W2 Reconciliation Worksheet

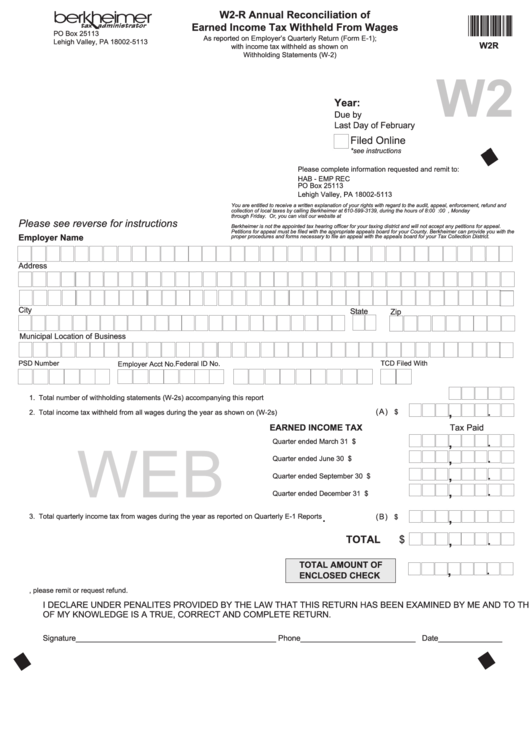

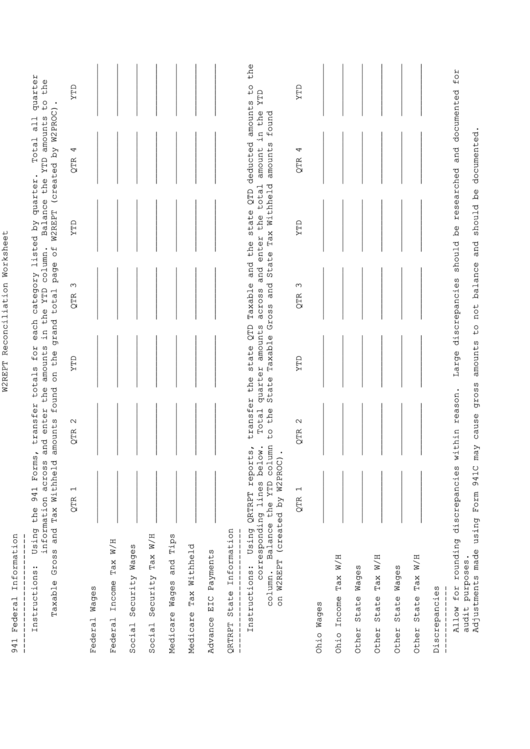

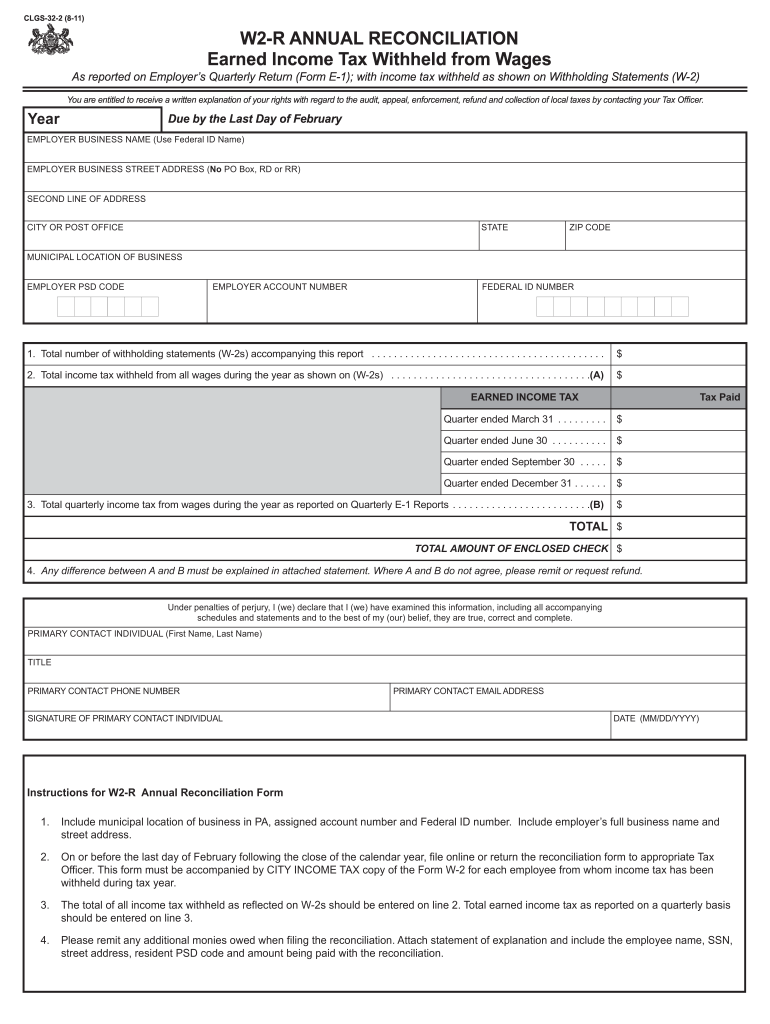

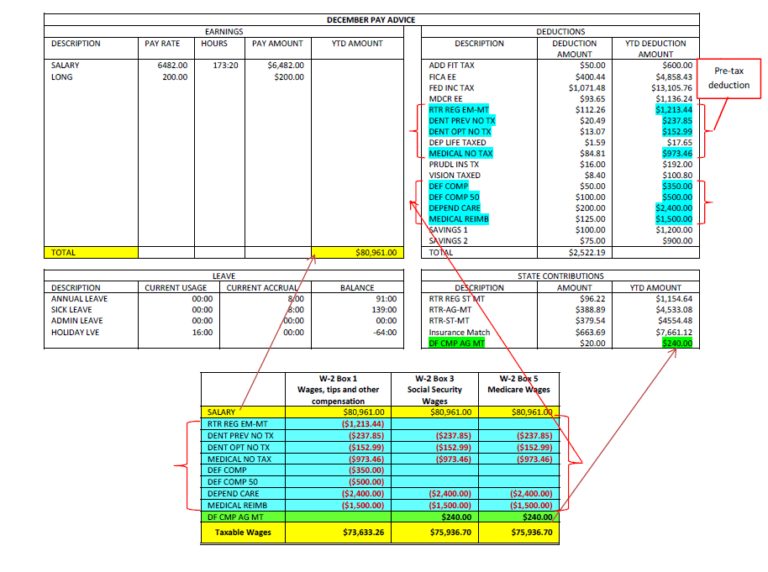

W2 Reconciliation Worksheet - Automatically track all your income and expenses. Web details of this report. Compare the data on the. A software that handles complex matching, exceptions management and account certification. Get a free guided quickbooks® setup. Select the get form button to begin enhancing. Using the 941 forms, transfer totals for each category. Switch on the wizard mode in the top toolbar to get additional. Using the 941 forms, transfer totals for each category listed by quarter. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Using the 941 forms, transfer totals for each category listed by quarter. Switch on the wizard mode in the top toolbar to get additional. The register should show wages and deductions for each employee during that quarter. Compare the data on the. Edit, sign and save reconciliation worksheet form. Attach statement of explanation showing a breakdown of the specific detail for each employee withholding adjustment. Select the get form button to begin enhancing. Automatically track all your income and expenses. Compare the data on the. Using the 941 forms, transfer totals for each category. Web details of this report. Using the 941 forms, transfer totals for each category. Web w2 report reconciliation worksheet (w2rept/classic or w2 report/redesign) 941 federal information instructions: Select the get form button to begin enhancing. The register should show wages and deductions for each employee during that quarter. Select the get form button to begin enhancing. Using the 941 forms, transfer totals for each category listed by quarter. Web how to fill out and sign pa w 2 reconciliation worksheet online? Get a free guided quickbooks® setup. Web remit any balance due when filing the reconciliation. Using the 941 forms, transfer totals for each category. Ad manage all your business expenses in one place with quickbooks®. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Web details of this report. Web w2 report reconciliation worksheet. Web w2 report reconciliation worksheet (w2rept/classic or w2 report/redesign) 941 federal information instructions: Web details of this report. A software that handles complex matching, exceptions management and account certification. Using the 941 forms, transfer totals for each category listed by quarter. Get a free guided quickbooks® setup. Attach statement of explanation showing a breakdown of the specific detail for each employee withholding adjustment. Ad drive efficiency & reduce risk. Using the 941 forms, transfer totals for each category. The register should show wages and deductions for each employee during that quarter. Download or email worksheet & more fillable forms, register and subscribe now! Edit, sign and save reconciliation worksheet form. Get a free guided quickbooks® setup. Ad manage all your business expenses in one place with quickbooks®. Using the 941 forms, transfer totals for each category listed by quarter. A software that handles complex matching, exceptions management and account certification. Get a free guided quickbooks® setup. Run a payroll register for the quarter. Web w2 report reconciliation worksheet (w2rept/classic or w2 report/redesign) 941 federal information instructions: Web details of this report. Compare the data on the. Ad drive efficiency & reduce risk. Using the 941 forms, transfer totals for each category listed by quarter. A software that handles complex matching, exceptions management and account certification. Attach statement of explanation showing a breakdown of the specific detail for each employee withholding adjustment. Select the get form button to begin enhancing. Ad manage all your business expenses in one place with quickbooks®. Web details of this report. Automatically track all your income and expenses. The following table explains where to find the report in the application object tree (aot) and how to navigate to the report in the microsoft. Run a payroll register for the quarter. Download or email worksheet & more fillable forms, register and subscribe now! Switch on the wizard mode in the top toolbar to get additional. Edit, sign and save reconciliation worksheet form. Using the 941 forms, transfer totals for each category listed by quarter. Web remit any balance due when filing the reconciliation. Using the 941 forms, transfer totals for each category. Web how to fill out and sign pa w 2 reconciliation worksheet online? The register should show wages and deductions for each employee during that quarter. Web w2 report reconciliation worksheet (w2rept/classic or w2 report/redesign) 941 federal information instructions: Compare the data on the. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Ad drive efficiency & reduce risk. Attach statement of explanation showing a breakdown of the specific detail for each employee withholding adjustment. Get a free guided quickbooks® setup. A software that handles complex matching, exceptions management and account certification. Ad drive efficiency & reduce risk. Using the 941 forms, transfer totals for each category listed by quarter. Automatically track all your income and expenses. The following table explains where to find the report in the application object tree (aot) and how to navigate to the report in the microsoft. Web how to fill out and sign pa w 2 reconciliation worksheet online? Download or email worksheet & more fillable forms, register and subscribe now! A software that handles complex matching, exceptions management and account certification. Compare the data on the. Edit, sign and save reconciliation worksheet form. Get a free guided quickbooks® setup. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Web w2 report reconciliation worksheet (w2rept/classic or w2 report/redesign) 941 federal information instructions: Switch on the wizard mode in the top toolbar to get additional. The register should show wages and deductions for each employee during that quarter. Run a payroll register for the quarter. Ad manage all your business expenses in one place with quickbooks®.Fillable Form W2R Annual Reconciliation Of Earned Tax

PA40 W2 RW Reconciliation Worksheet Free Download

W2rept Reconciliation Worksheet printable pdf download

W2 R Annual Reconciliation Form 2019 Fill Online, Printable, Fillable

W2 to Paystub Reconciliation Wyoming State Auditor's Office

Form W2R Download Fillable PDF or Fill Online Annual Reconciliation of

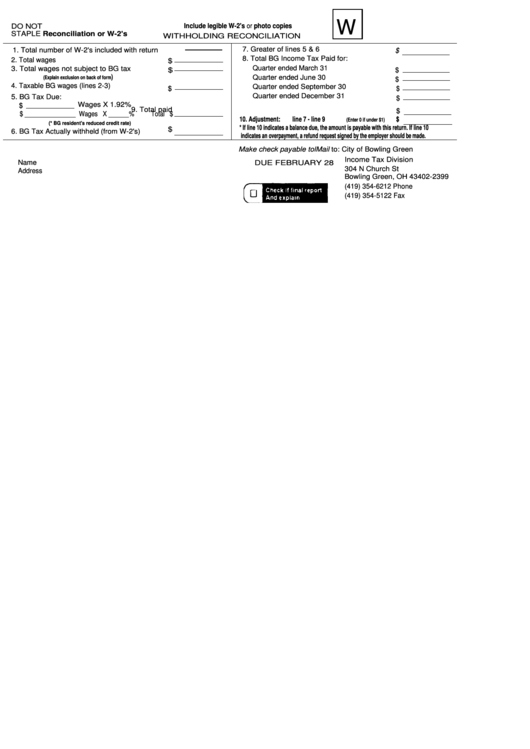

Form W2 Withholding Reconciliation printable pdf download

PA40 W2 RW Reconciliation Worksheet Free Download

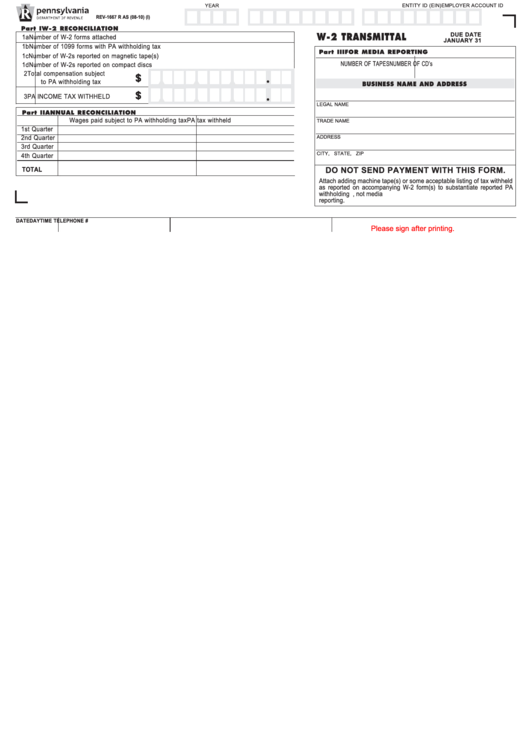

Fillable Form W2 Transmittal Reconciliation printable pdf download

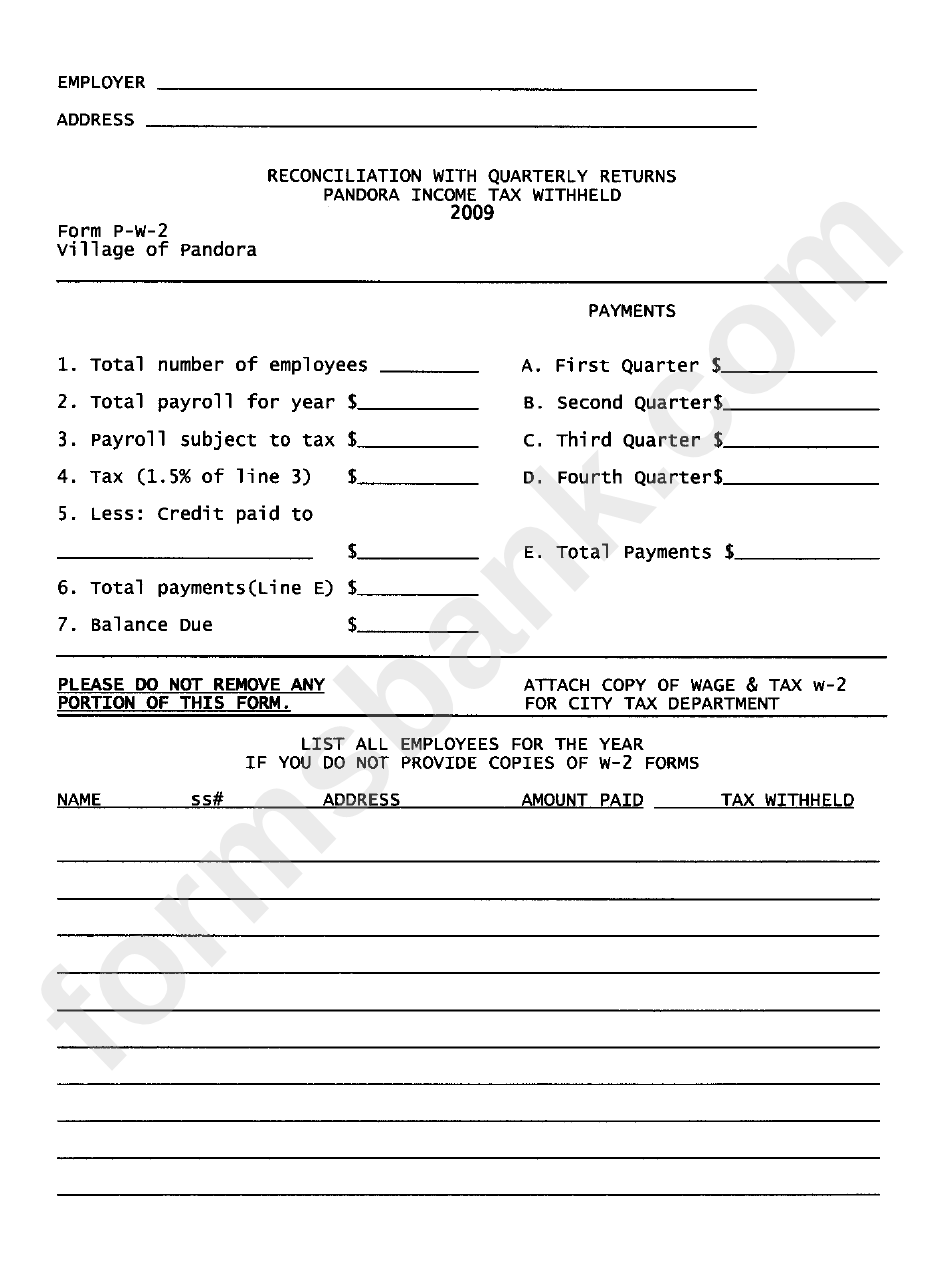

Form PW2 Reconciliation With Quartely Returns Pandore Tax

Select The Get Form Button To Begin Enhancing.

Web Details Of This Report.

Using The 941 Forms, Transfer Totals For Each Category.

Attach Statement Of Explanation Showing A Breakdown Of The Specific Detail For Each Employee Withholding Adjustment.

Related Post: