Social Security Taxable Worksheet

Social Security Taxable Worksheet - As your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent updates, related forms and instructions on how to file. To find out if their benefits are taxable, taxpayers should: Web social security benefits worksheet (2019) caution: Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits.the taxact® program will automatically calculate the taxable amount of your social security income (if any). Between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. Web up to 50% of your social security benefits are taxable if: Between $32,000 and $44,000, you may have to pay. He must include 85% of his social security benefits in his taxable income because he is married filing separately and lived with his spouse during 2022. If your income is modest, it is likely that none of your social security benefits are taxable. As your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. Calculating taxable benefits before filling out this worksheet: Bill figures his taxable benefits by completing worksheet 1, shown below. Enter your subtraction for dependents (use worksheet in instructions). Web jul 27, 2023 11:00 am edt. Web fifty percent of a taxpayer's benefits may be taxable if they are: Take one half of the. Web 2 nontaxable social security and/or railroad retirement board benefits received. All forms are printable and downloadable. It only needs three numbers plus your tax filing status. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web social security benefits include monthly retirement, survivor and disability benefits. I made an online calculator that helps you calculate it much more quickly. Do not use the worksheet below if any of the following apply to you; Web fill. Web social security benefits include monthly retirement, survivor and disability benefits. Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that will be taxable but the worksheet isn’t the easiest to use. Filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Between $32,000 and. Married filers with an agi of less than $60,000 may qualify for a full exemption ($45,000 for single filers. Filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income. If your income is modest, it is likely that none of your social security benefits are taxable. Web social security benefits include monthly retirement, survivor and. Web social security benefits include monthly retirement, survivor and disability benefits. The portion of benefits that are taxable depends on the taxpayer's income and filing status. Do not use the worksheet below if any of the following apply to you; Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that. Married filing separately and lived apart from their spouse for all of. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax on some of their benefit income. Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that will be taxable. Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. Web worksheet to determine if bene ts may be taxable a) amount of social security or railroad retirement bene ts. Once completed you can sign your fillable form or send for signing. As your gross income increases, a higher. Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. Social security taxable benets worksheet (2020) Instead, go directly to irs pub. And renter’s property tax refund 9995 *235211* Use fill to complete blank online others pdf forms for free. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax on some of their benefit income. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. Web the taxable portion of social security benefits is never more than 85% of the net benefits the. Web the taxable portion of social security benefits is never more than 85% of the net benefits the taxpayer received. Your social security benefits are taxable based on your filing status and agi. As your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. And renter’s property tax refund 9995 *235211* Web fill online, printable, fillable, blank social security taxable benets worksheet (2020) form. They don't include supplemental security income payments, which aren't taxable. Web you will pay tax on only 85 percent of your social security benefits, based on internal revenue service (irs) rules. Married filers with an agi of less than $60,000 may qualify for a full exemption ($45,000 for single filers. All forms are printable and downloadable. Social security taxable benets worksheet (2020) I made an online calculator that helps you calculate it much more quickly. Web social security income is generally taxable at the federal level, though whether or not you have to pay taxes on your depends on your income level. You file a joint return,. Calculating taxable benefits before filling out this worksheet: As your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits. Do not use this worksheet if any of the following apply. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits.the taxact® program will automatically calculate the taxable amount of your social security income (if any). Web worksheet to determine if bene ts may be taxable a) amount of social security or railroad retirement bene ts. 915, social security and equivalent railroad retirement benefits. In many cases, the taxable portion is less than 50%. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. In many cases, the taxable portion is less than 50%. Social security taxable benets worksheet (2020) Web up to 50% of your social security benefits are taxable if: See the instructions for line 16 for details. 915, social security and equivalent railroad retirement benefits. Between $32,000 and $44,000, you may have to pay. Once completed you can sign your fillable form or send for signing. Fill in lines a through e. Web social security income is generally taxable at the federal level, though whether or not you have to pay taxes on your depends on your income level. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. I made an online calculator that helps you calculate it much more quickly. Calculating taxable benefits before filling out this worksheet: Do not use this worksheet if any of the following apply. Married filing separately and lived apart from their spouse for all of. Web worksheet to determine if bene ts may be taxable a) amount of social security or railroad retirement bene ts.Social Security Taxable Worksheet 2023

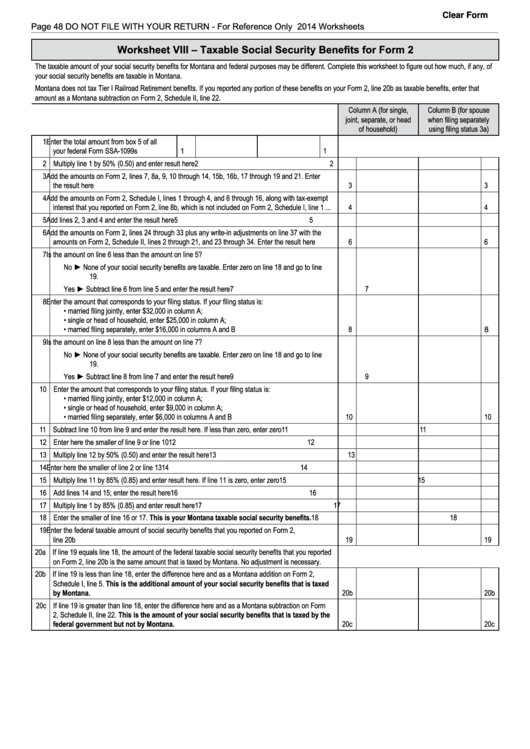

Fillable Worksheet Viii Taxable Social Security Benefits For Form 2

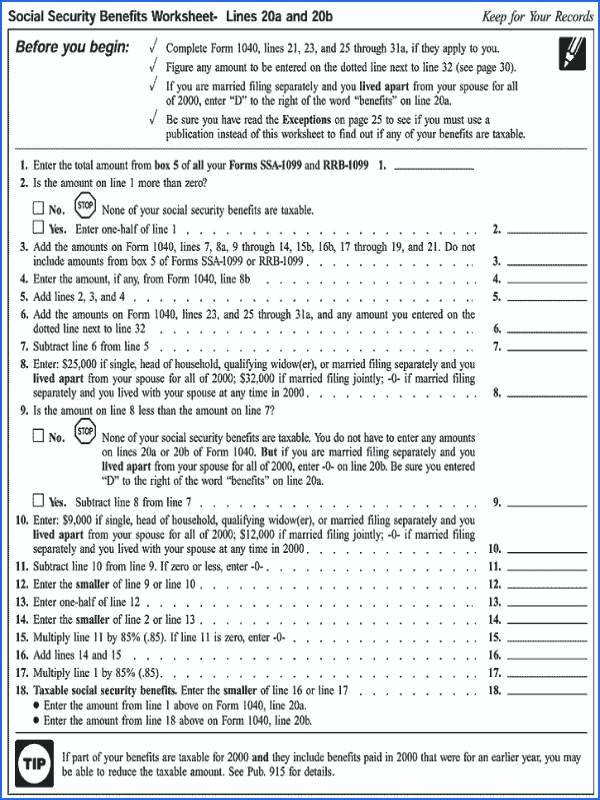

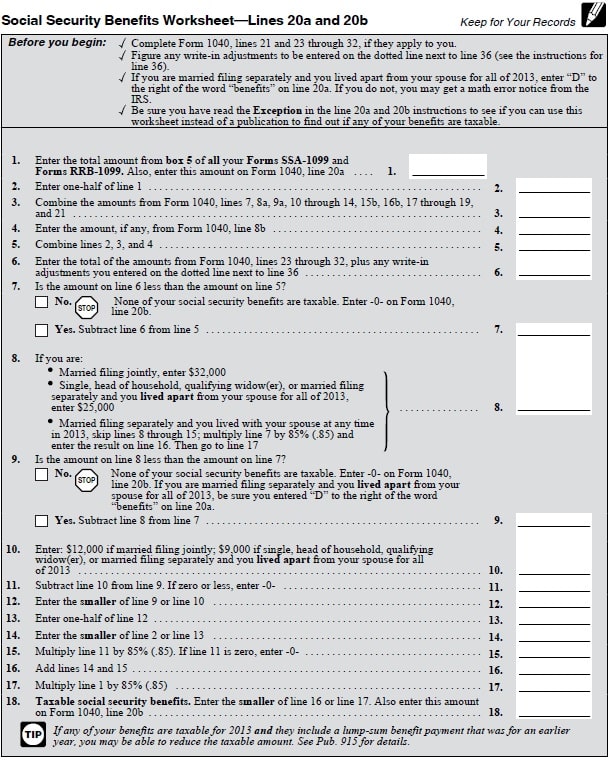

2018 Form 1040 Social Security Fillable Worksheet 1040 Form Printable

10++ Taxable Social Security Worksheet Worksheets Decoomo

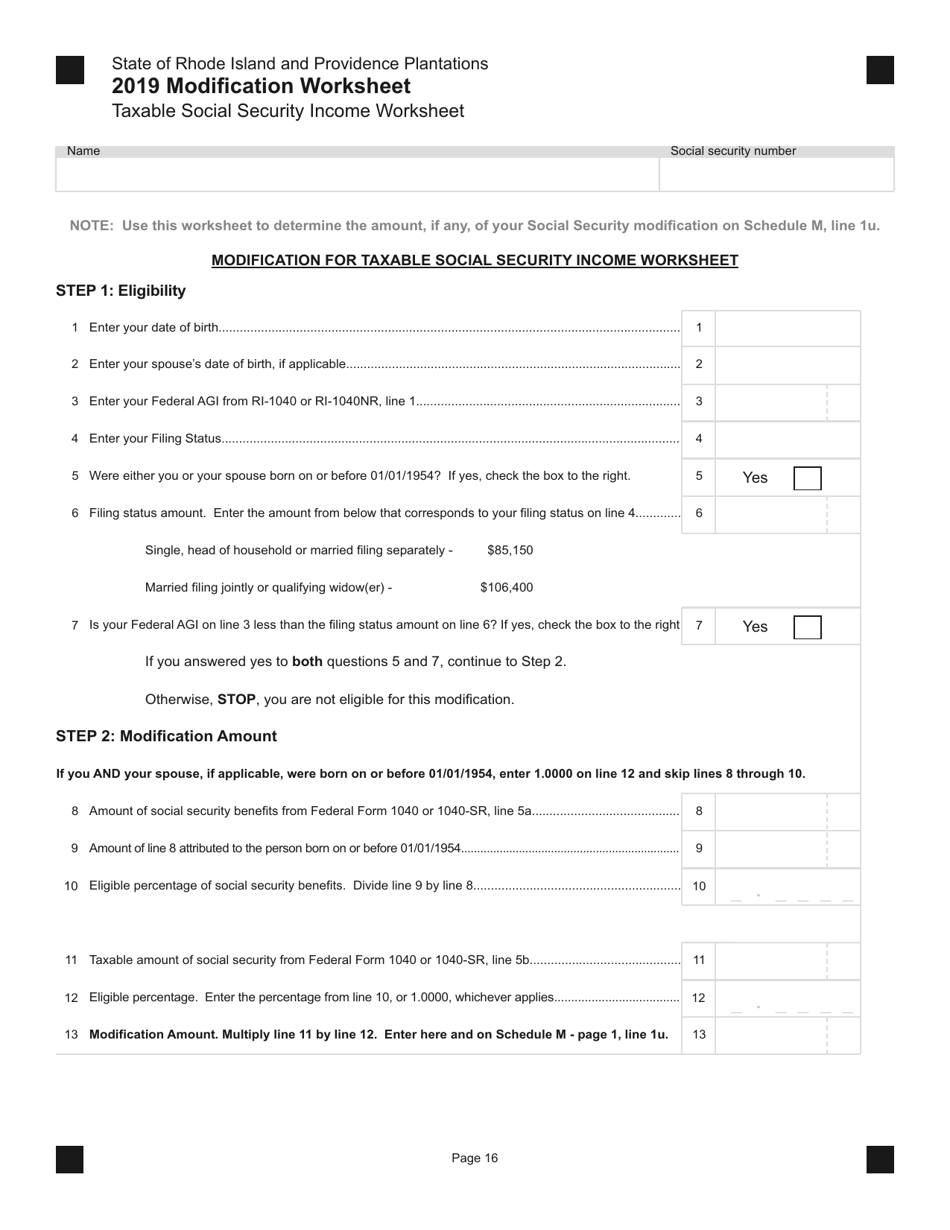

2019 Rhode Island Taxable Social Security Worksheet Download

Irs Social Security Tax Worksheet

Is Social Security Tax Deductible

Social Security Benefits Worksheet 2019 Calculator Worksheet Jay Sheets

Navigate Taxable Social Security With This 2023 Worksheet Style

10++ Taxable Social Security Worksheet

More Than $34,000, Up To 85 Percent Of Your Benefits May Be Taxable.

More Than $34,000, Up To 85 Percent Of Your Benefits May Be Taxable.

To Find Out If Their Benefits Are Taxable, Taxpayers Should:

Use Fill To Complete Blank Online Others Pdf Forms For Free.

Related Post: