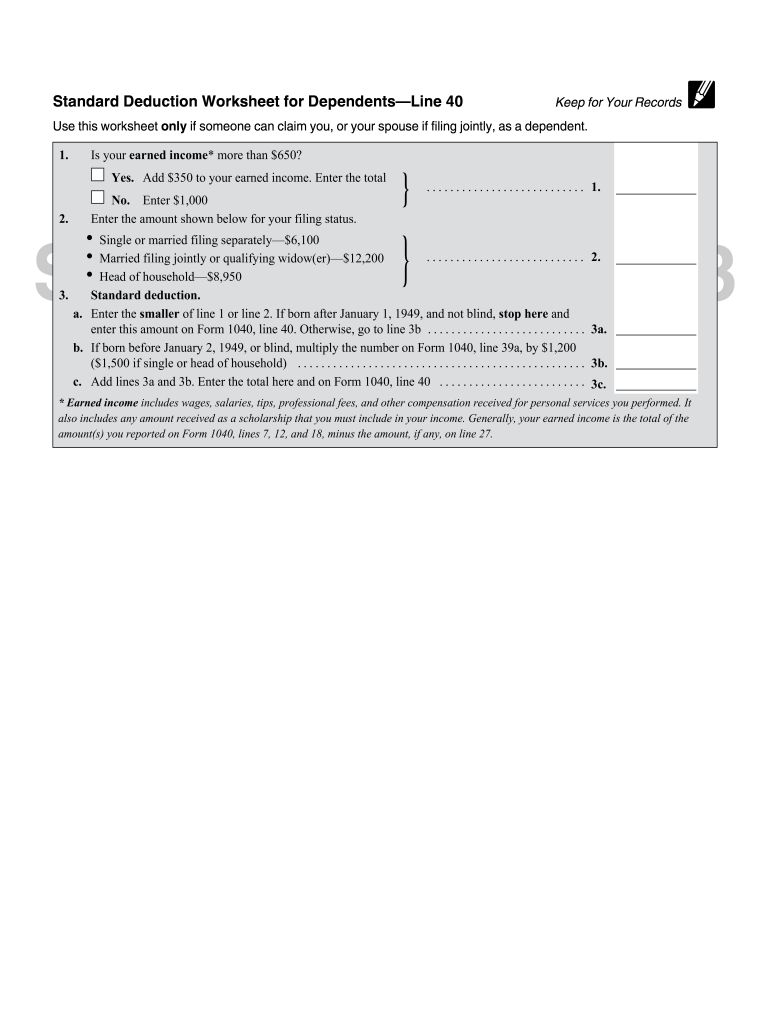

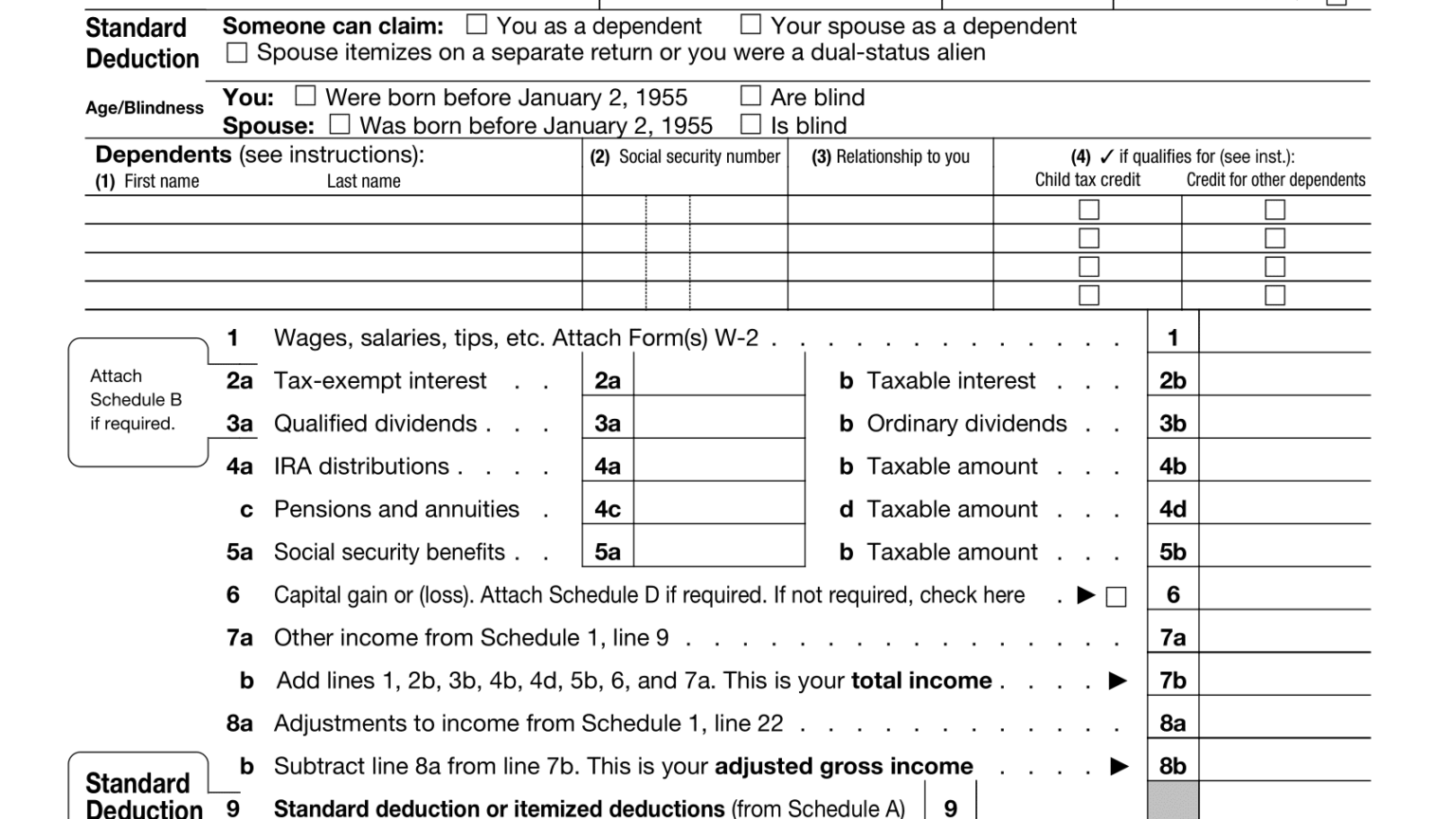

Standard Deduction Worksheet

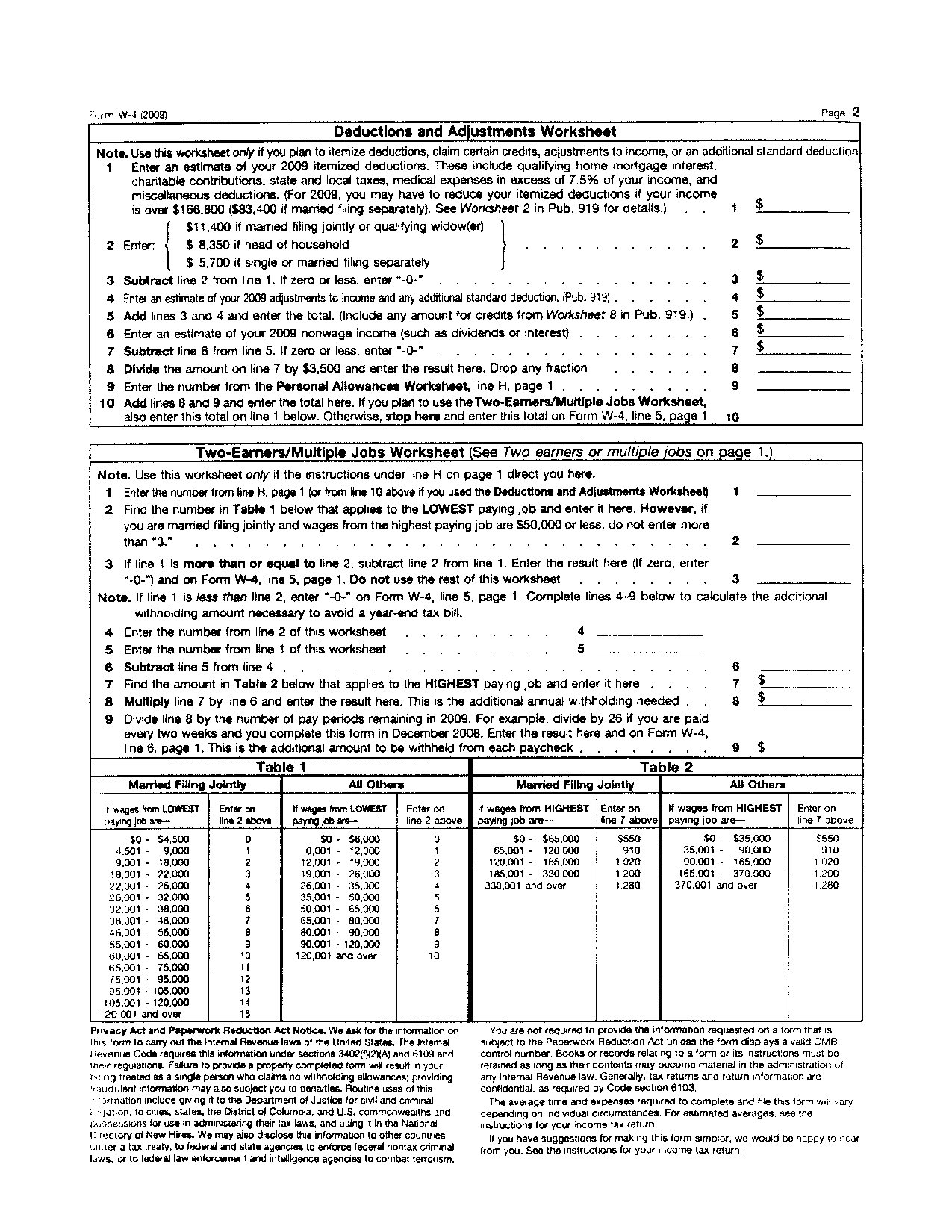

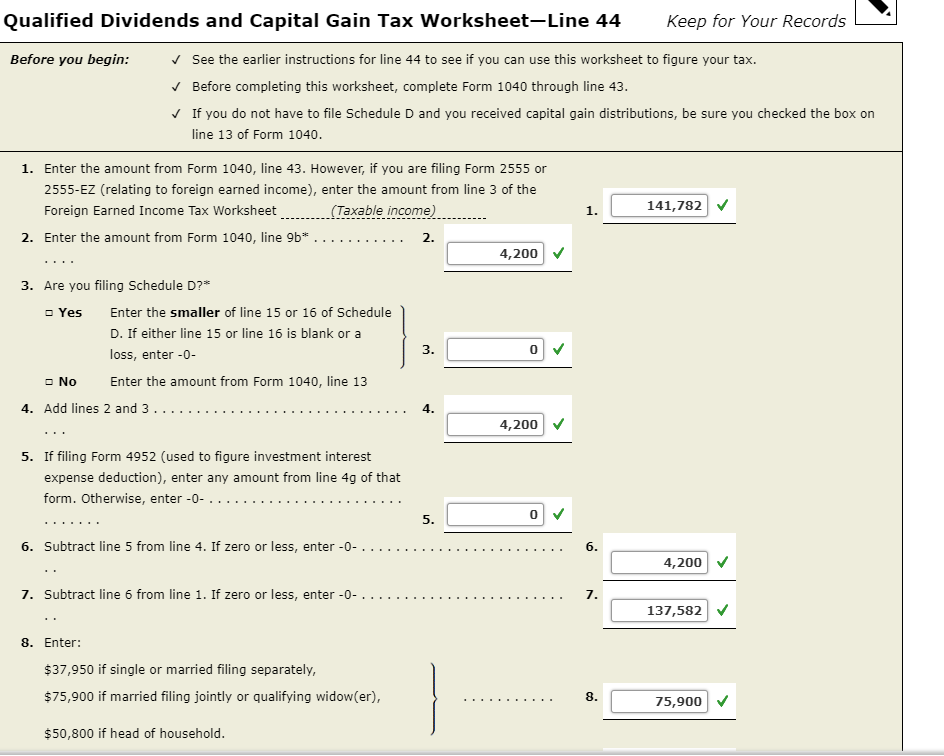

Standard Deduction Worksheet - Web irs standard tax deductions for 2022, 2023. Web you can claim the standard deduction unless someone else claims you as a dependent on their tax return. Web just remember that under the 2017 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who. Web the amount you can take with a standard deduction also varies according to your tax filing status, age, if you're blind or if someone can claim you as a dependent. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter. It's $20,800 for heads of household and $27,700 for married. Most states also have a standard deduction. These standard deductions will be applied by tax year for your irs tax return; Web standard deduction worksheet for dependents—line 8 keep for your records2018 form 1040—line 8 use this worksheet only if someone can claim you, or your spouse if filing. Line 2 of the standard deduction. Which of the following would you use to figure her standard deduction?. Most states also have a standard deduction. Web for tax year 2023, the standard deduction is $13,850 if you file as single or married filing separately. Web the amount you can take with a standard deduction also varies according to your tax filing status, age, if you're blind. Web you can claim the standard deduction unless someone else claims you as a dependent on their tax return. If you checked the box on form 540, line 6,. It's $20,800 for heads of household and $27,700 for married. If you checked the box on form 540nr, line 6, use. Web standard mileage rate for medical purposes is 16 cents. Web you can claim the standard deduction unless someone else claims you as a dependent on their tax return. It's $20,800 for heads of household and $27,700 for married. Web the amount you can take with a standard deduction also varies according to your tax filing status, age, if you're blind or if someone can claim you as a dependent.. Web standard deduction worksheet for dependents—line 8 keep for your records2018 form 1040—line 8 use this worksheet only if someone can claim you, or your spouse if filing. Web you can claim the standard deduction unless someone else claims you as a dependent on their tax return. The standard deduction is a specific dollar amount that reduces the amount of. Web for single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard. Web for tax year 2023, the standard deduction is $13,850 if you file as single or married filing separately. Web just remember that under the 2017 tax code, new homeowners (and home sellers) can. Web here is the standard deduction for each filing type for tax year 2022. Web standard mileage rate for medical purposes is 16 cents per mile. Which of the following would you use to figure her standard deduction?. Taxpayers who can be claimed as a dependent must use the standard deduction worksheet for dependents to determine their standard deduction. If. Web the amount you can take with a standard deduction also varies according to your tax filing status, age, if you're blind or if someone can claim you as a dependent. Most states also have a standard deduction. The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. Web irs standard tax. Web standard mileage rate for medical purposes is 16 cents per mile. Web just remember that under the 2017 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who. Web for single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900,. If you checked the box on form 540nr, line 6, use. Web standard mileage rate for medical purposes is 16 cents per mile. Web irs standard tax deductions for 2022, 2023. It's $20,800 for heads of household and $27,700 for married. Web standard deduction worksheet for dependents—line 8 keep for your records2018 form 1040—line 8 use this worksheet only if. Web for tax year 2023, the standard deduction is $13,850 if you file as single or married filing separately. Web the amount you can take with a standard deduction also varies according to your tax filing status, age, if you're blind or if someone can claim you as a dependent. Web you can claim the standard deduction unless someone else. Web standard mileage rate for medical purposes is 16 cents per mile. Which of the following would you use to figure her standard deduction?. Web for single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard. Web here is the standard deduction for each filing type for tax year 2022. Web irs standard tax deductions for 2022, 2023. Web for tax year 2023, the standard deduction is $13,850 if you file as single or married filing separately. Web standard deduction worksheet for dependents—line 8 keep for your records2018 form 1040—line 8 use this worksheet only if someone can claim you, or your spouse if filing. These standard deductions will be applied by tax year for your irs tax return; The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. If you checked the box on form 540, line 6,. Most states also have a standard deduction. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. Web you can claim the standard deduction unless someone else claims you as a dependent on their tax return. Web the amount you can take with a standard deduction also varies according to your tax filing status, age, if you're blind or if someone can claim you as a dependent. Web just remember that under the 2017 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who. Taxpayers who can be claimed as a dependent must use the standard deduction worksheet for dependents to determine their standard deduction. If you checked the box on form 540nr, line 6, use. Line 2 of the standard deduction. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter. It's $20,800 for heads of household and $27,700 for married. Web just remember that under the 2017 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who. It's $20,800 for heads of household and $27,700 for married. Most states also have a standard deduction. Web standard deduction worksheet for dependents—line 8 keep for your records2018 form 1040—line 8 use this worksheet only if someone can claim you, or your spouse if filing. These standard deductions will be applied by tax year for your irs tax return; The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. Web the amount you can take with a standard deduction also varies according to your tax filing status, age, if you're blind or if someone can claim you as a dependent. Web here is the standard deduction for each filing type for tax year 2022. Web irs standard tax deductions for 2022, 2023. Web for single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard. Web standard mileage rate for medical purposes is 16 cents per mile. Line 2 of the standard deduction. Web for tax year 2023, the standard deduction is $13,850 if you file as single or married filing separately. If you checked the box on form 540nr, line 6, use. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to.Standard Deduction Line Fill Online, Printable, Fillable, Blank

Standard Deduction For Seniors In 2020 Standard Deduction 2021

11 Best Images of Select Multiple Worksheets Maps Charts and Graphs

20+ Get Inspired For 1040ez Worksheet For Line 5 Minimum Standard Deduction

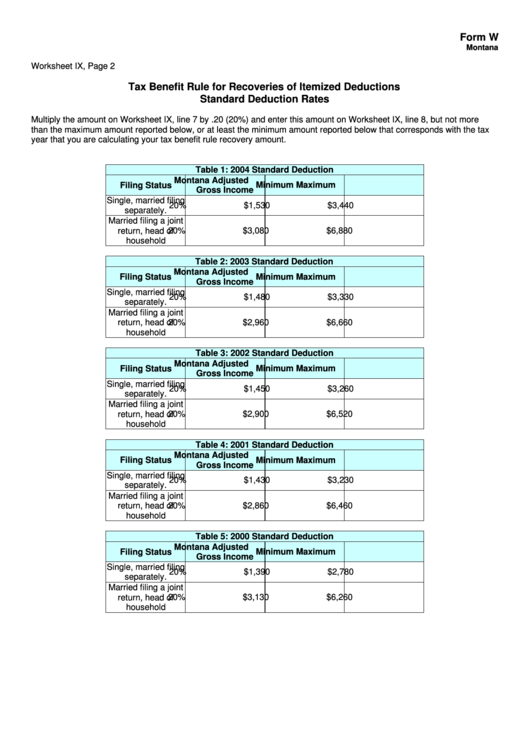

Worksheet Ix Tax Benefit Rule For Recoveries Of Itemized Deductions

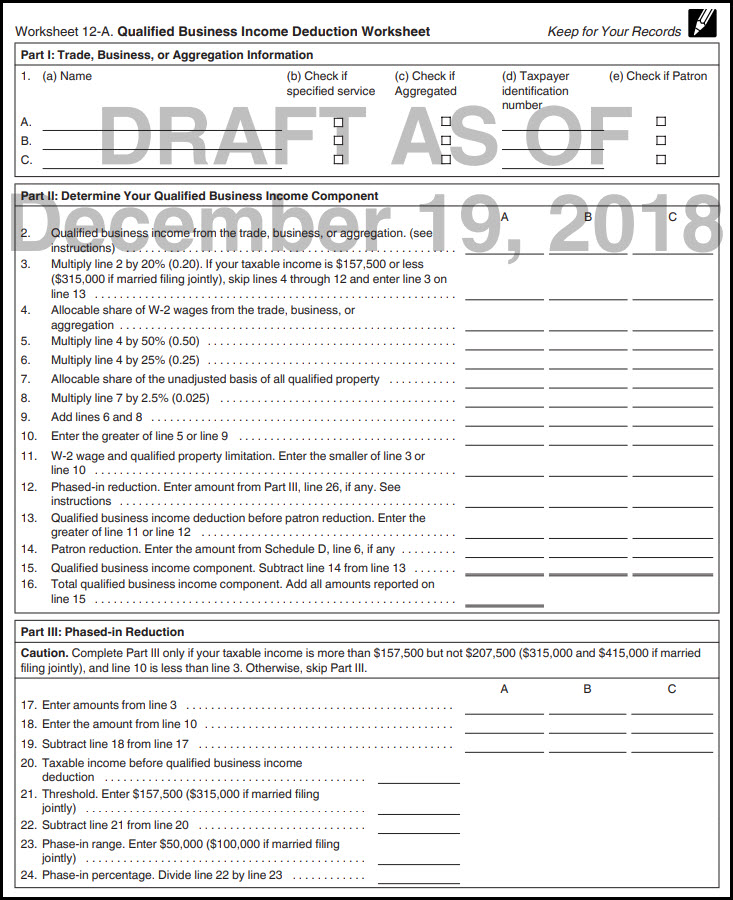

Qualified Business Deduction Worksheet dialasopa

Irs Standard Deduction Worksheet

Standard Deduction Worksheet

Standard Deduction Worksheet

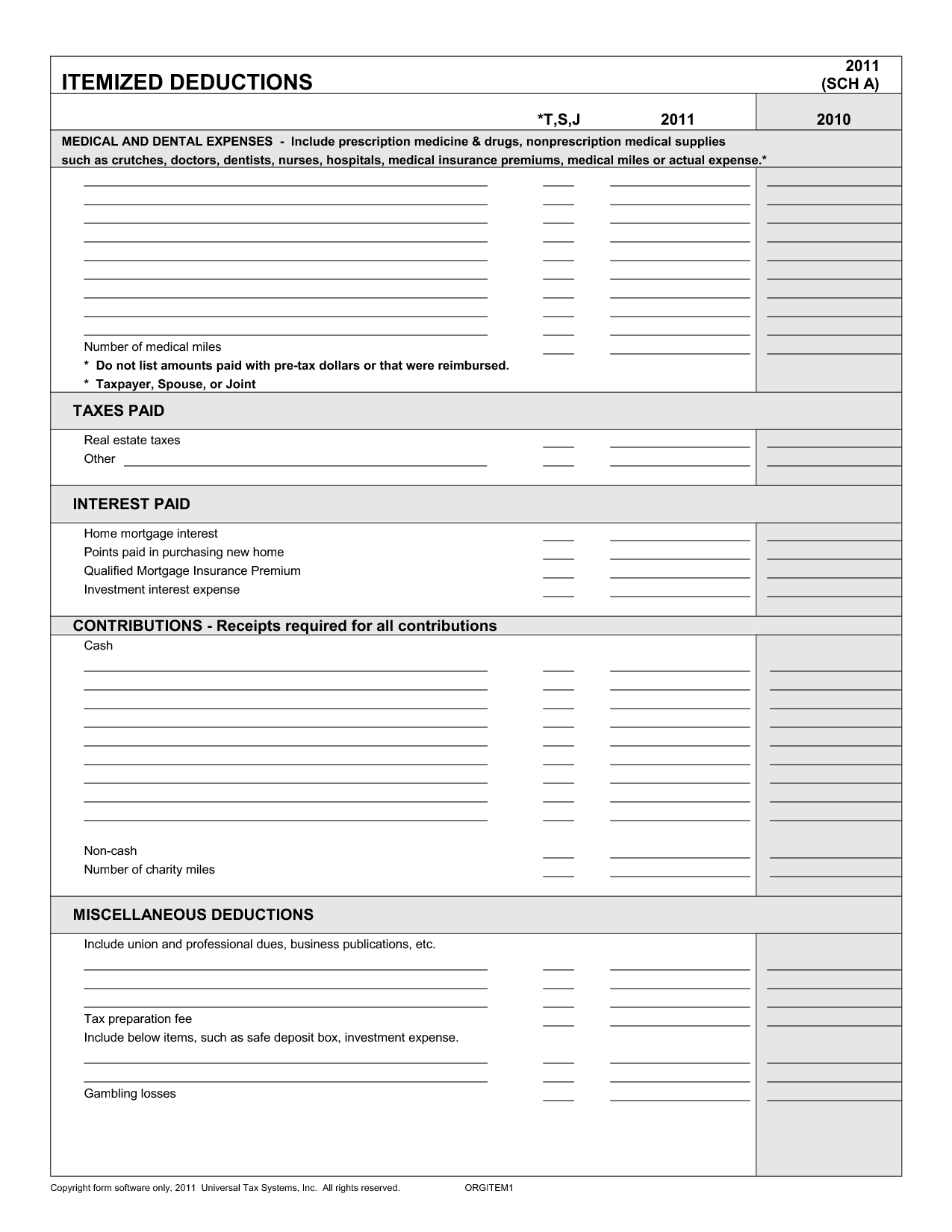

Small Business Tax Deduction Worksheets

Taxpayers Who Can Be Claimed As A Dependent Must Use The Standard Deduction Worksheet For Dependents To Determine Their Standard Deduction.

Web You Can Claim The Standard Deduction Unless Someone Else Claims You As A Dependent On Their Tax Return.

Which Of The Following Would You Use To Figure Her Standard Deduction?.

If You Checked The Box On Form 540, Line 6,.

Related Post: