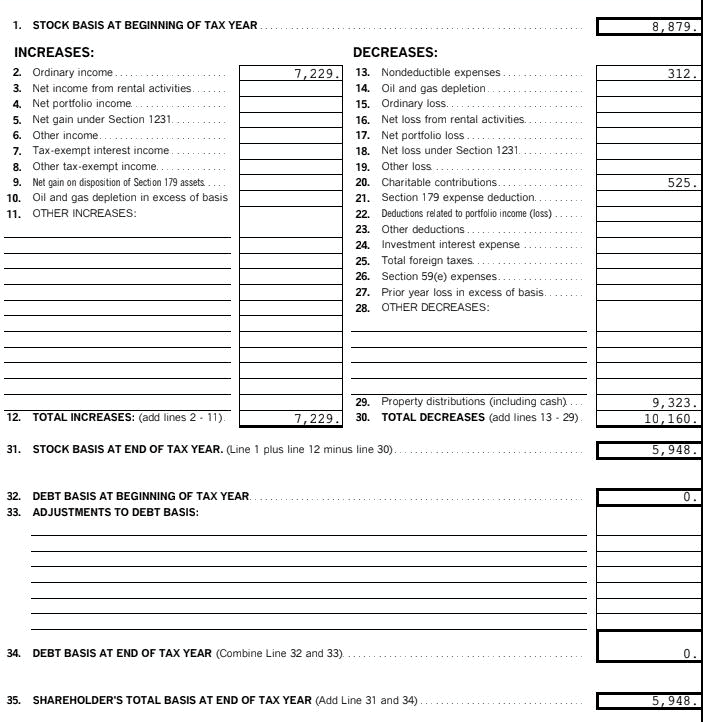

Shareholder Basis Worksheet

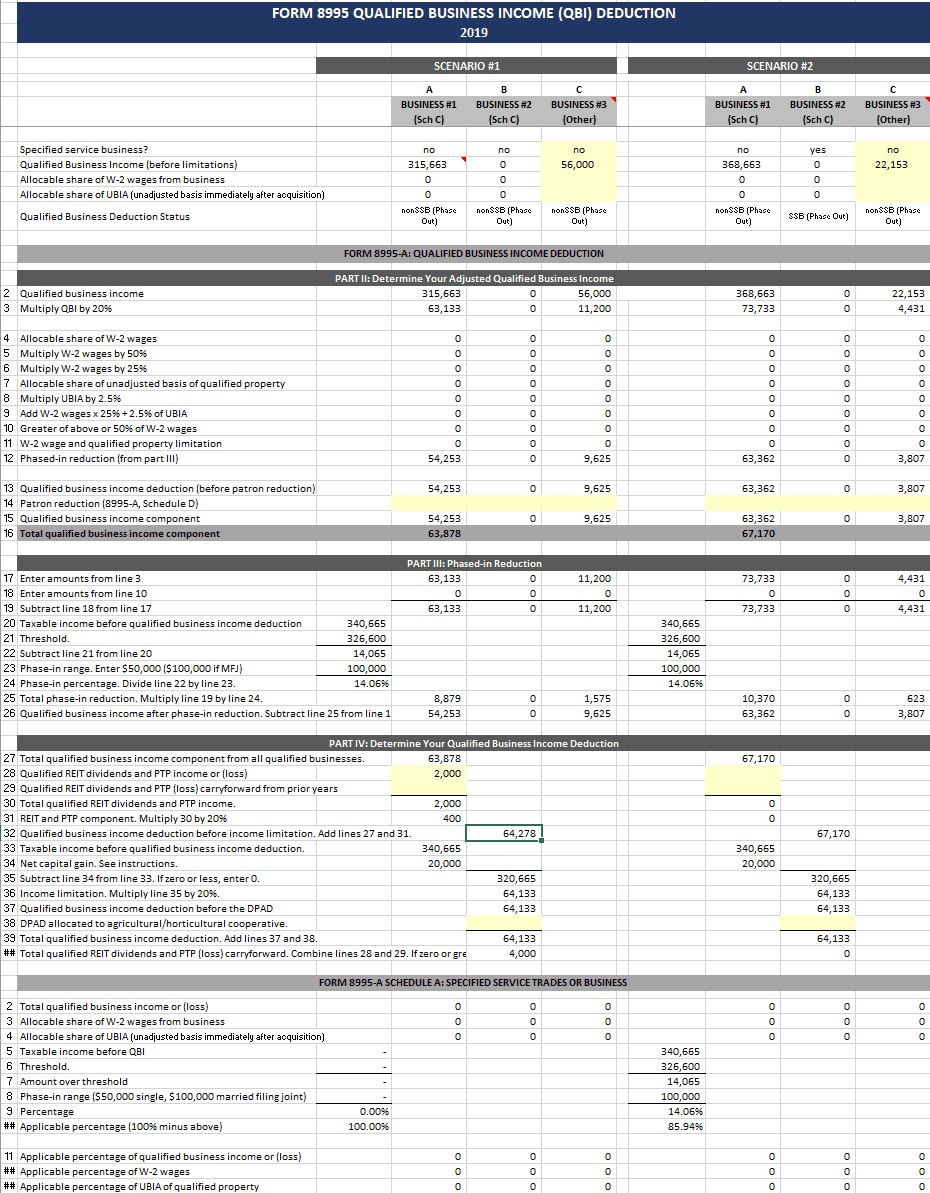

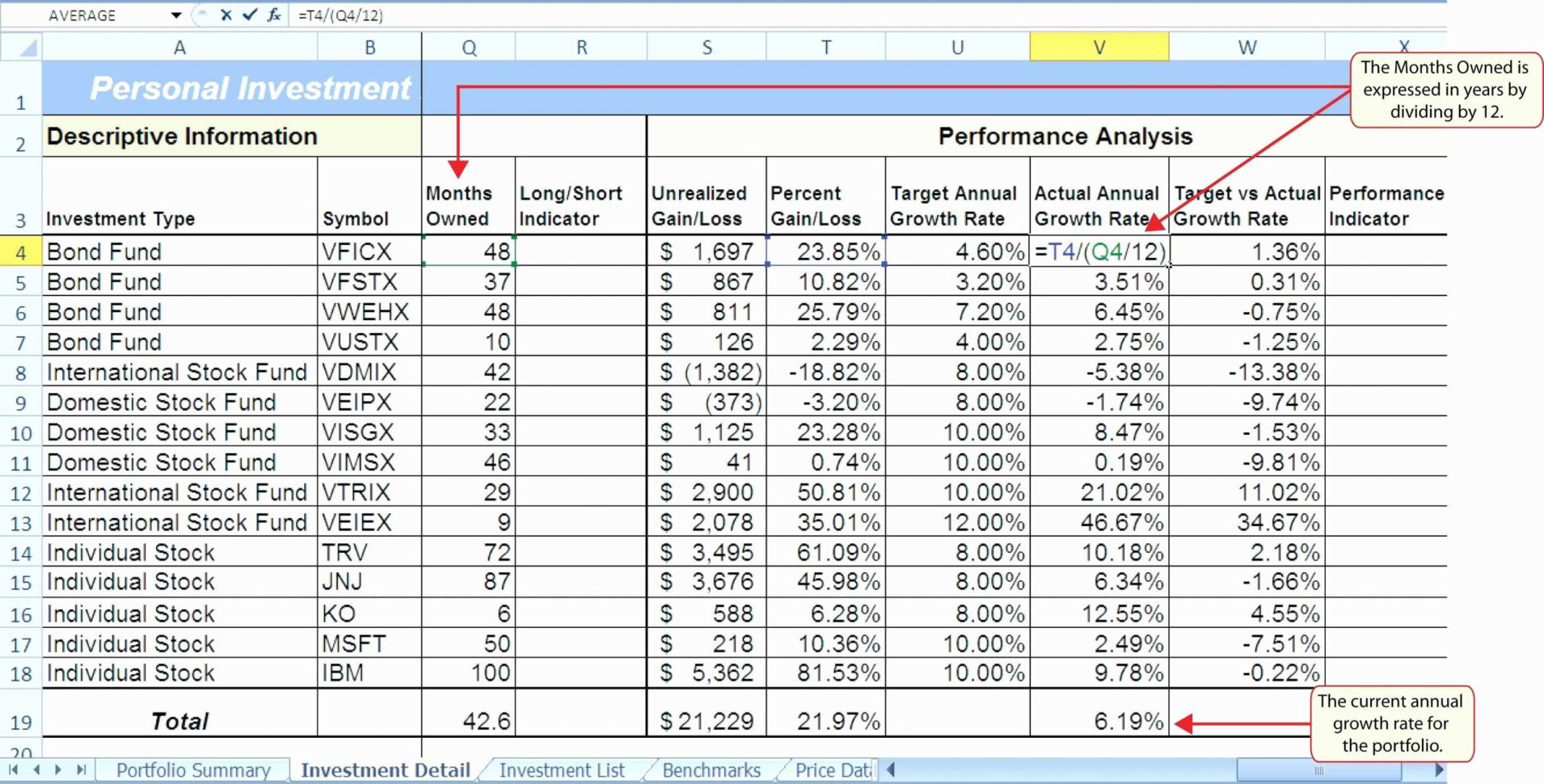

Shareholder Basis Worksheet - Shareholder losses and deductions are allowed in full when the total is less than the adjusted basis of the stock and basis of indebtedness. Web while the taxact program does not support form 7203 for 1040 returns, we do support the ability to attach the shareholder’s basis worksheet when required. To help track basis, there is a worksheet within the taxact program that can be used to calculate the adjusted basis. The adjusted shareholder basis will be used to figure gain or loss on the sale or disposition of shares. Web how do i use the shareholder's adjusted basis worksheet (basis wks)? 1366(d)] basis of stock reduced first, then debt. Web answer the shareholder basis worksheets and forms have been removed. Web shareholder's basis worksheet faqs. What losses and deductions are included in the basis limitation of the shareholder's share of the s corporation losses and deductions? The adjusted shareholder basis will be used to figure gain or loss on the sale or disposition of shares. The adjusted shareholder basis will be used to figure gain or loss on the sale or disposition of shares. Web answer the aggregate amount of losses and deductions that a shareholder may take into account for any taxable year may not exceed the sum of the adjusted basis of the shareholder's stock of the s corporation and the adjusted basis. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the year. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. See limitations on losses, deductions, and credits, later, for more information. Web answer the aggregate amount of losses and deductions that a. Web shareholder's basis computation worksheet i have read some other threads on shareholder basis and have a follow up question. 1366(d)] basis of stock reduced first, then debt. Web the adjusted basis of the shareholder's stock of the s corporation is calculated without regard to the shareholder's share of the losses and deductions. The adjusted shareholder basis will be used. Web answer the shareholder basis worksheets and forms have been removed. Web worksheet for tracking a shareholder's stock basis basis is the amount of investment in property for tax purposes. See limitations on losses, deductions, and credits, later, for more information. Web basis for s shareholders the basics: Web how do i use the shareholder's adjusted basis worksheet (basis wks)? 1366(d)] basis of stock reduced first, then debt. How does the shareholder's basis worksheet calculate the basis limitation on the deductibility of a shareholder's share of the s corporation's losses? Click the following links to read answers to common questions about processing shareholder's basis worksheets. Web how do i use the shareholder's adjusted basis worksheet (basis wks)? Web worksheet for. (for shareholder's use only) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. The amount that the property's owner has invested into the property is considered the basis. I understand that turbotax does not have a way to file the basis worksheet electronically (ridiculous by the way). Web answer the shareholder. Click the following links to read answers to common questions about processing shareholder's basis worksheets. Web how do i use the shareholder's adjusted basis worksheet (basis wks)? The worksheet is available from screen k1e. What losses and deductions are included in the basis limitation of the shareholder's share of the s corporation losses and deductions? The amount that the property's. Web the adjusted basis of the shareholder's stock of the s corporation is calculated without regard to the shareholder's share of the losses and deductions. Shareholders who have ownership in an s corporation must make a point to have a general understanding of basis. This is because the irs government form 7203 has replaced the need for additional statements. Web. Web shareholder's basis worksheet faqs. Any current undistributed income restores prior basis reductions of debt before increasing stock basis [sec. See limitations on losses, deductions, and credits, later, for more information. This is because the irs government form 7203 has replaced the need for additional statements. Web while the taxact program does not support form 7203 for 1040 returns, we. (for shareholder's use only) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. See limitations on losses, deductions, and credits, later, for more information. 1366(d)] basis of stock reduced first, then debt. The adjusted shareholder basis will be used to figure gain or loss on the sale or disposition of shares.. The adjusted shareholder basis will be used to figure gain or loss on the sale or disposition of shares. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the year. Click the following links to read answers to common questions about processing shareholder's basis worksheets. Web shareholder's basis worksheet faqs. The adjusted shareholder basis will be used to figure gain or loss on the sale or disposition of shares. Web worksheet for tracking a shareholder's stock basis basis is the amount of investment in property for tax purposes. Web the s corporation program in lacerte generates the shareholder basis computation worksheet. It is the shareholder's responsibility to consider and apply any applicable limitations. Web answer the aggregate amount of losses and deductions that a shareholder may take into account for any taxable year may not exceed the sum of the adjusted basis of the shareholder's stock of the s corporation and the adjusted basis of any indebtedness of the s corporation owed to the shareholder. Shareholder losses and deductions are allowed in full when the total is less than the adjusted basis of the stock and basis of indebtedness. See limitations on losses, deductions, and credits, later, for more information. The worksheet is available from screen k1e. The amount that the property's owner has invested into the property is considered the basis. Shareholders who have ownership in an s corporation must make a point to have a general understanding of basis. Web while the taxact program does not support form 7203 for 1040 returns, we do support the ability to attach the shareholder’s basis worksheet when required. Web answer the shareholder basis worksheets and forms have been removed. This is because the irs government form 7203 has replaced the need for additional statements. Web shareholder's basis computation worksheet i have read some other threads on shareholder basis and have a follow up question. Click the following links to read answers to common questions about processing shareholder's basis worksheets. 1366(d)] basis of stock reduced first, then debt. Web worksheet for tracking a shareholder's stock basis basis is the amount of investment in property for tax purposes. 1366(d)] basis of stock reduced first, then debt. Any current undistributed income restores prior basis reductions of debt before increasing stock basis [sec. Web shareholder's basis computation worksheet i have read some other threads on shareholder basis and have a follow up question. Web how do i use the shareholder's adjusted basis worksheet (basis wks)? It is the shareholder's responsibility to consider and apply any applicable limitations. I understand that turbotax does not have a way to file the basis worksheet electronically (ridiculous by the way). The amount that the property's owner has invested into the property is considered the basis. This is because the irs government form 7203 has replaced the need for additional statements. Web the adjusted basis of the shareholder's stock of the s corporation is calculated without regard to the shareholder's share of the losses and deductions. To help track basis, there is a worksheet within the taxact program that can be used to calculate the adjusted basis. Web answer the shareholder basis worksheets and forms have been removed. The worksheet is available from screen k1e. Web shareholder's basis worksheet faqs. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the year. Web worksheet for tracking a shareholder’s stock basis basis is the amount of investment in property for tax purposes.Using turbotax for s corp partner doppedia

S Corp Basis Worksheet Studying Worksheets

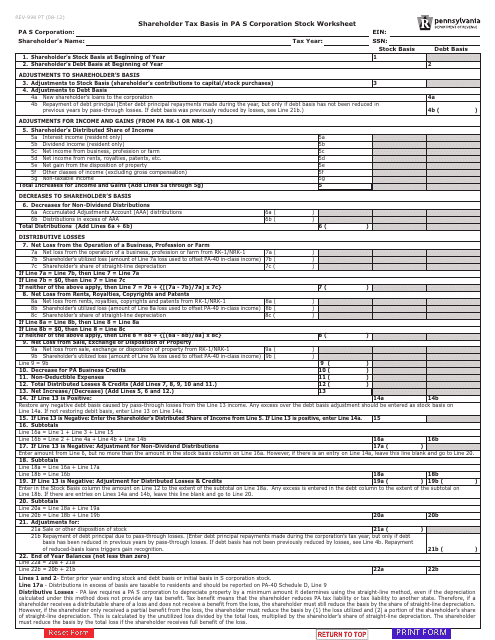

REV998 Shareholder Tax Basis in PA S Corporation Stock Worksheet

Shareholder Basis Worksheet Excel Promotiontablecovers

36 Shareholder Basis Worksheet Excel support worksheet

Shareholder Basis Worksheet Excel Escolagersonalvesgui

REV998 Shareholder Tax Basis in PA S Corporation Stock Worksheet

Stock Cost Basis Spreadsheet —

Quiz & Worksheet Shareholder s Basis & Transactions in S Corp Stock

Form REV998 Download Fillable PDF or Fill Online Shareholder Tax Basis

To Help Track Basis, There Is A Worksheet Within The Taxact Program That Can Be Used To Calculate The Adjusted Basis.

Click The Following Links To Read Answers To Common Questions About Processing Shareholder's Basis Worksheets.

How Does The Shareholder's Basis Worksheet Calculate The Basis Limitation On The Deductibility Of A Shareholder's Share Of The S Corporation's Losses?

Web Shareholder's Basis Worksheet Faqs.

Related Post: