Shopping For Credit Worksheet Answers

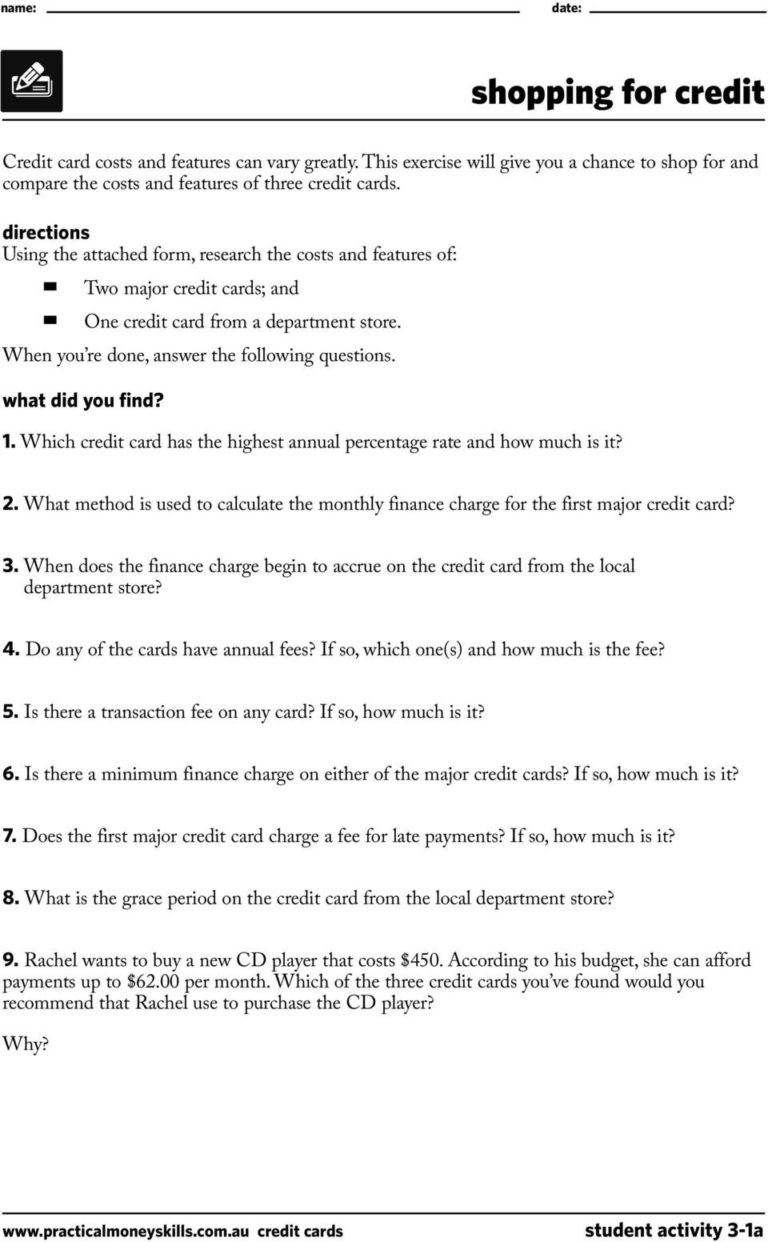

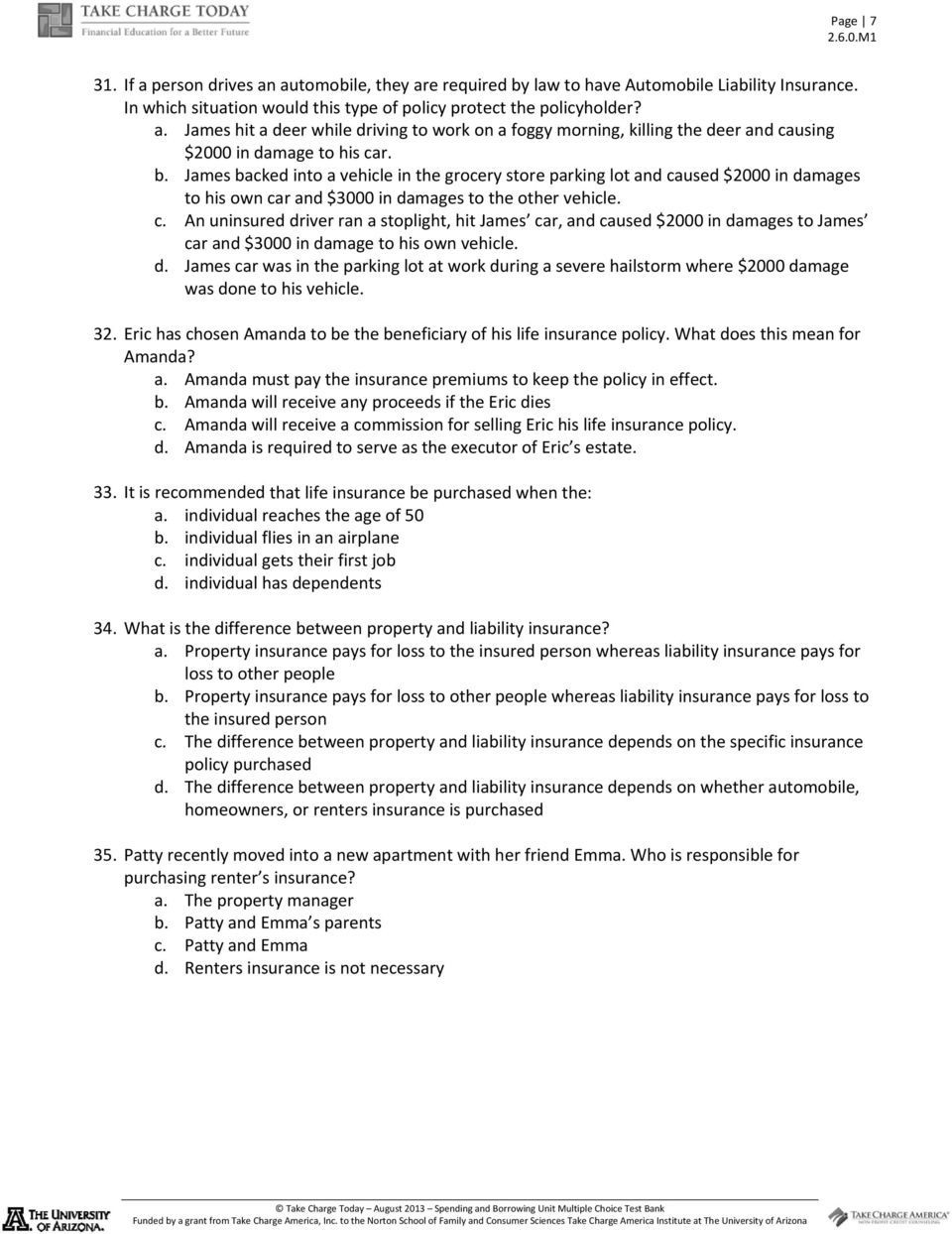

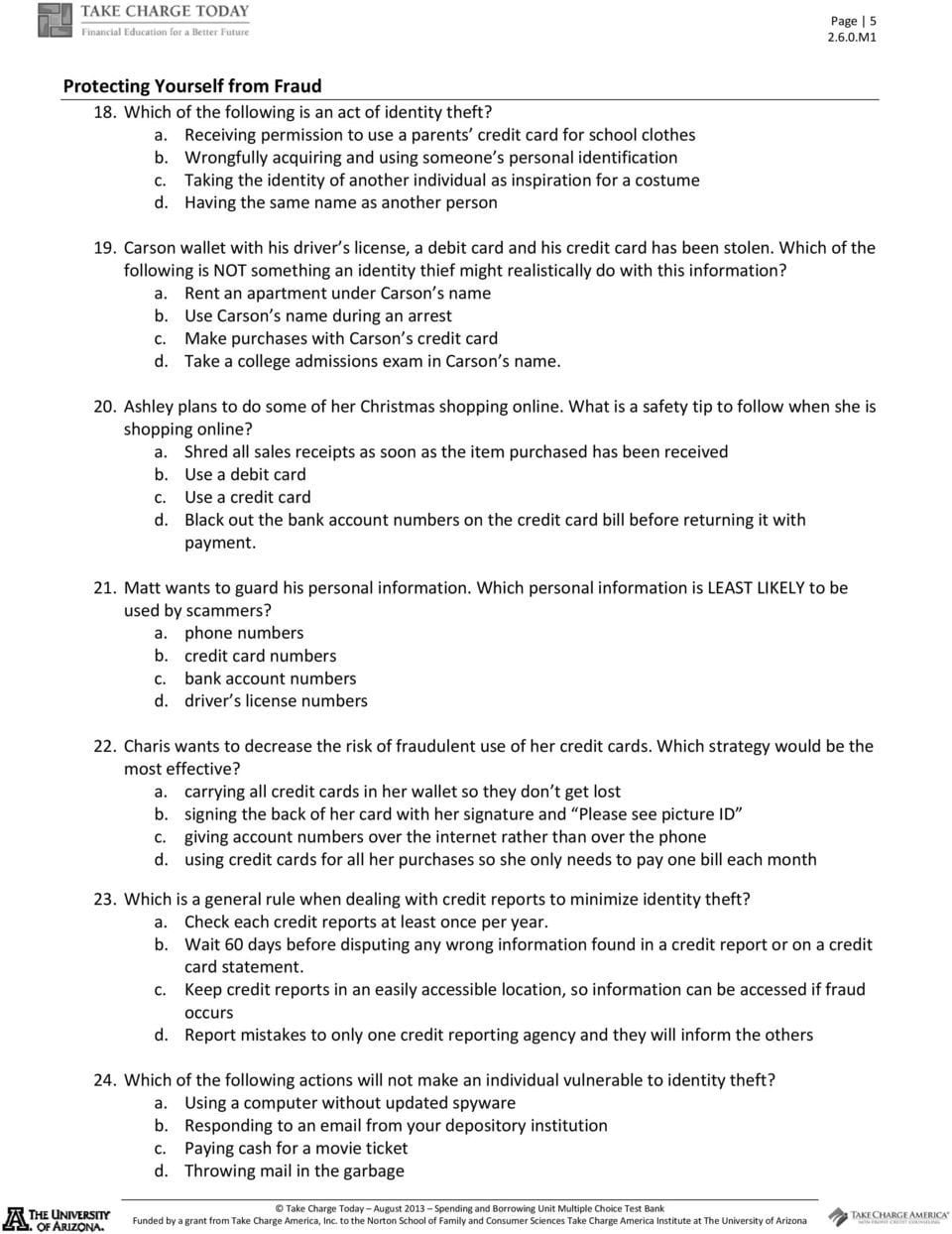

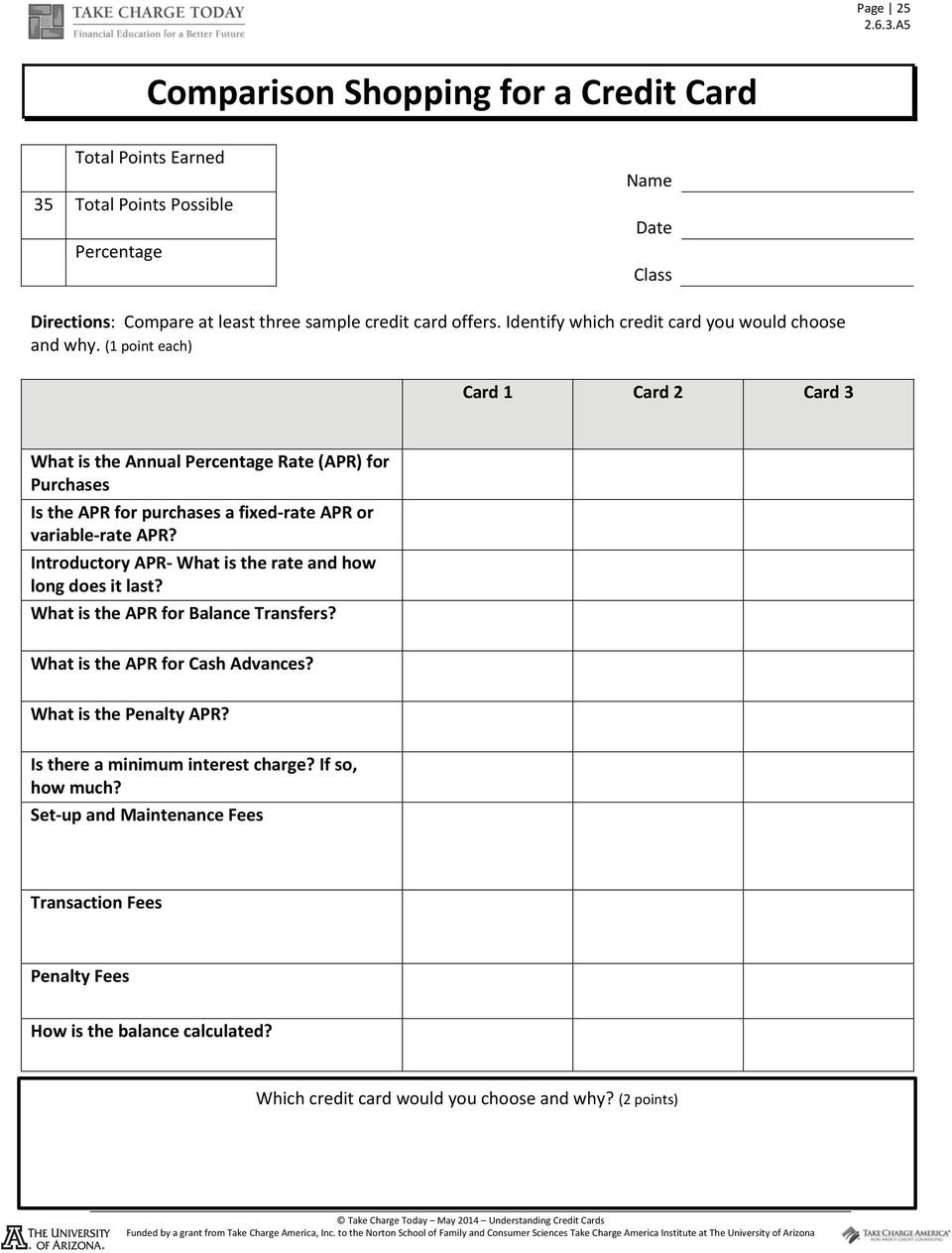

Shopping For Credit Worksheet Answers - §tudents will then answer the reflection questions. • read and understand a. Effortlessly add and highlight text, insert pictures, checkmarks, and icons, drop new fillable areas, and rearrange or remove pages from your paperwork. A recognizable name helps the shopper judge the product’s consistent level of quality. Web credit card comparison shopping worksheet. Research and compare watch features analyze the data collected to make an informed. Students play a shopping game to see how much money they would spend on four major purchases that require borrowing money. Though credit cards allow you to purchase items instantly without using cash, it’s important to use your cards as carefully as you would handle your cash. Web in this activity, students will be able to: If you're going to pay the bill in full every month, then the interest rate doesn't really matter to you. Research and compare watch features analyze the data collected to make an informed. What is the annual percentage rate (apr)? How can you plan ahead when you need or want to make a large. Web the fdic has a whole lesson plan, plus tons of consumer math and personal finance worksheets that you can immediately download and use. Web credit. Effortlessly add and highlight text, insert pictures, checkmarks, and icons, drop new fillable areas, and rearrange or remove pages from your paperwork. §tudents will use the information in the scenario and the comparison sheet to s answer the “choosing your watch” questions on the worksheet. Research and compare watch features analyze the data collected to make an informed. Web credit. Annual percentage rate (apr) ans: Use their knowledge and various online tools to assess her options for managing the debt responsibly. Borrowing money instead of paying cash for items can increase the total amount paid. Showing 94 results within credit cards. Web credit cards can be a convenient and flexible form of payment, but they have to be used responsibly. What features might you compare before making an expensive purchase? What is the corresponding periodic rate? Money, shopping, addition, subtraction, grade 4, math, word problems, worksheet. Web the best parts: Analyzing credit card statements understanding what’s on a credit card statement can help you to remain financially responsible while paying your bills on time, paying the appropriate amount, and using. Compare at least three sample credit card offers. Web in this activity, students will be able to: From late fees to lost cards, get answers to your credit card questions. Web shopping word problems grade 4 word problems worksheet using the below item prices, solve the equations. Research and compare watch features analyze the data collected to make an informed. Grade 4 math word problems worksheet keywords: Web answer the reflection questions. Money, shopping, addition, subtraction, grade 4, math, word problems, worksheet. Web analyzing credit card statements name: Before getting a credit card, first define your. Web answer the reflection questions. Whether you’re shopping for a new card or managing an existing card, it helps to have the facts. Web shopping word problems grade 4 word problems worksheet using the below item prices, solve the equations. Students practice creating a budget using an online salary paycheck tool and by calculating dollar amounts based on given percentages. Web shopping word problems grade 4 word problems worksheet using the below item prices, solve the equations. What is the date of the statement? Showing 94 results within credit cards. Web product research and comparison shopping can help you make informed buying decisions. What features might you compare before making an expensive purchase? Get the credit card comparison worksheet answers completed. Web the best parts: Research and compare watch features analyze the data collected to make an informed. Effortlessly add and highlight text, insert pictures, checkmarks, and icons, drop new fillable areas, and rearrange or remove pages from your paperwork. Web shopping for credit worksheets answers. Web in this activity, students will be able to: Web edit credit card comparison worksheet answers. Web credit card comparison shopping worksheet. Identify which credit card you would choose and why. A summary of the transactions on your account—your payments, credits, purchases, balance transfers, cash advances, fees, interest charges, and amounts past due. Effortlessly add and highlight text, insert pictures, checkmarks, and icons, drop new fillable areas, and rearrange or remove pages from your paperwork. What is the corresponding periodic rate? How many charges were made during the billing cycle? Web answer the reflection questions. Look for a card with no annual fee and a longer grace period so you don't get hit with a finance charge. Identify which credit card you would choose and why. Annual percentage rate (apr) ans: Because of your steady job, you’ve saved $2,000 and you can purchase some items you’ve always wanted: What is the annual percentage rate (apr)? Research and compare watch features analyze the data collected to make an informed. At the end of this lesson, the student will be able to: Things to consider when choosing a credit card: Web credit cards can be a convenient and flexible form of payment, but they have to be used responsibly in order to make the most of your money. Web in this activity, students will be able to: A recognizable name helps the shopper judge the product’s consistent level of quality. $7.14 sandra purchases a sweater and a tie. What is the date of the statement? Web shopping for credit worksheets answers. How can you make thoughtful spending decisions? Web what features would you look for if you planned to pay off your balance each month? [this activity has no answer key] view google doc. Though credit cards allow you to purchase items instantly without using cash, it’s important to use your cards as carefully as you would handle your cash. Borrowing money instead of paying cash for items can increase the total amount paid. What is the corresponding periodic rate? Discuss how costs and features can vary between credit cards, and have students apply their findings by making a decision about which kind of card they would use to purchase a popular electronic device. What is the date of the statement? At the end of this lesson, the student will be able to: Compare at least three sample credit card offers. §tudents will then answer the reflection questions. Web the best parts: Showing 94 results within credit cards. Web the fdic has a whole lesson plan, plus tons of consumer math and personal finance worksheets that you can immediately download and use. Web §sk students to read the scenario in the worksheet and review the features on a the watch comparison sheet. What was the previous balance? Identify which credit card you would choose and why. From late fees to lost cards, get answers to your credit card questions.Shopping For Credit Worksheet Answer Key —

Shopping For Credit Worksheet Answer Key —

Shopping For Credit Worksheet Answer Key —

Shopping For A Credit Card Worksheet Answers

The Secret History Of The Credit Card Worksheet Answers

Comparison Shopping For A Credit Card Answer Key 35 Comparison

Caroline Blue's Credit Report Worksheet Answers Alphabet Worksheets

Shopping For Credit Worksheet Answer Key

Shopping For Credit Worksheet Answer Key —

Shopping For A Credit Card Worksheet Answers —

Web The Questions Will Quiz You On Examples Of Types Of Credit And Present A Scenario For Analysis To Determine The Best Credit Option.

Web Credit Card Companies Tend To Monitor The Types And Locations Of Purchases As Another Means Of Protection.

Web Edit Credit Card Comparison Worksheet Answers.

Students Practice Creating A Budget Using An Online Salary Paycheck Tool And By Calculating Dollar Amounts Based On Given Percentages They Then Zoom In On Average Credit Card Spending Over 4 Years Of College And Identifying How Much Each Monthly Payment Adds Up To Be In Order To Pay Off The Debt In A Timely Fashion Lastly.

Related Post: