The Debt Snowball Worksheet Answers

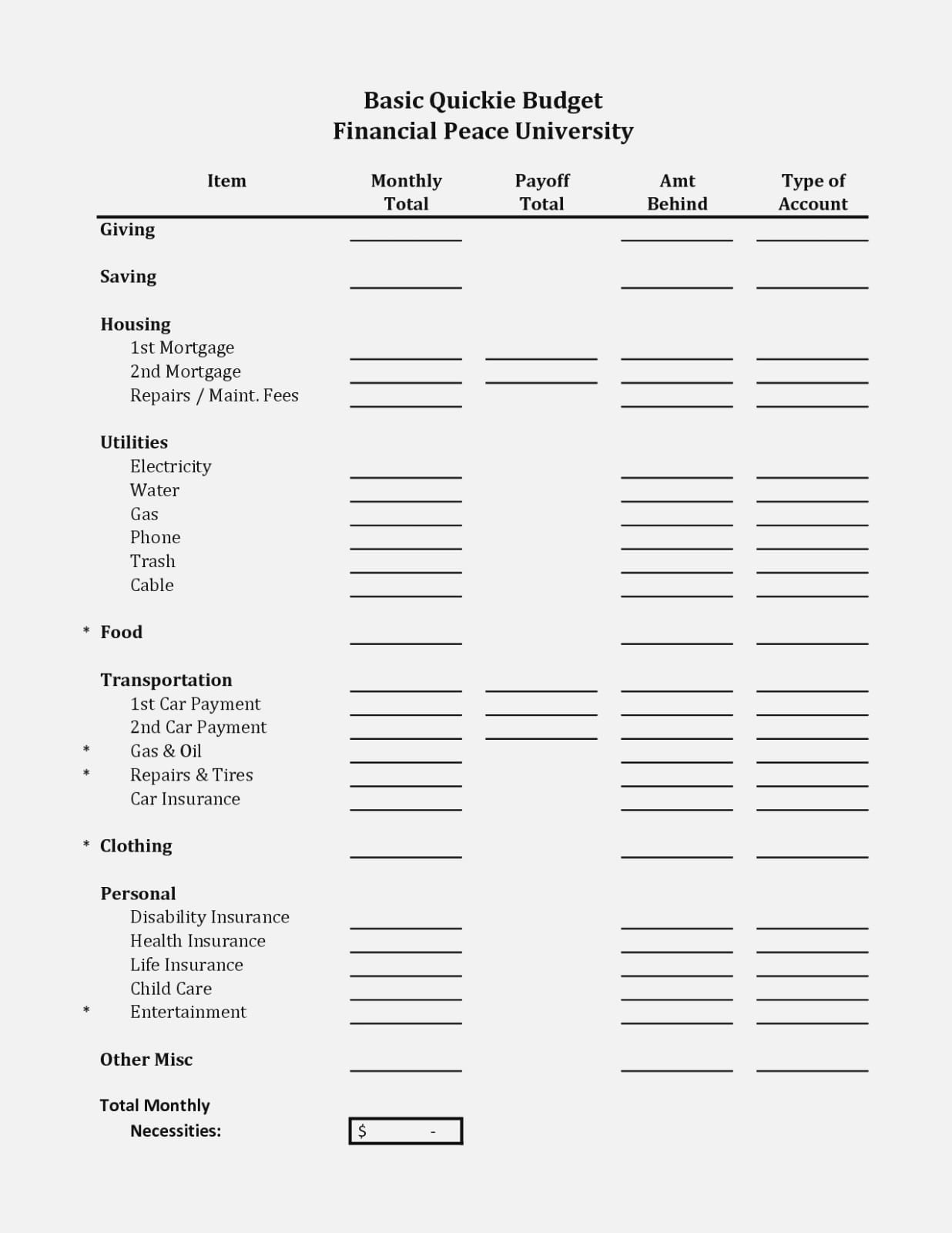

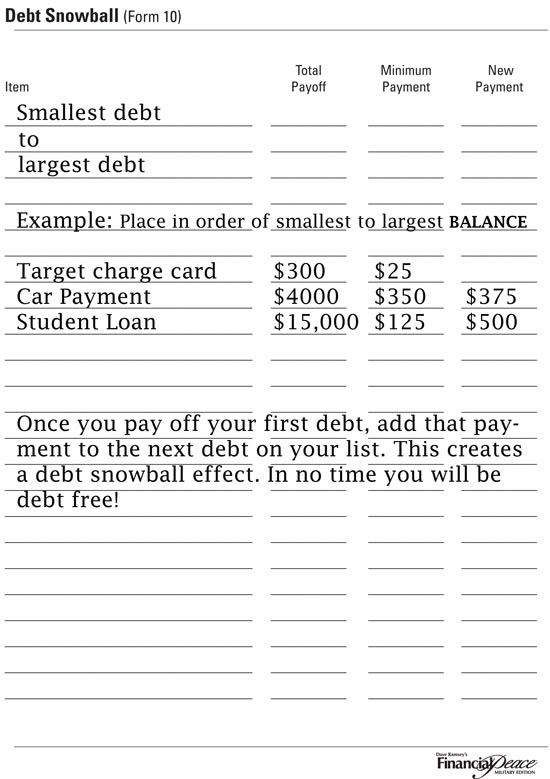

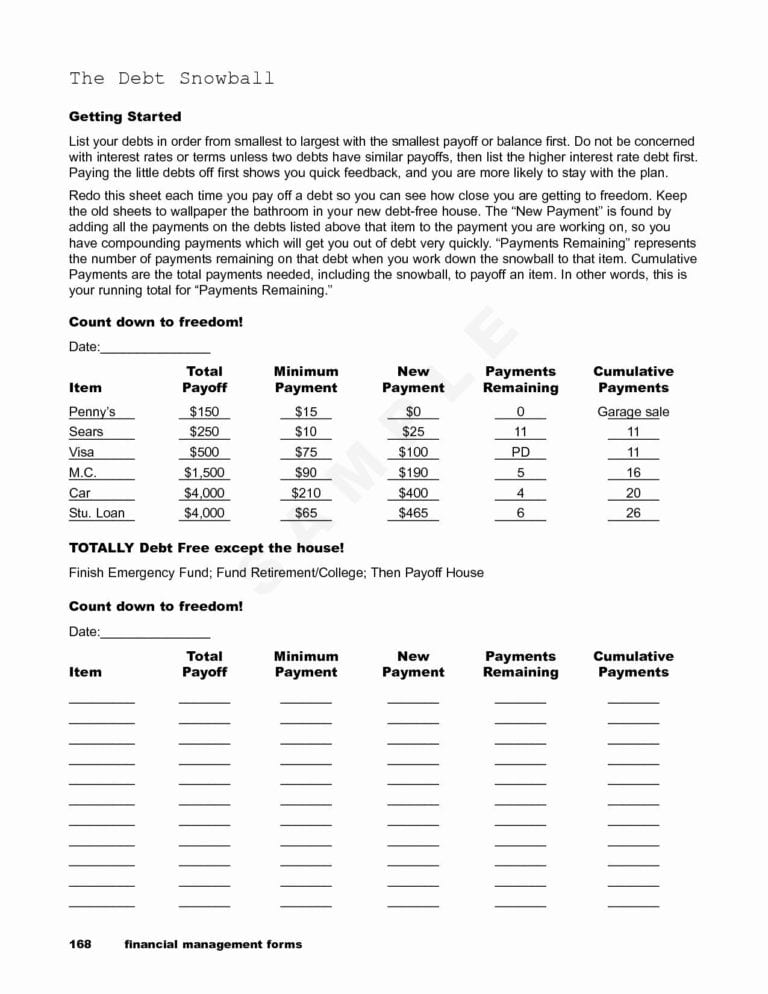

The Debt Snowball Worksheet Answers - It’s that building of momentum and excitement that other debt payoff methods. Instructions are at the bottom of the sheet, but i’ll list them here as well: Web this free debt snowball worksheet can be used to help you track your progress with paying off your debt using the debt snowball method. The debt snowball is one of the best ways to make a big dent in your outstanding debts. Throw every other penny at the debt with the lowest balance. Web so let’s address the top questions you've ask about the debt snowball method. Put any extra dollar amount into your smallest debt until it is paid off. Dave ramsey debt snowball pdf form. Don’t be concerned with the interest rates. Web the debt snowball worksheet answers from briefencounters.ca. Web this free debt snowball worksheet can be used to help you track your progress with paying off your debt using the debt snowball method. .paying off debt doesn't have to be so hard. Pay as much as possible on your smallest debt. Web so let’s address the top questions you've ask about the debt snowball method. Pay minimum payments. Easily sign the dave ramsey budget forms with your finger. Web example of the debt snowball worksheet filled out: Make minimum payments on all your debts except the smallest. Web this free printable debt snowball worksheet set will make paying down your debt simple and easy to understand. Sign it in a few clicks. Make minimum payments on all your debts except the smallest. Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. Web debt snowball spreadsheet for google sheets, debt snowball tracker, snowball debt tracker, debt snowball calculator, worksheet Web the debt snowball worksheet was created specifically with the debt snowball in mind. Be sure. Customize the blanks with unique fillable fields. Repeat until each debt is paid in full. Do the same for the second smallest debt untill that one is paid off as well. Web how does the debt snowball work? Web the debt snowball worksheet answers from briefencounters.ca. Pay the minimum payment on all debts except the one with the lowest balance. Web here’s how the debt snowball works: Easily sign the form with your finger. Web this free printable debt snowball worksheet set will make paying down your debt simple and easy to understand. Make minimum payments on all your debts except the smallest. List your debts in order, from the smallest balance to the largest. The debt snowball is a methodology to pay off debt developed by david ramsey. Web this free printable debt snowball worksheet set will make paying down your debt simple and easy to understand. Web get the the debt snowball chapter 4 student activity sheet answers you require. Throw. Pay as much as possible on your smallest debt. Web he used the snowball method to pay off roughly $100,000 worth of debt (including his mortgage). Don’t be concerned with the interest rates. Web this free debt snowball worksheet can be used to help you track your progress with paying off your debt using the debt snowball method. If you. It’s that building of momentum and excitement that other debt payoff methods. Web this debt snowball spreadsheet uses the debt snowball method and in turn, can also help you improve your credit score. Customize the blanks with unique fillable fields. The debt snowball worksheet answers. Web he used the snowball method to pay off roughly $100,000 worth of debt (including. Easily sign the dave ramsey budget forms with your finger. Web this debt snowball spreadsheet uses the debt snowball method and in turn, can also help you improve your credit score. What is the debt snowball. Customize the blanks with unique fillable fields. Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. It’s a way of planning steps you’ll take in order to pay off your debt. Web this free printable debt snowball worksheet set will make paying down your debt simple and easy to understand. .paying off debt doesn't have to be so hard. If you don’t have a surplus, then you need to find a way to reduce your expenses. It’s that building of momentum and excitement that other debt payoff methods. Pay the minimum payment on all debts except the one with the lowest balance. The debt snowball worksheet answers. List your debts from smallest to largest regardless of interest rate. Instructions are at the bottom of the sheet, but i’ll list them here as well: Open the ramsey worksheet printable and follow the instructions. Why do i list my debt in order of payoff balance instead of interest rate? Web here’s how the debt snowball works: Send filled & signed the debt snowball worksheet answers or save. It helps you focus on reducing high balances to improve your credit, and allows you to apply the debt snowball method to pay off the rest of your debt. Web example of the debt snowball worksheet filled out: Get the debt snowball worksheet answers. Customize the blanks with unique fillable fields. We are not affiliated with any brand or entity on this form. Have you ever heard of the snowball method? Make minimum payments on all your debts except the smallest. List your debts in order, from the smallest balance to the largest. Open form follow the instructions. Pay as much as possible on your smallest debt. Open the debt snowball worksheet pdf and follow the instructions. It’s that building of momentum and excitement that other debt payoff methods. Concerned parties names, addresses and numbers etc. Why do i list my debt in order of payoff balance instead of interest rate? The point of the debt snowball is behavior change. Make minimum payments on all your debts except the smallest. Be sure to watch our debt free journey series on youtube where we cover topics that will help you succeed at eliminating your debt and most importantly not getting into debt again. In order to do this method, you’ll need a debt snowball worksheet and a debt snowball calculator. Web the debt snowball method involves paying off your debt in order of smallest to largest balance. If you try to pay off your student loan first because it's the largest debt, you won't see results for a long time. Repeat until each debt is paid in full. Pay the minimum payment for all your debts except for the smallest one. Open form follow the instructions. When the smallest one is paid off, the amount of those payments shift to the next debt. Sign it in a few clicks. Send filled & signed form or save. Web this is the ultimate guide to debt snowball method!The Debt Snowball Worksheet Answers —

Chapter 4 The Debt Snowball Worksheet Answers [EXCLUSIVE]

Printable Debt Snowball Worksheet

30++ The Debt Snowball Worksheet Answers

Free Debt Snowball Worksheet

Debt Snowball Worksheet Free

Debt Snowball Tracker Printable Debt Payment Worksheet Etsy Canada

The Debt Snowball Worksheet Answers Fresh Dave Ramsey Debt

Part 6 Organizing your finances week… Debt Free stories A Bowl Full

Dave Ramsey Debt Snowball Worksheets —

★ ★ ★ ★ ★.

What Is The Debt Snowball.

Dave Ramsey Debt Snowball Pdf Form.

Instead Of Having One Sheet For Each Debt, You Will List All Of Your Debts On A Single Sheet.

Related Post:

![Chapter 4 The Debt Snowball Worksheet Answers [EXCLUSIVE]](http://www.simplyunscripted.com/wp-content/uploads/2018/03/debt-snowball-method-printable--600x773.jpg)