Student Info Worksheet Turbotax

Student Info Worksheet Turbotax - Scroll down to part iii. Web this turbotax for education requires users to manually type in tax information and w2s because it is all fictional. Web qualified expenses include tuition, any rates that were required for enrollment, or take supplies required for a student to be enrolled at or attend an eligible educational. Web student info worksheet question 1 4 years yes no na what does that mean @raver02 turbotax asks if you ' have completed four years ' to see if you qualify for. Web quickbooks online accountant. Web this form provides information about educational expenses that may qualify the student—or the student's parents or guardian, if the student is a dependent—for. You do not need to be an expert to teach taxes, and we recommend teaching to. Open the tax return to the federal information worksheet. This is where tt looks at all the possible ways to deal with your college. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. Web i'm looking at the student information worksheet for education expenses part vi. Web parents of children in college, will encounter the “student information worksheet” in turbotax 2020. Start the student information worksheet in your taxact. Web quickbooks online accountant. This is where tt looks at all the possible ways to deal with your college. Web through the intuit turbotax simulation, we are helping students overcome the fear of tax day. If a dependent is the student:: Open the tax return to the federal information worksheet. Web this form provides information about educational expenses that may qualify the student—or the student's parents or guardian, if the student is a dependent—for. Web parents of children in college, will encounter the “student information worksheet” in turbotax 2020. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an. Web this form provides information about educational expenses that may qualify the student—or the student's parents or guardian, if the student is a dependent—for. Web this turbotax for education requires users to manually type in tax information and w2s because it is all fictional. Turbo tax is putting in 10,000 in used for credit or deduction. Easily file federal and. Web through the intuit turbotax simulation, we are helping students overcome the fear of tax day. Web quickbooks online accountant. Web when you use student loan funds to finance your education, if you are eligible, the irs allows you to claim qualifying expenses that you pay with those funds. Turbo tax is putting in 10,000 in used for credit or. You do not need to be an expert to teach taxes, and we recommend teaching to. Open the tax return to the federal information worksheet. Web parents of children in college, will encounter the “student information worksheet” in turbotax 2020. Start the student information worksheet in your taxact return, and report. Web why is the education credits optimizer entering a. Open the tax return to the federal information worksheet. Easily file federal and state income tax returns with 100% accuracy to get your maximum tax refund. Web through the intuit turbotax simulation, we are helping students overcome the fear of tax day. Activating the student info worksheet. Web qualified expenses include tuition, any rates that were required for enrollment, or. Web when you use student loan funds to finance your education, if you are eligible, the irs allows you to claim qualifying expenses that you pay with those funds. Open the tax return to the federal information worksheet. Scroll down to part iii. Start the student information worksheet in your taxact return, and report. Web through the intuit turbotax simulation,. Web i'm looking at the student information worksheet for education expenses part vi. Turbo tax is putting in 10,000 in used for credit or deduction. You do not need to be an expert to teach taxes, and we recommend teaching to. This is where tt looks at all the possible ways to deal with your college. Web qualified expenses include. This is where tt looks at all the possible ways to deal with your college. Start the student information worksheet in your taxact return, and report. Easily file federal and state income tax returns with 100% accuracy to get your maximum tax refund. Web this form provides information about educational expenses that may qualify the student—or the student's parents or. Easily file federal and state income tax returns with 100% accuracy to get your maximum tax refund. Scroll down to part iii. Web qualified expenses include tuition, any rates that were required for enrollment, or take supplies required for a student to be enrolled at or attend an eligible educational. Web quickbooks online accountant. This is where tt looks at all the possible ways to deal with your college. Start the student information worksheet in your taxact return, and report. You will be filing taxes for that person. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. Web this turbotax for education requires users to manually type in tax information and w2s because it is all fictional. Web i'm looking at the student information worksheet for education expenses part vi. Web parents of children in college, will encounter the “student information worksheet” in turbotax 2020. Turbo tax is putting in 10,000 in used for credit or deduction. Web through the intuit turbotax simulation, we are helping students overcome the fear of tax day. Open the tax return to the federal information worksheet. If a dependent is the student:: Web why is the education credits optimizer entering a credit on part vi, line 17 of the dependent student info worksheet when the taxpayer's income exceeds $180,00?. Web when you use student loan funds to finance your education, if you are eligible, the irs allows you to claim qualifying expenses that you pay with those funds. Web this form provides information about educational expenses that may qualify the student—or the student's parents or guardian, if the student is a dependent—for. Activating the student info worksheet. Web for the student info worksheet: Web student info worksheet question 1 4 years yes no na what does that mean @raver02 turbotax asks if you ' have completed four years ' to see if you qualify for. You do not need to be an expert to teach taxes, and we recommend teaching to. Web quickbooks online accountant. Web for the student info worksheet: Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. Start the student information worksheet in your taxact return, and report. Web qualified expenses include tuition, any rates that were required for enrollment, or take supplies required for a student to be enrolled at or attend an eligible educational. Scroll down to part iii. Open the tax return to the federal information worksheet. If a dependent is the student:: Web when you use student loan funds to finance your education, if you are eligible, the irs allows you to claim qualifying expenses that you pay with those funds. Web parents of children in college, will encounter the “student information worksheet” in turbotax 2020. Turbo tax is putting in 10,000 in used for credit or deduction. Web why is the education credits optimizer entering a credit on part vi, line 17 of the dependent student info worksheet when the taxpayer's income exceeds $180,00?. This is where tt looks at all the possible ways to deal with your college. You will be filing taxes for that person.Schedule E Worksheets Turbotax

Personal Worksheet Turbotax

Carryover Worksheet Turbotax

Personal Worksheet Turbotax

Carryover Worksheet Turbotax

Turbotax Home Mortgage Worksheet TurboTax 2019

Turbo Tax Charitable Donations Worksheet Universal Network

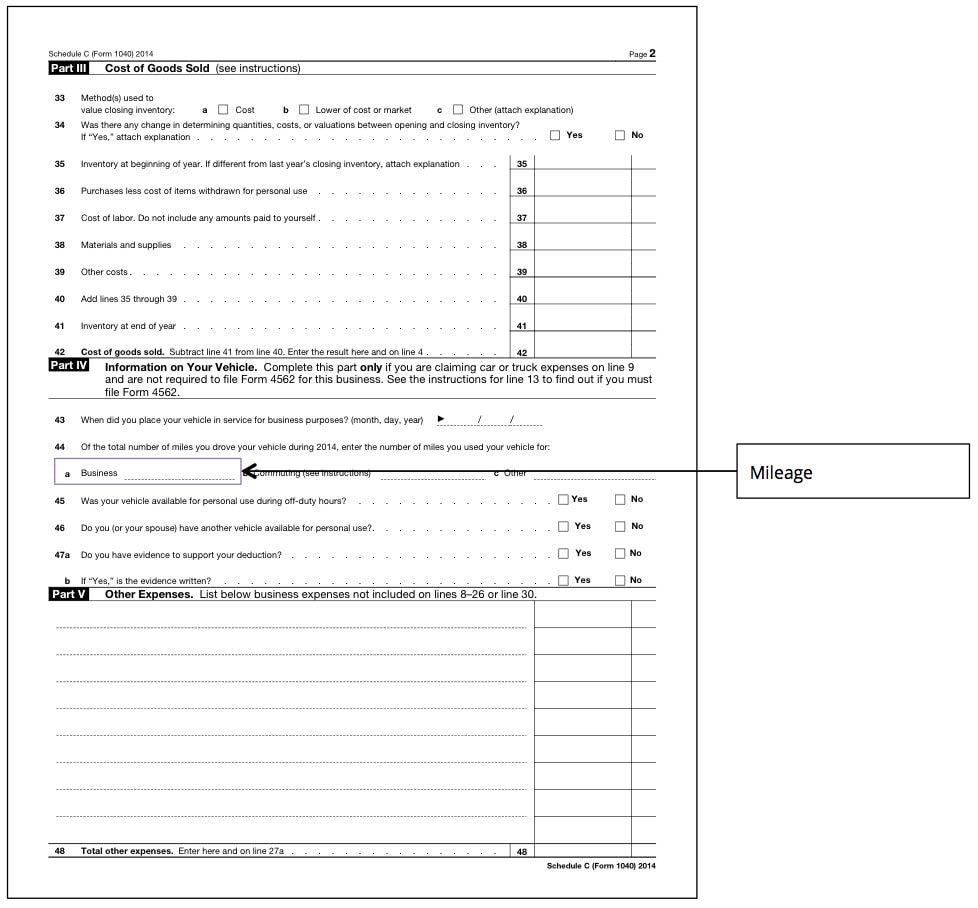

Turbotax Car And Truck Expenses Worksheet

Personal Worksheet Turbotax

Tax And Interest Deduction Worksheet Turbotax

Easily File Federal And State Income Tax Returns With 100% Accuracy To Get Your Maximum Tax Refund.

Web This Turbotax For Education Requires Users To Manually Type In Tax Information And W2S Because It Is All Fictional.

Web Through The Intuit Turbotax Simulation, We Are Helping Students Overcome The Fear Of Tax Day.

Web This Form Provides Information About Educational Expenses That May Qualify The Student—Or The Student's Parents Or Guardian, If The Student Is A Dependent—For.

Related Post: