Truck Driver Tax Deductions Worksheet

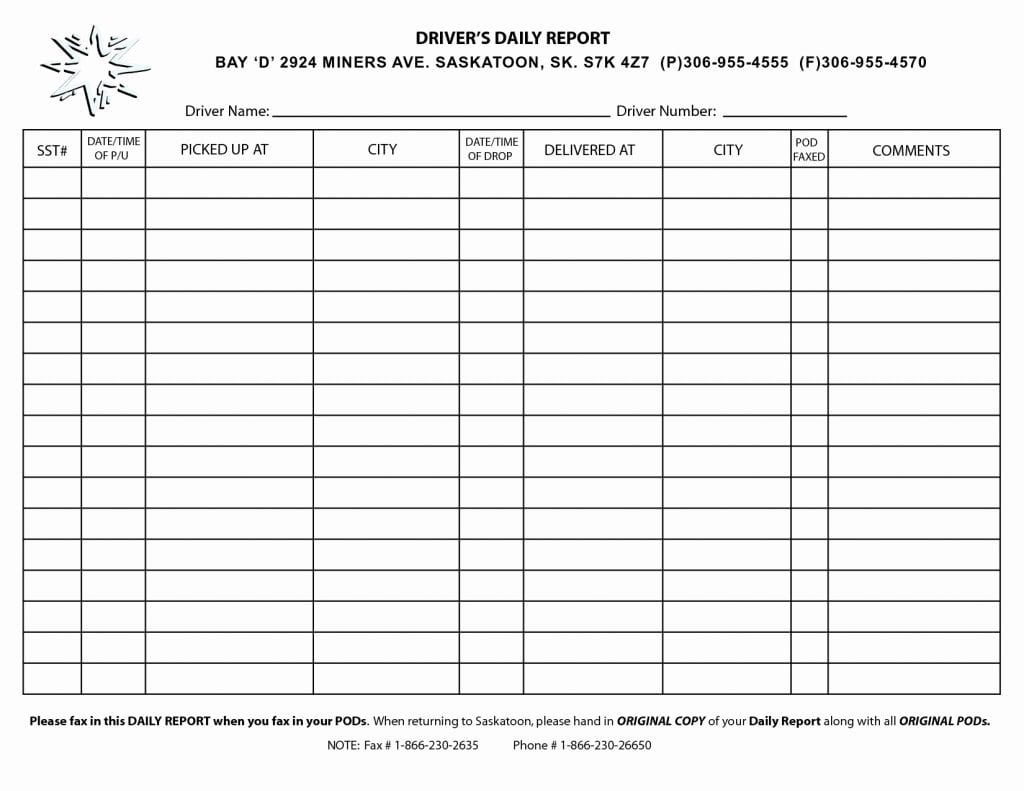

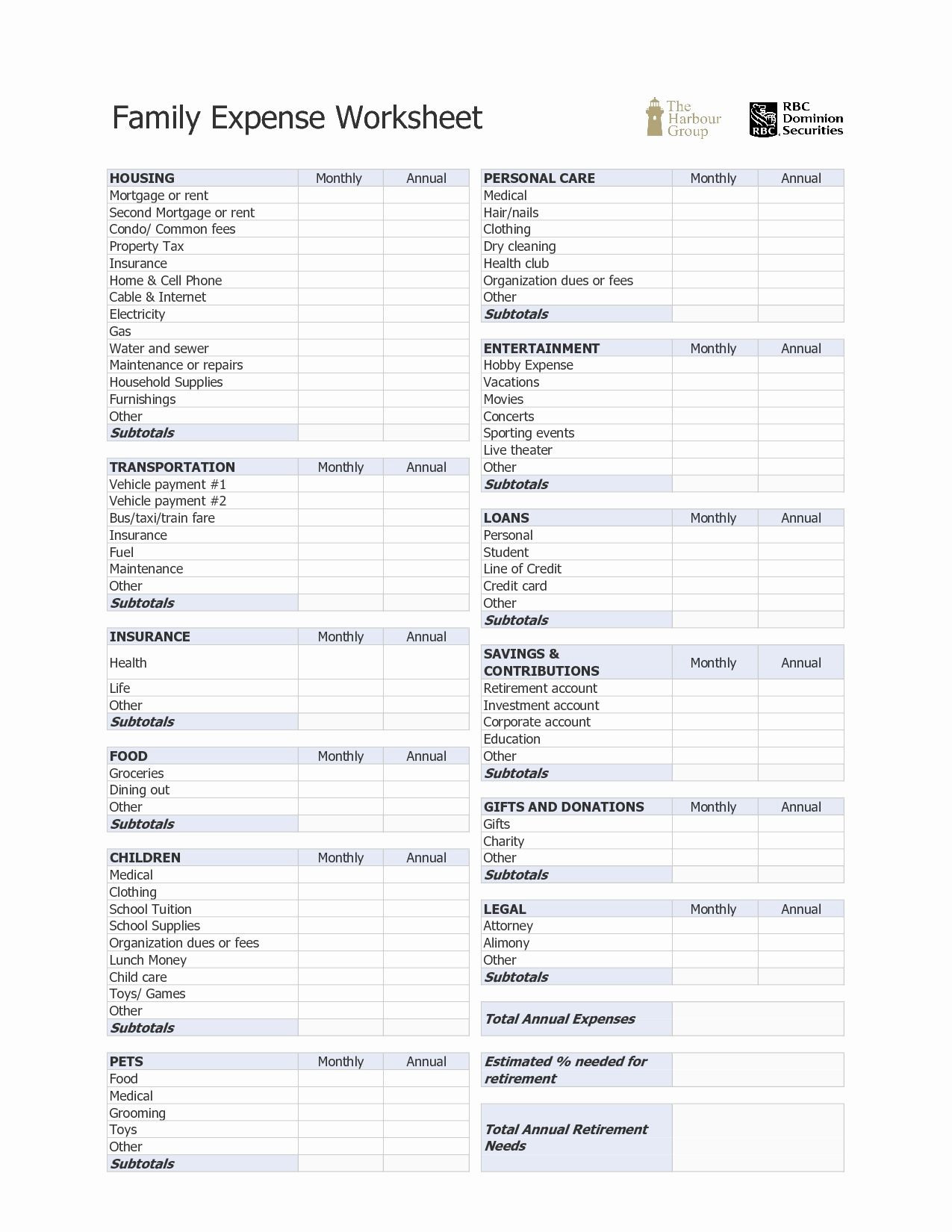

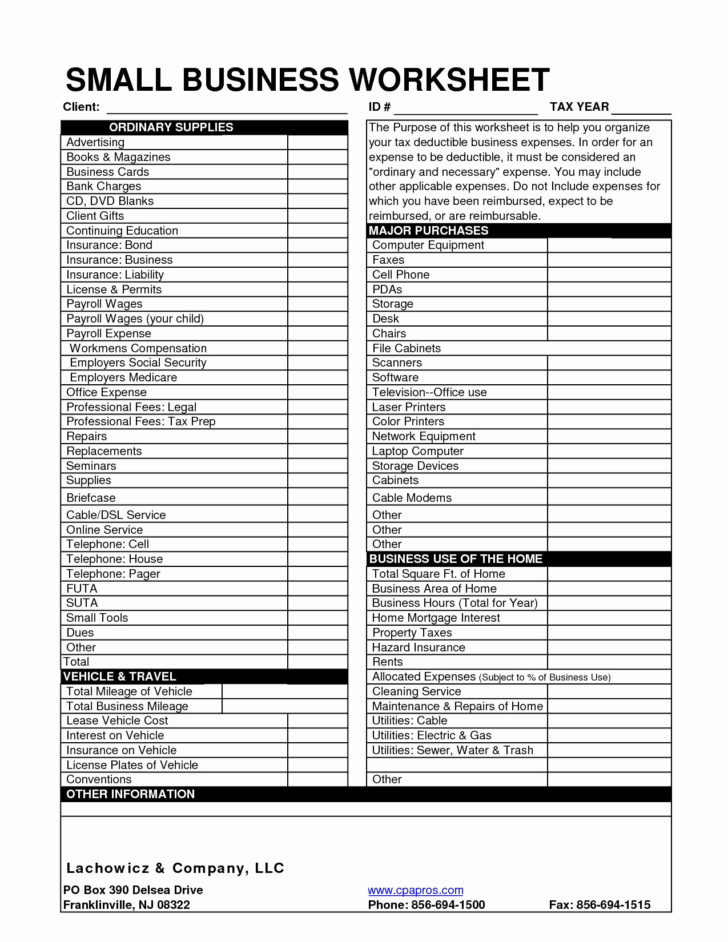

Truck Driver Tax Deductions Worksheet - Web start on editing, signing and sharing your truck driver deductions spreadsheet online with the help of these easy steps: In order for an expense to be deductible, it must be considered an “ordinary. So, if your monthly bill is $100 and you use your. Push the get form or get form now button on the current. Sign it in a few. Web jackson hewitt job specific deductions truck driver employment tax deductions for truck drivers if you are a driver, such as a bus driver, taxicab driver, or truck driver, you should. Web there are lots of deductions you're potentially eligible to claim as a truck driver, and making sure you tick all the right boxes (and have the documentation to back it up) can make a. Non cash contribution deduction $ nurses & medical professionals; Web the purpose of this worksheet is to help you organize your tax deductible business expenses. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. Fuel oil repairs tires washing insurance any other legitimate business expense other. Sign it in a few. Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Web to deduct actual expenses for the truck, your expenses can include (but aren’t limited. Sign it in a few. Fuel oil repairs tires washing insurance any other legitimate business expense other. Push the get form or get form now button on the current. Web jackson hewitt job specific deductions truck driver employment tax deductions for truck drivers if you are a driver, such as a bus driver, taxicab driver, or truck driver, you should.. Use get form or simply click on the template preview to open it in the editor. Web t car and truck expenses (personal vehicle) t veidclel year and make of vehicle date purchased (month, date and year) ending odometer reading (december 31). Push the get form or get form now button on the current. Sign it in a few. Web. Fuel oil repairs tires washing insurance any other legitimate business expense other. Use get form or simply click on the template preview to open it in the editor. Income and allowance amounts you need to include in your tax return and. Web truck loans equipment loans business only credit card legal & professional: So, if your monthly bill is $100. In order for an expense to be deductible, it must be considered an “ordinary. Web the standard tax deduction stands at $12,550 for single people or married couples filing separately, $18,800 for head of household, and $25,100 for married. Web t car and truck expenses (personal vehicle) t veidclel year and make of vehicle date purchased (month, date and year). Web jackson hewitt job specific deductions truck driver employment tax deductions for truck drivers if you are a driver, such as a bus driver, taxicab driver, or truck driver, you should. Income and allowance amounts you need to include in your tax return and. Web to deduct actual expenses for the truck, your expenses can include (but aren’t limited to):. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. Sign it in a few. In order for an expense to be deductible, it must be considered an “ordinary. Income and allowance amounts you need to include in your tax return and. Non cash contribution deduction $ nurses & medical professionals; Push the get form or get form now button on the current. Web jackson hewitt job specific deductions truck driver employment tax deductions for truck drivers if you are a driver, such as a bus driver, taxicab driver, or truck driver, you should. Web the standard tax deduction stands at $12,550 for single people or married couples filing separately, $18,800. Web jackson hewitt job specific deductions truck driver employment tax deductions for truck drivers if you are a driver, such as a bus driver, taxicab driver, or truck driver, you should. Attorney fees for business, accounting fees, bonds, permits, etc. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. Non cash contribution. Web most truck driver pay about $550 dollar for heavy highway use tax. So, if your monthly bill is $100 and you use your. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. Web jackson hewitt job specific deductions truck driver employment tax deductions for truck drivers if you are a driver,. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. Push the get form or get form now button on the current. Income and allowance amounts you need to include in your tax return and. Web t car and truck expenses (personal vehicle) t veidclel year and make of vehicle date purchased (month, date and year) ending odometer reading (december 31). Edit your tax deduction worksheet for truck drivers online type text, add images, blackout confidential details, add comments, highlights and more. Web most truck driver pay about $550 dollar for heavy highway use tax. Attorney fees for business, accounting fees, bonds, permits, etc. Sign it in a few. Web the standard tax deduction stands at $12,550 for single people or married couples filing separately, $18,800 for head of household, and $25,100 for married. Use get form or simply click on the template preview to open it in the editor. Web there are lots of deductions you're potentially eligible to claim as a truck driver, and making sure you tick all the right boxes (and have the documentation to back it up) can make a. Web to deduct actual expenses for the truck, your expenses can include (but aren’t limited to): Fuel oil repairs tires washing insurance any other legitimate business expense other. Web jackson hewitt job specific deductions truck driver employment tax deductions for truck drivers if you are a driver, such as a bus driver, taxicab driver, or truck driver, you should. Web to calculate, simply take your monthly bill and multiply it by the percentage of time you use the device for business. Web truck loans equipment loans business only credit card legal & professional: Web the purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must be considered an “ordinary. Web in this article we are going to talk about truck driver tax deductions: Web start on editing, signing and sharing your truck driver deductions spreadsheet online with the help of these easy steps: Income and allowance amounts you need to include in your tax return and. Edit your tax deduction worksheet for truck drivers online type text, add images, blackout confidential details, add comments, highlights and more. Attorney fees for business, accounting fees, bonds, permits, etc. Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! So, if your monthly bill is $100 and you use your. Web to deduct actual expenses for the truck, your expenses can include (but aren’t limited to): Web most truck driver pay about $550 dollar for heavy highway use tax. Web there are lots of deductions you're potentially eligible to claim as a truck driver, and making sure you tick all the right boxes (and have the documentation to back it up) can make a. Web jackson hewitt job specific deductions truck driver employment tax deductions for truck drivers if you are a driver, such as a bus driver, taxicab driver, or truck driver, you should. Push the get form or get form now button on the current. Web to calculate, simply take your monthly bill and multiply it by the percentage of time you use the device for business. Web t car and truck expenses (personal vehicle) t veidclel year and make of vehicle date purchased (month, date and year) ending odometer reading (december 31). Web start on editing, signing and sharing your truck driver deductions spreadsheet online with the help of these easy steps: How much can a truck driver claim on taxes, what is the difference between an owner operator and. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web in this article we are going to talk about truck driver tax deductions:Truck Driver T Trucker Tax Deduction Worksheet Beautiful —

Tax De Trucker Tax Deduction Worksheet Great Linear —

30 Truck Driver Tax Deductions Trucking business, Accounting classes

Student Loan Interest Deduction Worksheet 2016 Briefencounters

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

20 Unique Truck Driver Tax Deductions Worksheet

2020 Truck Driver Tax Deductions Worksheet Fill Online, Printable

Truck Driver Tax Deductions Worksheet —

Truck Driver Tax Deductions Best Truck In The World —

Trucker Tax Deduction Worksheet Worksheet List

Web The Standard Tax Deduction Stands At $12,550 For Single People Or Married Couples Filing Separately, $18,800 For Head Of Household, And $25,100 For Married.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Fuel Oil Repairs Tires Washing Insurance Any Other Legitimate Business Expense Other.

In Order For An Expense To Be Deductible, It Must Be Considered An “Ordinary.

Related Post: