State Tax Refund Worksheet Item Q Line 1

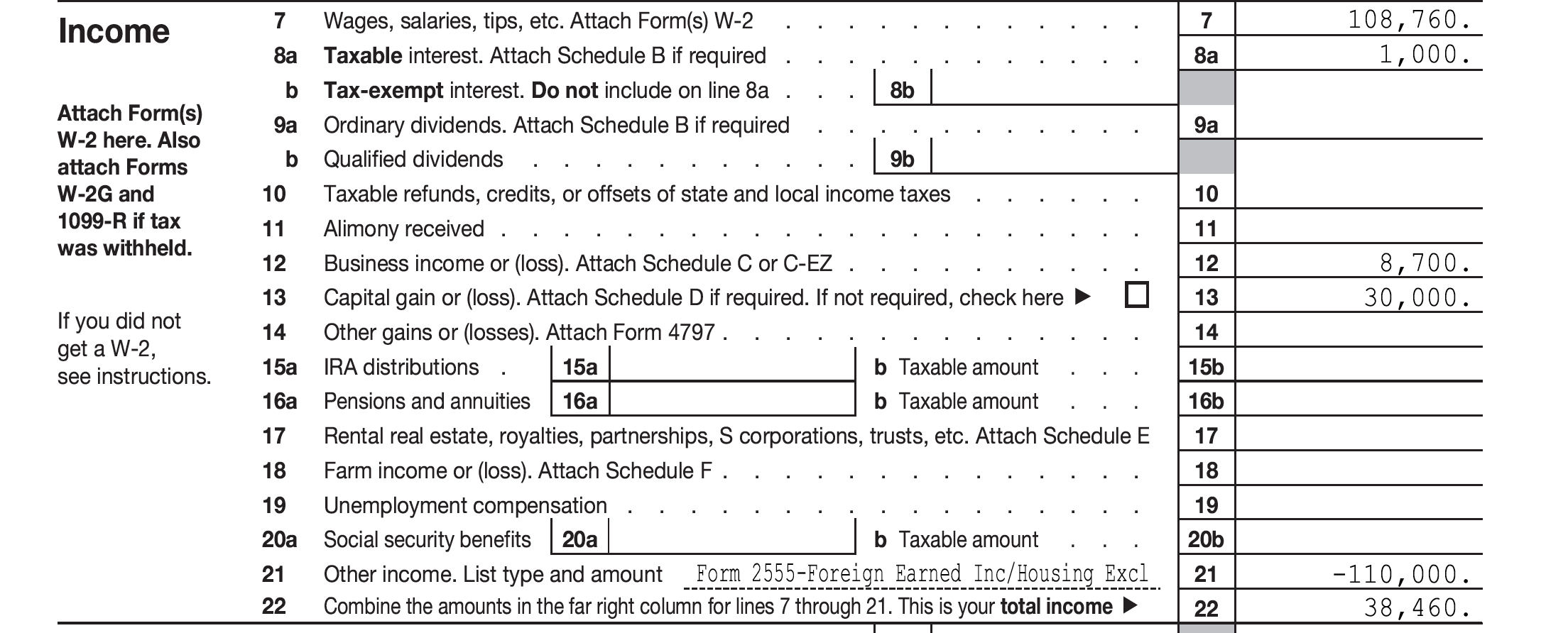

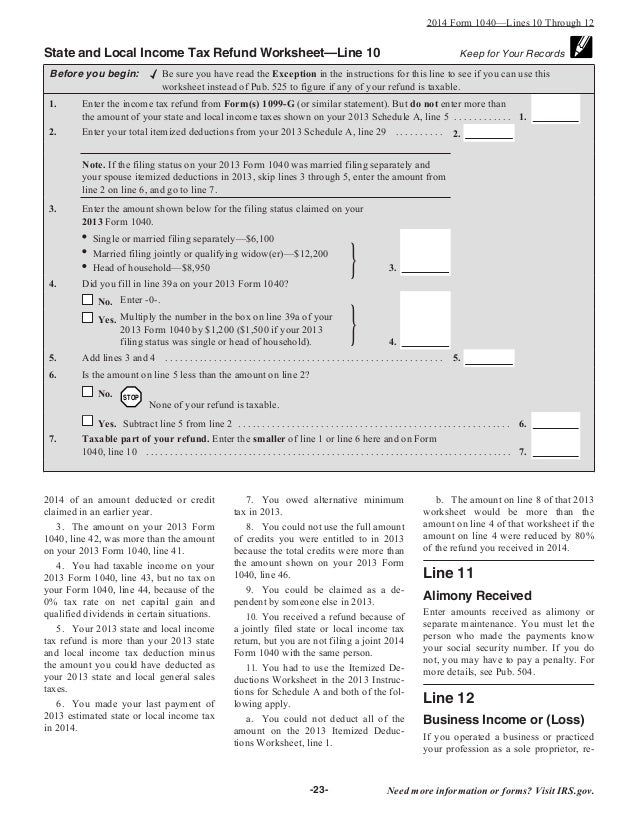

State Tax Refund Worksheet Item Q Line 1 - Web use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year. Web this article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit proconnect. Web enter your individual shared responsibility penalty from form ftb 3853, part iv, line 1. Log in to your myftb account. The state tax refund worksheet is used to determine how much (if any) of your previous year (s) state tax refund is included in taxable. Web liberty tax service offers professional income tax preparation service and online tax filing. Web california franchise tax board. Get your maximum tax refund guaranteed at liberty tax! Web 19 rows 1: Web state and local income tax refund worksheet—schedule 1, line 10 before you begin: Web march 13, 2021 8:43 pm. If you have this type of income,. Follow the links to popular topics, online services. Web this article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit proconnect. To find out how the. State and local income tax refunds (prior year) income tax refunds, credits or offsets. Be sure you have read the exception in the instructions for this line to see if you can use. Web the state refund worksheet reflects the calculation of the amount (if any) of the state income tax refund received that would be taxable and transferred to. Use a copy of the taxpayer’s previous year return. Web state tax refund item q line 2 is your refund received in 2020 for state or local taxes paid. Web the state tax refund worksheet is trying to determine whether your state tax refund received in 2020 for the 2019 tax return is taxable or not. Web california franchise tax. Web the state refund worksheet reflects the calculation of the amount (if any) of the state income tax refund received that would be taxable and transferred to line 1 of irs. If you did not itemize. It is not your tax refund. Web getting back to the state refund worksheet, item q line 1 is the state real estate tax. Get your maximum tax refund guaranteed at liberty tax! @reneevyne the state tax refund worksheet, item q, line 1, is for property tax from your 2019 return. Web march 13, 2021 8:43 pm. Overpaid tax or tax due. Web june 1, 2019 7:27 am. Web liberty tax service offers professional income tax preparation service and online tax filing. State and local income tax refunds (prior year) income tax refunds, credits or offsets. Get your maximum tax refund guaranteed at liberty tax! File a return, make a payment, or check your refund. Be sure you have read the exception in the instructions for this line. State and local income tax refunds (prior year) income tax refunds, credits or offsets. Web understanding the state refund worksheet: To find out how the. Log in to your myftb account. If you have this type of income,. Use a copy of the taxpayer’s previous year return. To find out how the. The state tax refund worksheet is used to determine how much (if any) of your previous year (s) state tax refund is included in taxable. Web this article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in. Web june 1, 2019 7:27 am. Web liberty tax service offers professional income tax preparation service and online tax filing. Web understanding the state refund worksheet: Follow the links to popular topics, online services. Web state and local income tax refund worksheet—schedule 1, line 10 before you begin: Web getting back to the state refund worksheet, item q line 1 is the state real estate tax (property tax on your house and land) item q line 2 is the state personal. If you did not itemize. Log in to your myftb account. Web enter your individual shared responsibility penalty from form ftb 3853, part iv, line 1. If. State and local income tax refunds (prior year) income tax refunds, credits or offsets. Web understanding the state refund worksheet: Your state or local tax refund is not taxable if you did not itemize your. Use a copy of the taxpayer’s previous year return. Web use this worksheet to determine the portion of the taxpayer’s prior year state refund that is considered taxable in the current year. @reneevyne the state tax refund worksheet, item q, line 1, is for property tax from your 2019 return. Log in to your myftb account. To avoid delay in processing of your tax return,. If you did not itemize. Web 19 rows 1: If you have this type of income,. Web enter your individual shared responsibility penalty from form ftb 3853, part iv, line 1. It is not your tax refund. Web getting back to the state refund worksheet, item q line 1 is the state real estate tax (property tax on your house and land) item q line 2 is the state personal. Get your maximum tax refund guaranteed at liberty tax! Do not enter more than the amount of your state and. Web california franchise tax board. Web liberty tax service offers professional income tax preparation service and online tax filing. Web this article will help you understand how the state and local refunds taxable worksheet for form 1040 is calculated in intuit proconnect. Web the state refund worksheet reflects the calculation of the amount (if any) of the state income tax refund received that would be taxable and transferred to line 1 of irs. If you have this type of income,. Be sure you have read the exception in the instructions for this line to see if you can use. It is not your tax refund. Follow the links to popular topics, online services. State and local income tax refunds (prior year) income tax refunds, credits or offsets. Web the state tax refund worksheet is trying to determine whether your state tax refund received in 2020 for the 2019 tax return is taxable or not. Web march 13, 2021 8:43 pm. Overpaid tax or tax due. Web 19 rows 1: Web state and local income tax refund worksheet—schedule 1, line 10 before you begin: Log in to your myftb account. The state tax refund worksheet is used to determine how much (if any) of your previous year (s) state tax refund is included in taxable. @reneevyne the state tax refund worksheet, item q, line 1, is for property tax from your 2019 return. Your state or local tax refund is not taxable if you did not itemize your. Web understanding the state refund worksheet: Web do i need to complete the state refund worksheet?1040 (2021) Internal Revenue Service

State And Local Tax Refund Worksheet 2019 Maths Worksheets For

Form 1040 State And Local Tax Refund Worksheet 1040 Form Printable

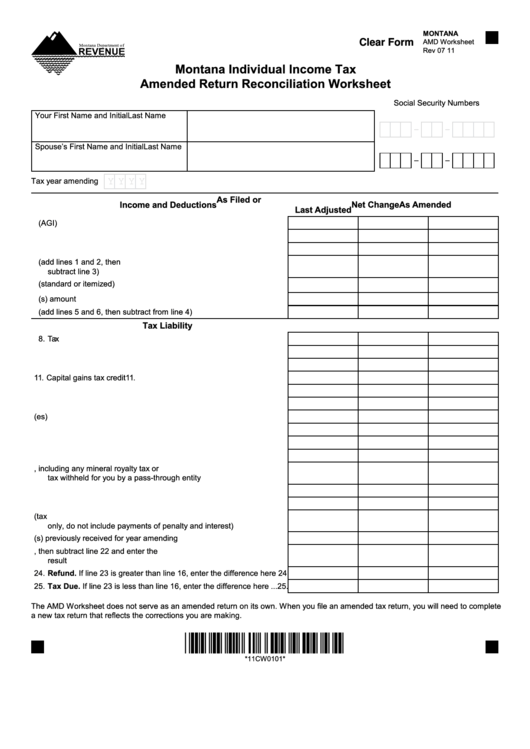

Fillable Form Amd Montana Individual Tax Amended Return

1040 INSTRUCTIONS

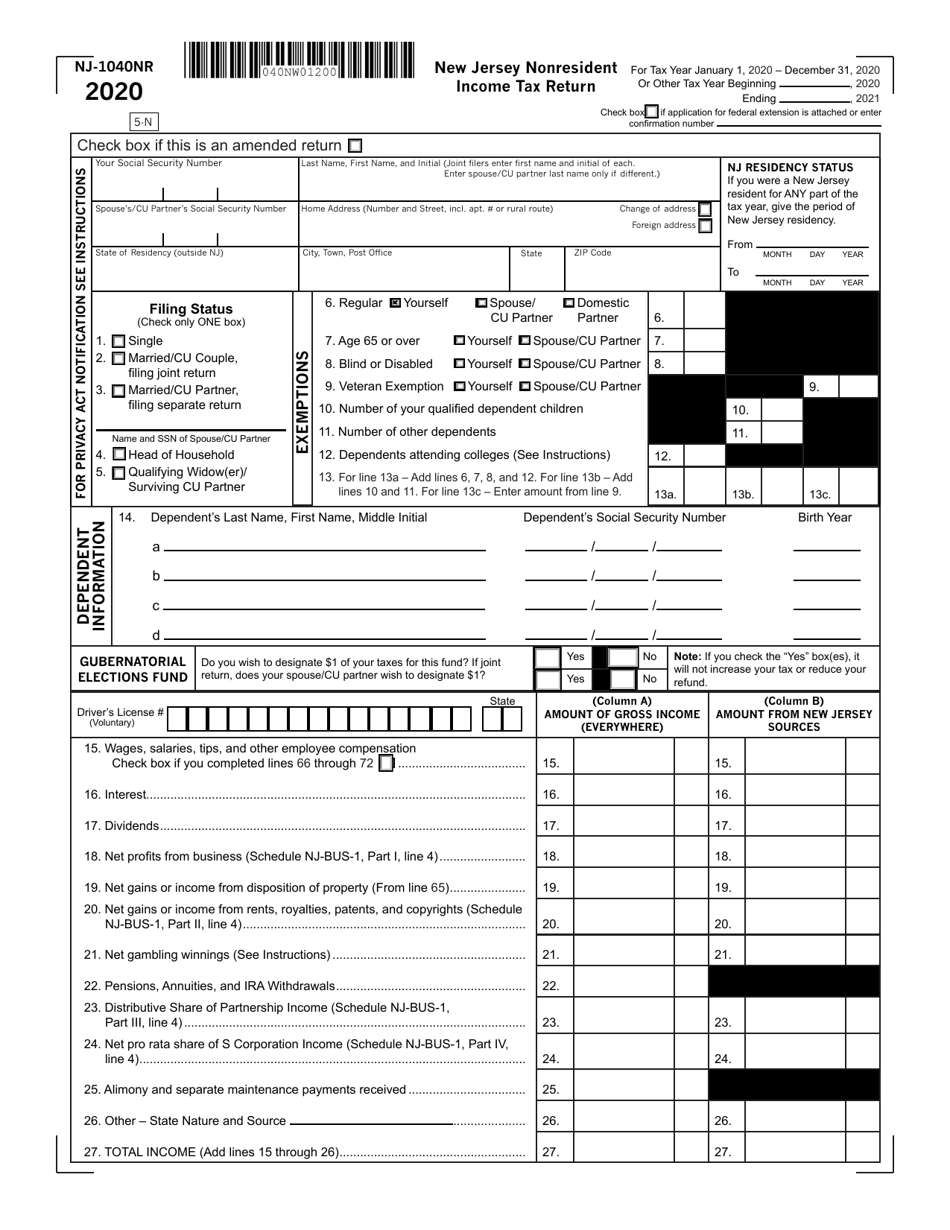

Nj tax refund status skylasem

Section 754 Calculation Worksheet

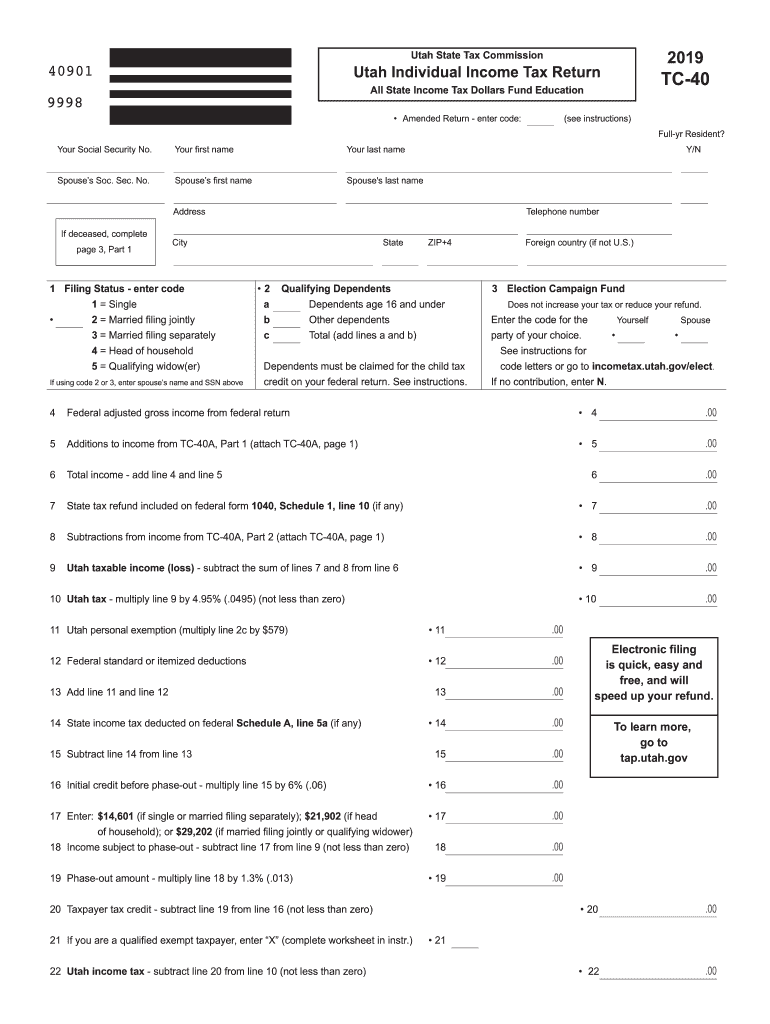

2019 Form UT TC40 Fill Online, Printable, Fillable, Blank pdfFiller

2018 Tax Computation Worksheet

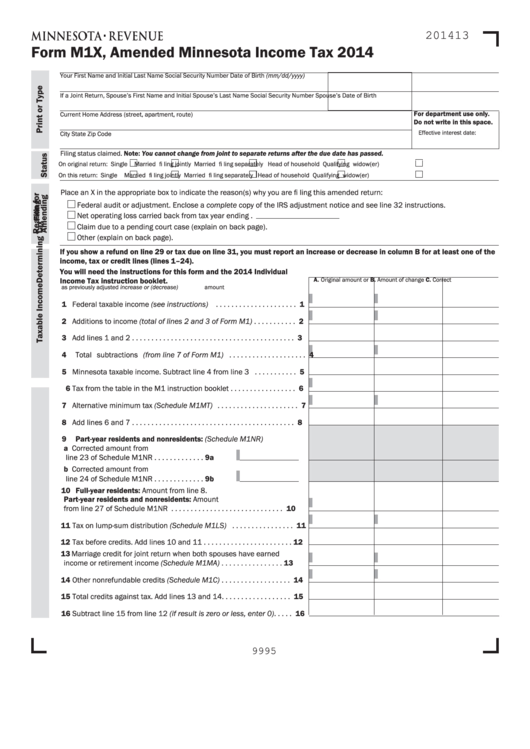

Minnesota State Tax Table M1

Loans Are Offered In Amounts Of $250, $500, $750, $1,250 Or $3,500.

Web Getting Back To The State Refund Worksheet, Item Q Line 1 Is The State Real Estate Tax (Property Tax On Your House And Land) Item Q Line 2 Is The State Personal.

Use A Copy Of The Taxpayer’s Previous Year Return.

Web State Tax Refund Item Q Line 2 Is Your Refund Received In 2020 For State Or Local Taxes Paid.

Related Post: