Social Security Taxable Calculation Worksheet

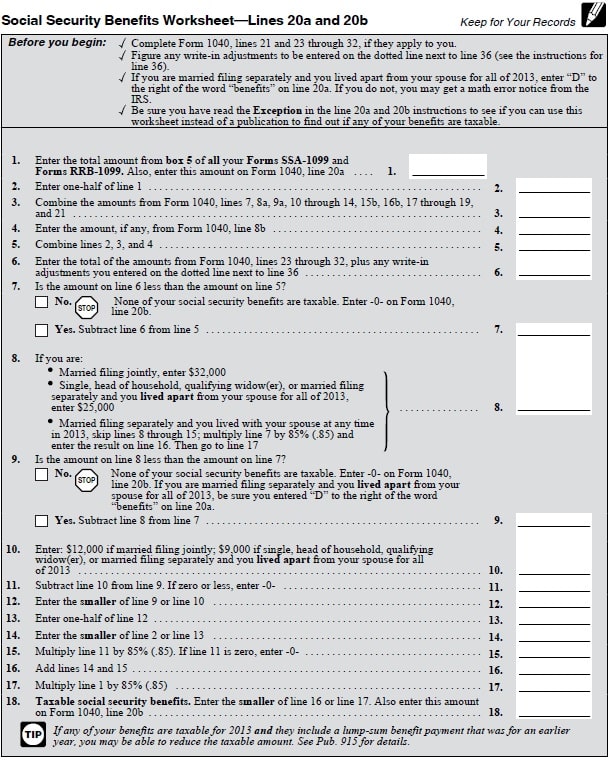

Social Security Taxable Calculation Worksheet - Web filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. More than $34,000, up to 85 percent of your benefits may be taxable. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Install the calculator by expanding anypia.dmg, which will create a disk image on your computer. Calculating taxable benefits before filling out this worksheet: Web uncollected employee social security and medicare tax on wages from form 8919 shown on the dotted line next to part i, line 6, plus. Web the taxable amount determined by the projection displays on the social security worksheet (report d16), then carried to the taxable income analysis, column. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. Web how to calculate my social security benefits. Use this calculator to see. Web how to calculate my social security benefits. You can use the money help center calculator to determine how much social security you will get and how income tax may. Calculating taxable benefits before filling out this worksheet: Must be downloaded and installed on your computer. The estimate includes wep reduction. Will your social security benefits be taxable? Amount on form 8959, line 7 Web the social security tax rate for employees and employers is 6.2% of employee compensation, for a total of 12.4%. More than $34,000, up to 85 percent of your benefits may be taxable. Use this calculator to see. Web the social security tax rate for employees and employers is 6.2% of employee compensation, for a total of 12.4%. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. Web the taxable portion of the benefits that's included. The taxable amount, if any, of a taxpayer’s social. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Web as your gross income increases, a higher percentage of your social security benefits become. Amount on form 8959, line 7 $ your annual earnings must be earnings covered by social security. Calculating taxable benefits before filling out this worksheet: Will your social security benefits be taxable? Must be downloaded and installed on your computer. Web the social security tax rate for employees and employers is 6.2% of employee compensation, for a total of 12.4%. Married filing separately and lived apart from their spouse for all of. More than $34,000, up to 85 percent of your benefits may be taxable. Amount on form 8959, line 7 Use this calculator to see. Web filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Tax deferred retirement plans tend to increase tax liability on social. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Install the calculator by expanding anypia.dmg, which will create a disk image on. Amount on form 8959, line 7 The taxable amount, if any, of a taxpayer’s social. Calculating taxable benefits before filling out this worksheet: Will your social security benefits be taxable? 2) the taxpayer repaid any benefits in 2019 and total repayments (box 4) were more than total benefits for 2019 (box. Use this calculator to see. Web how to calculate my social security benefits. Web filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Calculating taxable benefits before filling out this worksheet: Install the calculator by expanding anypia.dmg, which will create a disk image on your computer. Web how to calculate my social security benefits. More than $34,000, up to 85 percent of your benefits may be taxable. Web click on anypia.dmg (10,306,970 bytes) to download the mac os version. Must be downloaded and installed on your computer. 2) the taxpayer repaid any benefits in 2019 and total repayments (box 4) were more than total benefits for. Web worksheet instead of a publication to find out if any of your benefits are taxable. Web click on anypia.dmg (10,306,970 bytes) to download the mac os version. Web get the most precise estimate of your retirement, disability, and survivors benefits. Web filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. $ your annual earnings must be earnings covered by social security. Will your social security benefits be taxable? Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and. The estimate includes wep reduction. Must be downloaded and installed on your computer. Use this calculator to see. Amount on form 8959, line 7 2) the taxpayer repaid any benefits in 2019 and total repayments (box 4) were more than total benefits for 2019 (box. Web the social security tax rate for employees and employers is 6.2% of employee compensation, for a total of 12.4%. Married filing separately and lived apart from their spouse for all of. Tax deferred retirement plans tend to increase tax liability on social. Web uncollected employee social security and medicare tax on wages from form 8919 shown on the dotted line next to part i, line 6, plus. Web enter your date of birth ( month / day / year format) / / enter earnings in the current year: More than $34,000, up to 85 percent of your benefits may be taxable. Web the taxable amount determined by the projection displays on the social security worksheet (report d16), then carried to the taxable income analysis, column. Web get the most precise estimate of your retirement, disability, and survivors benefits. Web enter your date of birth ( month / day / year format) / / enter earnings in the current year: Web click on anypia.dmg (10,306,970 bytes) to download the mac os version. Use this calculator to see. Will your social security benefits be taxable? Must be downloaded and installed on your computer. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web how to calculate my social security benefits. Tax deferred retirement plans tend to increase tax liability on social. Web the taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and. Web worksheet instead of a publication to find out if any of your benefits are taxable. Web uncollected employee social security and medicare tax on wages from form 8919 shown on the dotted line next to part i, line 6, plus. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. 2) the taxpayer repaid any benefits in 2019 and total repayments (box 4) were more than total benefits for 2019 (box. Web the taxable amount determined by the projection displays on the social security worksheet (report d16), then carried to the taxable income analysis, column. $ your annual earnings must be earnings covered by social security.Calculate Taxable Social Security Worksheets

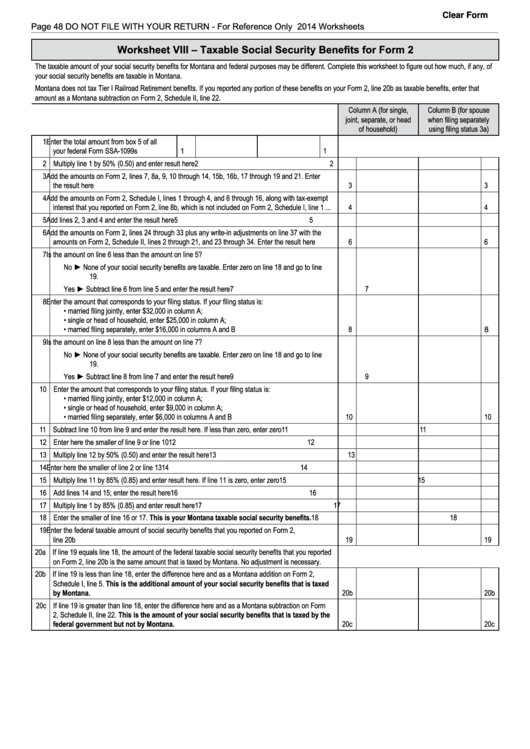

Fillable Worksheet Viii Taxable Social Security Benefits For Form 2

Is Social Security Tax Deductible

Social Security Tax Equation Tessshebaylo

2018 Social Security Taxable Worksheet Master of

Social Security Calculator Spreadsheet Inside Example Of Retirement

Social Security Spreadsheet Fun Bankers Anonymous

IRS Instruction 943 20202021 Fill out Tax Template Online US Legal

Social Security Calculator Spreadsheet Inside Break Even Analysis Excel

Taxable Social Security Calculator

The Estimate Includes Wep Reduction.

Web Between $25,000 And $34,000, You May Have To Pay Income Tax On Up To 50 Percent Of Your Benefits.

You Can Use The Money Help Center Calculator To Determine How Much Social Security You Will Get And How Income Tax May.

More Than $34,000, Up To 85 Percent Of Your Benefits May Be Taxable.

Related Post: