Worksheet Business Organizations Answer Key

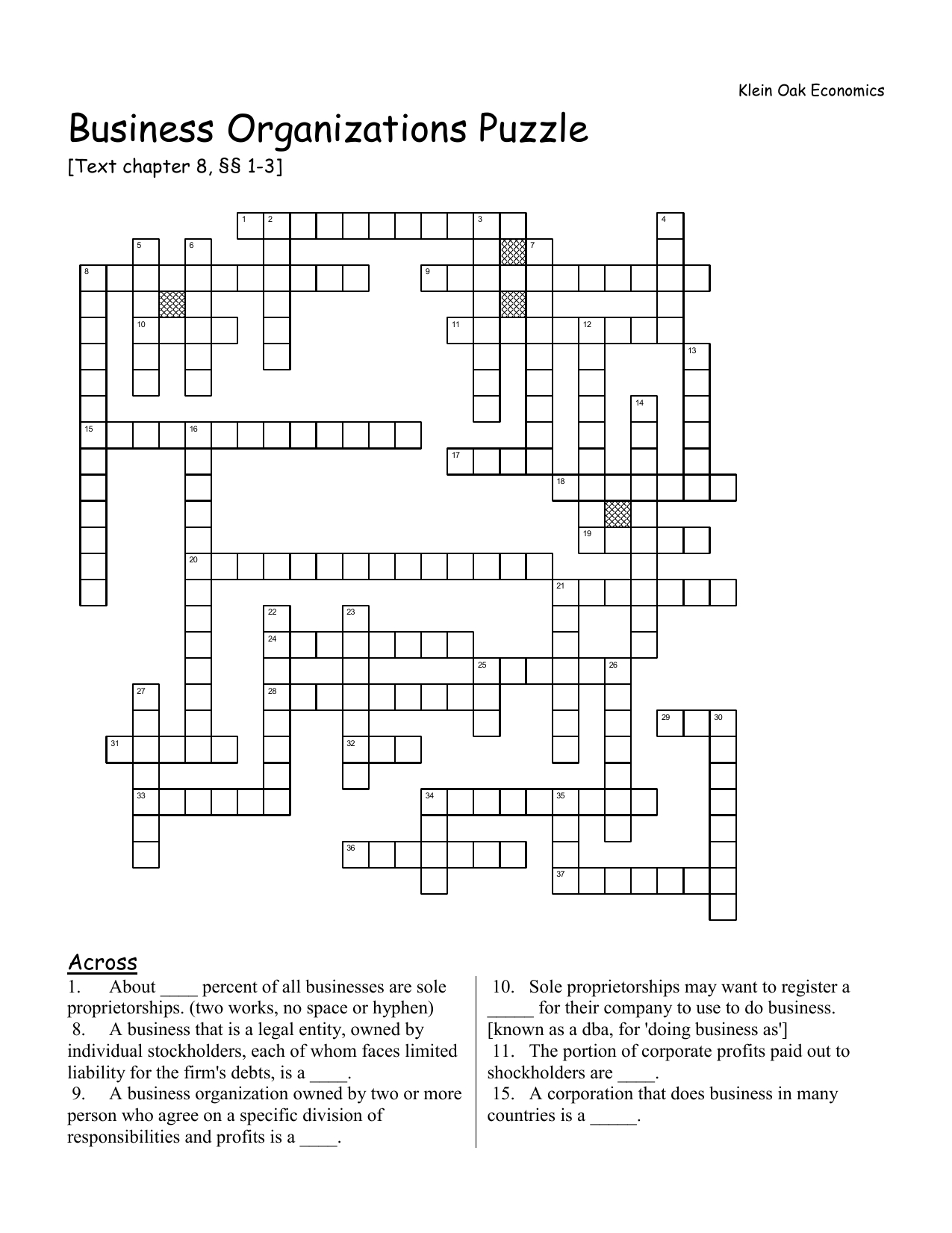

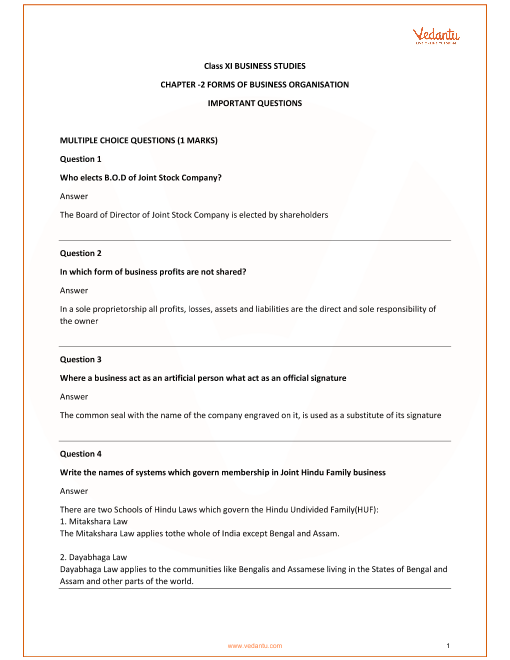

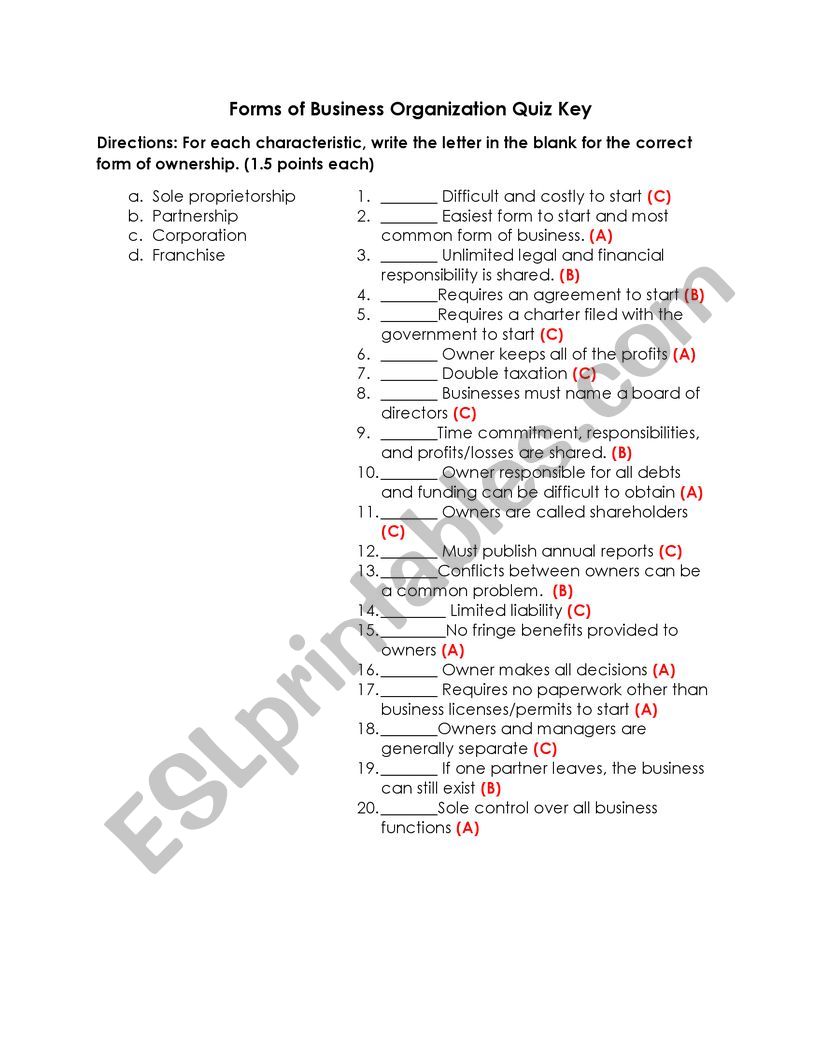

Worksheet Business Organizations Answer Key - Web this product provides an opportunity for your students to research and respond to various websites regarding the business organizations. Ask students if they see any omissions. A company that retains its corporate identity 71 2. Topics you'll need to know to pass the quiz include the. Web the crossword solver found 30 answers to business organization, 7 letters crossword clue. Authorization to start a business issued by the local government. Web showing 8 worksheets for types of business organizations. Includes space for notes on what each type of business organization is and the advantages and disadvantages of each. Owner is personality and fully responsible for all losses and debts of business. Following is a list of key factors that a new owner(s) needs to consider when deciding what type of business organization is best for his or her situation. Answer key is included!now updated for easy use with any online learning management system! This lesson has discussed the cost and benefits of three different types of business organizations: Enter the length or pattern for better results. Review the list of factors to consider when selecting a business organization. Web have your students read about the different types of business. The crossword solver finds answers to classic crosswords and cryptic crossword puzzles. One advantage of a __________. Of the producers in a market economy arebusinessorganizations, commercial or industrial enterprises and thework in them. Web showing 8 worksheets for types of business organizations. Click the answer to find similar crossword clues. To offer shares to raise money for expansion or motivational incentive for employees. Legal obligations general partners and sole proprietors because they are liable for all business debts if the business can't pay its liabilities. Web terms in this set (45) business organization. Business owned and operated by a single individual. Links to sites for the students to research and. A business owned and run by one person. Ask students if they see any omissions. A stock of finished goods and parts in reserve. Sole proprietor, partnership and corporation. Authorization to start a business issued by the local government. Worksheets are types of business organizations sole proprietorships, types of business organ. Web students can record notes about sole proprietorships, partnerships and corporations. You will be quizzed on corporations and sole proprietorship. A business owned by two or more people. The crossword solver finds answers to classic crosswords and cryptic crossword puzzles. Legal obligations general partners and sole proprietors because they are liable for all business debts if the business can't pay its liabilities. You will be quizzed on corporations and sole proprietorship. An establishment formed to carry on commercial enterprise. The crossword solver finds answers to classic crosswords and cryptic crossword puzzles. Add to my workbooks (11) download file pdf embed. # of letters or pattern. Click the answer to find similar crossword clues. This lesson has discussed the cost and benefits of three different types of business organizations: Web this quiz and worksheet can help you assess your knowledge of business organizations. Following is a list of key factors that a new owner(s) needs to consider when deciding what type. Web terms in this set (45) business organization. Enter the length or pattern for better results. A business owned and run by one person. Owner is personality and fully responsible for all losses and debts of business. Law in a city of town that designates separate areas for residency and for business. An establishment formed to carry on commercial enterprise. Worksheets are types of business organizations sole proprietorships, types of business organ. A company that retains its corporate identity 71 2. Included are the following resources: Web chapter 8 key concept. Web this quiz and corresponding worksheet gauge your understanding of the different types of business organizational structure and ownership. Of the producers in a market economy arebusinessorganizations, commercial or industrial enterprises and thework in them. A _______ _______ is a merger of. The legally bound obligation to pay debts. Worksheets are types of business organizations sole proprietorships, types of business. Business owner is fully responsibloe for all debts and losses. The crossword solver finds answers to classic crosswords and cryptic crossword puzzles. Review the list of factors to consider when selecting a business organization. Click the answer to find similar crossword clues. # of letters or pattern. This lesson has discussed the cost and benefits of three different types of business organizations: Web business organization interactive and downloadable worksheets. A _______ _______ is a merger of. Sole proprietor, partnership and corporation. One advantage of a __________. Ask students if they see any omissions. Web business organization worksheet instructions: Web this quiz and worksheet can help you assess your knowledge of business organizations. Legal obligations general partners and sole proprietors because they are liable for all business debts if the business can't pay its liabilities. The purpose of most business organizationsearn a profit. Read each scenario then decide which one of the three types of business organization (listed below) best fits each scenario. The legally bound obligation to pay debts. Enter the length or pattern for better results. Law in a city of town that designates separate areas for residency and for business. Web showing 8 worksheets for types of business organizations. Enter the length or pattern for better results. Enter the length or pattern for better results. You will be quizzed on the different types of business entities. Read each scenario then decide which one of the three types of business organization (listed below) best fits each scenario. Web showing 8 worksheets for types of business organizations. One advantage of a __________. Web students can record notes about sole proprietorships, partnerships and corporations. Authorization to start a business issued by the local government. Owner is personality and fully responsible for all losses and debts of business. Business owner is fully responsibloe for all debts and losses. Web business organization worksheet instructions: Included are the following resources: Types of busines organization by msmejia06: Of the producers in a market economy arebusinessorganizations, commercial or industrial enterprises and thework in them. Business owned and operated by a single individual. Terms in this set (32) sole proprietorship.️Business Organization Worksheet Answers Free Download Goodimg.co

Chapter 8 Business Organizations Worksheet Answers —

️Business Organization Worksheet Answers Free Download Goodimg.co

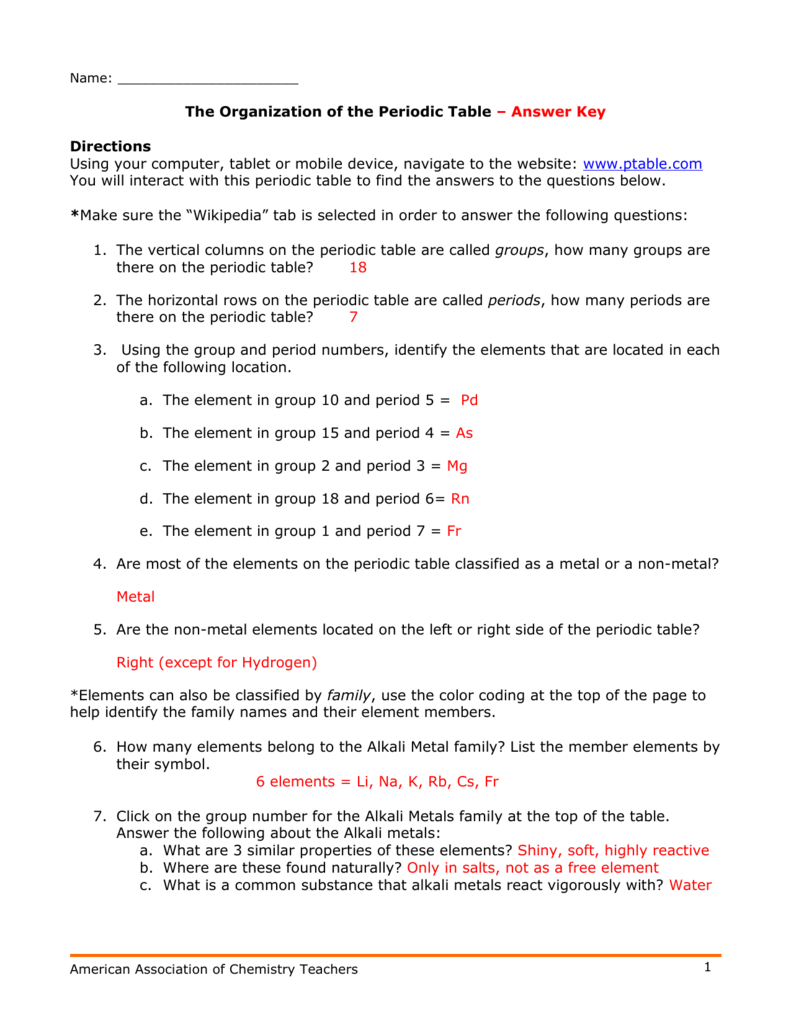

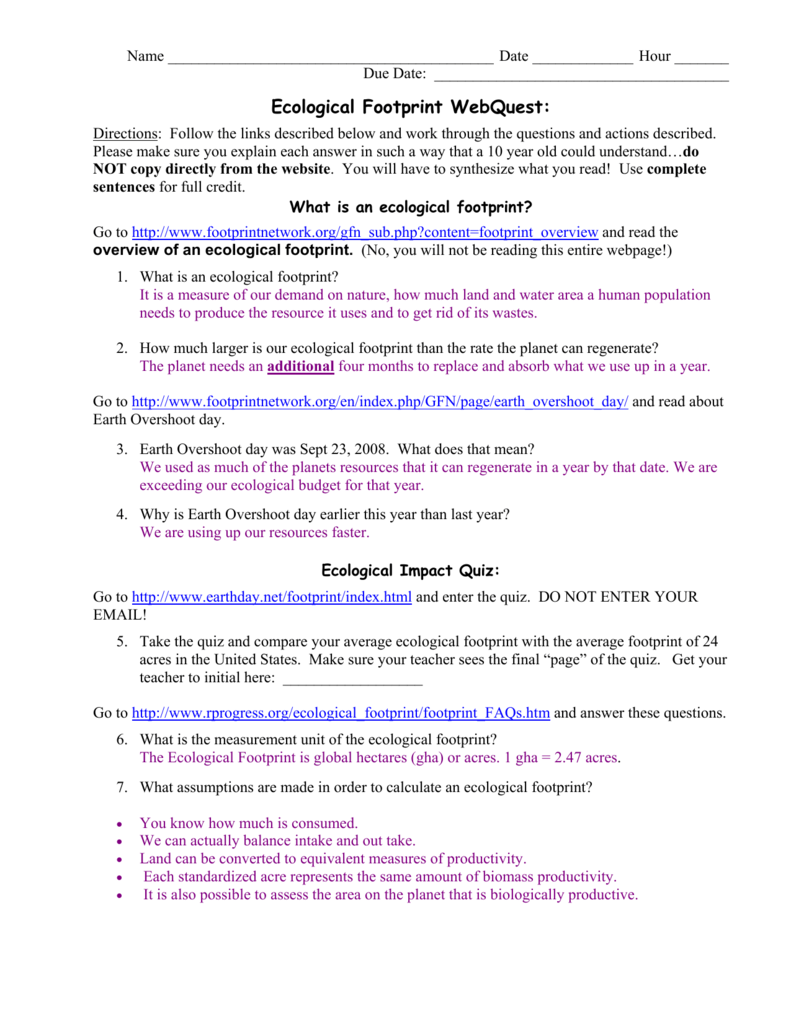

Periodic Table Webquest Worksheet Answers

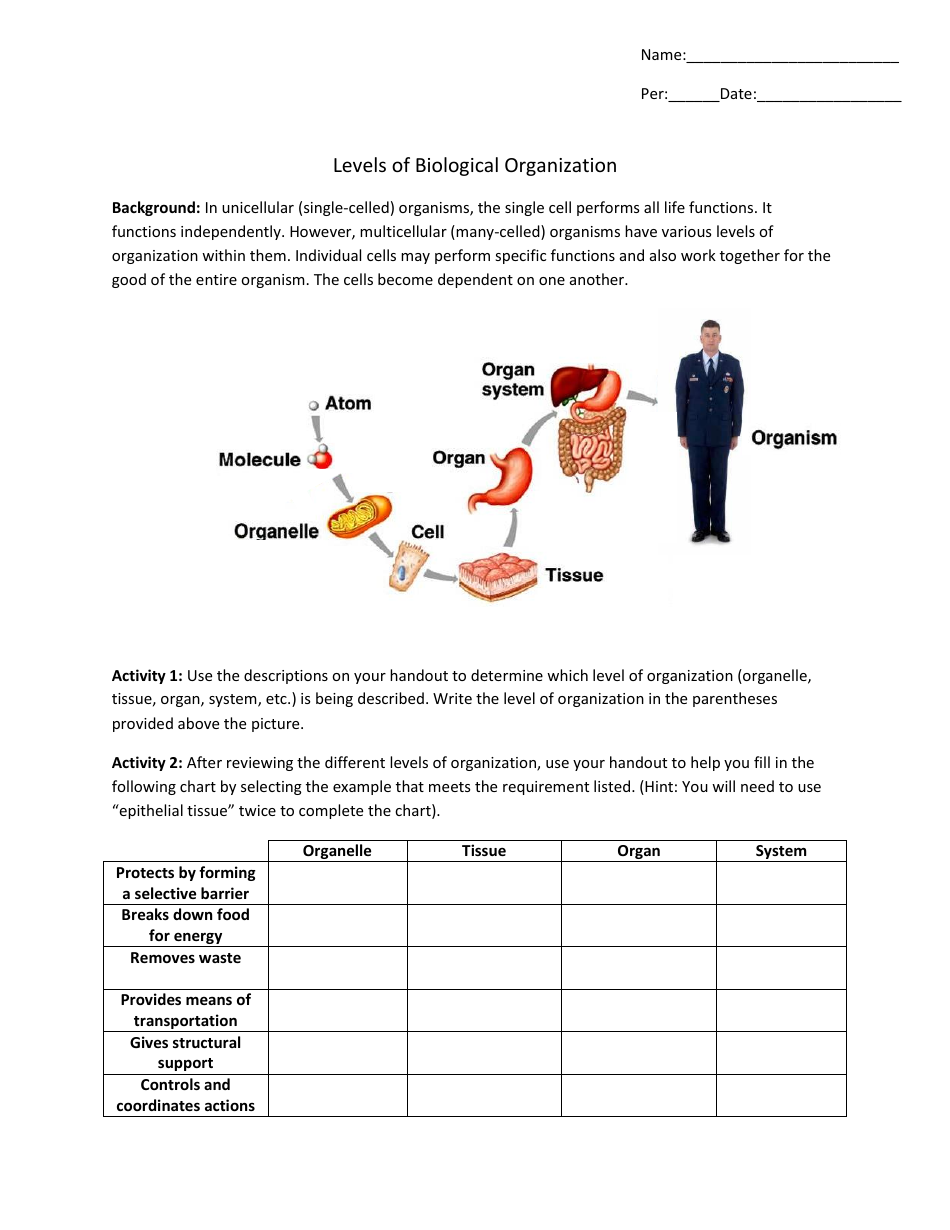

Level Of Organization Worksheet

Types Of Business Organizations Worksheet Answers slide share

Human Footprint Worksheet Answers

Types Of Business Organizations Worksheet Answers slide share

Levels Of Organization Worksheet Worksheets For Home Learning

Economic Vocabulary Activity Chapter 3 Business Organizations Worksheet

The Legally Bound Obligation To Pay Debts.

Law In A City Of Town That Designates Separate Areas For Residency And For Business.

A Business Owned And Run By One Person.

Web Business Organization Interactive And Downloadable Worksheets.

Related Post: