Small Business Tax Deductions Worksheet

Small Business Tax Deductions Worksheet - If you do, you’re allowed to deduct a specific amount when you compute your taxable profit. Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction. Under section 2042 of the small business jobs act, a deduction, for income tax purposes, is allowed to self. Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. The full list of potential deductions you can claim. Web use this form to figure your qualified business income deduction. Ad manage all your business expenses in one place with quickbooks®. Web up to 24% cash back if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help and resources that you might need. Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from your qualified trade or business, plus 20% of the. Web tax year 2022 small business checklist section a identification client(s) who actually operate business name of business (if any). Ad manage all your business expenses in one place with quickbooks®. Automatically track all your income and expenses. If you do, you’re allowed to deduct a specific amount when you compute your taxable profit. Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. Web use this form to figure your qualified. If you do, you’re allowed to deduct a specific amount when you compute your taxable profit. Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet template that you can use to organize. Ad manage all your business expenses in one place with quickbooks®. Manage your tax deductions with netsuite;. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web use this form to figure your qualified business income deduction. Get a free guided quickbooks® setup. Under section 2042 of the small business jobs act, a deduction, for income tax purposes, is allowed to self. Web tax year 2022 small business checklist section a identification client(s) who actually operate business name of business (if any). Web up to 24% cash back if you're facing an audit or filing taxes for the first time, complete our free. Which tax deductions for small businesses are available to you? Get a free guided quickbooks® setup. Web up to 24% cash back if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help and resources that you might need. Funds delivered in days, not. Explore updated credits,. Web use this form to figure your qualified business income deduction. Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet template that you can use to organize all. Explore updated credits, deductions, and exemptions, including the standard. Automatically track all your income and expenses. Web up to 24% cash back. Which tax deductions for small businesses are available to you? Ad manage all your business expenses in one place with quickbooks®. The full list of potential deductions you can claim. Explore updated credits, deductions, and exemptions, including the standard. Starting a business is a big feat for many entrepreneurs, but keeping the ball rolling is a much bigger challenge. Which tax deductions for small businesses are available to you? If you do, you’re allowed to deduct a specific amount when you compute your taxable profit. Funds delivered in days, not. Ad manage all your business expenses in one place with quickbooks®. Automatically track all your income and expenses. If you do, you’re allowed to deduct a specific amount when you compute your taxable profit. Get a free guided quickbooks® setup. Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet template that you can use to organize all. Web the irs recently released the new inflation adjusted 2022 tax. Web up to 24% cash back if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help and resources that you might need. The full list of potential deductions you can claim. Web to help you minimize your tax liability, here is a list of 20+ small. Web tax year 2022 small business checklist section a identification client(s) who actually operate business name of business (if any). Under section 2042 of the small business jobs act, a deduction, for income tax purposes, is allowed to self. Web up to 24% cash back if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help and resources that you might need. Automatically track all your income and expenses. 20 top small business expense tax deductions; The full list of potential deductions you can claim. Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. If you do, you’re allowed to deduct a specific amount when you compute your taxable profit. Starting a business is a big feat for many entrepreneurs, but keeping the ball rolling is a much bigger challenge. Ad manage all your business expenses in one place with quickbooks®. Automatically track all your income and expenses. Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction. Car expenses do you use your car for work? Web use this form to figure your qualified business income deduction. Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet template that you can use to organize all. Web farwah jafri | june 11 2021. Web complete list of small business tax deductions. Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from your qualified trade or business, plus 20% of the. Explore updated credits, deductions, and exemptions, including the standard. Get a free guided quickbooks® setup. Which tax deductions for small businesses are available to you? Web use this form to figure your qualified business income deduction. Funds delivered in days, not. Web up to 24% cash back if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help and resources that you might need. Ad manage all your business expenses in one place with quickbooks®. Automatically track all your income and expenses. 20 top small business expense tax deductions; Automatically track all your income and expenses. Explore updated credits, deductions, and exemptions, including the standard. Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. Get a free guided quickbooks® setup. Car expenses do you use your car for work? Web farwah jafri | june 11 2021. Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet template that you can use to organize all. Web small business forms and publications. Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction.10++ Small Business Tax Deductions Worksheet

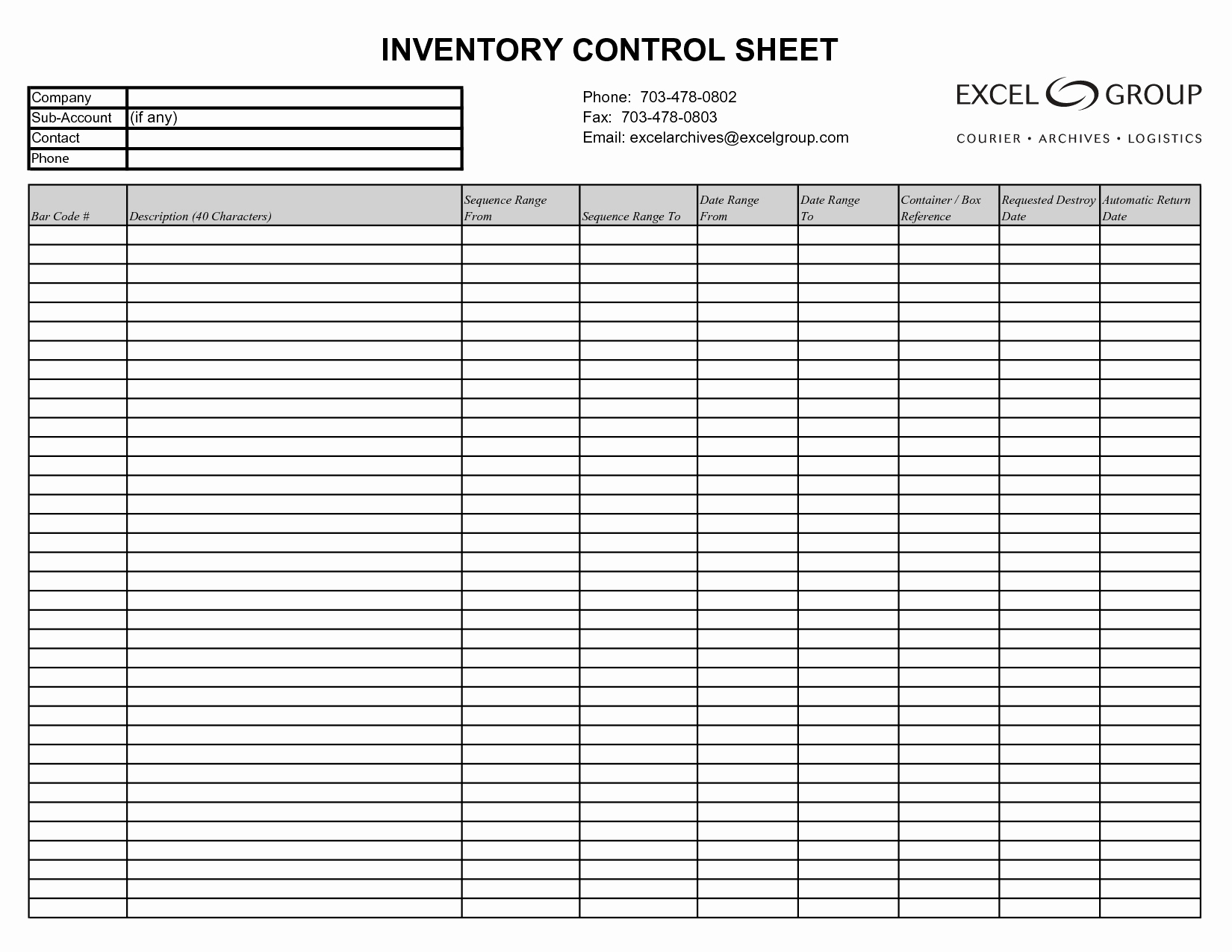

Small Business Tax Deductions Worksheet New Small Business Tax inside

Small Business Expenses Spreadsheet With Small Business Tax Deductions

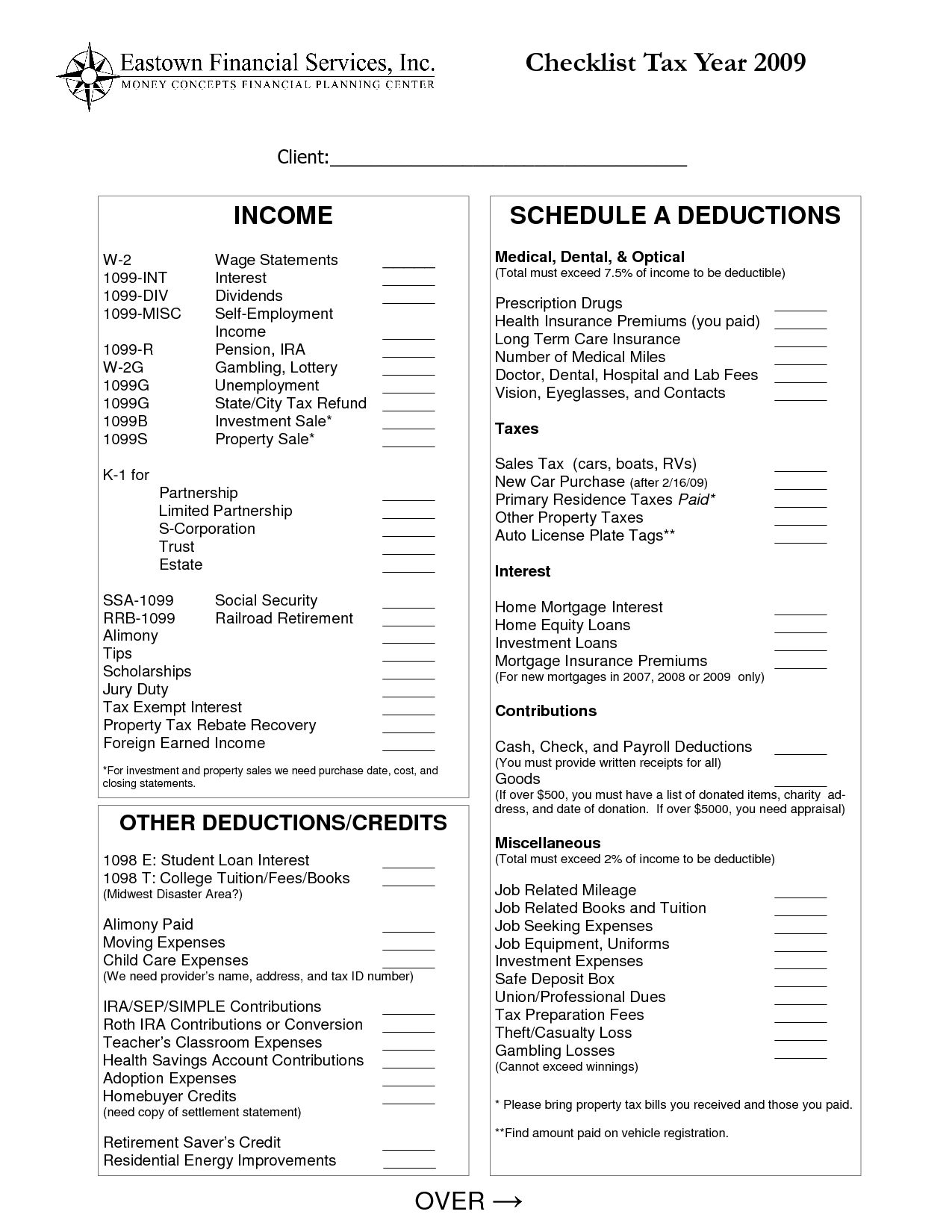

8 Best Images of Tax Preparation Organizer Worksheet Individual

Itemized Deductions Spreadsheet in Business Itemized Deductions

10 Business Tax Deductions Worksheet /

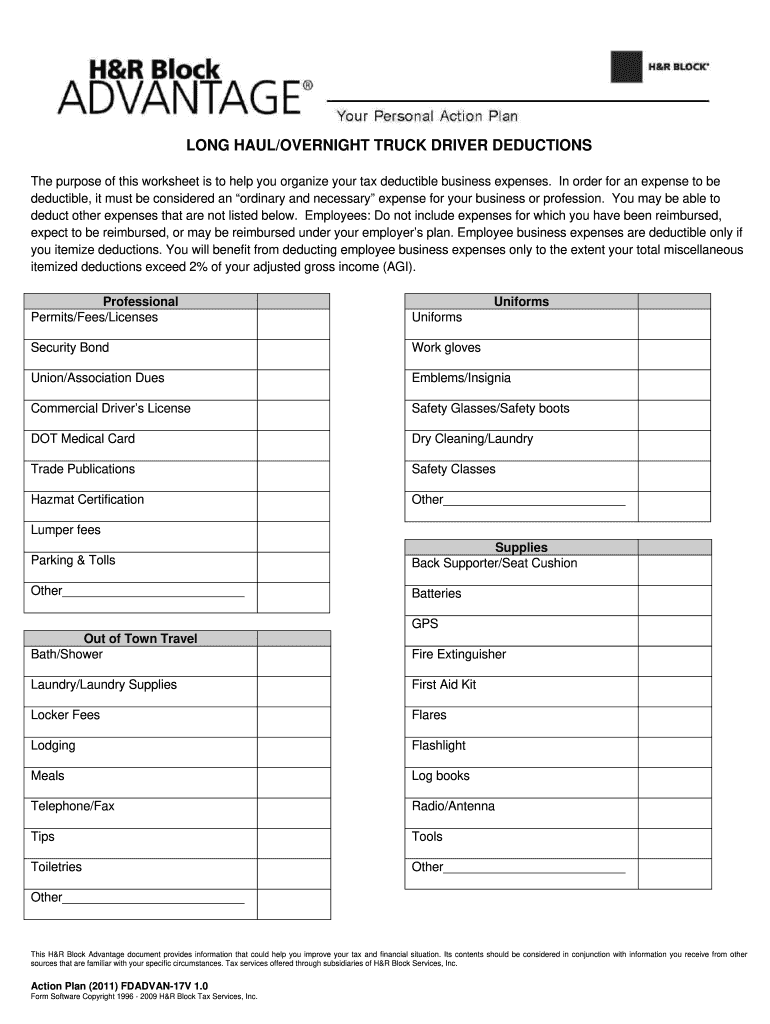

Owner Operator Tax Deductions Worksheet Form Fill Out and Sign

Small Business Tax Deductions Worksheets

Self Employment Printable Small Business Tax Deductions Worksheet

8 Tax Itemized Deduction Worksheet /

Web Tax Year 2022 Small Business Checklist Section A Identification Client(S) Who Actually Operate Business Name Of Business (If Any).

Web For Tax Years Beginning After 2017, You May Be Entitled To Take A Deduction Of Up To 20% Of Your Qualified Business Income From Your Qualified Trade Or Business, Plus 20% Of The.

Web Complete List Of Small Business Tax Deductions.

Get A Free Guided Quickbooks® Setup.

Related Post: