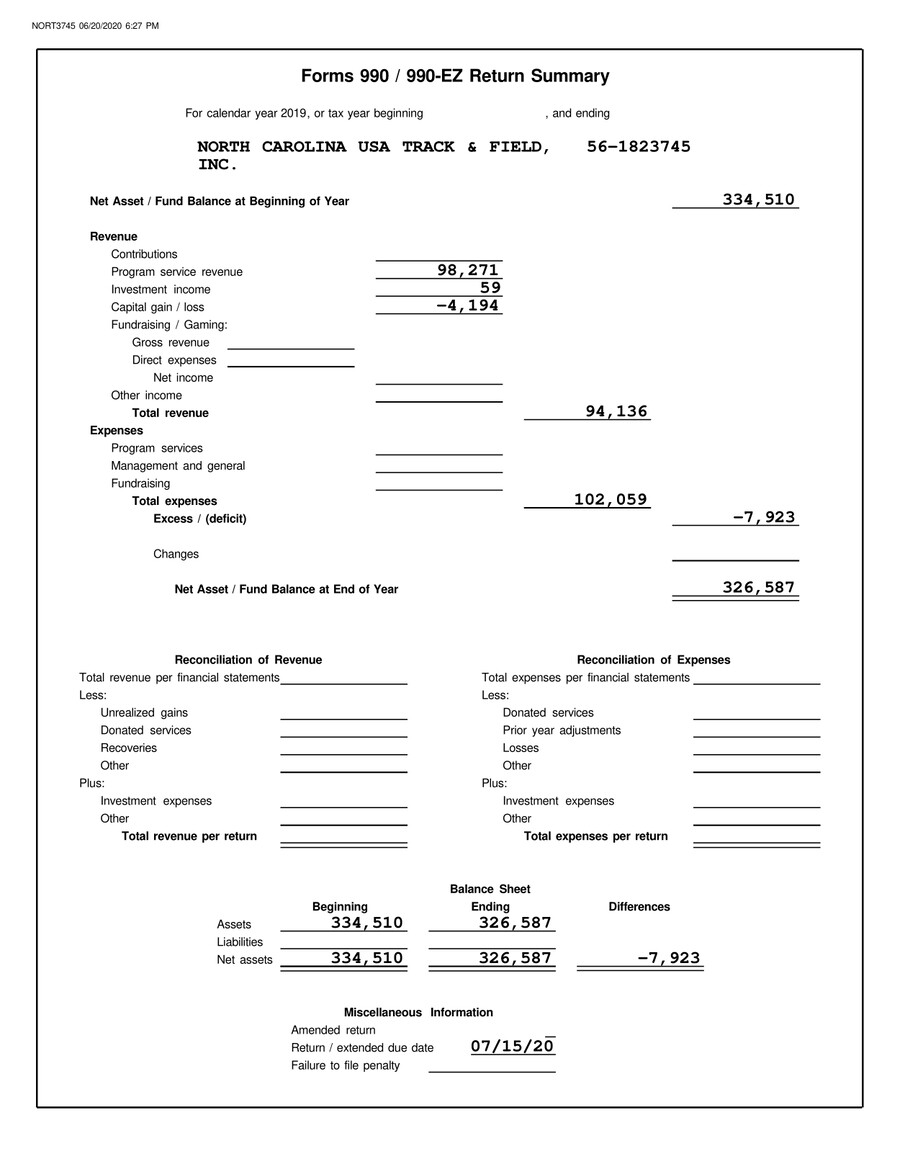

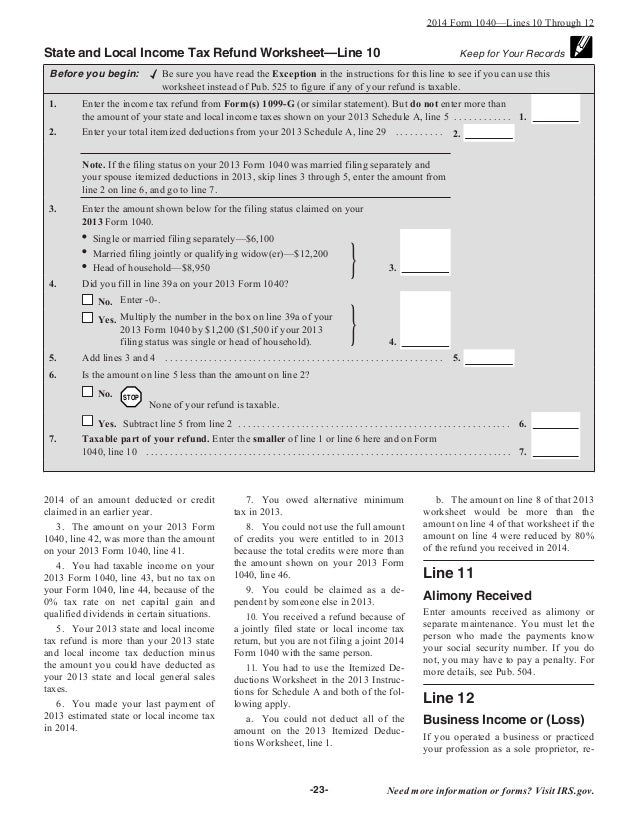

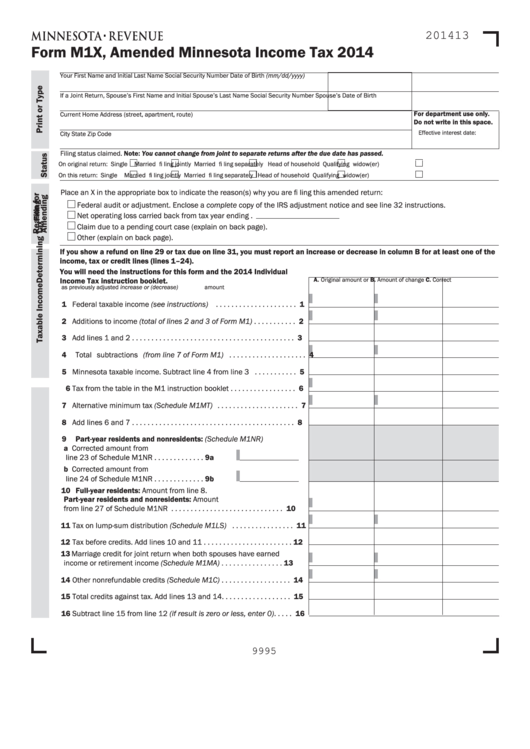

State Tax Refund Worksheet Item Q Line 2

State Tax Refund Worksheet Item Q Line 2 - Web state tax refund item q line 2 is your refund received in 2020 for state or local taxes paid. Web understanding the state refund worksheet: Your state or local tax refund is not taxable if you did not itemize your. Web the state refund worksheet reflects the calculation of the amount (if any) of the state income tax refund received that would be taxable and transferred to line 1 of schedule. Web california franchise tax board. Get your maximum tax refund guaranteed at liberty tax! It is not your tax refund. Web complete a separate worksheet for lines 2 through 6 for each locality in your state if you lived in more than one locality in the same state during 2022 and each locality didn't. Web for line 1 and line 2, the input fields are found on the tax refund, unempl. Web state and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Web did you use the state sales tax paid as a deduction? (box by line 5a ix not checked) turbotax is asking about your numbers. Web california franchise tax board. The state refund worksheetreflects the calculation of the amount (if any) of the state income tax refund received that would be. Web (form 1040), from the amount of state and. Log in to your myftb account. Web liberty tax service offers professional income tax preparation service and online tax filing. Follow the links to popular topics, online services. The state refund worksheetreflects the calculation of the amount (if any) of the state income tax refund received that would be. Your state or local tax refund is not taxable if you. Web did you use the state sales tax paid as a deduction? Add the amount of tax, if any, from each form ftb 3803, line. Web taxes state tax filing if i am being told to check this entry and it says state tax refund worksheet item q line 2 what do i put in there? Web the state tax. Refunds attributable to post 12/31/20xx payments per irs pub. Web state tax refund item q line 2 is your refund received in 2020 for state or local taxes paid. The state refund worksheetreflects the calculation of the amount (if any) of the state income tax refund received that would be. Web taxes state tax filing if i am being told. Web (form 1040), from the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in 2021 [line 5d of the 2021 schedule a. Refundable food/excise tax credit (line 28). Web state and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Web did you use. The state refund worksheetreflects the calculation of the amount (if any) of the state income tax refund received that would be. Web the state tax refund worksheet is used to determine how much (if any) of your previous year (s) state tax refund is included in taxable income for the current tax. Add the amount of tax, if any, from. (box by line 5a ix not checked) turbotax is asking about your numbers. Web do i need to complete the state refund worksheet? Web understanding the state refund worksheet: Follow the links to popular topics, online services. Web did you use the state sales tax paid as a deduction? Web taxes state tax filing if i am being told to check this entry and it says state tax refund worksheet item q line 2 what do i put in there? Add the amount of tax, if any, from each form ftb 3803, line. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. File a return, make. It is not your tax refund. Web liberty tax service offers professional income tax preparation service and online tax filing. The state refund worksheetreflects the calculation of the amount (if any) of the state income tax refund received that would be. Web getting back to the state refund worksheet, item q line 1 is the state real estate tax (property. The state refund worksheetreflects the calculation of the amount (if any) of the state income tax refund received that would be. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Web liberty tax service offers professional income tax preparation service and online tax filing. Follow the links to popular topics, online services. Web california franchise tax board. Web (form 1040), from the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in 2021 [line 5d of the 2021 schedule a. Web complete a separate worksheet for lines 2 through 6 for each locality in your state if you lived in more than one locality in the same state during 2022 and each locality didn't. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Web did you use the state sales tax paid as a deduction? Web state and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: Refundable food/excise tax credit (line 28). Get your maximum tax refund guaranteed at liberty tax! It is not your tax refund. Web do i need to complete the state refund worksheet? For the rest of the lines, go to the tax refund, unempl. Refunds attributable to post 12/31/20xx payments per irs pub. Web taxes state tax filing if i am being told to check this entry and it says state tax refund worksheet item q line 2 what do i put in there? Web california franchise tax board. Web getting back to the state refund worksheet, item q line 1 is the state real estate tax (property tax on your house and land) item q line 2 is the state personal. Web the state refund worksheet reflects the calculation of the amount (if any) of the state income tax refund received that would be taxable and transferred to line 1 of schedule. Web understanding the state refund worksheet: Your state or local tax refund is not taxable if you did not itemize your. Then yes, at least part may be taxable. File a return, make a payment, or check your refund. Follow the links to popular topics, online services. Web the state tax refund worksheet is used to determine how much (if any) of your previous year (s) state tax refund is included in taxable income for the current tax. For the rest of the lines, go to the tax refund, unempl. Your state or local tax refund is not taxable if you did not itemize your. Web did you use the state sales tax paid as a deduction? Then yes, at least part may be taxable. Web complete a separate worksheet for lines 2 through 6 for each locality in your state if you lived in more than one locality in the same state during 2022 and each locality didn't. File a return, make a payment, or check your refund. Web taxes state tax filing if i am being told to check this entry and it says state tax refund worksheet item q line 2 what do i put in there? Web (form 1040), from the amount of state and local income taxes (or general sales taxes), real estate taxes, and personal property taxes paid in 2021 [line 5d of the 2021 schedule a. Log in to your myftb account. Web if the filing status on your 2017 form 1040 was married filing separately and your spouse itemized deductions in 2017, skip lines 3 through 5, enter the amount from line 2 on line. Web state and local income tax refunds (prior year) income tax refunds, credits or offsets (2) 2: (box by line 5a ix not checked) turbotax is asking about your numbers. Add the amount of tax, if any, from each form ftb 3803, line. Web for line 1 and line 2, the input fields are found on the tax refund, unempl. Web state tax refund item q line 2 is your refund received in 2020 for state or local taxes paid.Tax Refund Worksheet 2014 Worksheet Resume Examples

1040 (2021) Internal Revenue Service

2019 USATF North Carolina Tax Return by USATF Flipsnack

Tax Return Worksheets

How To Check 2018 Tax Refund Status QATAX

Irs 1040 Form Line 8B Stimulus Check 2020 Everything You Need to

2018 Tax Computation Worksheet

REV414 (P/S) 2012 PA Nonresident Tax Withholding Worksheet Free Download

2014 Federal Tax Form 1040 Instructions Tax Walls

Minnesota State Tax Table M1

Web File A Separate Form Ftb 3803 For Each Child Whose Income You Elect To Include On Your Form 540.

Get Your Maximum Tax Refund Guaranteed At Liberty Tax!

The State Refund Worksheetreflects The Calculation Of The Amount (If Any) Of The State Income Tax Refund Received That Would Be.

Loans Are Offered In Amounts Of $250, $500, $750, $1,250 Or $3,500.

Related Post: