Tax Itemization Worksheet

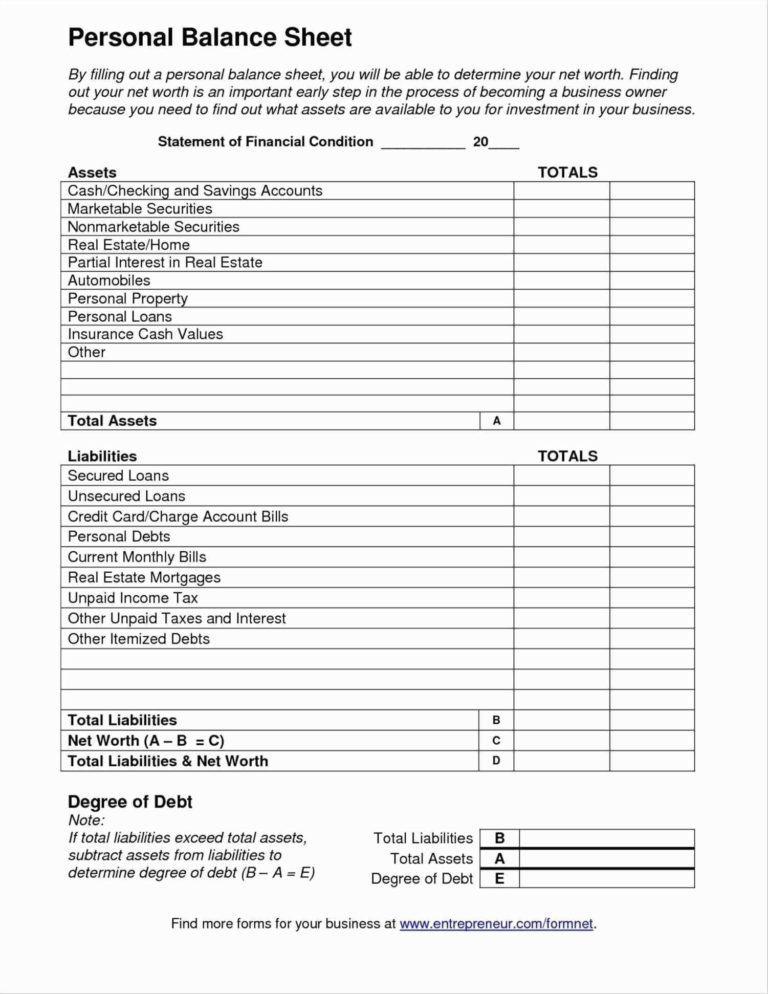

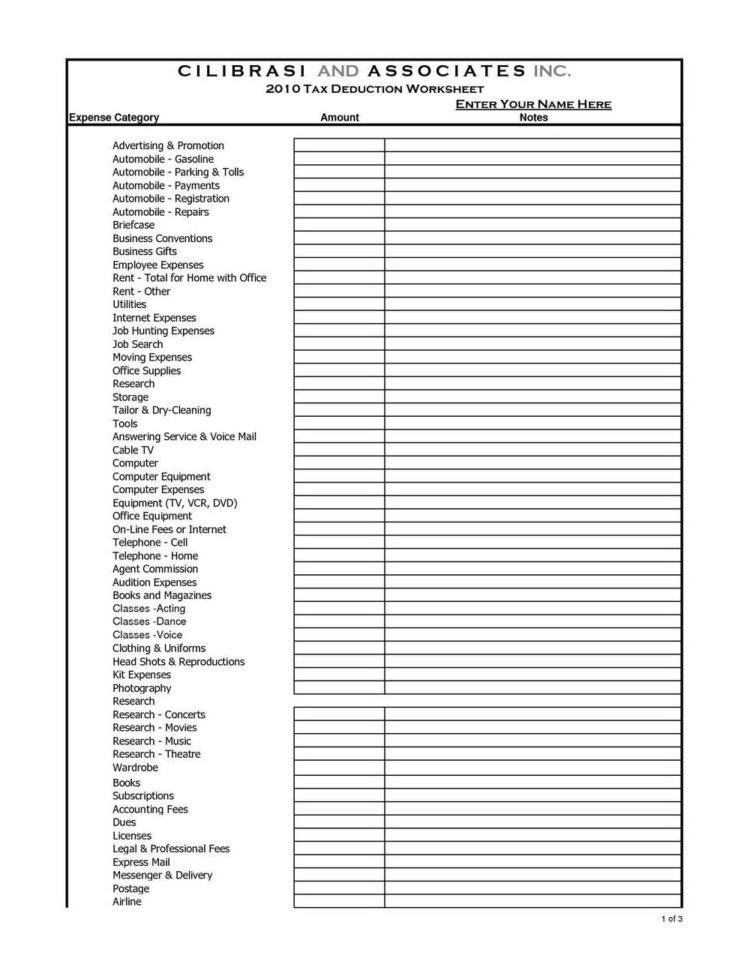

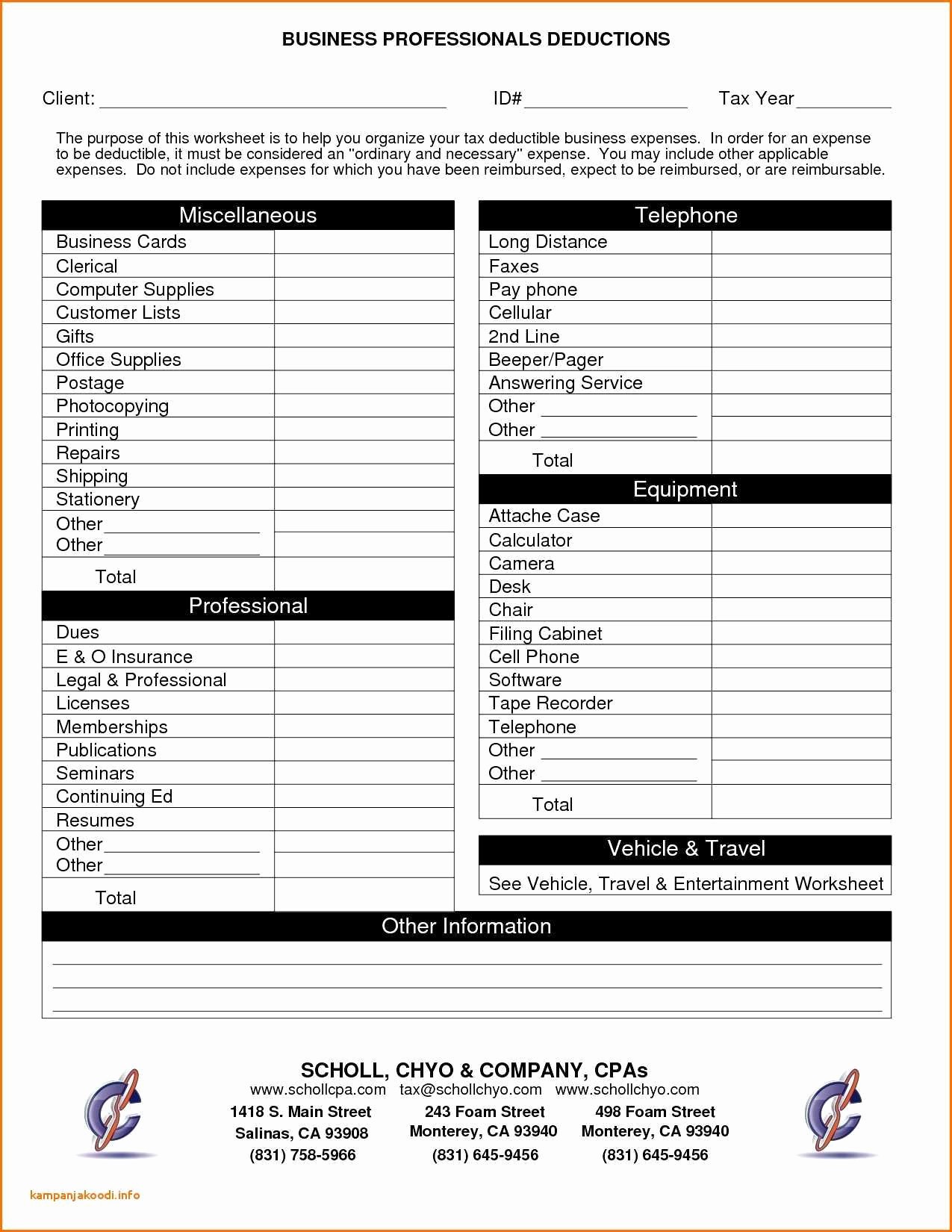

Tax Itemization Worksheet - Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Tax deductions for calendar year 2 0 ___ ___ hired$___________help $___________$___________. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready. Itemized deductions include amounts you paid for. Enter your expenses on the. Which of these would generally be allowed as an itemized deduction? Web in order to claim itemized deductions, you must file your income taxes using form 1040 and list your itemized deductions on schedule a: Web for federal income tax purposes, the total itemized deduction for state and local taxes you paid in 2022 is limited to an aggregate amount not to exceed $10,000. If married or an rdp and filing a separate tax return, you and your spouse/rdp must either both. Web here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Types of itemized deductions include mortgage. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Web we’ll use your 2022 federal standard deduction shown below if. Which of these would generally be allowed as an itemized deduction? Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Web here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Complete the itemized deductions worksheet in. Enter your expenses on the. Web itemized deductions worksheet you will need: Medical expenses paid by insurance. Tax deductions for calendar year 2 0 ___ ___ hired$___________help $___________$___________. Types of itemized deductions include mortgage. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Web here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Web this downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax refunds, social security,. Web for federal income tax purposes, the total. Medical expenses paid by insurance. Which of these would generally be allowed as an itemized deduction? Save or instantly send your ready. Web itemized deductions worksheet you will need: Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Complete the itemized deductions worksheet in the next column. Itemized. Web here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Tax deductions for calendar year 2 0 ___ ___ hired$___________help $___________$___________. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. If married or an rdp and filing a separate tax return, you and your spouse/rdp. Complete the itemized deductions worksheet in the next column. Save or instantly send your ready. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Which of these would generally be allowed as an itemized deduction? Web this worksheet allows you to itemize your tax. There are seven federal income tax rates in. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Easily fill out pdf blank, edit, and sign them. Which of these would generally be allowed as an itemized deduction? Web in 2022, the income limits for. Save or instantly send your ready. The value of a laptop. Tax deductions for calendar year 2 0 ___ ___ hired$___________help $___________$___________. Easily fill out pdf blank, edit, and sign them. Web this downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax refunds, social security,. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Which of these would generally be allowed as an itemized deduction? Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Itemized deductions include amounts you paid for. Enter your expenses on the. Web for federal income tax purposes, the total itemized deduction for state and local taxes you paid in 2022 is limited to an aggregate amount not to exceed $10,000. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Web this worksheet allows you to itemize your tax deductions for a given year. Complete the itemized deductions worksheet in the next column. There are seven federal income tax rates in. Medical expenses paid by insurance. Tax deductions for calendar year 2 0 ___ ___ hired$___________help $___________$___________. Types of itemized deductions include mortgage. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Save or instantly send your ready. Web itemized deductions worksheet you will need: Easily fill out pdf blank, edit, and sign them. Web this downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax refunds, social security,. If married or an rdp and filing a separate tax return, you and your spouse/rdp must either both. Tax deductions for calendar year 2 0 ___ ___ hired$___________help $___________$___________. Itemized deductions include amounts you paid for. Web in order to claim itemized deductions, you must file your income taxes using form 1040 and list your itemized deductions on schedule a: Web for federal income tax purposes, the total itemized deduction for state and local taxes you paid in 2022 is limited to an aggregate amount not to exceed $10,000. Enter your expenses on the. The value of a laptop. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Which of these would generally be allowed as an itemized deduction? Web itemized deductions worksheet you will need: Web this worksheet allows you to itemize your tax deductions for a given year. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Types of itemized deductions include mortgage. Web here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Save or instantly send your ready. Complete the itemized deductions worksheet in the next column. Easily fill out pdf blank, edit, and sign them.8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

Itemized Deductions Spreadsheet in Business Itemized Deductions

Beautiful Business Tax Worksheet Background Small Letter Worksheet

Tax Itemized Deductions Worksheet Universal Network —

10 2014 Itemized Deductions Worksheet /

Printable Yearly Itemized Tax Deduction Worksheet Fill Online

8 Tax Itemized Deduction Worksheet /

Printable Real Estate Agent Tax Deductions Worksheet Printable Word

2018 Itemized Deduction Worksheet Excel acquit 2019 Worksheet

Small Business Deductions Worksheet petermcfarland.us

Web Complete Printable Yearly Itemized Tax Deduction Worksheet Online With Us Legal Forms.

There Are Seven Federal Income Tax Rates In.

Web We’ll Use Your 2022 Federal Standard Deduction Shown Below If More Than Your Itemized Deductions Above (If Blind, Add $1,750 Or $1,400 If Married):

Web You May Be Able To Reduce Your Tax By Itemizing Deductions On Schedule A (Form 1040), Itemized Deductions.

Related Post: