Section 199A Information Worksheet

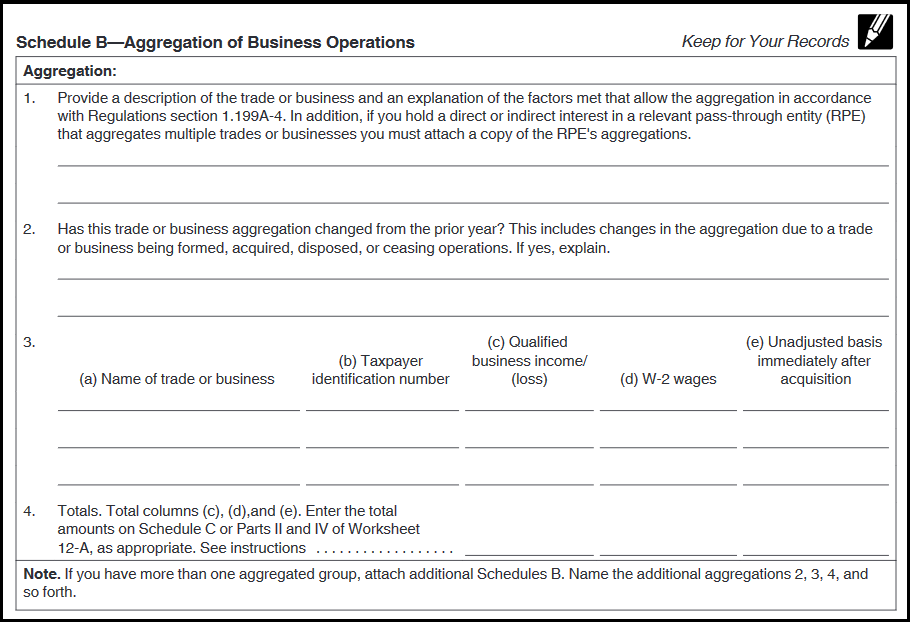

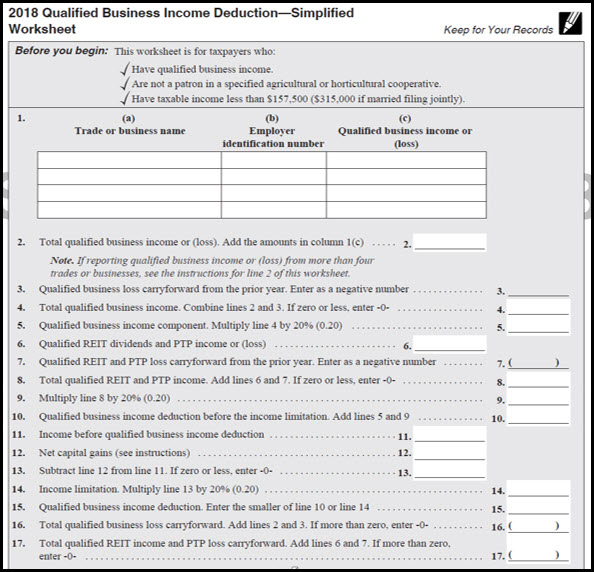

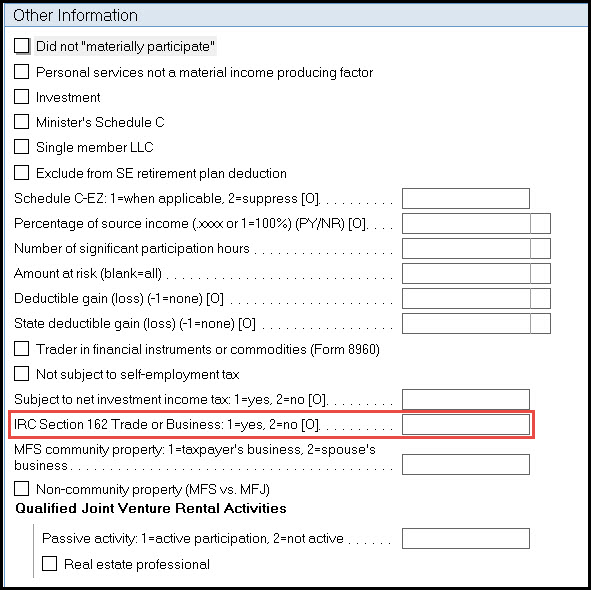

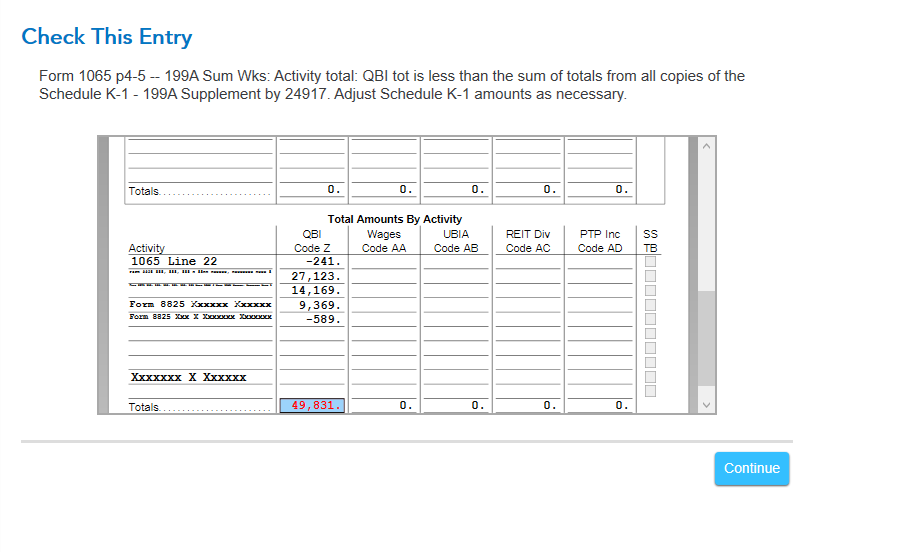

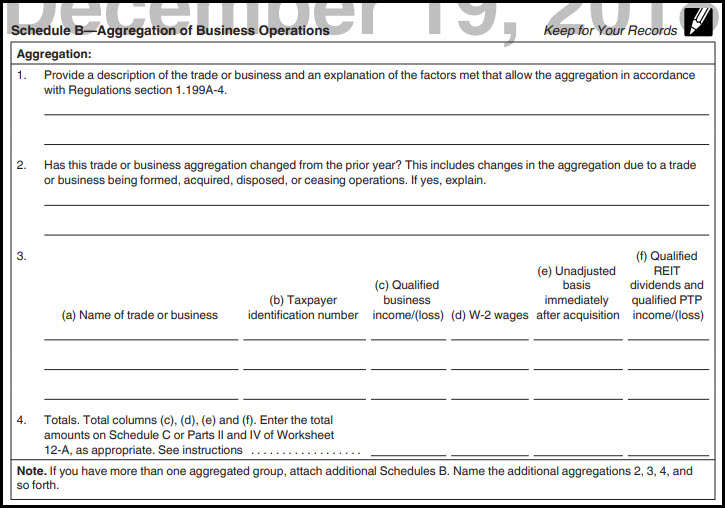

Section 199A Information Worksheet - Net rental income (loss) w2 wages. To override the income amounts on the qbid (199a) worksheet for certain entities, do the following: In the turbotax questionnaire, there is a checkbox for ubia of qualified property (unadjusted basis. It allows owners to deduct up to 20 percent of the domestic qualified business income (qbi) earned by the business on the owner’s tax return, subject to other significant limitations. Larry l gray, cpa, cgma. If you are filing form 1065, this will be an entry on schedule k, box 20, code z. This is a significant tax break for small business owners but there are rules and limits of course. Continue on, and there is a screen near the end of the interview titled we need. (owners of certain agricultural or horticultural cooperatives, real estate investment trusts Web partnership’s section 199a information worksheet. Review and planning to maximize the benefits of qbi on the form 1040. If you are using turbotax download/cd, check for updates (menu at top, online>>check for updates). (owners of certain agricultural or horticultural cooperatives, real estate investment trusts Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income, minus capital. Web section 199a income. Web in the qualified business income section, in the qualified option (field 1), choose qualified or specified service. The information worksheets print when you enter 1 in the qualifies as trade or business for section 199a field on screen qbi. If you make $200,000, the deduction is $40,000 times your marginal tax rate of 24% which. The best tax strategies may include a combination of business entities to optimize the tax results for the taxpayer. Section 199a, qualified business income for fiscal year s. Web june 22, 2023. Section 199, without the a, is the section covering domestic production activities deduction. The attached partner's section 199a worksheet has these values: Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income, minus capital gains. This worksheet is applicable to a fiscal year s corporation only. It allows owners to deduct up to 20 percent of the domestic qualified business income (qbi) earned by the business on the owner’s tax return, subject to. Generally, you may be allowed a deduction of up to 20% of your net qualified business income (qbi) plus 20% of your qualified reit dividends, also known as section 199a dividends, and qualified ptp income from your partnership. Web in the qualified business income section, in the qualified option (field 1), choose qualified or specified service. Web the section 199a. Web 199a qualified business income (qbi): Web calculating the section 199a deductions. Deluxe to maximize tax deductions. Continue on, and there is a screen near the end of the interview titled we need. If you are filing form 1065, this will be an entry on schedule k, box 20, code z. Section 199a, qualified business income for fiscal year s. You will now see the entities you selected on the government view form qbid (199a) worksheet. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s corporations and some trusts and estates, a deduction of income from a qualified trade or business. Single 163,300 213,300. The deduction has two components. I have code ah* and value=stmt in box 20 of my k1. Tax forms included with turbotax. Section 199a, qualified business income for fiscal year s. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business income (qbi) deduction. Single 163,300 213,300 see below for calculation details. Web the section 199a information worksheet for the s corporation and the shareholder, and the section 199a aggregation worksheets are available in forms view. Web section 199a income. Deluxe to maximize tax deductions. (owners of certain agricultural or horticultural cooperatives, real estate investment trusts Web calculating the section 199a deductions. Generally, you may be allowed a deduction of up to 20% of your net qualified business income (qbi) plus 20% of your qualified reit dividends, also known as section 199a dividends, and qualified ptp income from your partnership. Continue on, and there is a screen near the end of the interview titled we need.. This is the net ordinary income or, generally, the net rental income produced by the entity. To override the income amounts on the qbid (199a) worksheet for certain entities, do the following: Net rental income (loss) w2 wages. Web how to enter section 199a information? The information worksheets print when you enter 1 in the qualifies as trade or business for section 199a field on screen qbi. Section 199, without the a, is the section covering domestic production activities deduction. You will now see the entities you selected on the government view form qbid (199a) worksheet. Web calculating the section 199a deductions. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business income (qbi) deduction. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s corporations and some trusts and estates, a deduction of income from a qualified trade or business. Status beginning ending 2021 calculator: Section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income, minus capital gains. Web the section 199a information worksheet includes columns for multiple activities. I have code ah* and value=stmt in box 20 of my k1. Review and planning to maximize the benefits of qbi on the form 1040. If the estate or trust has no dni for the tax year, section 199a items are allocated entirely to the estate or trust. In the turbotax questionnaire, there is a checkbox for ubia of qualified property (unadjusted basis. Web partnership’s section 199a information worksheet. Web section 199a deduction also known as the qualified business income deduction (qbid) arises from the tax cuts & jobs act of 2017. This worksheet is applicable to a fiscal year s corporation only. Larry l gray, cpa, cgma. Turbotax online will be updated when you sign in. If you make $200,000, the deduction is $40,000 times your marginal tax rate of 24% which equals $9,600 in your pocket. If you are filing form 1065, this will be an entry on schedule k, box 20, code z. Web in the qualified business income section, in the qualified option (field 1), choose qualified or specified service. The deduction has two components. This is a significant tax break for small business owners but there are rules and limits of course. Continue on, and there is a screen near the end of the interview titled we need. What we will cover… qbi final regulations. This is the net ordinary income or, generally, the net rental income produced by the entity. Web 199a qualified business income (qbi): Single 163,300 213,300 see below for calculation details. Tax law & stimulus updates. Web the section 199a information worksheet for the s corporation and the shareholder, and the section 199a aggregation worksheets are available in forms view. If you are using turbotax download/cd, check for updates (menu at top, online>>check for updates). Web the section 199a information worksheet includes columns for multiple activities.Section 199a Information Worksheet

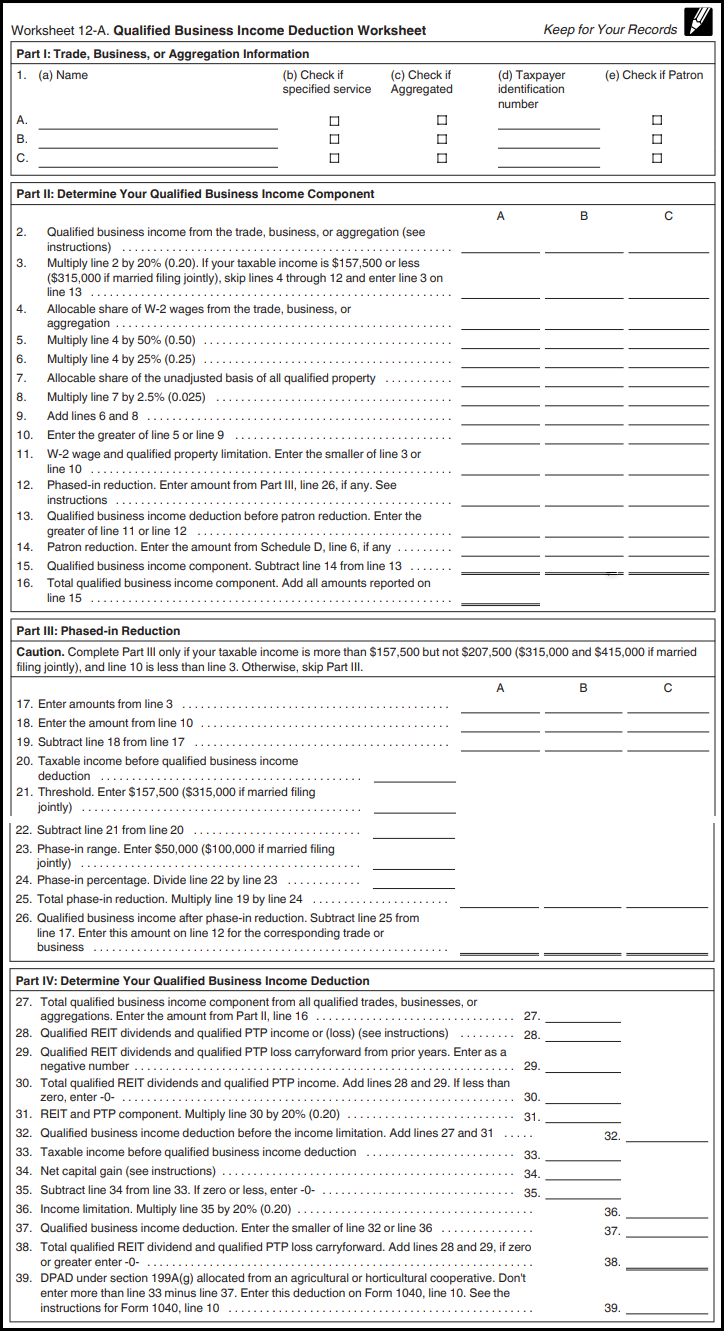

Lacerte Complex Worksheet Section 199A Qualified Business

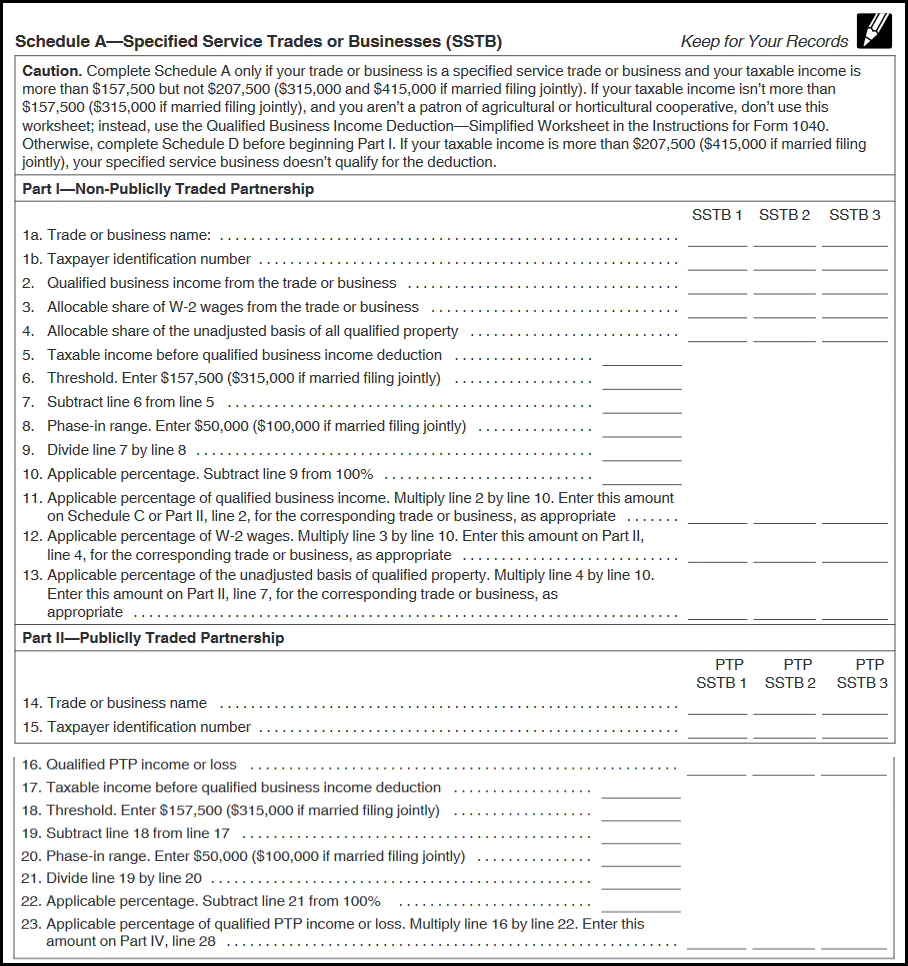

Section 199a Deduction Worksheet Master of Documents

How to enter and calculate the qualified business deduction

ProConnect Tax Online Simplified Worksheet Section 199A Qualif

Section 199a Information Worksheet

Lacerte Complex Worksheet Section 199A Qualified Business

Lacerte QBI Section 199A Partnership and SCorporate Details

Tax And Interest Deduction Worksheet Turbotax

ProConnect Tax Online Complex Worksheet Section 199A Qualified

Web Section 199A Deduction Also Known As The Qualified Business Income Deduction (Qbid) Arises From The Tax Cuts & Jobs Act Of 2017.

I Have Code Ah* And Value=Stmt In Box 20 Of My K1.

Section 199, Without The A, Is The Section Covering Domestic Production Activities Deduction.

What Is The Section 199A Deduction?

Related Post: