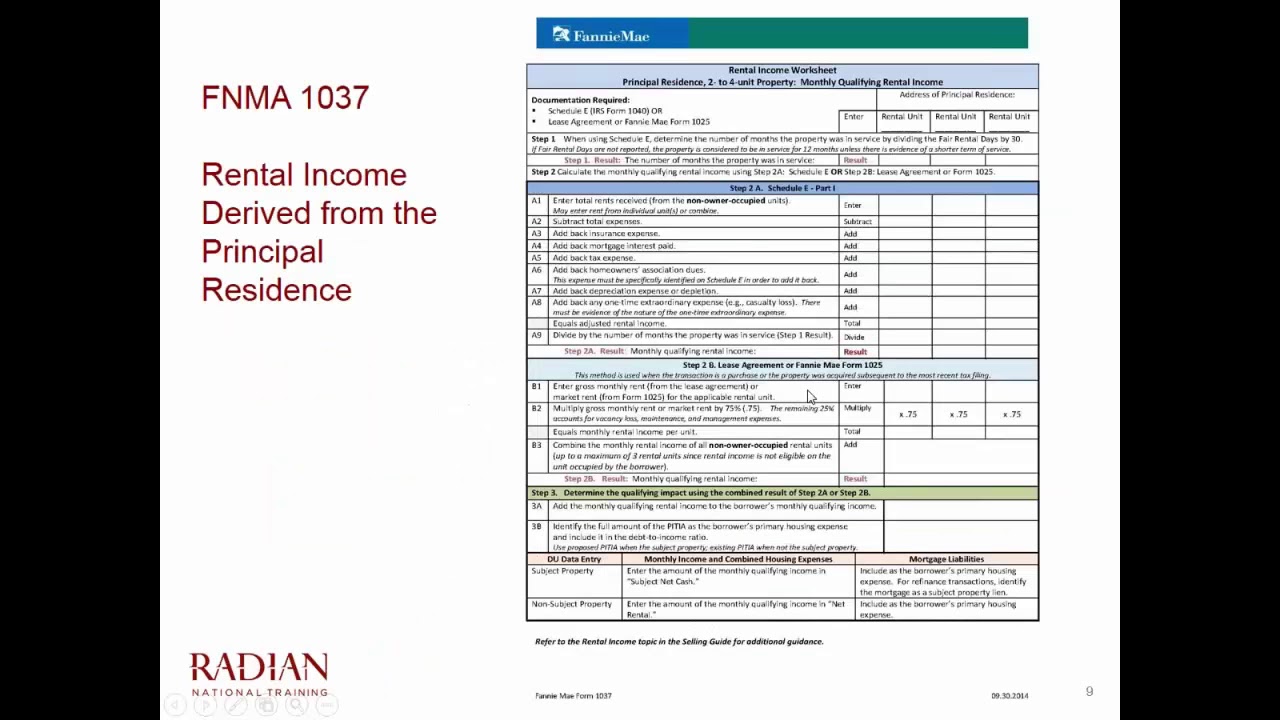

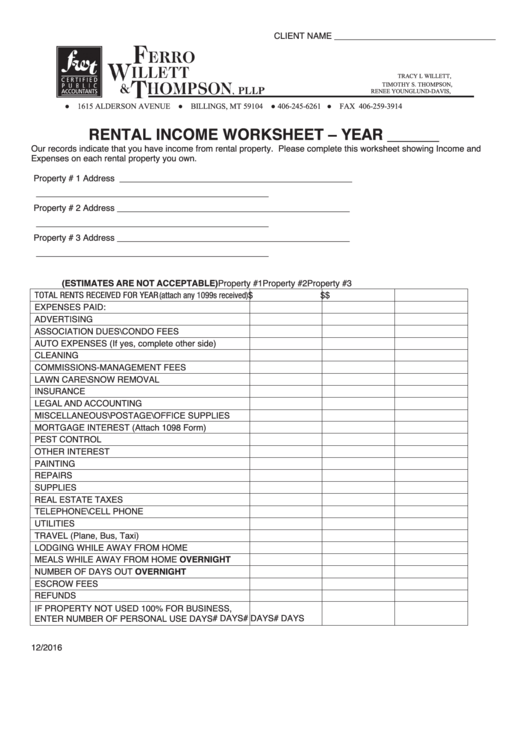

Schedule E Worksheet For Rental Property - Days you spent there for personal use days family members or friends spent there paying less than the going rent. Just to clarify what is already stated in this thread. Get answers to frequently asked questions about the schedule e: One of the more common reasons you may find yourself filling out a schedule e is if you own real estate that you rent out. You can download the most up to date schedule e from the irs website here. Monthly qualifying rental income (or loss) documentation required: Web the government created a $25,000 offset to address this issue. Web how to calculate rental property depreciation for schedule e, that was converted from residential to rental? Web this list is intended to help you discover all the income and expense information needed to prepare schedule e (form 1040), supplemental income and loss forms for your. Number of days the property was occupied by you, a member of your family or any individual not paying rent at fair market value 2. You can download the most up to date schedule e from the irs website here. Web how to calculate rental property depreciation for schedule e, that was converted from residential to rental? Web the property type requested on the schedule e is used to determine if the income is subject to any special rules. Web reporting rental income on schedule. Web schedule e worksheet (rental property) provide all 1099’s (misc & nec) received and issued by your company. Just to clarify what is already stated in this thread. Web reporting rental income on schedule e. Get answers to frequently asked questions about the schedule e: Web common questions about schedule e in proseries. Web filing your taxes schedule e tax form here's what the schedule e looks like: How to dispose of a rental property. Web reporting rental income on schedule e. Web total number of rental units in this property 1. Web schedule e worksheet (rental property) provide all 1099’s (misc & nec) received and issued by your company. Our spreadsheet categories correct to. Web rental property income and spend cannot are difficult to organize and track, especially if her wait until the end of which year. Refer to the rental income topic in. Web this list is intended to help you discover all the income and expense information needed to prepare schedule e (form 1040), supplemental income and. Keep records for 3 years if situations (4), (5), and (6) below. Web rental property income and spend cannot are difficult to organize and track, especially if her wait until the end of which year. Get answers to frequently asked questions about the schedule e: One of the more common reasons you may find yourself filling out a schedule e. Please download before each calculation as calculators are updated periodically. Web total number of rental units in this property 1. Just to clarify what is already stated in this thread. Monthly qualifying rental income (or loss) documentation required: Web reporting rental income on schedule e. Web the government created a $25,000 offset to address this issue. Number of days the property was occupied by you, a member of your family or any individual not paying rent at fair market value 2. Refer to the rental income topic in. Web schedule e worksheet (rental property) provide all 1099’s (misc & nec) received and issued by your. Web reporting rental income on schedule e. You can download the most up to date schedule e from the irs website here. Our spreadsheet categories correct to. Just to clarify what is already stated in this thread. Web follow these steps to enter a disposition of schedule e rental property with assets: Web the property type requested on the schedule e is used to determine if the income is subject to any special rules. Web common questions about schedule e in proseries. Web we must calculate rental and personal days personal days are: Irsrecordkeeping requirements period of limitations that apply to income tax returns 1. Web this list is intended to help. Types of property that may be subject to special rules. Web rental property income and spend cannot are difficult to organize and track, especially if her wait until the end of which year. Web how to calculate rental property depreciation for schedule e, that was converted from residential to rental? Web for full functionality, download pdf first before entering data.. Web the property type requested on the schedule e is used to determine if the income is subject to any special rules. Please download before each calculation as calculators are updated periodically. Our spreadsheet categories correct to. Web rental property income and spend cannot are difficult to organize and track, especially if her wait until the end of which year. Web reporting rental income on schedule e. Refer to the rental income topic in. Days you spent there for personal use days family members or friends spent there paying less than the going rent. Web we must calculate rental and personal days personal days are: Web filing your taxes schedule e tax form here's what the schedule e looks like: Web for full functionality, download pdf first before entering data. One of the more common reasons you may find yourself filling out a schedule e is if you own real estate that you rent out. Web rental income worksheet individual rental income from investment property(s): Web total number of rental units in this property 1. Irsrecordkeeping requirements period of limitations that apply to income tax returns 1. Web the government created a $25,000 offset to address this issue. Web how to calculate rental property depreciation for schedule e, that was converted from residential to rental? Keep records for 3 years if situations (4), (5), and (6) below. You can download the most up to date schedule e from the irs website here. Web common questions about schedule e in proseries. Web this list is intended to help you discover all the income and expense information needed to prepare schedule e (form 1040), supplemental income and loss forms for your. Web how to calculate rental property depreciation for schedule e, that was converted from residential to rental? Monthly qualifying rental income (or loss) documentation required: Number of days the property was occupied by you, a member of your family or any individual not paying rent at fair market value 2. Web schedule e worksheet (rental property) provide all 1099’s (misc & nec) received and issued by your company. Web we must calculate rental and personal days personal days are: Our spreadsheet categories correct to. One of the more common reasons you may find yourself filling out a schedule e is if you own real estate that you rent out. Web rental income worksheet individual rental income from investment property(s): Web rental property income and spend cannot are difficult to organize and track, especially if her wait until the end of which year. Just to clarify what is already stated in this thread. Get answers to frequently asked questions about the schedule e: How to dispose of a rental property. Web follow these steps to enter a disposition of schedule e rental property with assets: Web reporting rental income on schedule e. You can download the most up to date schedule e from the irs website here. Refer to the rental income topic in.Tenant Payment Record Rental Payment Record Template 25 Etsy Rental

Schedule E Excel Spreadsheet Pertaining To Rental Property Accounting

Schedule E Rental Worksheet Fill Online, Printable, Fillable

How to Fill Out Schedule E for Real Estate Investments YouTube

Analyzing Schedule E Rental 2 1 18 YouTube

printable and expense worksheet

Schedule E Screen (Drake16) (ScheduleE)

Schedule E Property Rental Android Apps on Google Play

Rental Sheets Rental Spreadsheets Rental Sheets Rental Property

Example Image Rental Property Condition Form Rental property, Rental

Irsrecordkeeping Requirements Period Of Limitations That Apply To Income Tax Returns 1.

Web For Full Functionality, Download Pdf First Before Entering Data.

Web This List Is Intended To Help You Discover All The Income And Expense Information Needed To Prepare Schedule E (Form 1040), Supplemental Income And Loss Forms For Your.

Keep Records For 3 Years If Situations (4), (5), And (6) Below.

Related Post: