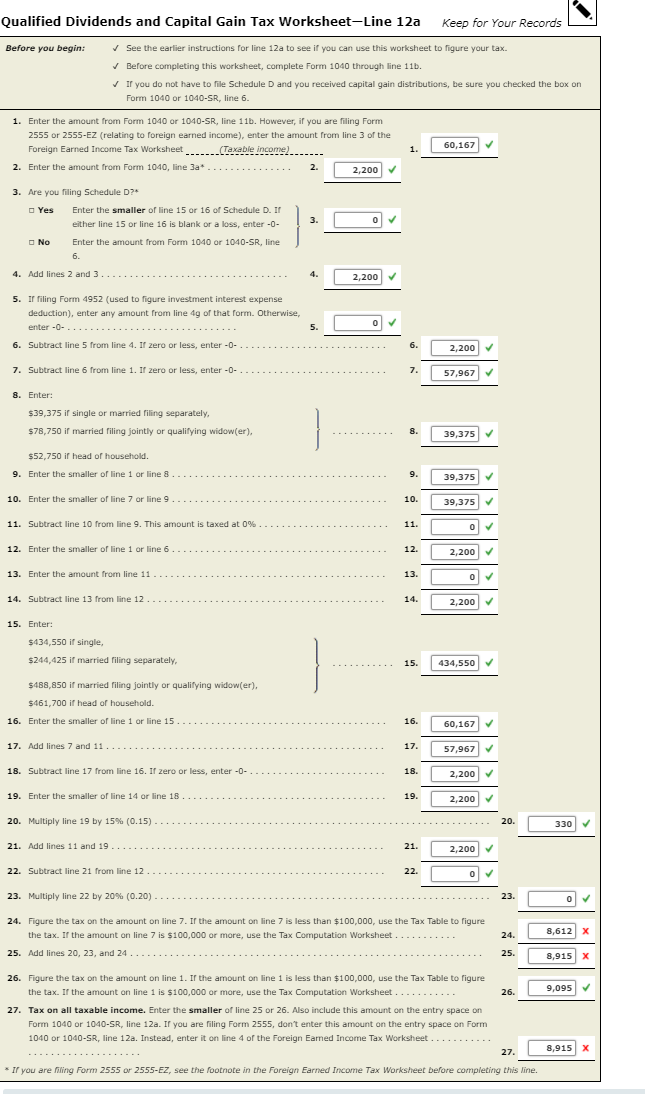

The Qualified Dividends And Capital Gains Tax Worksheet

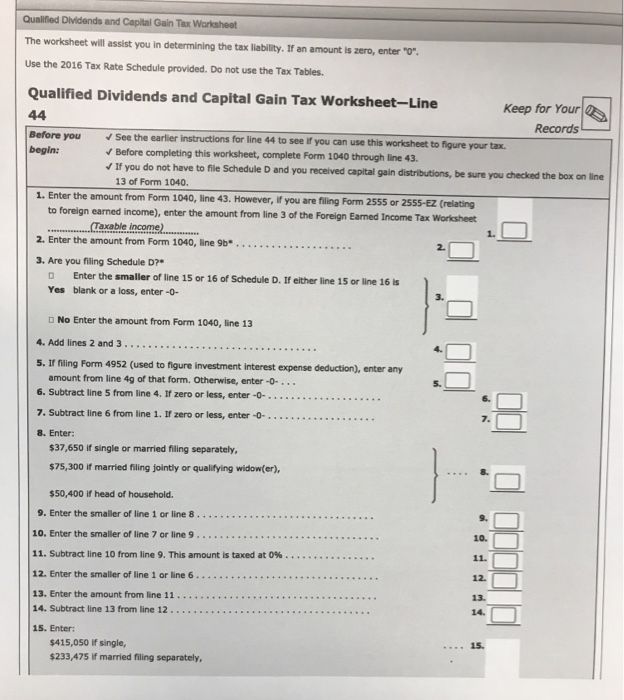

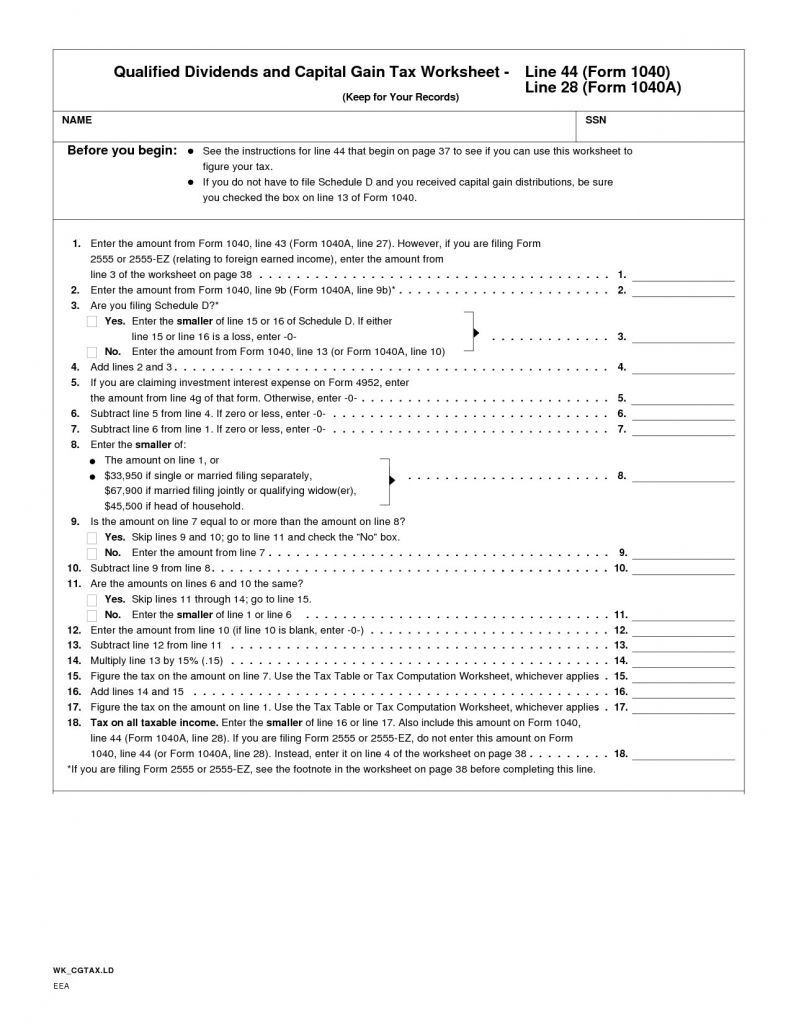

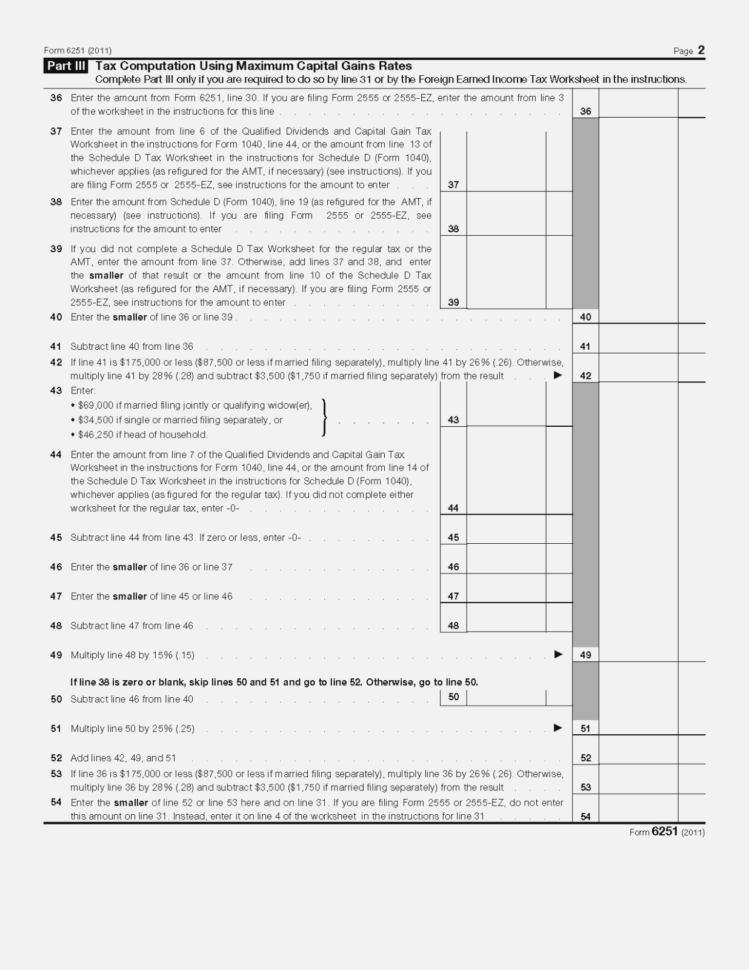

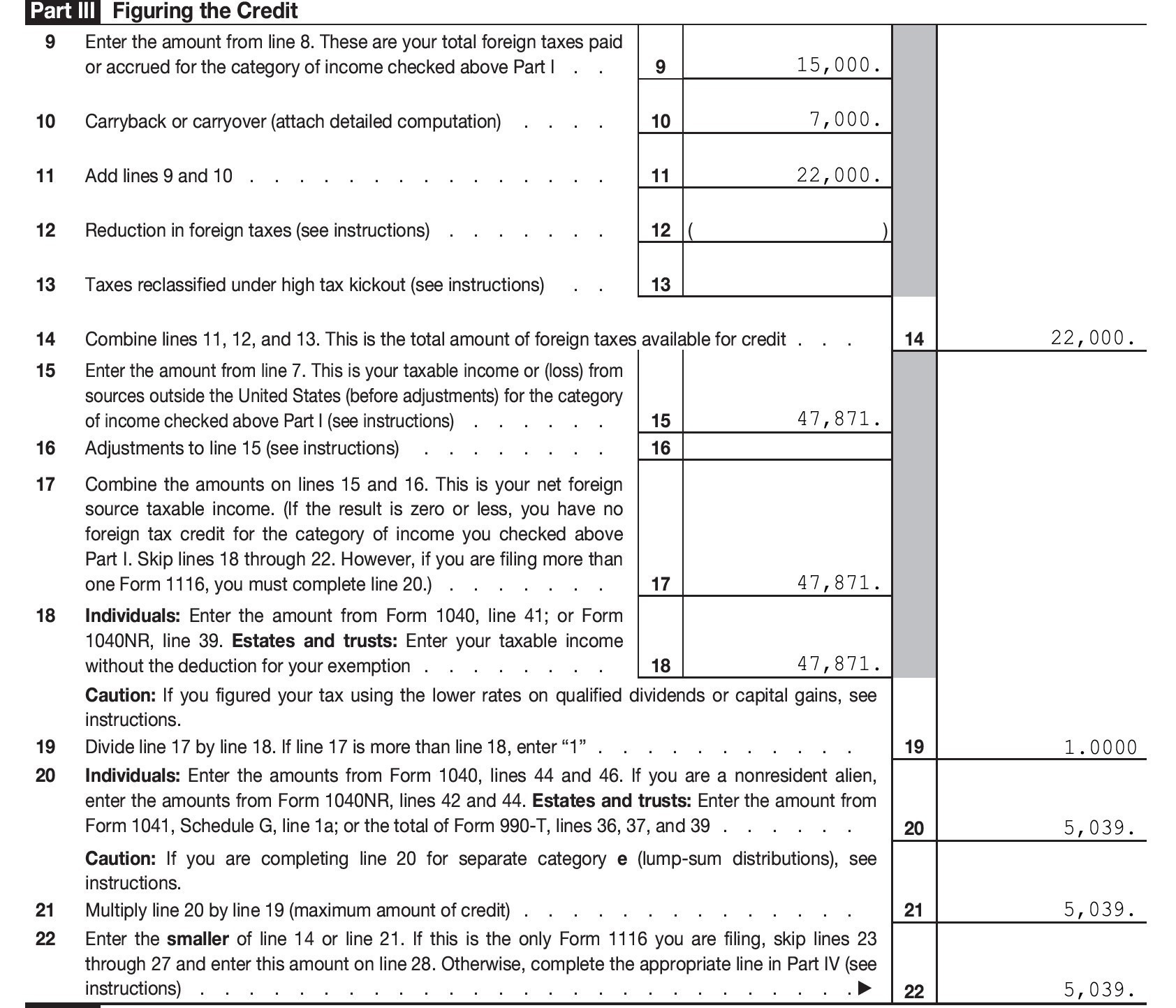

The Qualified Dividends And Capital Gains Tax Worksheet - Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Form 8862, who must file. Web qualified dividends and capital gain tax worksheet (2020) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. If “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you don’t need to file schedule d. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, alternative minimum tax (amt), earned income tax credit (eitc), child tax credit (ctc), capital gains brackets, qualified business. Qualified dividends and capital gain tax worksheet—line 16; Web the 2020 qualified dividends and capital gain tax worksheet (h&rblock) form is 1 page long and contains: Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: Ordinary income is then everything leftover, which is taxable income minus qualified income. Qualified dividends and capital gain tax worksheet line 44. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. It is used. Web irs.gov qualified dividends and capital gains tax worksheet author: Otherwise, complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line. Browse h&rblock forms related forms 2021 federal. Ordinary income is then everything leftover, which is taxable income minus qualified income. Foreign earned income tax worksheet—line 16; Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete form 1040 through line 15. If. It is used to calculate the tax liability associated with these earnings, which can vary depending on one’s filing status. Ordinary income is then everything leftover, which is taxable income minus qualified income. Irs.gov qualified dividends and capital gains tax worksheet. The tax rates on ordinary dividends are the same as the tax rates on income from salary or wages.. Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax worksheet‘. Web 1 best answer tomk expert alumni for the desktop version you can switch to forms mode and open the worksheet to see it. If “yes,” attach form 8949 and see its instructions for additional requirements for reporting. Qualified dividends are taxed at lower capital gains tax rates, which can range from 0% to 20%. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, alternative minimum tax (amt), earned income tax credit (eitc), child tax credit (ctc), capital gains brackets, qualified business. Web this year i dashed off this quick excel to check my. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, alternative minimum tax (amt), earned income tax credit (eitc), child tax credit (ctc), capital gains brackets, qualified business. Web to find out if you had a capital gain excess, subtract the amount from your 2022 schedule j, line 7, from line 6 of your 2019 qualified dividends. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? But, please check my math on the excel. Ordinary income is then everything leftover, which is taxable income minus qualified income. Before completing this worksheet, complete form 1040 through line 15. How are qualified dividends described for tax purposes? With a good understanding of the mechanics, preparers can spot opportunities to advise clients to take advantage of the 0% rate and minimize the 20% rate. Web it takes 27 lines in the irs qualified dividends and capital gain tax worksheet to work through the computations ( form 1040 instructions (2013), p. Web qualified dividends and capital gain tax worksheet. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Qualified dividends and capital gain tax worksheet line 44. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. If the amount on line. If the amount on line 5 is $100,000 or more, use the tax computation worksheet add lines 18, 21, and 22 figure the tax on the amount on line 1. Make sure i haven’t screwed up. Here is everything y created date: Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you don’t need to file schedule d. Web figure the tax on the amount on line 5. Child tax credit and credit for other dependents. Web 1 best answer tomk expert alumni for the desktop version you can switch to forms mode and open the worksheet to see it. Web irs.gov qualified dividends and capital gains tax worksheet author: Web schedule d tax worksheet. These tax rates are lower than the income tax rate on ordinary or unqualified dividends. If the amount on line 1 is less than $100,000, use the tax table to figure the. Don't be stumbled by taxes when you're trying to sell your home. Pdf use our library of forms to quickly fill and sign your h&rblock forms online. Otherwise, complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, alternative minimum tax (amt), earned income tax credit (eitc), child tax credit (ctc), capital gains brackets, qualified business. Click forms in the upper right (upper left for mac) and look through the forms in my return list and open the qualified dividends and capital gain tax worksheet. Ordinary income is then everything leftover, which is taxable income minus qualified income. Qualified dividends and capital gain tax worksheet. Web 1 best answer tomk expert alumni for the desktop version you can switch to forms mode and open the worksheet to see it. Web it takes 27 lines in the irs qualified dividends and capital gain tax worksheet to work through the computations ( form 1040 instructions (2013), p. If the amount on line 5 is less than $100,000, use the tax table to figure the tax. Qualified dividends and capital gain tax worksheet. It is very, very basic. Ordinary income is then everything leftover, which is taxable income minus qualified income. The tax rates on ordinary dividends are the same as the tax rates on income from salary or wages. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: Here is everything y created date: If “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. Child tax credit and credit for other dependents. It is used to calculate the tax liability associated with these earnings, which can vary depending on one’s filing status. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Qualified dividends and capital gain tax worksheet—line 16; Qualified dividends and capital gain tax worksheet line 44.Capital Gains Worksheets

Qualified Dividends Worksheet Master of Documents

" Qualified Dividends and Capital Gain Tax Worksheet." not showing

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Qualified Dividends And Capital Gain Tax Worksheet 2017 —

2017 Qualified Dividends and Capital Gain Tax Worksheet

Note This Problem Is For The 2019 Tax Year. Beth

Qualified Dividends and Capital Gain Tax Worksheet 2016

Qualified Dividends and Capital Gain Tax Worksheet—Line 44

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web To Find Out If You Had A Capital Gain Excess, Subtract The Amount From Your 2022 Schedule J, Line 7, From Line 6 Of Your 2019 Qualified Dividends And Capital Gain Tax Worksheet (Line 10 Of Your 2019 Schedule D Tax Worksheet).

Before Completing This Worksheet, Complete Form 1040 Through Line 15.

Foreign Earned Income Tax Worksheet—Line 16;

Otherwise, Complete The Qualified Dividends And Capital Gain Tax Worksheet In The Instructions For Form 1040, Line.

Related Post: