Taxation Worksheet Answers

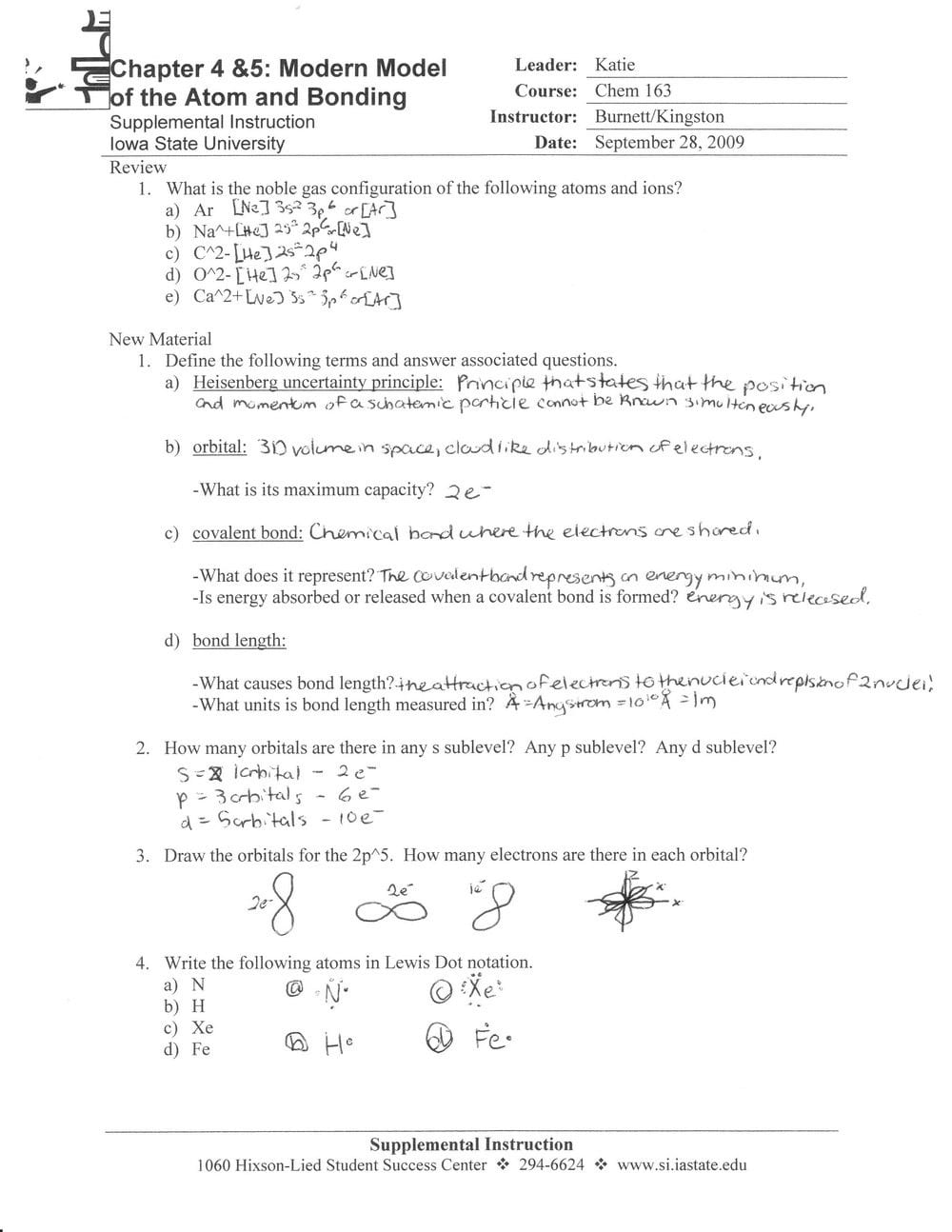

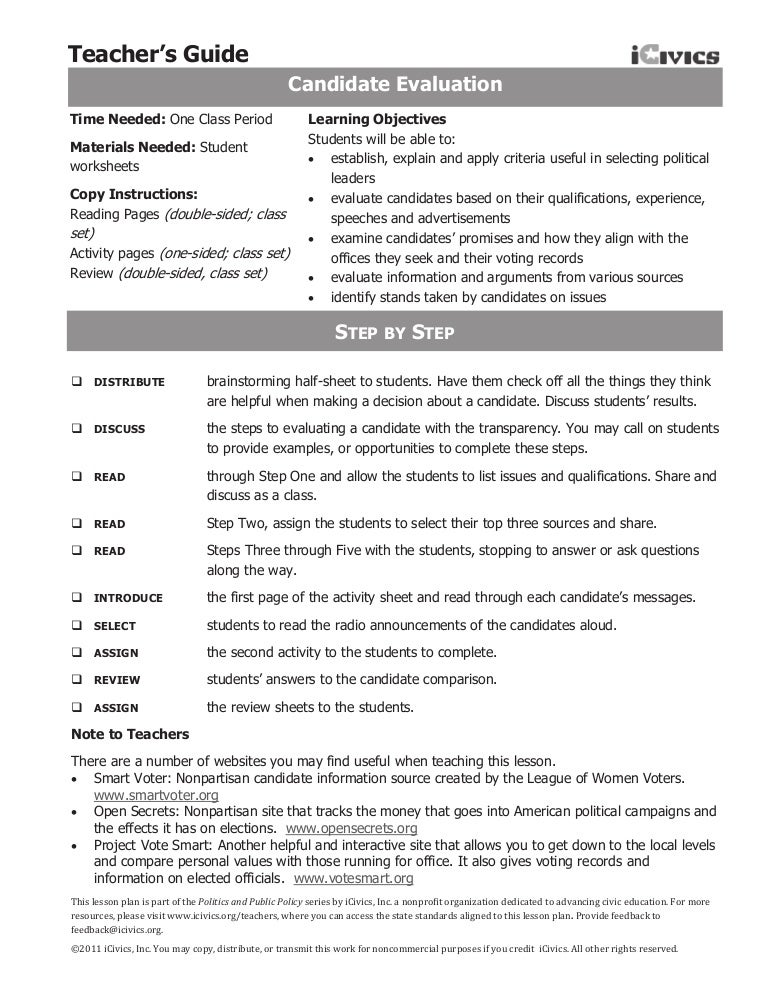

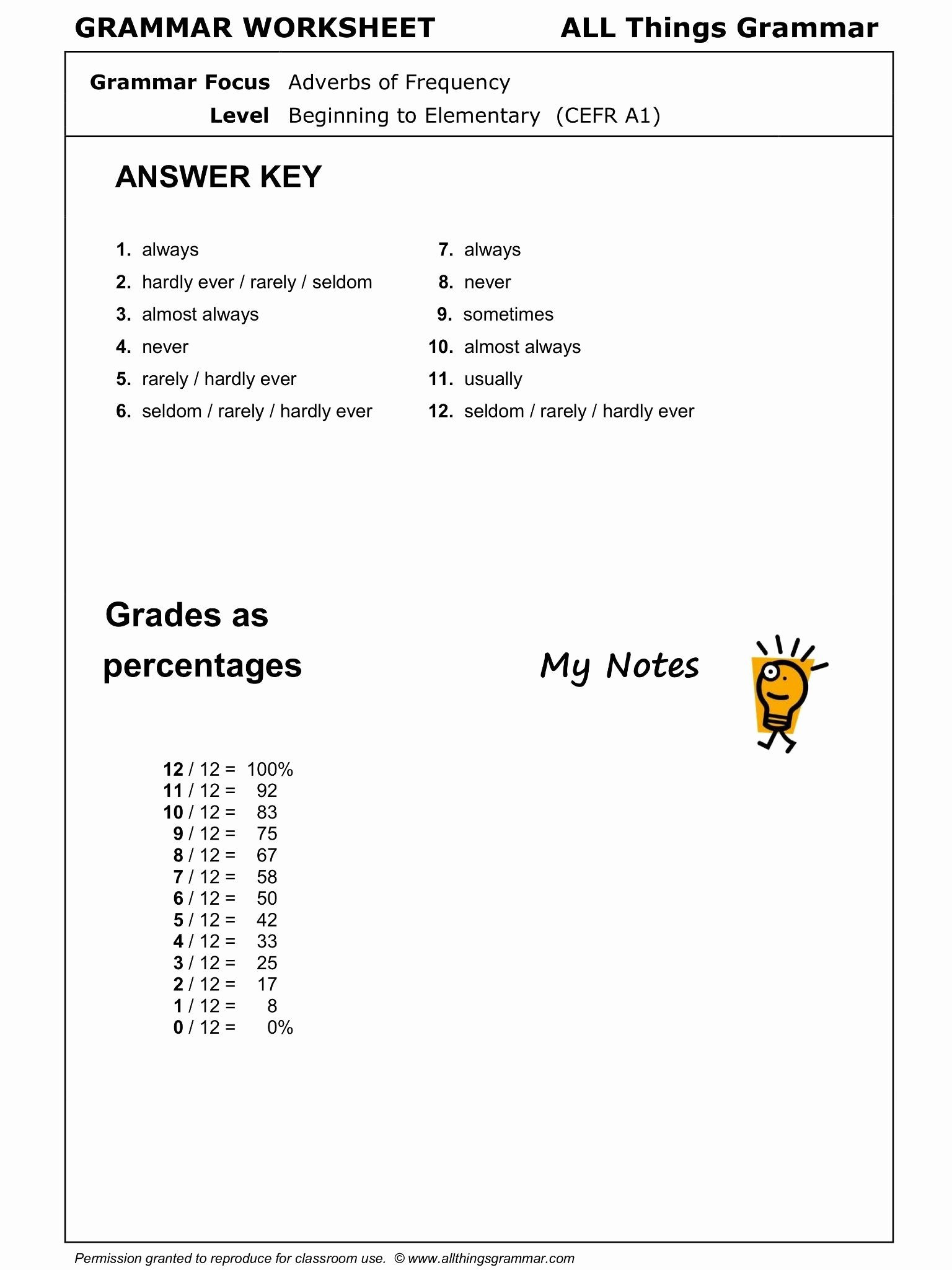

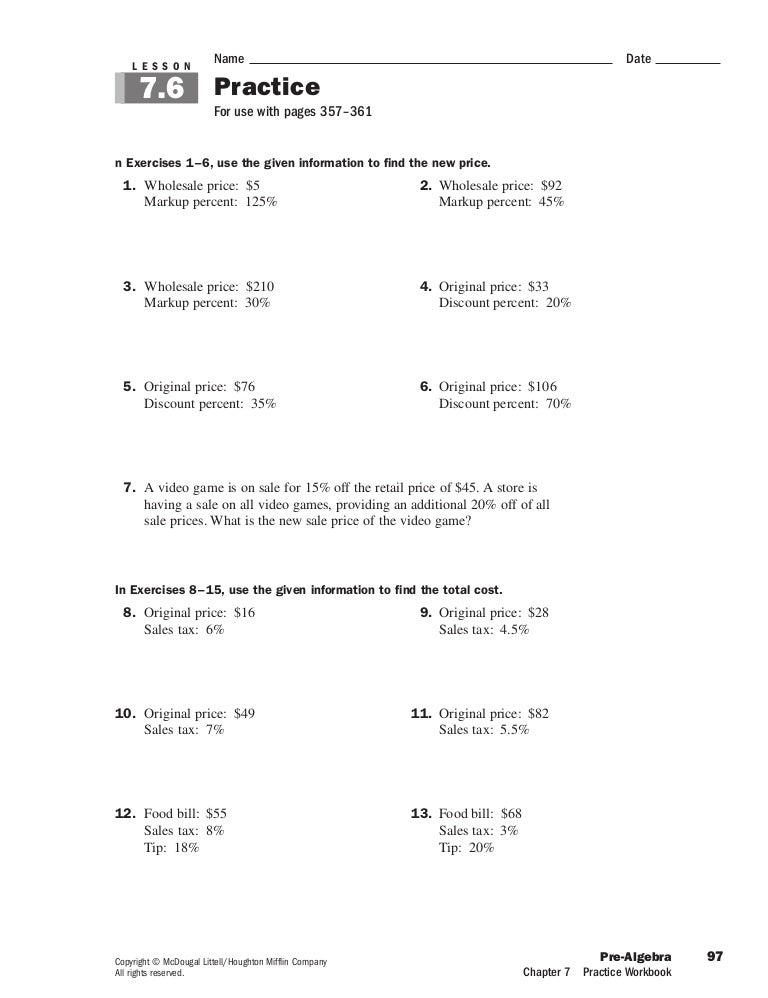

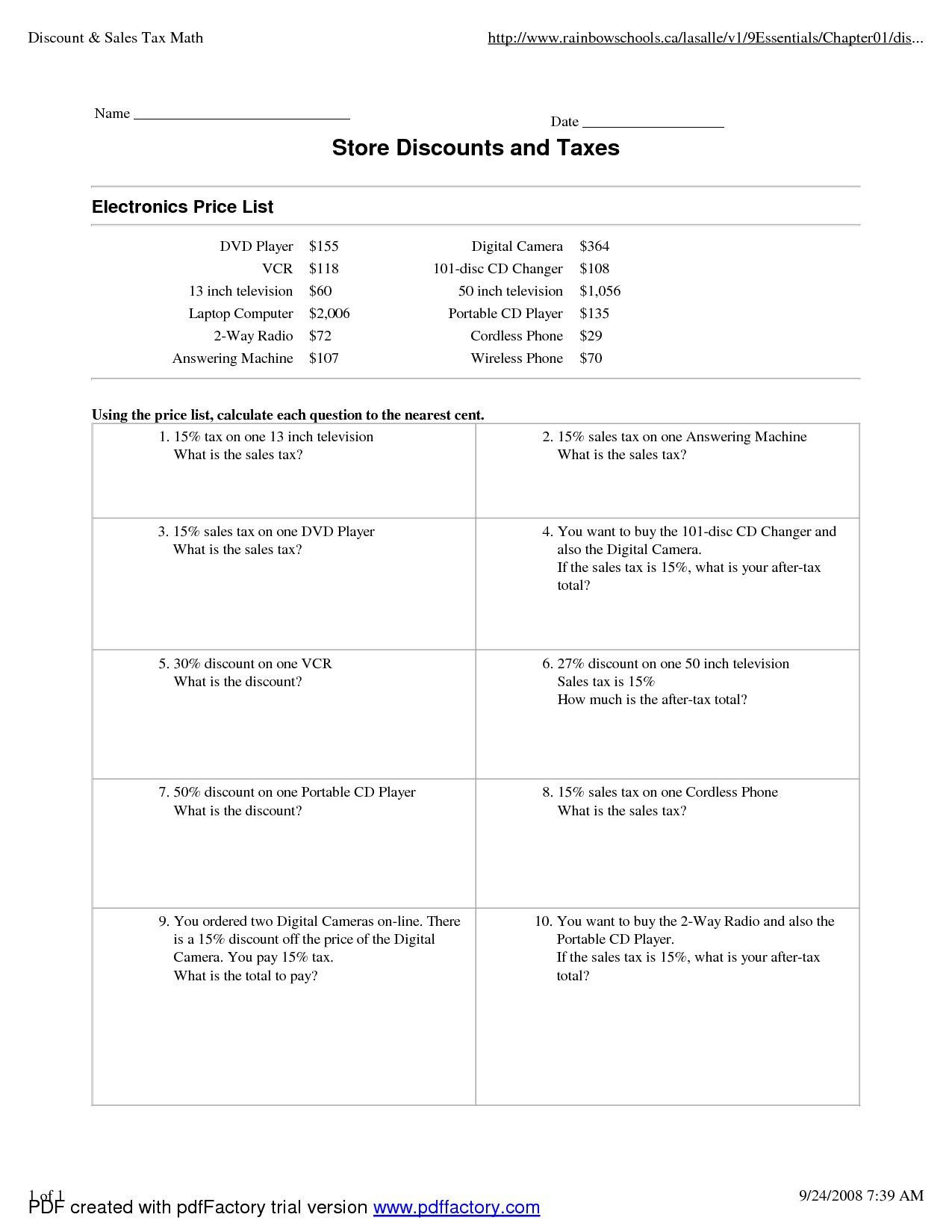

Taxation Worksheet Answers - This is a great functional reading / money skill to practice with students as they work on independent living skills. Terms in this set (14) sin tax. 1 seagate hard drive 2 panasonic portable dvd player 3 seagate hard drive lomega portable hard drive. This worksheet was designed by volunteers from the “icvic” community as a tool to help make their. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Others want to increase the local sales tax from 1 percent to 2 percent. Which of the following is a. You will receive your score and answers at the end. Revenueis a fancy word for income. Lesson closes review with students the importance of taxes, what they fund and why it is important to pay them. Others want to increase the local sales tax from 1 percent to 2 percent. You will receive your score and answers at the end. Some have proposed increasing property taxes. If you would like to use information for the current tax year, you will need to replace the numbers in the slide and in this table. Choose an answer and. Check students work by using the answer key. These income ranges and rates come from a slide in the powerpoint file accompanying this lesson. This is a great functional reading / money skill to practice with students as they work on independent living skills. According to the tables below, what amount of tax would people in each tax system pay?. Use the proportions in the chart to help you label each dollar amount. Worksheets are teachers guide, work calculating marginal average taxes, teacher lesson plan, income taxes who pays and how much lesson plan, personal allowances work, income taxes, benefits retirement reminders railroad equivalent 1, 30 of 107. The top marginal income tax rate of 37 percent will hit taxpayers. Which of the following is a. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. *click on view preview to see in d. Then add to see the total amount of taxes the federal government received in 2011. Worksheets are teachers guide, work calculating marginal average taxes, teacher lesson plan, income taxes who pays. Web $10,000 answers will vary. Web the answer is attached in the explanation below. Revenueis a fancy word for income. Web income tax ranges and rates for the current tax reporting year. There is a lot of books user manual or guidebook that related to icivics judicial branch in a flash answers pdf in the link below. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Web the answer is attached in the explanation below. Embed in my website or blog. Web teaching taxes can take a traditional approach as students complete downloaded worksheets, classroom activities, and assessment pages. Final burden. Web after familiarizing yourself with the irs website answer the questions with the quizizz activity, tax time scavenger hunt worksheet or complete the readyassessments activity. Web $10,000 answers will vary. Plot the curve on the graphs by joining the dots. Which of the following is a. 1 seagate hard drive 2 panasonic portable dvd player 3 seagate hard drive lomega. Students learn how people’s income is taxed, how much revenue taxes generate, and how taxes and government services are related. Revenueis a fancy word for income. Web in order to properly prepare for and complete your taxes you need an answer for every question. The top marginal income tax rate of 37 percent will hit taxpayers with taxable. This is. You will receive your score and answers at the end. Use the proportions in the chart to help you label each dollar amount. Plot the curve on the graphs by joining the dots. Check students work by using the answer key. This resource is designed to help students apply their knowledge to questions. Revenueis a fancy word for income. Some have proposed increasing property taxes. This is a great functional reading / money skill to practice with students as they work on independent living skills. This is tailored for the edexcel specification, however, the versatile nature of this resource makes it suitable for other exam boards too. What they are, who pays them,. Scholaron has more than 2 million+ answers life long with accounting. Relatively high tax designed to raise revenue and discourage consumption of a socially undesirable product. With a picture visual of what they are buying as well as the sales tax rate. These income ranges and rates come from a slide in the powerpoint file accompanying this lesson. Web a level economics worksheet activity containing questions about the lesson: *click on view preview to see in d. Some have proposed increasing property taxes. This resource is designed to help students apply their knowledge to questions. Web this lesson teaches the basics of taxes: If you would like to use information for the current tax year, you will need to replace the numbers in the slide and in this table. Tax funds governmental body responsible for rate of taxation. Web income tax ranges and rates for the current tax reporting year. Or, students can complete work online and take part in interactive activities and simulations. Web there are 12 questions on each worksheet, asking students what is the final price with sales tax? Embed in my website or blog. This is a great functional reading / money skill to practice with students as they work on independent living skills. Then add to see the total amount of taxes the federal government received in 2011. Plot the curve on the graphs by joining the dots. Terms in this set (14) sin tax. There are seven federal income tax rates in 2022: Revenueis a fancy word for income. Web after familiarizing yourself with the irs website answer the questions with the quizizz activity, tax time scavenger hunt worksheet or complete the readyassessments activity. Write the amounts over each dot on the line graphs. Plot the curve on the graphs by joining the dots. Final burden of a tax. Web there are 12 questions on each worksheet, asking students what is the final price with sales tax? Terms in this set (14) sin tax. According to the tables below, what amount of tax would people in each tax system pay? These income ranges and rates come from a slide in the powerpoint file accompanying this lesson. Embed in my website or blog. Lesson closes review with students the importance of taxes, what they fund and why it is important to pay them. *click on view preview to see in d. 1 seagate hard drive 2 panasonic portable dvd player 3 seagate hard drive lomega portable hard drive. Scholaron has more than 2 million+ answers life long with accounting. This is a great functional reading / money skill to practice with students as they work on independent living skills. Calculating sales tax worksheet lovely sales tax tips and markup from taxation worksheet answers , source:edinblogs.net.sales tax and discount worksheet 7th grade answer key1 Worksheets Free

Chapter 7 Federal Tax Worksheet Answers —

Irs Foreign Tax Worksheet Universal Network

Taxation Worksheet Icivics Answer Key » Semanario Worksheet for Student

Taxation Icivics Answers Icivics Taxation Answer Key Pdf + My PDF

Taxation Worksheet Answers —

34 Sales Tax And Discount Worksheet Answers support worksheet

Taxation Worksheet Icivics Answer Key » Answer Key Hub Your Source

Taxation Worksheet Answers —

taxation icivics worksheet answers

Web In Order To Properly Prepare For And Complete Your Taxes You Need An Answer For Every Question.

Web A Level Economics Worksheet Activity Containing Questions About The Lesson:

You Will Receive Your Score And Answers At The End.

What They Are, Who Pays Them, What Kinds Exist, And What They’re Used For.

Related Post: