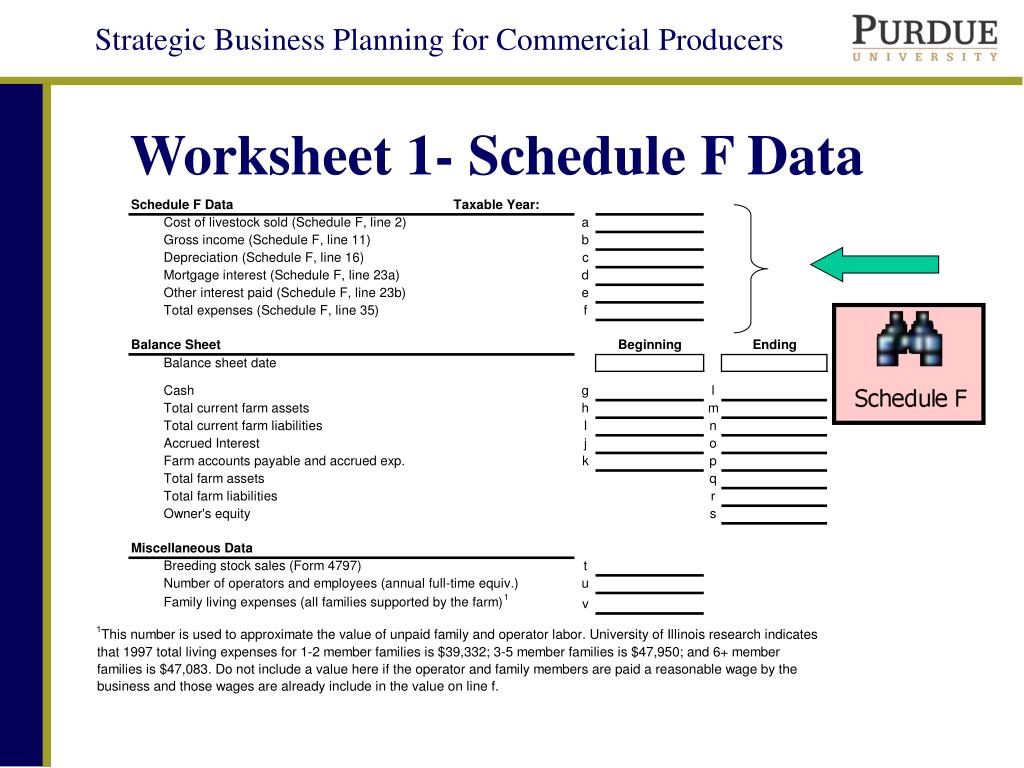

Schedule F Worksheet

Schedule F Worksheet - Your reproduced worksheet(s) on the appropriate summary page. Farm & agriculture income & expense. Name of person filing form 5471. Web where is the home office worksheet for schedule f? You must accurately report your income, then subtract your expenses from your revenues. Breakeven revenue + additional needs 7 [(1+needs)÷b] enter data above gross income (schedule f, line 9) depreciation (schedule f, line 14) mortgage interest (schedule f, line 21a) other interest paid (schedule f, line 21b) total expenses (schedule f, line 33) example alternative 1. Treasury schedule f has been given a separate worksheet that can be accessed by clicking on the. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. Different programs may use different entry lines. Completing schedule f involves some calculations. The third sheet summaries the first two pages and calculates your farm’s profit or loss for the year. Web use schedule f (form 1040) to report farm income and expenses. Amount of distribution in foreign corporation's functional currency. Web there is no worksheet for schedule f. Most of the farm expenses are entered directly on schedule f itself. There is no breakdown or detail other than what is shown in part ii of the form. Your reproduced worksheet(s) on the appropriate summary page. Web schedule f worksheet farm & agriculture income & expense. Social security number (ssn) a. Completing schedule f involves some calculations. You must accurately report your income, then subtract your expenses from your revenues. Use schedule f (form 1040) to report farm income and expenses. Amount of distribution in foreign corporation's functional currency. Proseries doesn't support a home office worksheet for schedule f to enter home office expenses. Record the net farm profit or (loss) reported on schedule f. Amount of e&p distribution in foreign corporation's functional currency. Web there is no worksheet for schedule f. Web schedule f worksheet (farm and/or farm rental) provide all 1099’s (misc & nec) received and issued and cooperative distributions received. The first sheet is designed to enter your farm’s bank deposits and record all types of farm income. B enter code from. Total income received in 2020: Did you make any payments requiring a form 1099?if yes, did you file required form 1099? Web sum the amounts on lines 7, 8, and 10 on worksheet 3. Web use schedule f (form 1040) to report farm income and expenses. B enter code from part iv. Reference id number of foreign corporation. Name of person filing form 5471. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. Web schedule f worksheet (farm and/or farm rental) provide all 1099’s (misc & nec) received and issued and cooperative distributions received. The first sheet is designed to enter. Do not use form 8829 in the following situations. Web sum the amounts on lines 7, 8, and 10 on worksheet 3. Download the schedule f farm income and expense worksheets here. Consult your guidelines for assistance. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. Name of person filing form 5471. Breakeven revenue + additional needs 7 [(1+needs)÷b] enter data above gross income (schedule f, line 9) depreciation (schedule f, line 14) mortgage interest (schedule f, line 21a) other interest paid (schedule f, line 21b) total expenses (schedule f, line 33) example alternative 1. Use schedule f (form 1040) to report farm income and expenses.. Web there is no worksheet for schedule f. Total rent received in 2021: D employer id number (ein) (see instr.) e. Amount of e&p distribution in foreign corporation's functional currency. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. Name principal crop or activityemployer i.d. For instructions and the latest information. Web schedule f worksheet (farm and/or farm rental) provide all 1099’s (misc & nec) received and issued and cooperative distributions received. There is no breakdown or detail other than what is shown in part ii of the form. Farm & agriculture income & expense. Check with your state and local governments for more information. Corporation (form 1120) if analysis shows declining income, it may not be prudent to average the income. You must accurately report your income, then subtract your expenses from your revenues. Date placed in service _______________ year/make/model _________________________. There is no breakdown or detail other than what is shown in part ii of the form. Amount of e&p distribution in foreign corporation's functional currency. Treasury schedule f has been given a separate worksheet that can be accessed by clicking on the. Most of the farm expenses are entered directly on schedule f itself. Farm & agriculture income & expense. Web use schedule f (form 1040) to report farm income and expenses. This schedule must be included on form 1040 tax return, regardless of the type of farm income. Your reproduced worksheet(s) on the appropriate summary page. Certain federal agriculture program payments, coop distributions, and insurance/loan proceeds are not fully taxable. Web schedule f is used to report taxable income earned from farming or agricultural activities. Business miles driven _________________ personal. B enter code from part iv. Download the schedule f farm income and expense worksheets here. The second sheet is designed to enter your farm’s expenses of all types. Different programs may use different entry lines. Web there is no worksheet for schedule f. Amount of e&p distribution in foreign corporation's functional currency. Web schedule f worksheet (farm and/or farm rental) provide all 1099’s (misc & nec) received and issued and cooperative distributions received. Total rent received in 2021: 2021 schedue c & e worksheets.xlsx author: Proseries doesn't support a home office worksheet for schedule f to enter home office expenses. The third sheet summaries the first two pages and calculates your farm’s profit or loss for the year. Social security number (ssn) a. Did you make any payments requiring a form 1099?if yes, did you file required form 1099? Consult your guidelines for assistance. Web schedule f sale of purchased livestock, machinery, equipment or land farm income farm income & expense tax worksheet you are required to file information returns (1099‐misc) for any non‐employee, to whom you paid an aggregate of $600 or more during the year for services or rent. B enter code from part iv. For instructions and the latest information. Certain federal agriculture program payments, coop distributions, and insurance/loan proceeds are not fully taxable. Record the net farm profit or (loss) reported on schedule f. Treasury schedule f has been given a separate worksheet that can be accessed by clicking on the. Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file.Pin on AB Alphabet

PPT Assessing Financial Performance How Am I Doing? PowerPoint

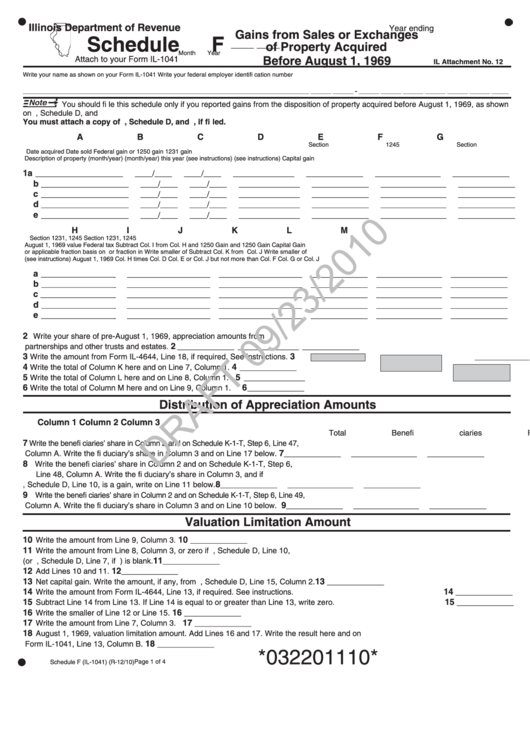

Schedule F Draft Attach To Form Il1041 Gains From Sales Or

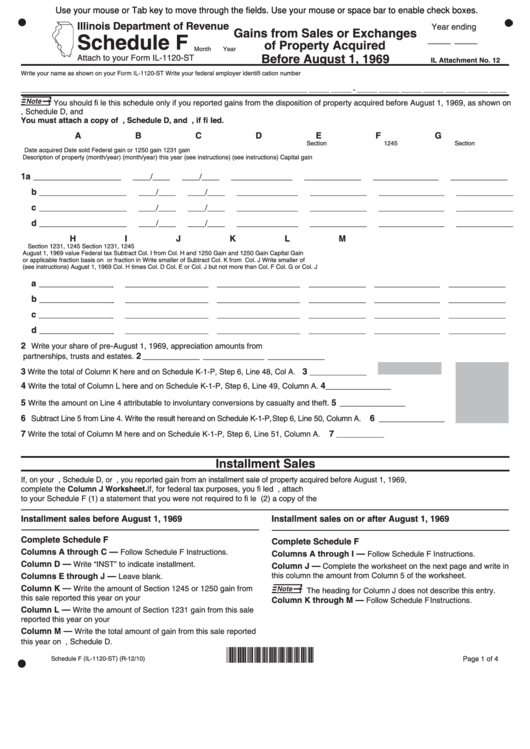

Fillable Schedule F Attach To Form Il1120St Gains From Sales Or

Form 1040 Schedule F Edit, Fill, Sign Online Handypdf

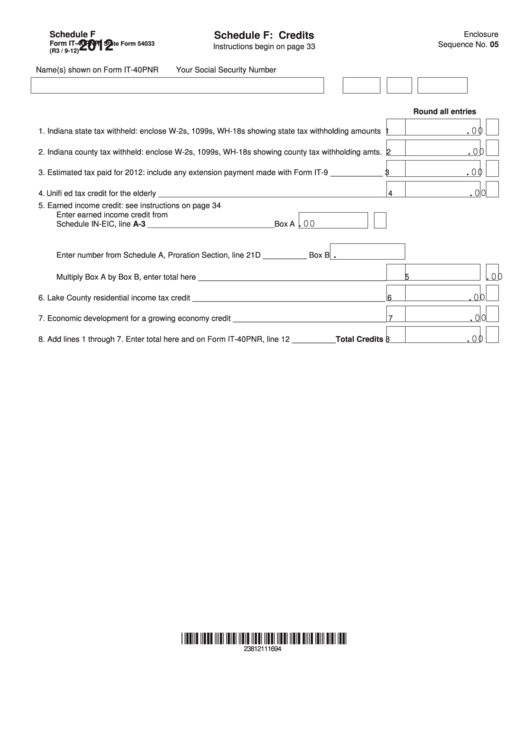

Fillable Schedule F (Form It40pnr) Credits 2012 printable pdf download

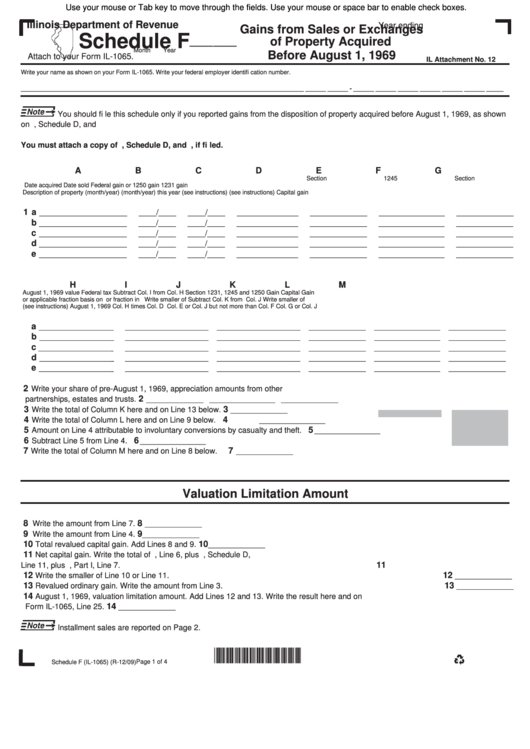

Fillable Schedule F Form Gains From Sales Or Exchanges Of Property

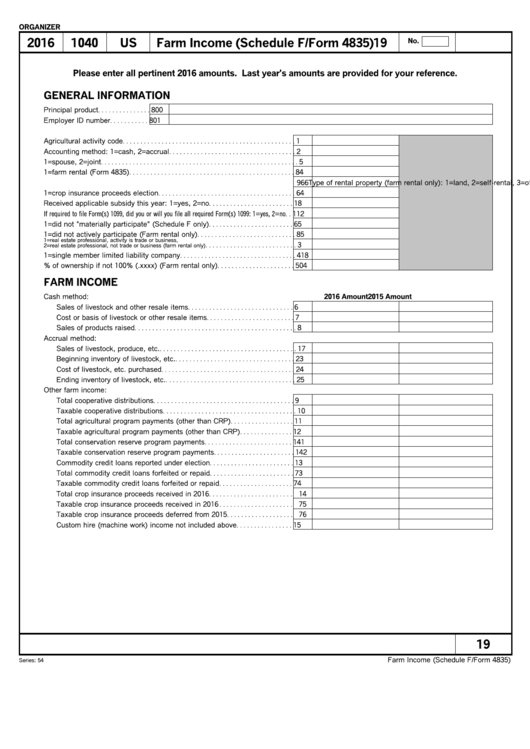

Farm (Schedule F / Form 4835) printable pdf download

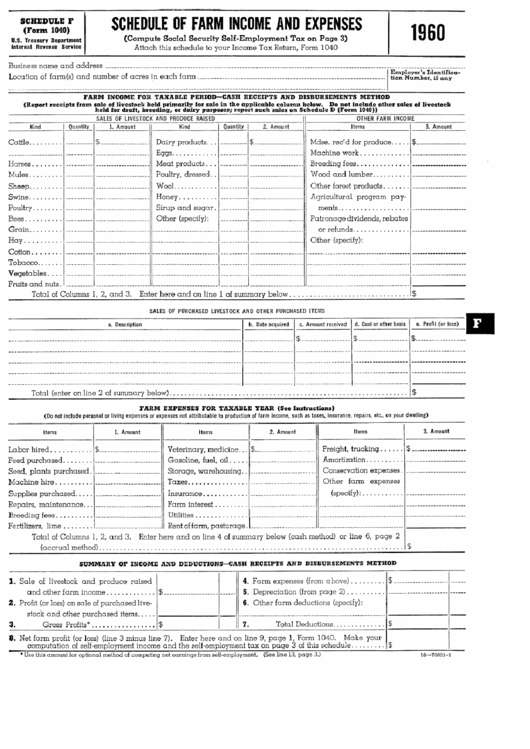

Schedule F (Form 1040) Schedule Of Farm And Expenses 1960

2015 schedule f Fill out & sign online DocHub

Web Schedule F Worksheet Farm & Agriculture Income & Expense.

Web Use Schedule F (Form 1040) To Report Farm Income And Expenses.

Check With Your State And Local Governments For More Information.

Farm & Agriculture Income & Expense.

Related Post: