Truck Driver Expenses Worksheet

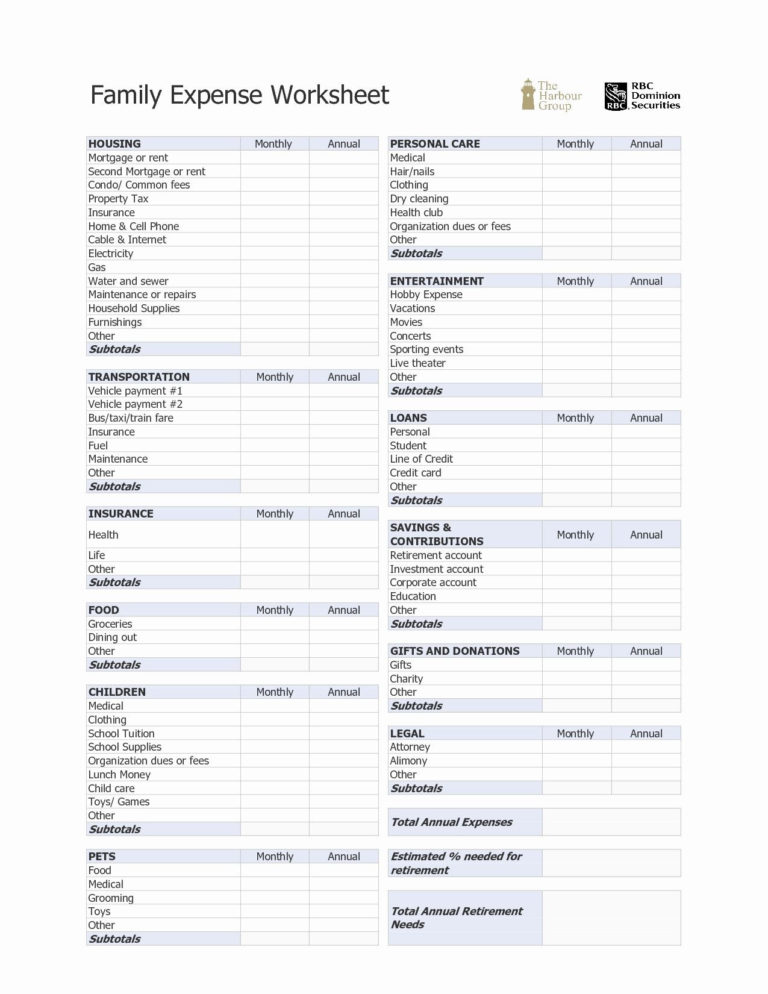

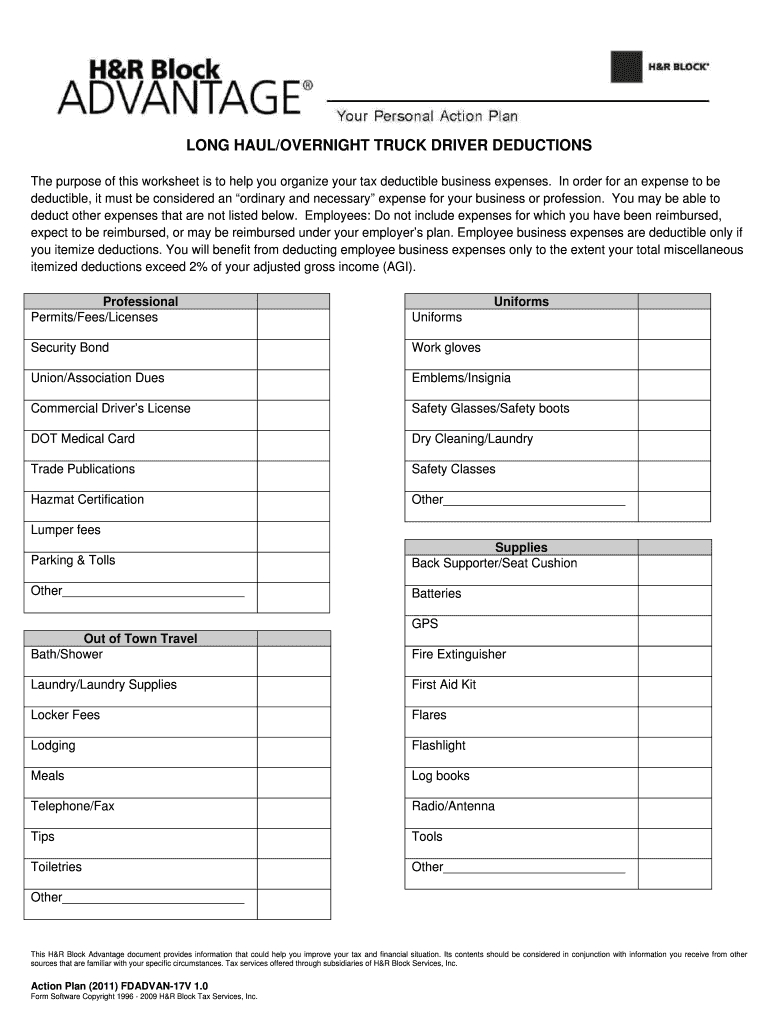

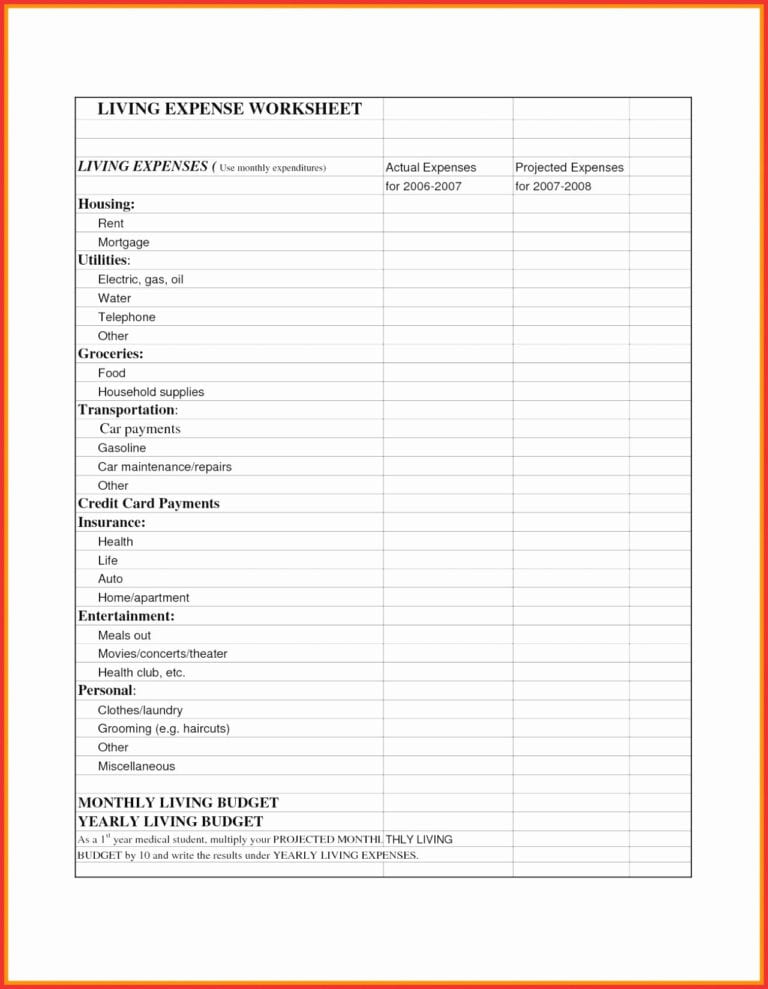

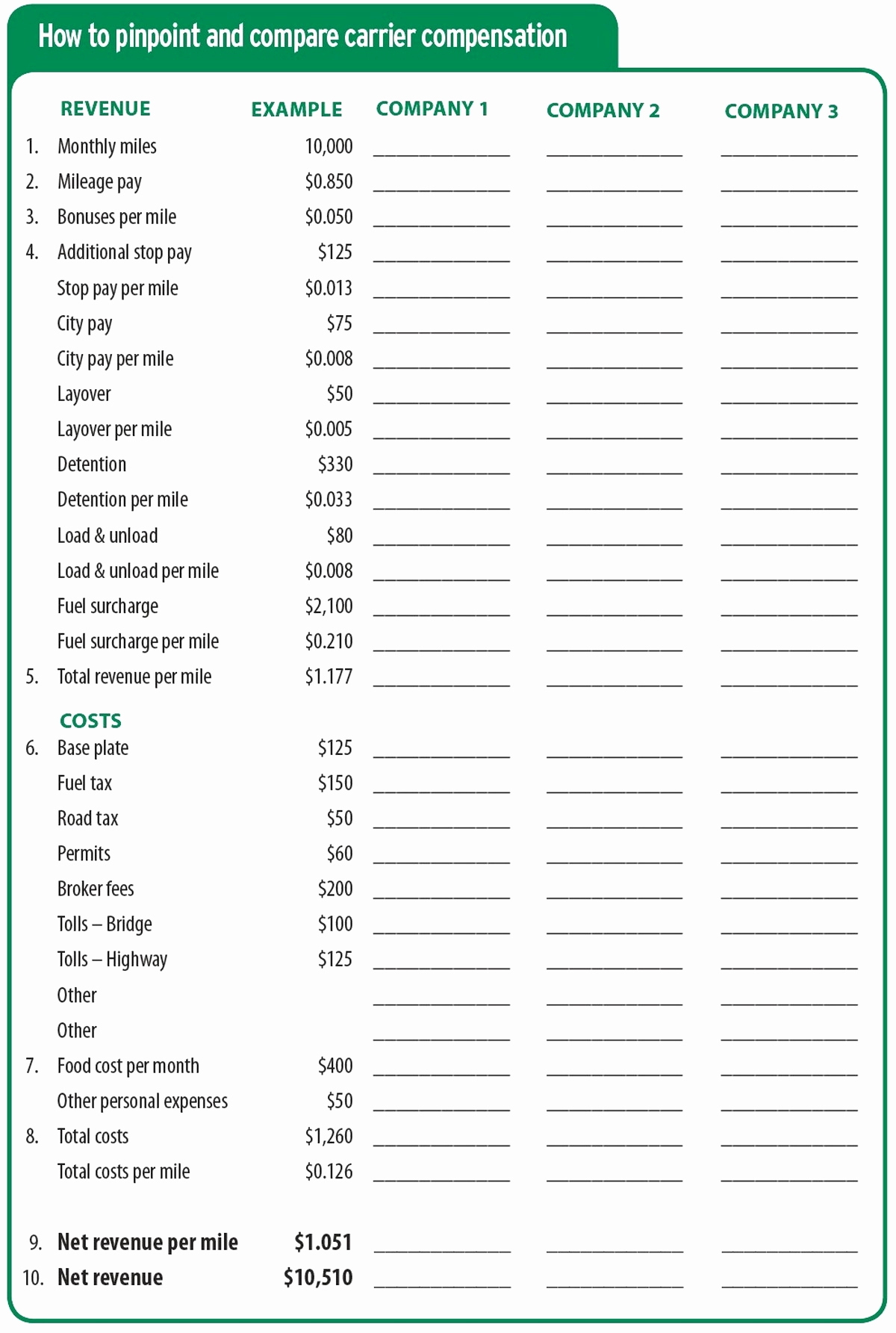

Truck Driver Expenses Worksheet - Web the fixed expenses in your spreadsheet can include vehicle payments, permit costs, insurance, licensing fees, physical damages, and other miscellaneous expenses. Company truck drivers also have such travel expenses as food, shower, and cell phone. One simple online platform to access legal posters and pdfs in a few seconds. The purpose of this worksheet is to help you organize your tax deductible business expenses. Web company truck driver’s expenses. The variable expenses can include costs like. Web smarthop’s expense calculator is a free trucking expenses spreadsheet built to help you better understand how much it costs to run your business. Web download the truck driver tax deductions worksheet in pdf to help you save your money on taxes! Web filling out truck driver tax deductions involves several steps. The company has full responsibility for all the truck related, insurance, and fuel payments. The purpose of this worksheet is to help you organize your tax deductible business expenses. Or less lease costs _____ over 6000 lbs. Click free, customizable excel spreadsheet templates for budget planning, project management, scoring, and other personal press business tasks. Our list of the most common truck driver tax deductions will help you find out how you can save. Web to deduct actual expenses for the truck, your expenses can include (but aren’t limited to): Some companies offer a per diem. Web smarthop’s expense calculator is a free trucking expenses spreadsheet built to help you better understand how much it costs to run your business. The company has full responsibility for all the truck related, insurance, and fuel payments.. Web filling out truck driver tax deductions involves several steps. Use get form or simply click on the template preview to open it in the editor. Web company truck driver’s expenses. Web download the truck driver tax deductions worksheet in pdf to help you save your money on taxes! Web looking for truck driver deductions spreadsheet to fill? Build your own spreadsheet for trucking 4. Truck drivers can deduct business expenses that are “regular and necessary” by the irs. One simple online platform to access legal posters and pdfs in a few seconds. Click free, customizable excel spreadsheet templates for budget planning, project management, scoring, and other personal press business tasks. Web smarthop’s expense calculator is a free. Fuel oil repairs tires washing insurance any other legitimate business expense other unreimbursed expenses you can deduct include: Gas, oil, lube, repairs, tires, batteries, insurance, supplies, wash, wax, etc. Simply add in your expenses and the sheet will update to calculate your operating cost per mile, total monthly expenses, and average monthly profit after expenses. Trucker’s income & expense worksheet;. One simple online platform to access legal posters and pdfs in a few seconds. Start completing the fillable fields and carefully type in required information. In order for an expense to be deductible, it must be considered an “ordinary and necessary” expense for your business or profession. Company drivers do not own a truck — a company provides them with. Fuel oil repairs tires washing insurance any other legitimate business expense other unreimbursed expenses you can deduct include: Truck drivers can deduct business expenses that are “regular and necessary” by the irs. Web to deduct actual expenses for the truck, your expenses can include (but aren’t limited to): Web download the truck driver tax deductions worksheet in pdf to help. Fuel oil repairs tires washing insurance any other legitimate business expense other unreimbursed expenses you can deduct include: Long haul/overnight truck driver deductions. Web smarthop’s expense calculator is a free trucking expenses spreadsheet built to help you better understand how much it costs to run your business. Start completing the fillable fields and carefully type in required information. Log books. Web view, edit, and permeate in truck driver expenses worksheet in no time with formspal! Web truck driver expenses worksheet. Log books lumper fees cell phone that’s 100% for business use license and fees for truck and trailer Some companies offer a per diem. Web this truck driver expenses worksheet form can help make the process a little easier. Taxation seasoning is a chance to claim truck driver tax deductions and get some of this money back. Truck drivers can deduct business expenses that are “regular and necessary” by the irs. Web trucker tax deduction worksheet. Cocodoc is the best spot for you to go, offering you a marvellous and editable version of truck driver deductions spreadsheet as you. Remember, you must provide receipts or other documentation to claim tax deductions. Web looking for truck driver deductions spreadsheet to fill? The purpose of this worksheet is to help you organize your tax deductible business expenses. Web the fixed expenses in your spreadsheet can include vehicle payments, permit costs, insurance, licensing fees, physical damages, and other miscellaneous expenses. The variable expenses can include costs like. Simply add in your expenses and the sheet will update to calculate your operating cost per mile, total monthly expenses, and average monthly profit after expenses. Make sure to keep track of both business and personal expenses related to your truck driving job. Some companies offer a per diem. Click free, customizable excel spreadsheet templates for budget planning, project management, scoring, and other personal press business tasks. Or less lease costs _____ over 6000 lbs. Who can assert truck driver tax deductions? Taxation seasoning is a chance to claim truck driver tax deductions and get some of this money back. Web this truck driver expenses worksheet form can help make the process a little easier. Gross vehicle weight (check one): Web download the truck driver tax deductions worksheet in pdf to help you save your money on taxes! Trucker’s income & expense worksheet 2. In order for an expense to be deductible, it must be considered an “ordinary and necessary” expense for your business or profession. Web view, edit, and permeate in truck driver expenses worksheet in no time with formspal! Web smarthop’s expense calculator is a free trucking expenses spreadsheet built to help you better understand how much it costs to run your business. Truck driver expenses worksheet 5. Build your own spreadsheet for trucking 4. Click free, customizable excel spreadsheet templates for budget planning, project management, scoring, and other personal press business tasks. Cocodoc is the best spot for you to go, offering you a marvellous and editable version of truck driver deductions spreadsheet as you desire. Please visit the links below for more information: Gross vehicle weight (check one): Company truck drivers also have such travel expenses as food, shower, and cell phone. Web this truck driver expenses worksheet form can help make the process a little easier. Web 19 truck driver tax deductions that will save you money here’s a look at common deductions and business expenses truck drivers can claim on their taxes. How a wagon driver, you rack up a considerable number of spending on the road — from fueling top to chowing down. Web to deduct actual expenses for the truck, your expenses can include (but aren’t limited to): Web smarthop’s expense calculator is a free trucking expenses spreadsheet built to help you better understand how much it costs to run your business. Keep track of what deductions you are taking advantage of. The variable expenses can include costs like. Web truck driver expenses worksheet. Fuel oil repairs tires washing insurance any other legitimate business expense other unreimbursed expenses you can deduct include: Web trucker tax deduction worksheet.Truck Driver Expenses Worksheet —

Truck Driver Expense Spreadsheet Tagua

Truck Driver Expense Spreadsheet Spreadsheet Softwar truck driver

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Truck Driver Tax Deductions Worksheet —

20 Unique Truck Driver Tax Deductions Worksheet

tax deduction worksheet for truck drivers LAOBING KAISUO

Free Truck Driver Expense Spreadsheet LAOBING KAISUO

Truck Driver Expense Spreadsheet —

31 Truck Driver Expenses Worksheet support worksheet

Web Taxes Breaks For Truck Drivers.

Here's A General Guide To Help You Get Started:

Truck Drivers Can Deduct Business Expenses That Are “Regular And Necessary” By The Irs.

Some Companies Offer A Per Diem.

Related Post: