Vehicle Expenses Worksheet

Vehicle Expenses Worksheet - Mileage number of business miles for the year: If yes provide sales invoice. You should use this worksheet if you're claiming actual expenses or the standard mileage rate. Number of total miles for the year: Web description of vehicle * date placed in service* total business miles* total commuting miles* other miles* total miles for the period* purchased or leased vehicle information total purchase price (all fees and charges necessary to obtain vehicle) date interest rate actual expenses gasoline repairs, oil changes car wash, misc car expense. File a separate form 4562 for each business or activity on your return for which form 4562 is required. If your organization owns a few vehicles. Web please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Is the vehicle leased (not owned at the end of the monthly payments)? Web for entering vehicle expenses in an individual return, intuit proseries has a car and truck expense worksheet. There are two versions of this worksheet; Web the dashboard in the myvehicles expense log allows you to see important information about the vehicle of your choosing without having to dig through your recorded data. Web for entering vehicle expenses in an individual return, intuit proseries has a car and truck expense worksheet. A) gasoline, oil, repairs, insurance, etc…………… b). Web description of vehicle * date placed in service* total business miles* total commuting miles* other miles* total miles for the period* purchased or leased vehicle information total purchase price (all fees and charges necessary to obtain vehicle) date interest rate actual expenses gasoline repairs, oil changes car wash, misc car expense. This dashboard is completely dynamic! Web your employer. You should use this worksheet if you're claiming actual expenses or the standard mileage rate. There are two versions of this worksheet; Did you acquire / purchase the vehicle this year? If you feel like safely and securely submitting this information via our website, please use this redirect link‐ Web the dashboard in the myvehicles expense log allows you to. Did you acquire / purchase the vehicle this year? Web your employer reimbursed you for vehicle expenses at the standard mileage rate or according to a flat rate or stated schedule, and you verified the date of each trip, mileage, and business purpose of the vehicle use. If yes provide sales invoice. A non‐fillable pdf (what you are viewing now). Is there evidence to support the business use claimed? Web the dashboard in the myvehicles expense log allows you to see important information about the vehicle of your choosing without having to dig through your recorded data. Web vehicle expense spreadsheet excel template (free) looking for an excel vehicle expense spreadsheet template? A) gasoline, oil, repairs, insurance, etc…………… b) vehicle. There are two versions of this worksheet; Web please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. A) gasoline, oil, repairs, insurance, etc…………… b) vehicle registration, license (excluding property taxes)………………………………… c) vehicle lease or rental. Web description of vehicle * date placed in service* total business miles* total commuting miles*. Is the vehicle leased (not owned at the end of the monthly payments)? If your organization owns a few vehicles. If you feel like safely and securely submitting this information via our website, please use this redirect link‐ Web the dashboard in the myvehicles expense log allows you to see important information about the vehicle of your choosing without having. Is there evidence to support the business use claimed? Is the vehicle leased (not owned at the end of the monthly payments)? Web vehicle expense spreadsheet excel template (free) looking for an excel vehicle expense spreadsheet template? Web the dashboard in the myvehicles expense log allows you to see important information about the vehicle of your choosing without having to. This dashboard is completely dynamic! Web please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. File a separate form 4562 for each business or activity on your return for which form 4562 is required. Number of total miles for the year: Web for entering vehicle expenses in an individual return,. A non‐fillable pdf (what you are viewing now) and an online digital form. Web the dashboard in the myvehicles expense log allows you to see important information about the vehicle of your choosing without having to dig through your recorded data. Web your employer reimbursed you for vehicle expenses at the standard mileage rate or according to a flat rate. Is the vehicle leased (not owned at the end of the monthly payments)? That means no matter how many vehicles you have (even you jay leno!), the dashboard will be able to adapt and give you access to your data. Is there evidence to support the business use claimed? A) gasoline, oil, repairs, insurance, etc…………… b) vehicle registration, license (excluding property taxes)………………………………… c) vehicle lease or rental. This dashboard is completely dynamic! If your organization owns a few vehicles. If yes provide sales invoice. Did you acquire / purchase the vehicle this year? A non‐fillable pdf (what you are viewing now) and an online digital form. You should use this worksheet if you're claiming actual expenses or the standard mileage rate. Mileage number of business miles for the year: File a separate form 4562 for each business or activity on your return for which form 4562 is required. Web vehicle expense spreadsheet excel template (free) looking for an excel vehicle expense spreadsheet template? There are two versions of this worksheet; Number of total miles for the year: Web for entering vehicle expenses in an individual return, intuit proseries has a car and truck expense worksheet. If you feel like safely and securely submitting this information via our website, please use this redirect link‐ Web description of vehicle * date placed in service* total business miles* total commuting miles* other miles* total miles for the period* purchased or leased vehicle information total purchase price (all fees and charges necessary to obtain vehicle) date interest rate actual expenses gasoline repairs, oil changes car wash, misc car expense. Web the dashboard in the myvehicles expense log allows you to see important information about the vehicle of your choosing without having to dig through your recorded data. Web your employer reimbursed you for vehicle expenses at the standard mileage rate or according to a flat rate or stated schedule, and you verified the date of each trip, mileage, and business purpose of the vehicle use. Web for entering vehicle expenses in an individual return, intuit proseries has a car and truck expense worksheet. If your organization owns a few vehicles. Is there evidence to support the business use claimed? A non‐fillable pdf (what you are viewing now) and an online digital form. Is the vehicle leased (not owned at the end of the monthly payments)? A) gasoline, oil, repairs, insurance, etc…………… b) vehicle registration, license (excluding property taxes)………………………………… c) vehicle lease or rental. That means no matter how many vehicles you have (even you jay leno!), the dashboard will be able to adapt and give you access to your data. Did you acquire / purchase the vehicle this year? Web the dashboard in the myvehicles expense log allows you to see important information about the vehicle of your choosing without having to dig through your recorded data. You should use this worksheet if you're claiming actual expenses or the standard mileage rate. Web please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. This dashboard is completely dynamic! Number of total miles for the year: If you feel like safely and securely submitting this information via our website, please use this redirect link‐ Mileage number of business miles for the year: Web your employer reimbursed you for vehicle expenses at the standard mileage rate or according to a flat rate or stated schedule, and you verified the date of each trip, mileage, and business purpose of the vehicle use.20++ Car And Truck Expenses Worksheet

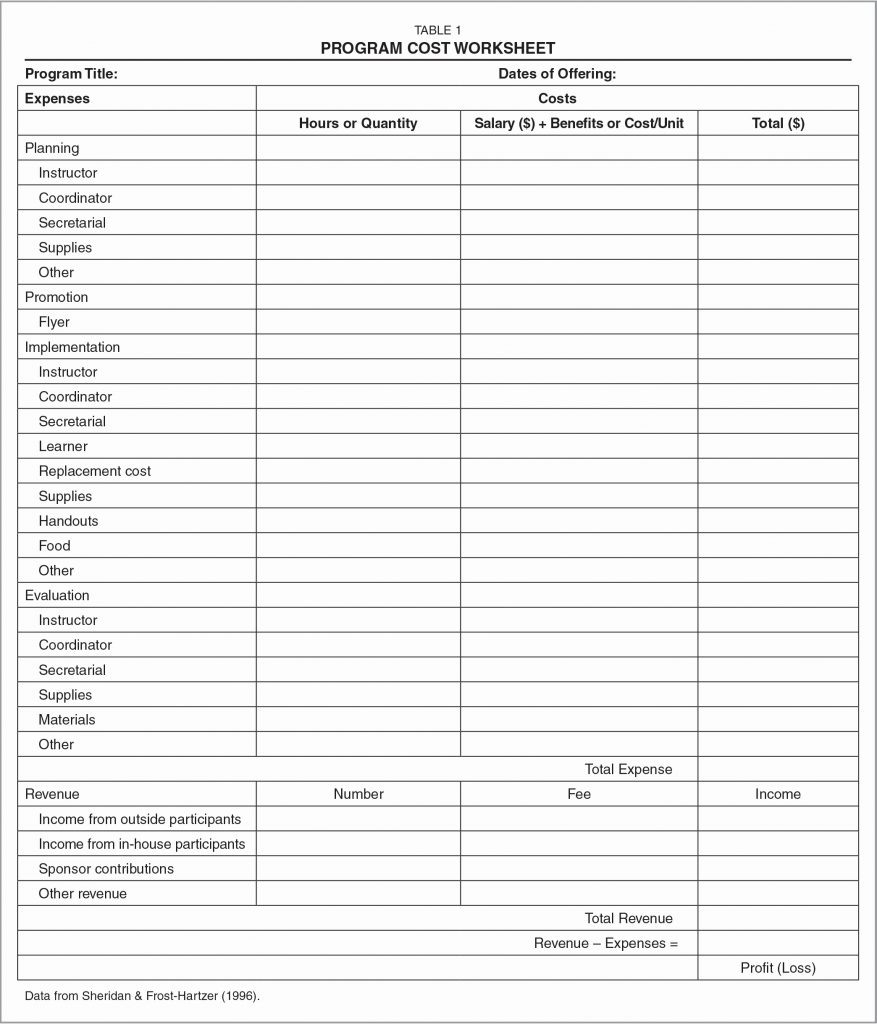

Car And Truck Expenses Worksheet —

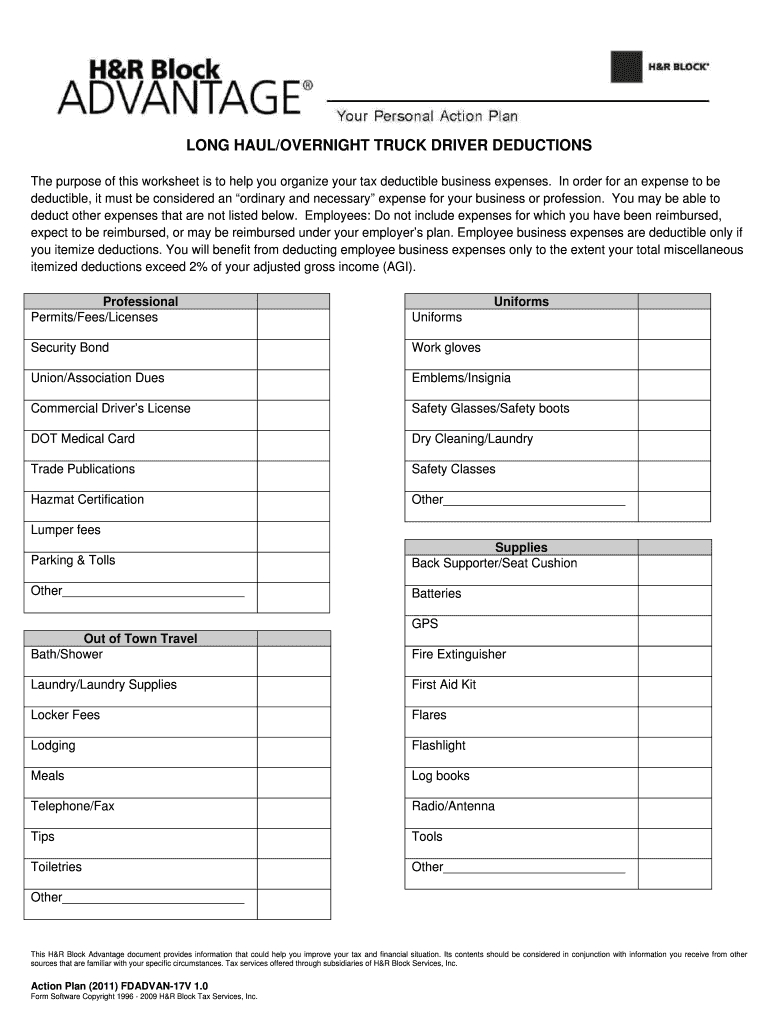

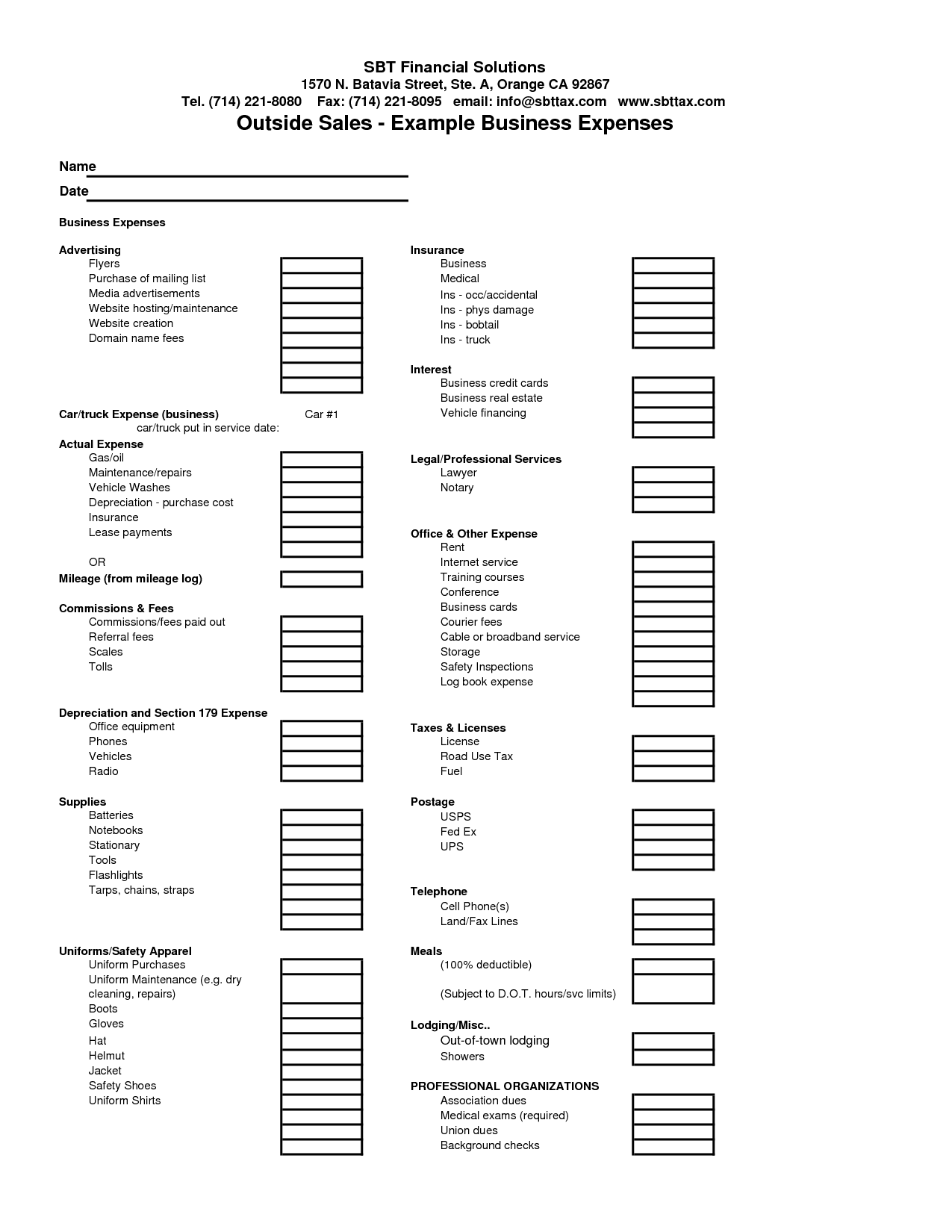

Truck Driver Expenses Worksheet —

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

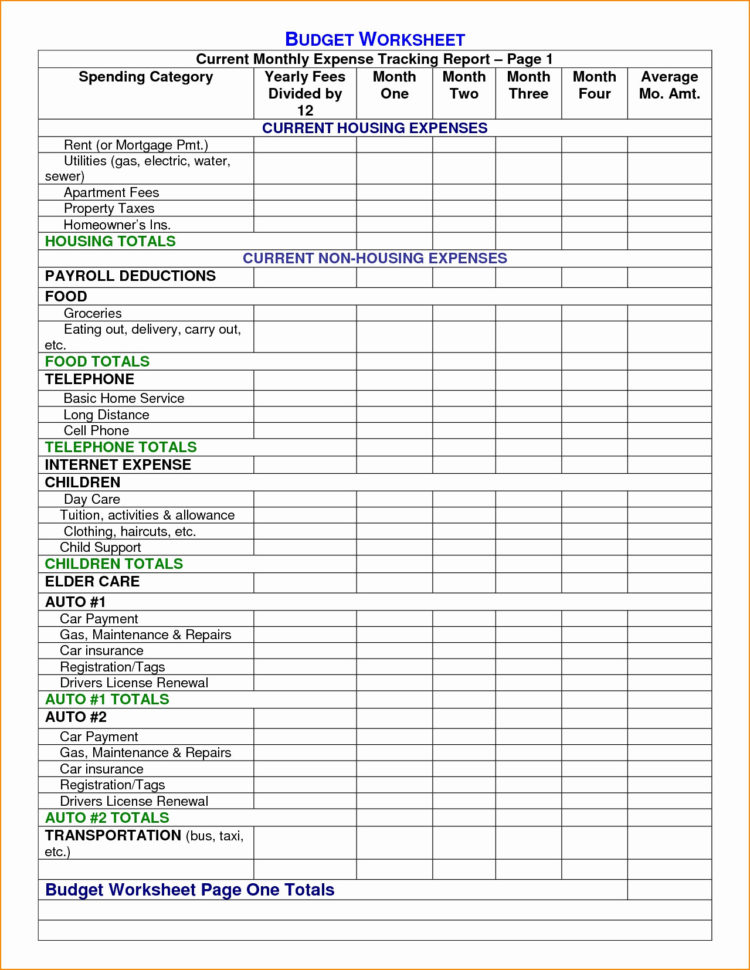

Schedule C Expenses Worksheet —

12 Vehicle Sales Worksheet /

Irs Vehicle Expense Worksheet Fill Out and Sign Printable PDF

Schedule C Car And Truck Expenses Worksheet Awesome Driver —

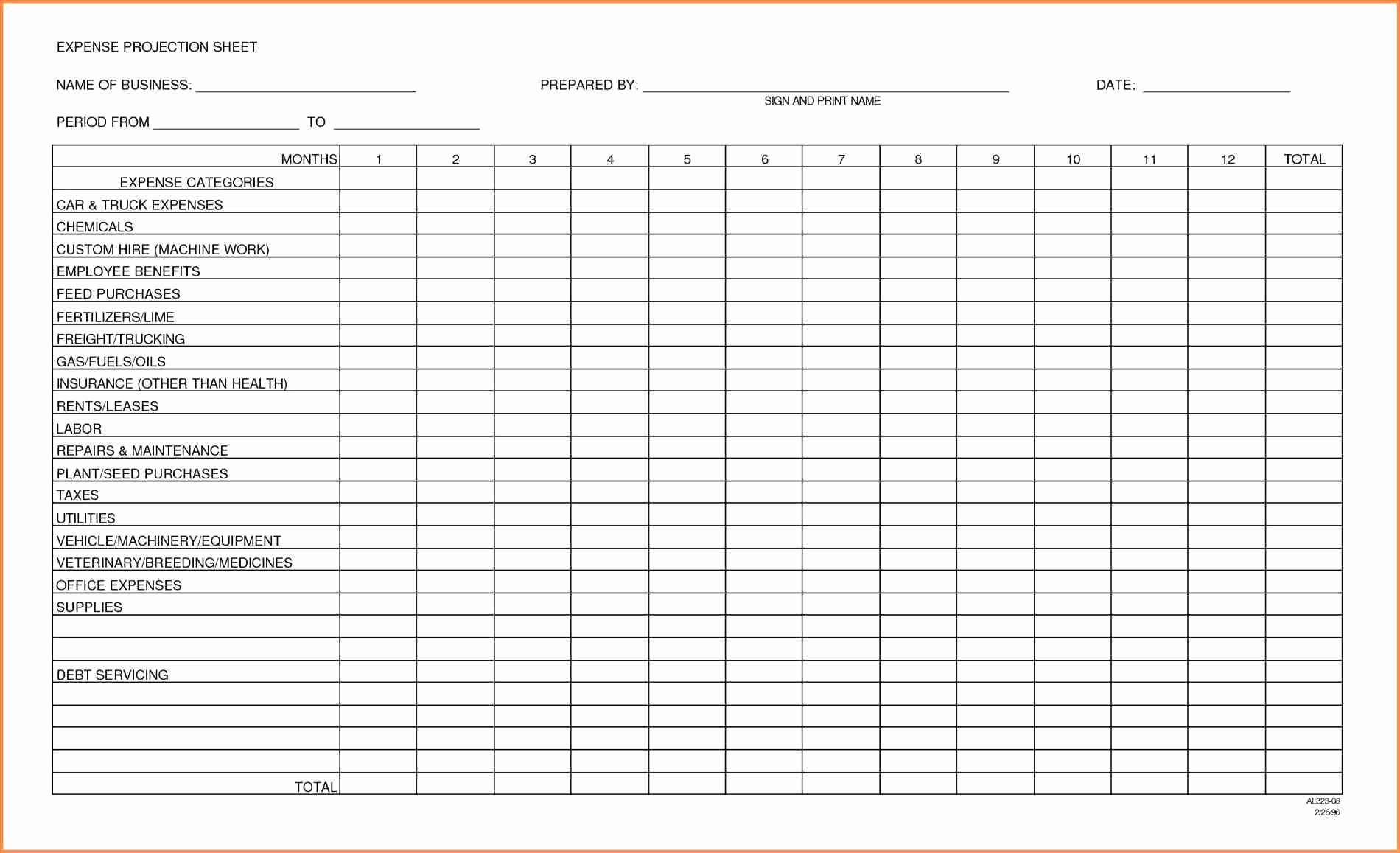

Truck Expenses Worksheet Spreadsheet template, Printable worksheets

13 Free Sample Auto Expense Report Templates Printable Samples

Web Vehicle Expense Spreadsheet Excel Template (Free) Looking For An Excel Vehicle Expense Spreadsheet Template?

Web Description Of Vehicle * Date Placed In Service* Total Business Miles* Total Commuting Miles* Other Miles* Total Miles For The Period* Purchased Or Leased Vehicle Information Total Purchase Price (All Fees And Charges Necessary To Obtain Vehicle) Date Interest Rate Actual Expenses Gasoline Repairs, Oil Changes Car Wash, Misc Car Expense.

There Are Two Versions Of This Worksheet;

File A Separate Form 4562 For Each Business Or Activity On Your Return For Which Form 4562 Is Required.

Related Post: