Self Employment Printable Small Business Tax Deductions Worksheet

Self Employment Printable Small Business Tax Deductions Worksheet - In summary, we need these sources of information: Use a separate worksheet for each business owned/operated. So if you use your $3,000 laptop 50% of the time for business, you can only deduct $1,500. If you make the payment under an accountable plan, deduct it in the category of the expense paid. The business standard mileage rate from july 1, 2022, to december 31, 2022, is 62.5 cents per mile. Web the home office deduction is one of the most significant tax benefits of running a small business out of your home. Web but as with other deductions, you’ll have to figure out the percentage used for business and personal use. New form 7205, energy efficient commercial buildings deduction. If you’re not sure where something goes don’t worry, every expense on here, except for meals, is deducted at the same rate. Web expenses (other than parking/tolls) if you use the standard mileage rate (use add mileage) depreciation and section 179 (line 13) depreciation expense on business assets (e.g. Computers, office equipment, tools, furniture, cars). You can deduct up to $2,500 for each individual piece of equipment through what’s called a safe harbor deduction. Web the business standard mileage rate from january 1, 2022, to june 30, 2022, is 58.5 cents per mile. If it goes in the wrong category it does not affect the bottom line. If you. Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction. Web expenses (other than parking/tolls) if you use the standard mileage rate (use add mileage) depreciation and section 179 (line 13) depreciation expense on business assets (e.g. If you make the payment under an accountable plan, deduct it in the category of the expense paid.. Web but as with other deductions, you’ll have to figure out the percentage used for business and personal use. Web reimbursements for business expenses. Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. Use separate sheet for each business. Web below is a list of items we will need before we can prepare. Web the legal structure of the business and other factors such as allowable business expenses and special deductions will all be considered when determining the tax payment amount. Use this form to figure your qualified business income deduction. All you need is smooth internet connection and a device to work on. Computers, office equipment, tools, furniture, cars). The business standard. You can deduct up to $2,500 for each individual piece of equipment through what’s called a safe harbor deduction. If you are an aspiring entrepreneur and are unsure of which tax publications may be relevant to you, please. Try your best to fill this out. The business standard mileage rate from july 1, 2022, to december 31, 2022, is 62.5. Use a separate worksheet for each business owned/operated. Use this form to figure your qualified business income deduction. However, your deduction may be limited. New tax deductions in 2023; While the tax benefit often would be sufficient enough to prevent you from moving to a dedicated office space once the need arises, it should be taken advantage of until then. While the tax benefit often would be sufficient enough to prevent you from moving to a dedicated office space once the need arises, it should be taken advantage of until then. Use a separate worksheet for each business owned/operated. Web expenses (other than parking/tolls) if you use the standard mileage rate (use add mileage) depreciation and section 179 (line 13). The irs requires you to use form 4562 to claim these deductions. Web the home office deduction is one of the most significant tax benefits of running a small business out of your home. However, your deduction may be limited. While the tax benefit often would be sufficient enough to prevent you from moving to a dedicated office space once. Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. Try your best to fill this out. The business standard mileage rate from july 1, 2022, to december 31, 2022, is 62.5 cents per mile. If you are an aspiring entrepreneur and are unsure of which tax publications may be relevant to you, please.. This publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file your income tax return. Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction. So if you use your $3,000 laptop 50% of the time for business, you can only deduct $1,500. Try your. If you are an aspiring entrepreneur and are unsure of which tax publications may be relevant to you, please. Use a separate worksheet for each business owned/operated. While the tax benefit often would be sufficient enough to prevent you from moving to a dedicated office space once the need arises, it should be taken advantage of until then. In summary, we need these sources of information: Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. If you make the payment under an accountable plan, deduct it in the category of the expense paid. Web the home office deduction is one of the most significant tax benefits of running a small business out of your home. New tax deductions in 2023; Web below is a list of items we will need before we can prepare your taxes: Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction. Web reimbursements for business expenses. Web the legal structure of the business and other factors such as allowable business expenses and special deductions will all be considered when determining the tax payment amount. Use separate sheet for each business. Completed organizer (see below) prior years tax returns ‐ if you are a first‐time tax client, please provide a copy of tax returns for the past 2 years (federal and state). You can deduct up to $2,500 for each individual piece of equipment through what’s called a safe harbor deduction. How do business tax deductions work? Web printable self employed tax deductions worksheet combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. Try your best to fill this out. All you need is smooth internet connection and a device to work on. However, your deduction may be limited. Web the home office deduction is one of the most significant tax benefits of running a small business out of your home. Web expenses (other than parking/tolls) if you use the standard mileage rate (use add mileage) depreciation and section 179 (line 13) depreciation expense on business assets (e.g. Web below is a list of items we will need before we can prepare your taxes: Use this form to figure your qualified business income deduction. While the tax benefit often would be sufficient enough to prevent you from moving to a dedicated office space once the need arises, it should be taken advantage of until then. You can generally deduct the amount you pay or reimburse employees for business expenses incurred for your business. New form 7205, energy efficient commercial buildings deduction. Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year, and identify potential ways to save money on this year’s tax bill. Web the business standard mileage rate from january 1, 2022, to june 30, 2022, is 58.5 cents per mile. Use separate sheet for each business. However, your deduction may be limited. Computers, office equipment, tools, furniture, cars). Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Web small business forms and publications. If you’re not sure where something goes don’t worry, every expense on here, except for meals, is deducted at the same rate. This publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file your income tax return.Pin by Jonathancdrake on Templates printable free Business tax

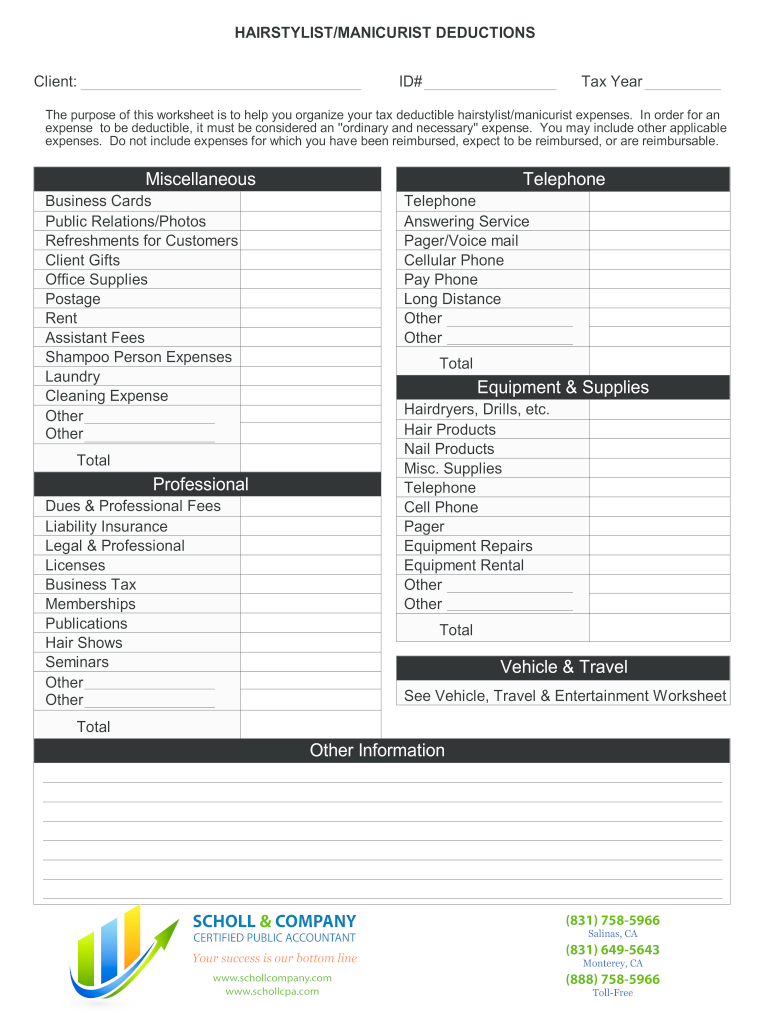

Self Employed Tax Deductions Worksheet Form Fill Out and Sign

Self Employment Printable Small Business Tax Deductions Worksheet

Self Employment Printable Small Business Tax Deductions Worksheet

10++ Small Business Tax Deductions Worksheet

Small Business Tax Deductions Worksheet

Tax Deductions Write Offs Self Employed Entrepreneur Creative

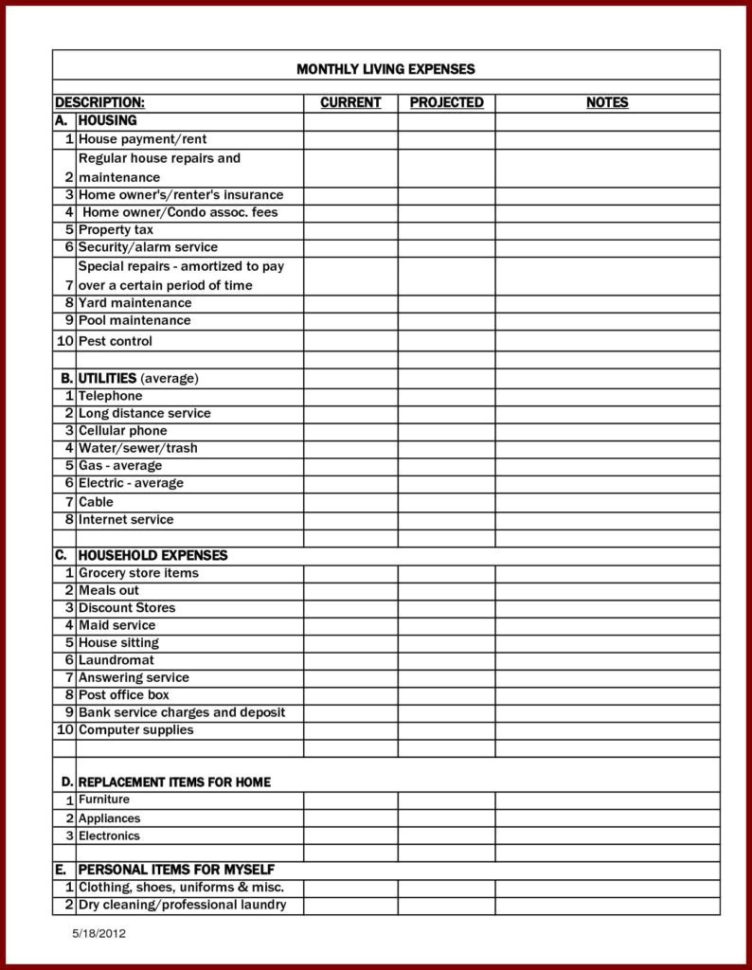

Itemized Deductions Spreadsheet In Business Itemized Deductions

FunctionalBest Of Self Employed Tax Deductions Worksheet Check more at

Self Employed Tax Deductions Worksheet —

So If You Use Your $3,000 Laptop 50% Of The Time For Business, You Can Only Deduct $1,500.

Simply Follow The Instructions On This Sheet And Start Lowering Your Social Security And Medicare Taxes.

Web Self Employed Tax Deduction Cheat Sheet.

When We’re Done, You’ll Know Exactly How To Reduce Your Income Tax Bill By Making Sure You’re Claiming All The Tax Deductions Available To Your Small Business.

Related Post: