Trucker Tax Deduction Worksheet

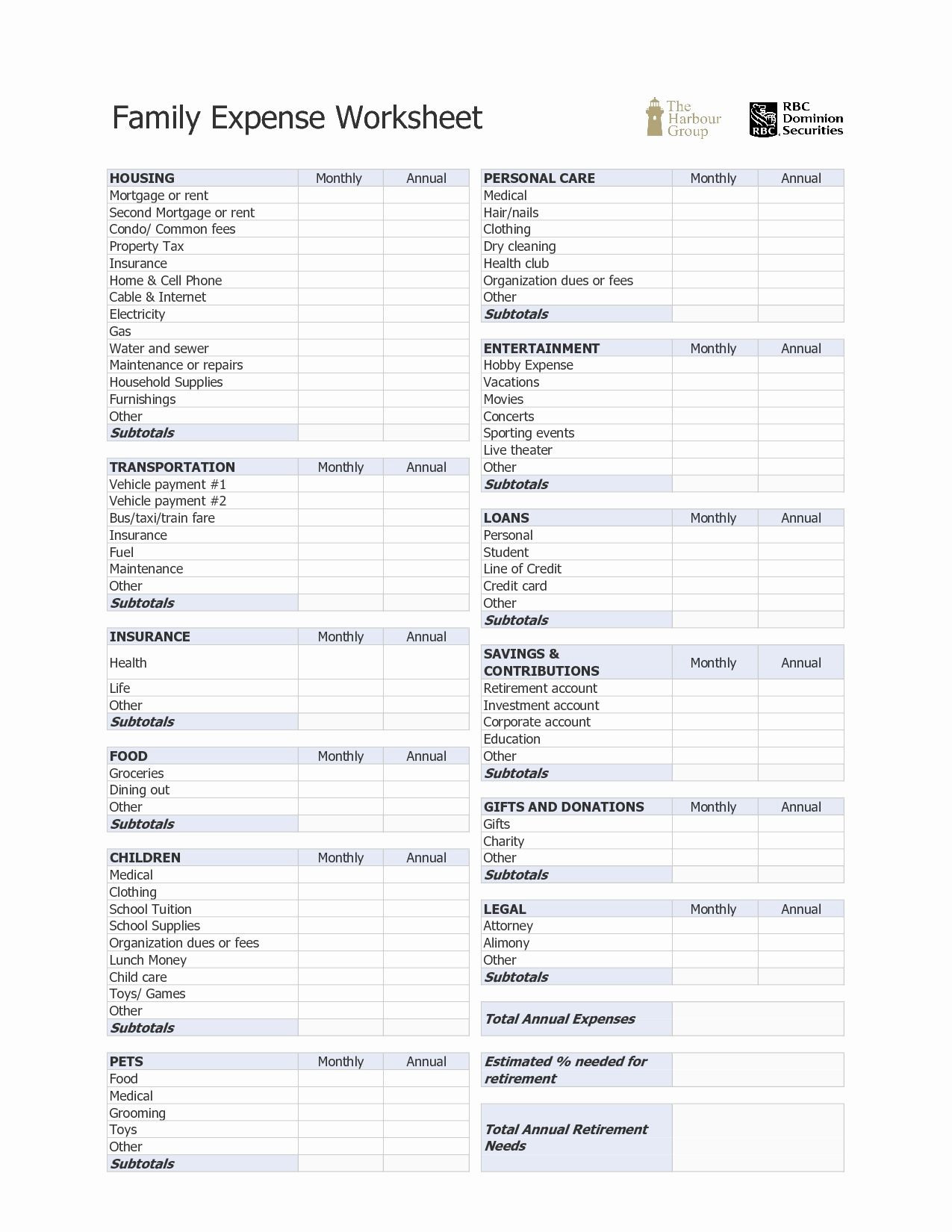

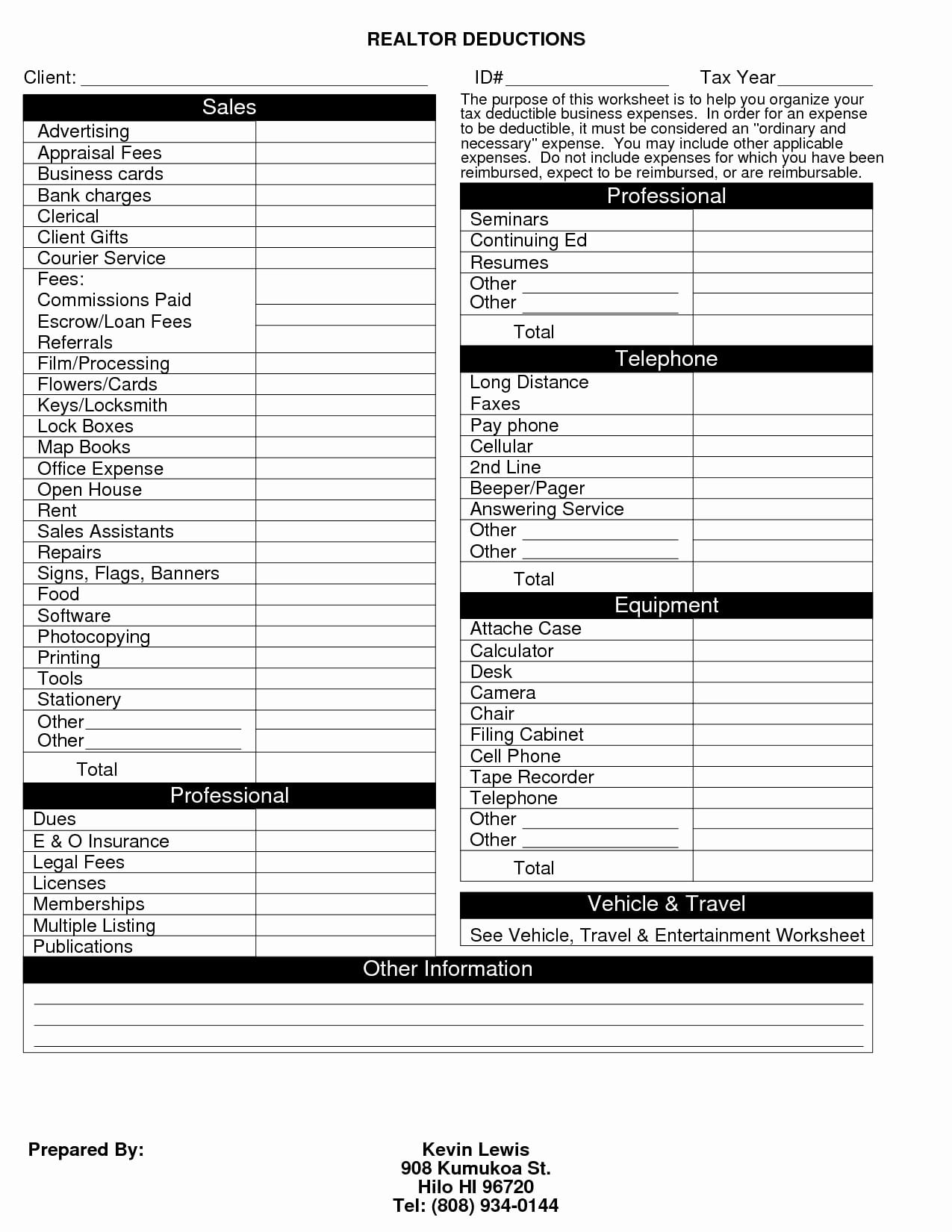

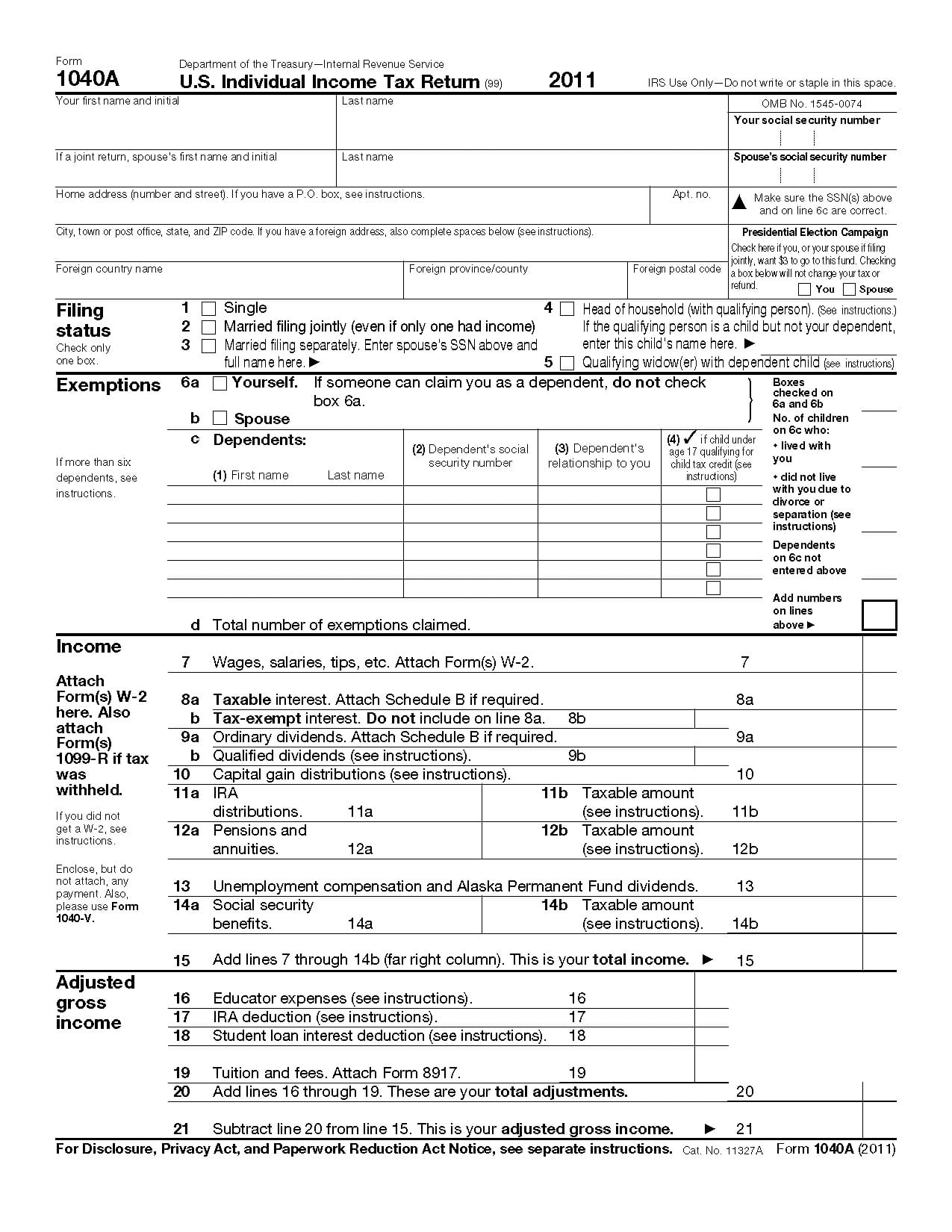

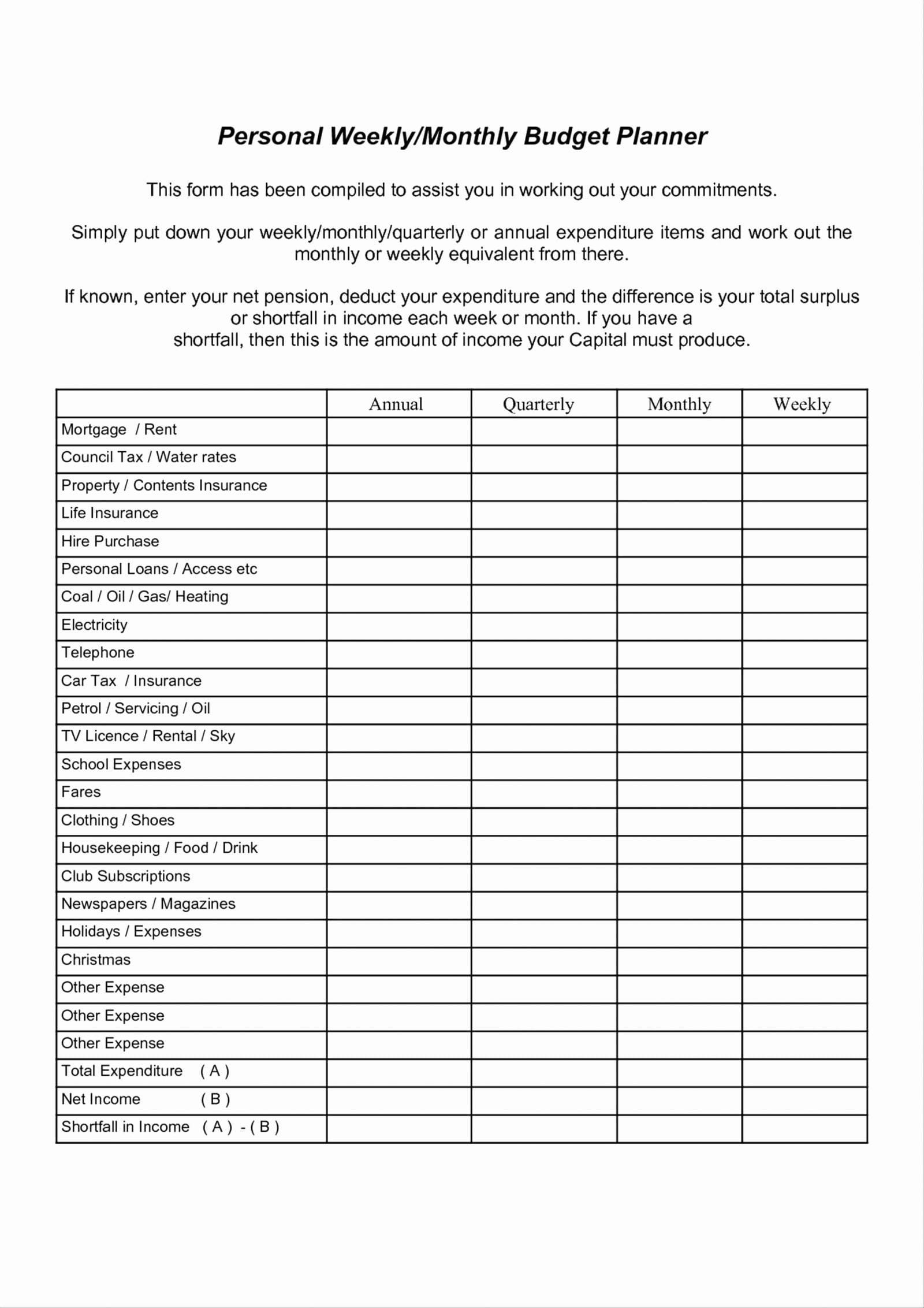

Trucker Tax Deduction Worksheet - Web trucker tax deduction worksheet this is a quick list to help identify business expenses that are used in the trucking business on a daily basis and can all be deducted yearly on our taxes. Who can claim truck driver tax deductions? As a truck driver, you rack up a considerable number of expenses on the road — from fueling up to chowing down. Do you have evidence to support the deduction? Remember, you must provide receipts or other documentation to claim tax deductions. Web 19 truck driver tax deductions that will save you money. Download 2023 per diem tracker Home office square footage of home sq./ft cost of utilities except. Web trucker’s expenses (continued) equipment purchased radio, pager, cellular phone, answering machine, other… item purchased date purchased cost (including sales tax) item traded additional cash paid traded with related property other information! Web trucking business tax worksheet name of business: Web trucking business tax worksheet name of business: Web trucker tax deduction worksheet this is a quick list to help identify business expenses that are used in the trucking business on a daily basis and can all be deducted yearly on our taxes. Web tax breaks for truck drivers. Yes or no number of miles driven for commuting mi. Web. Yes or no number of miles driven for commuting mi. Checkout these “31 tax deductions for truckers, truck drivers & owner operators?” we have prepared income taxes for truck drivers and self employed for over 20 years. Who can claim truck driver tax deductions? Web review information on filing form 2290, heavy highway vehicle use tax return, and other tax. Tax season is a chance to claim truck driver tax deductions and get some of that money back. Web 31 best tax deductions for truckers, truck drivers & owner operators are you a trucker looking to lower your taxes? Web trucking business tax worksheet name of business: Do you have evidence to support the deduction? Web trucker’s expenses (continued) equipment. Web 19 truck driver tax deductions that will save you money. Keep track of what deductions you are taking advantage of. Expenses amount accounting services (quickbooks, prior year taxes) administrative services (me!) broker fees (factoring fees) comdata, comchek fees. Do you have evidence to support the deduction? Remember, you must provide receipts or other documentation to claim tax deductions. Keep track of what deductions you are taking advantage of. Web review information on filing form 2290, heavy highway vehicle use tax return, and other tax tips, trends and statistics related to the trucking industry. Yes or no number of miles driven for commuting mi. Web trucker tax deduction worksheet this is a quick list to help identify business expenses. Web download trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Here’s a look at common deductions and business expenses truck drivers can claim on their taxes. Web trucker’s expenses (continued) equipment purchased radio, pager, cellular phone, answering machine, other… item purchased. Web trucker’s expenses (continued) equipment purchased radio, pager, cellular phone, answering machine, other… item purchased date purchased cost (including sales tax) item traded additional cash paid traded with related property other information! Download 2023 per diem tracker Tax season is a chance to claim truck driver tax deductions and get some of that money back. Web review information on filing. Here’s a look at common deductions and business expenses truck drivers can claim on their taxes. Home office square footage of home sq./ft cost of utilities except. Web 19 truck driver tax deductions that will save you money. Expenses amount accounting services (quickbooks, prior year taxes) administrative services (me!) broker fees (factoring fees) comdata, comchek fees. Yes or no number. Amounts of $600.00 or more paid to individuals (not Web trucking business tax worksheet name of business: Remember, you must provide receipts or other documentation to claim tax deductions. Web trucker tax deduction worksheet this is a quick list to help identify business expenses that are used in the trucking business on a daily basis and can all be deducted. Keep track of what deductions you are taking advantage of. Who can claim truck driver tax deductions? Checkout these “31 tax deductions for truckers, truck drivers & owner operators?” we have prepared income taxes for truck drivers and self employed for over 20 years. Web review information on filing form 2290, heavy highway vehicle use tax return, and other tax. Yes or no number of miles driven for commuting mi. Web tax breaks for truck drivers. Web 31 best tax deductions for truckers, truck drivers & owner operators are you a trucker looking to lower your taxes? Web review information on filing form 2290, heavy highway vehicle use tax return, and other tax tips, trends and statistics related to the trucking industry. Download 2023 per diem tracker Expenses amount accounting services (quickbooks, prior year taxes) administrative services (me!) broker fees (factoring fees) comdata, comchek fees. As a truck driver, you rack up a considerable number of expenses on the road — from fueling up to chowing down. Do you have evidence to support the deduction? Who can claim truck driver tax deductions? Web trucker tax deduction worksheet this is a quick list to help identify business expenses that are used in the trucking business on a daily basis and can all be deducted yearly on our taxes. Remember, you must provide receipts or other documentation to claim tax deductions. Here’s a look at common deductions and business expenses truck drivers can claim on their taxes. Web trucker’s expenses (continued) equipment purchased radio, pager, cellular phone, answering machine, other… item purchased date purchased cost (including sales tax) item traded additional cash paid traded with related property other information! Web 19 truck driver tax deductions that will save you money. Keep track of what deductions you are taking advantage of. Web trucking business tax worksheet name of business: Checkout these “31 tax deductions for truckers, truck drivers & owner operators?” we have prepared income taxes for truck drivers and self employed for over 20 years. Web download trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Amounts of $600.00 or more paid to individuals (not Home office square footage of home sq./ft cost of utilities except. Web 31 best tax deductions for truckers, truck drivers & owner operators are you a trucker looking to lower your taxes? Web review information on filing form 2290, heavy highway vehicle use tax return, and other tax tips, trends and statistics related to the trucking industry. Web trucking business tax worksheet name of business: Web trucker’s expenses (continued) equipment purchased radio, pager, cellular phone, answering machine, other… item purchased date purchased cost (including sales tax) item traded additional cash paid traded with related property other information! As a truck driver, you rack up a considerable number of expenses on the road — from fueling up to chowing down. Home office square footage of home sq./ft cost of utilities except. Do you have evidence to support the deduction? Who can claim truck driver tax deductions? Expenses amount accounting services (quickbooks, prior year taxes) administrative services (me!) broker fees (factoring fees) comdata, comchek fees. Here’s a look at common deductions and business expenses truck drivers can claim on their taxes. Tax season is a chance to claim truck driver tax deductions and get some of that money back. Download 2023 per diem tracker Web download trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Amounts of $600.00 or more paid to individuals (not Web tax breaks for truck drivers. Keep track of what deductions you are taking advantage of.Printable Real Estate Agent Tax Deductions Worksheet Printable Word

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Truck Driver Tax Deductions Worksheet —

Truck Driver T Trucker Tax Deduction Worksheet Perfect —

Tax De Trucker Tax Deduction Worksheet Great Linear —

2020 Truck Driver Tax Deductions Worksheet Fill Online, Printable

Truck Driver T Trucker Tax Deduction Worksheet Perfect —

Truck Driver T Trucker Tax Deduction Worksheet Perfect —

Truck Driver Tax Deductions Worksheet —

31 Truck Driver Expenses Worksheet support worksheet

Checkout These “31 Tax Deductions For Truckers, Truck Drivers & Owner Operators?” We Have Prepared Income Taxes For Truck Drivers And Self Employed For Over 20 Years.

Web 19 Truck Driver Tax Deductions That Will Save You Money.

Web Trucker Tax Deduction Worksheet This Is A Quick List To Help Identify Business Expenses That Are Used In The Trucking Business On A Daily Basis And Can All Be Deducted Yearly On Our Taxes.

Yes Or No Number Of Miles Driven For Commuting Mi.

Related Post: