Turbotax Carryover Worksheet

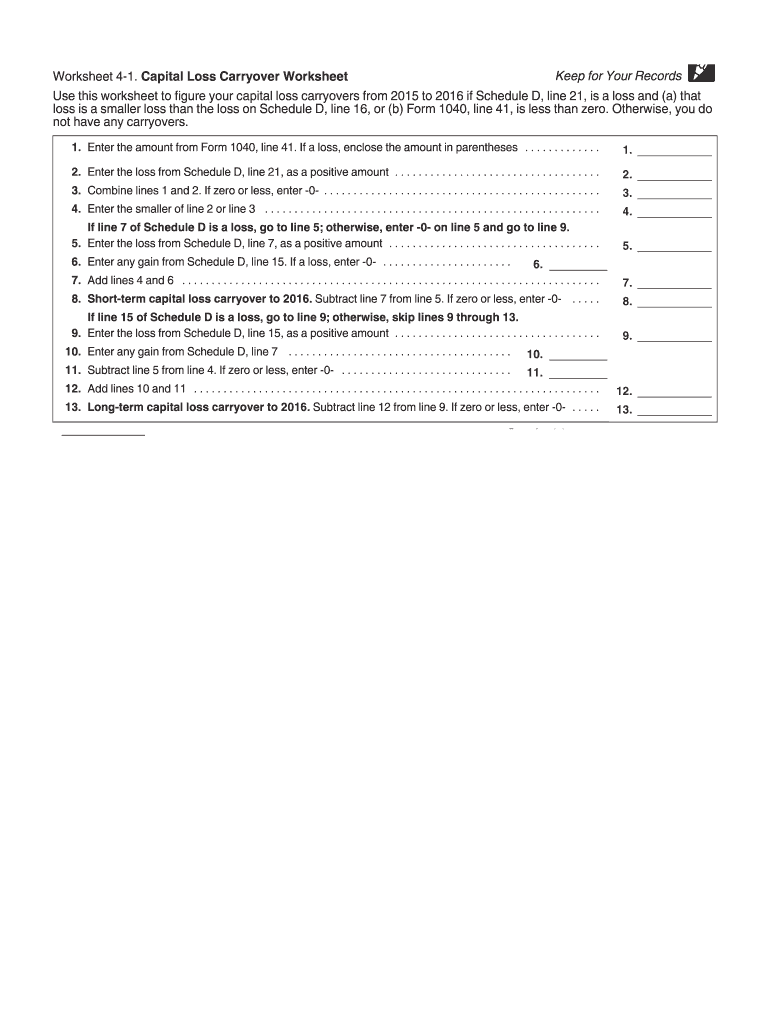

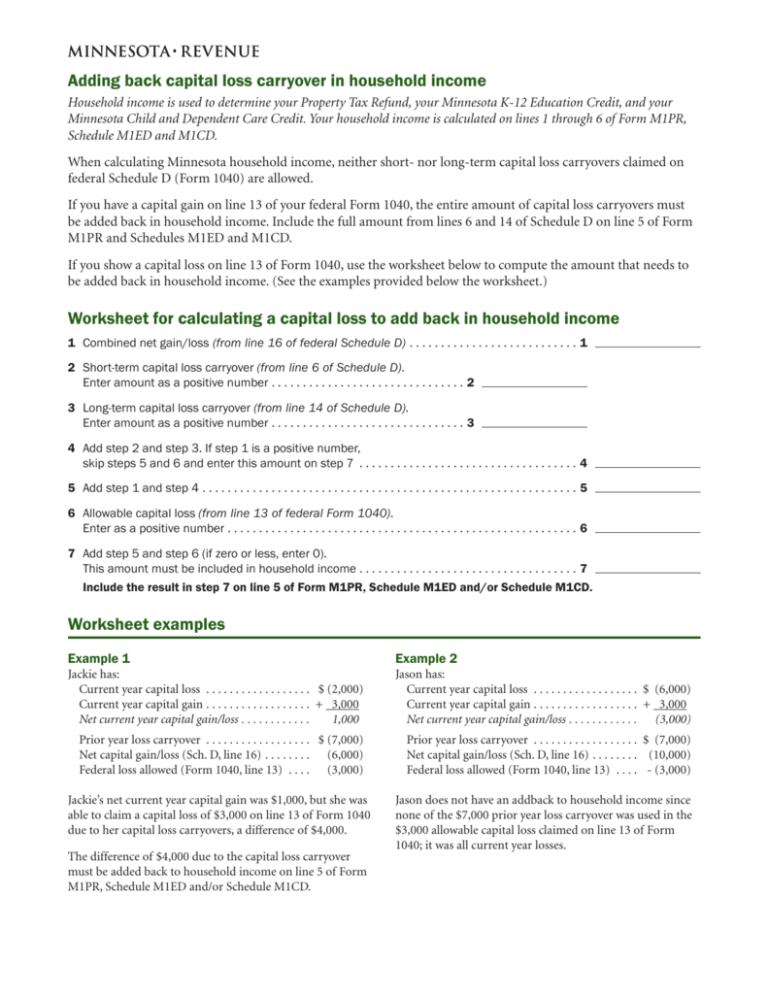

Turbotax Carryover Worksheet - They are independent of one another, so you could have one, two, or three. Turbotax fills out the section 179 worksheet for you from your entries in this section. Web what is the federal carryover worksheet in turbotax? Web sign in to your turbotax account and open your return by selecting continue or pick up where you left off in the progress tracker ; Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. Web if you completed your 2020 ca state return in turbotax you can sign in to your account and print/download your 2020 return. Be sure to select all. How to carry an nol back or forward. Web you would not carry over your 2019 income to this worksheet. But using the form enables you to carry. They are independent of one another, so you could have one, two, or three. Where do i find my capital loss carryover amount in turbotax? Where do i find my passive loss carryover? In the search bar, search for capital. Web click on my turbotax (click on my tax timeline in the drop down menu) scroll down where is says. Your screen will display forms with. Enter the section 179 as a positive number on line a. When to use an nol. If not you may have. Web 2022 capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). Web sign in to your turbotax account and open your return by selecting continue or pick up where you left off in the progress tracker ; How to carry an nol back or forward. Web you would not carry over your 2019 income to this worksheet. Web if you completed your 2020 ca state return in turbotax you can sign. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. Read through and see if you entered correctly. Web sign in to your turbotax account and open your return by selecting continue or pick up where you left off in the progress. Web if you completed your 2020 ca state return in turbotax you can sign in to your account and print/download your 2020 return. Entering section 179 carryover from a schedule f:. If not you may have. Does turbotax automatically carry losses forward? Web sign in to your turbotax account and open your return by selecting continue or pick up where. Web you would not carry over your 2019 income to this worksheet. To update/correct the unused net capital losses amount (per your latest notice of assessment (s)) from what was carried forward by turbo tax from the. Your screen will display forms with. Does turbotax automatically carry losses forward? Entering section 179 carryover from a schedule f:. Where do i find my capital loss carryover amount in turbotax? Web what is the federal carryover worksheet in turbotax? In the search bar, search for capital. Web capital loss carryover worksheet. Does turbotax automatically carry losses forward? This article answers the question on the carry forward and 2020 amounts. Your screen will display forms with. Web where do i find my federal carryover worksheet when you are in turbo tax, look at the top left for forms icon and click it. Web if you completed your 2020 ca state return in turbotax you can sign in to. Read through and see if you entered correctly. This article answers the question on the carry forward and 2020 amounts. Web 2022 capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). How to carry an nol back or forward. Web sign in to your turbotax account and open your return by selecting continue or. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Where do i find my passive loss carryover? Enter the section 179 as a positive number on line a. Web if you completed. Web capital loss carryover worksheet. Web you would not carry over your 2019 income to this worksheet. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. If not you may have. Web if you completed your 2020 ca state return in turbotax you can sign in to your account and print/download your 2020 return. How to claim an nol deduction. Turbotax fills it out for you based on your 2019 return. Entering section 179 carryover from a schedule f:. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9,. Web where do i find my federal carryover worksheet when you are in turbo tax, look at the top left for forms icon and click it. Your screen will display forms with. It is usually for business losses you could not. Web scroll down to the carryovers to 2022 smart worksheet. When to use an nol. Web sign in to your turbotax account and open your return by selecting continue or pick up where you left off in the progress tracker ; In the search bar, search for capital. Be sure to select all. To update/correct the unused net capital losses amount (per your latest notice of assessment (s)) from what was carried forward by turbo tax from the. Web click on my turbotax (click on my tax timeline in the drop down menu) scroll down where is says prior year return(s) click on load my tax timeline. To update/correct the unused net capital losses amount (per your latest notice of assessment (s)) from what was carried forward by turbo tax from the. This article answers the question on the carry forward and 2020 amounts. Turbotax fills out the section 179 worksheet for you from your entries in this section. Use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. But using the form enables you to carry. They are independent of one another, so you could have one, two, or three. Web single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing form 1116. Your screen will display forms with. Entering section 179 carryover from a schedule f:. Web where do i find my federal carryover worksheet when you are in turbo tax, look at the top left for forms icon and click it. It is usually for business losses you could not. Web 2022 capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. If not you may have. Does turbotax automatically carry losses forward? If you had a 179 carryover from 2018, click this link.Carryover Worksheet Turbotax

Carryover Worksheet Turbotax

What Is A Federal Carryover Worksheet

Carryover Worksheet Turbotax

Federal Carryover Worksheet Studying Worksheets

Carryover Worksheet Turbotax

turbotax nol carryback Fill Online, Printable, Fillable Blank form

Carryover Worksheet Turbotax

Carryover Worksheet Turbotax

Carryover Worksheet Turbotax

Web Scroll Down To The Carryovers To 2022 Smart Worksheet.

Where Do I Find My Capital Loss Carryover Amount In Turbotax?

Web If You Completed Your 2020 Ca State Return In Turbotax You Can Sign In To Your Account And Print/Download Your 2020 Return.

Web Click On My Turbotax (Click On My Tax Timeline In The Drop Down Menu) Scroll Down Where Is Says Prior Year Return(S) Click On Load My Tax Timeline.

Related Post: