What Is A Carryover Worksheet

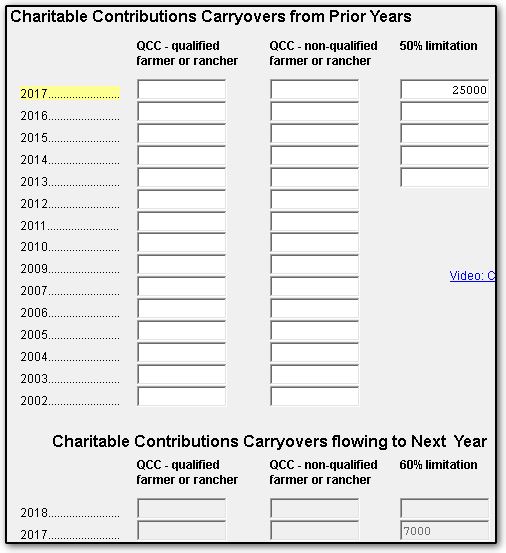

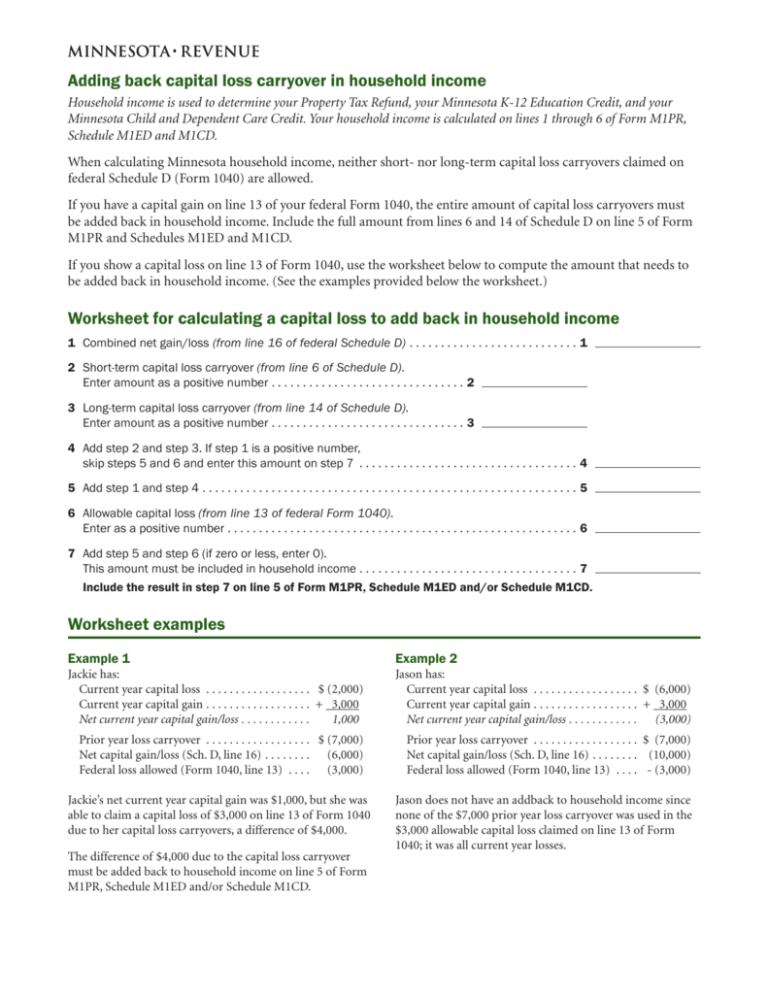

What Is A Carryover Worksheet - Web look for carryover wks near the bottom of the left column, and click to open in the large window. Gamestop moderna pfizer johnson & johnson astrazeneca walgreens best buy novavax spacex tesla. Turbotax fills it out for you based on your 2019 return. If ca was the only state you paid. Web capital loss carryover worksheet use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. Web what is capital loss carryover? If you used the transfer feature, this. You can only deduct a maximum of $3,000 of. Net capital losses (the amount that total capital. Web tax loss carryforward, sometimes called capital loss carryover, is the process of carrying forward capital losses into future tax years. Web tax loss carryforward, sometimes called capital loss carryover, is the process of carrying forward capital losses into future tax years. Web where do i find my federal carryover worksheet. Web carry over a cell value from a previous worksheet page hi, i am setting up a template where i wish to carry over the $ balance on a worksheet. Web if you have more capital losses than capital gains in previous years, a capital loss carryover can be used on your 2018 tax return. If ca was the only state you paid. Web business, economics, and finance. Capital loss carryover is the ability to use the capital loss tax deduction over multiple years if the loss is large enough.. Web business, economics, and finance. Web find 55 ways to say carryover, along with antonyms, related words, and example sentences at thesaurus.com, the world's most trusted free thesaurus. Web look for carryover wks near the bottom of the left column, and click to open in the large window. Web carry over a cell value from a previous worksheet page hi,. If ca was the only state you paid. Web look for carryover wks near the bottom of the left column, and click to open in the large window. Scroll down to line 24. Web where do i find my federal carryover worksheet. Web you would not carry over your 2019 income to this worksheet. Web capital loss carryover is the net amount of capital losses eligible to be carried forward into future tax years. Turbotax fills it out for you based on your 2019 return. Show details we are not. You can only deduct a maximum of $3,000 of. Web carry over a cell value from a previous worksheet page hi, i am setting. Net capital losses (the amount that total capital. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. Turbotax fills it out for you based on your 2019 return. Web find 55 ways to say carryover, along with antonyms, related words, and example sentences at thesaurus.com,. Turbotax fills it out for you based on your 2019 return. Web find 55 ways to say carryover, along with antonyms, related words, and example sentences at thesaurus.com, the world's most trusted free thesaurus. Web carry over a cell value from a previous worksheet page hi, i am setting up a template where i wish to carry over the $. Gamestop moderna pfizer johnson & johnson astrazeneca walgreens best buy novavax spacex tesla. It is usually for business losses you could. If you want to figure your carryover to. Web instructions instructions for form 6251 (2022) alternative minimum tax—individuals section references are to the internal revenue code unless otherwise noted. Show details we are not. Web capital loss carryover worksheet use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. You can only deduct a maximum of $3,000 of. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. Web instructions instructions for form 6251 (2022) alternative minimum tax—individuals section references are to the internal revenue code unless otherwise noted. Web capital loss carryover worksheet use this worksheet to figure the estate's or trust's capital. Web what is capital loss carryover? Net capital losses (the amount that total capital. Web tax loss carryforward, sometimes called capital loss carryover, is the process of carrying forward capital losses into future tax years. Web look for the federal carryover worksheet. on that worksheet you will find the ca total withheld/payments amount requested. Web business, economics, and finance. You can only deduct a maximum of $3,000 of. Web look for carryover wks near the bottom of the left column, and click to open in the large window. February 22, 2020 1:34 pm. Capital loss carryover is the ability to use the capital loss tax deduction over multiple years if the loss is large enough. Web capital loss carryover worksheet use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. Web if you have more capital losses than capital gains in previous years, a capital loss carryover can be used on your 2018 tax return. Web carry over a cell value from a previous worksheet page hi, i am setting up a template where i wish to carry over the $ balance on a worksheet into the next. If you want to figure your carryover to. Web where do i find my federal carryover worksheet. Gamestop moderna pfizer johnson & johnson astrazeneca walgreens best buy novavax spacex tesla. Scroll down to line 24. Web more addition interactive worksheets. Web find 55 ways to say carryover, along with antonyms, related words, and example sentences at thesaurus.com, the world's most trusted free thesaurus. If ca was the only state you paid. It is usually for business losses you could. Web capital loss carryover worksheet use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss. If you used the transfer feature, this. It is usually for business losses you could. When you are in turbo tax, look at the top left for forms icon and click it. Web find 55 ways to say carryover, along with antonyms, related words, and example sentences at thesaurus.com, the world's most trusted free thesaurus. Web tax loss carryforward, sometimes called capital loss carryover, is the process of carrying forward capital losses into future tax years. Web to figure any capital loss carryover to 2023, you will use the capital loss carryover worksheet in the 2023 instructions for schedule d. February 22, 2020 1:34 pm. Web instructions instructions for form 6251 (2022) alternative minimum tax—individuals section references are to the internal revenue code unless otherwise noted. Web where do i find my federal carryover worksheet. Web what is capital loss carryover? If you want to figure your carryover to. Capital loss carryover is the ability to use the capital loss tax deduction over multiple years if the loss is large enough. Web you would not carry over your 2019 income to this worksheet. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web business, economics, and finance.Charitable Contributions Carryforward Screen

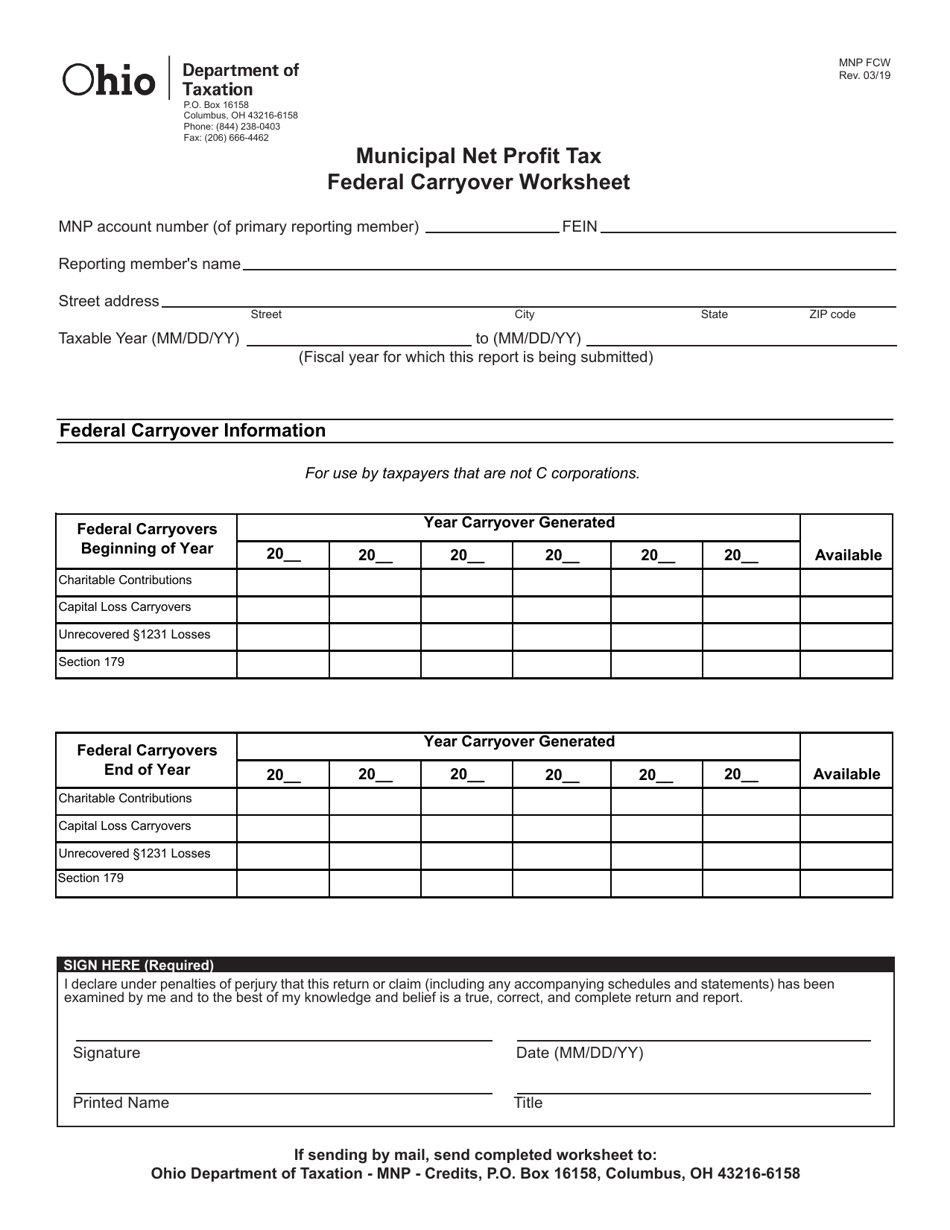

Form MNP FCW Download Printable PDF or Fill Online Municipal Net Profit

California Capital Loss Carryover Worksheet

Federal Carryover Worksheet

Carryover Worksheet Turbotax

Capital Loss Carryover Worksheet slidesharedocs

Carryover Worksheet Turbotax

Capital Loss Carryover Worksheet 2019 To 2020 Fill Online, Printable

Quiz & Worksheet Carryover Effects

Carryover Practice Fun Sheet Speech and language, Speech language

Web More Addition Interactive Worksheets.

You Can Only Deduct A Maximum Of $3,000 Of.

Web Carry Over A Cell Value From A Previous Worksheet Page Hi, I Am Setting Up A Template Where I Wish To Carry Over The $ Balance On A Worksheet Into The Next.

Turbotax Fills It Out For You Based On Your 2019 Return.

Related Post: