1099 R Simplified Method Worksheet

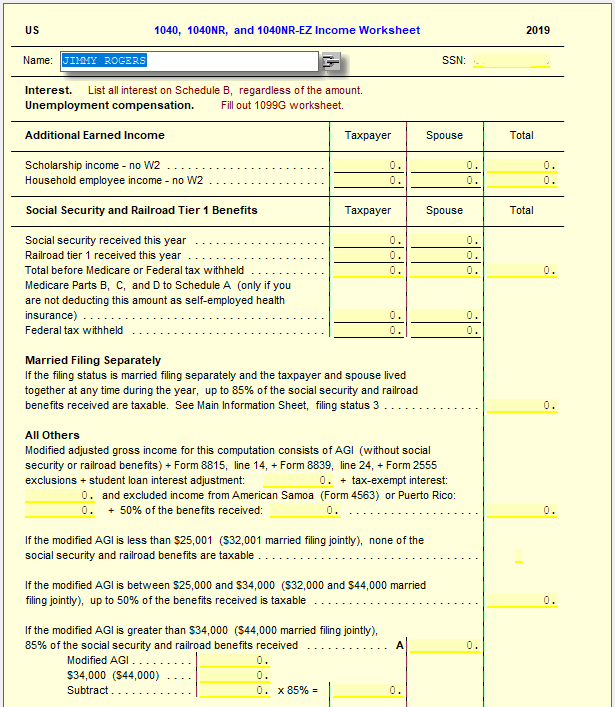

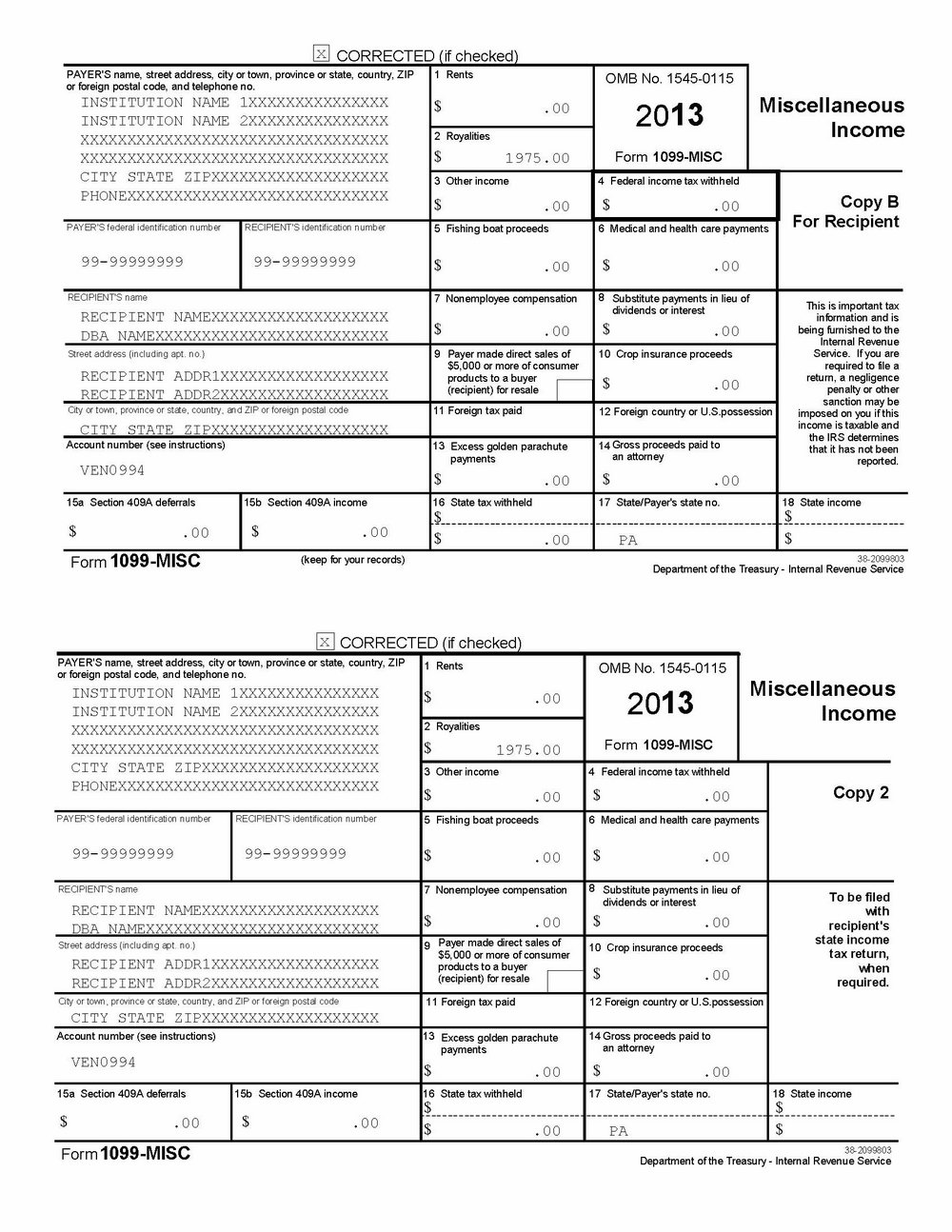

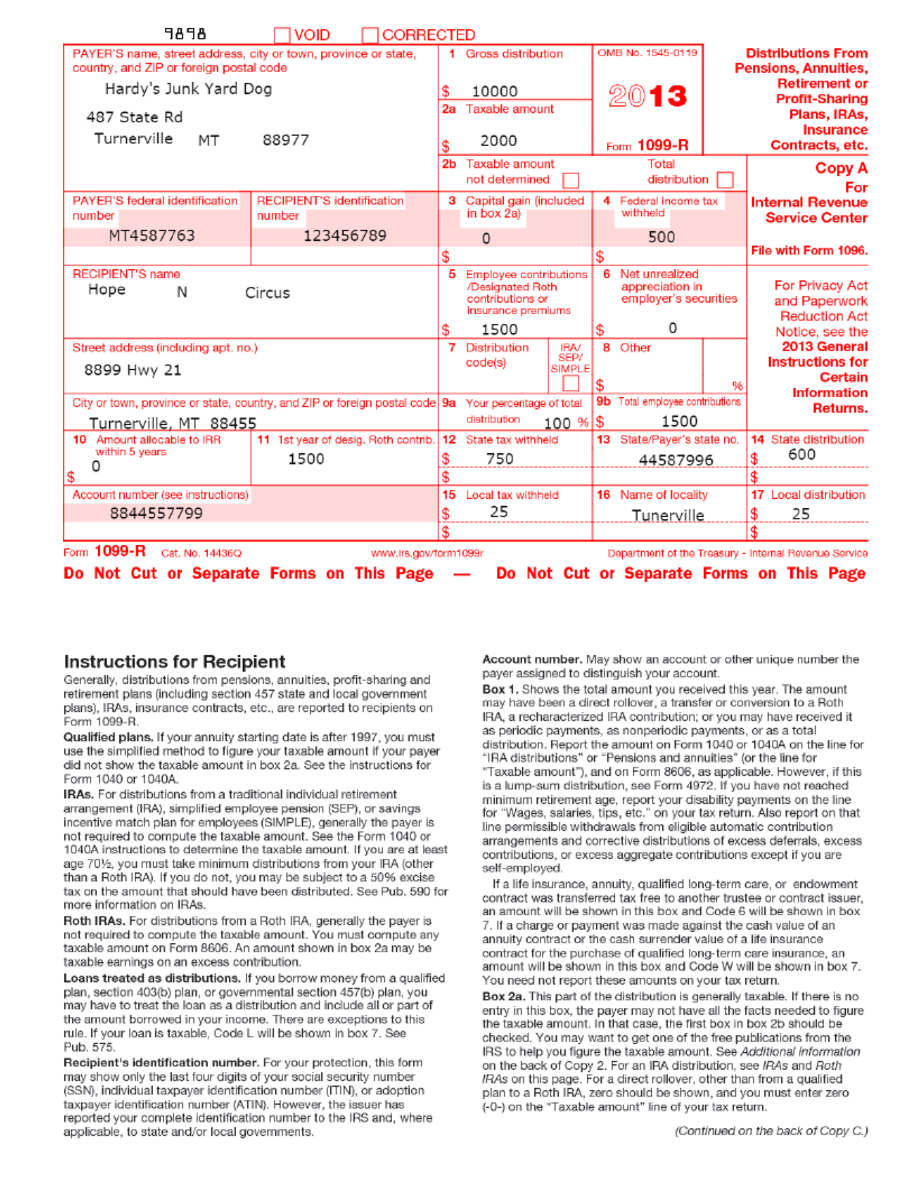

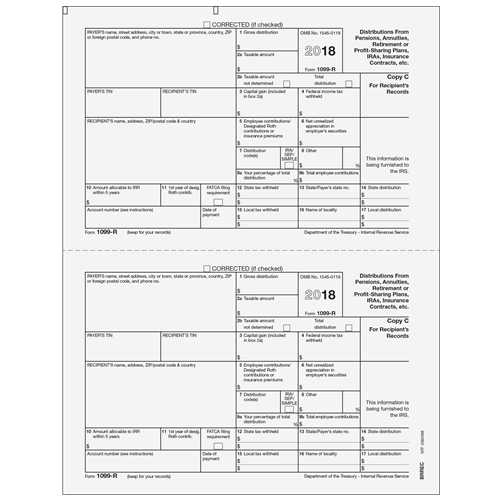

1099 R Simplified Method Worksheet - Simplified method worksheet line 3 wants 'plan cost at annuity starting date'. Use this publication if you receive pension or. Web method is the simplified method, which is discussed in pub. Web the simplified general rule worksheet. Who must use the general rule. Generally, for a joint and survivor annuity, use the combined ages to calculate the taxable amount for the. If your annuity starting date is after 1997, you must use the. The simplified method worksheet can be. Qualified plans and section 403(b) plans. It will show any tax you had withheld. If your annuity starting date is after 1997, you must use the. Simplified method worksheet line 3 wants 'plan cost at annuity starting date'. Web murphlag returning member entered 1099r. Generally, for a joint and survivor annuity, use the combined ages to calculate the taxable amount for the. Who must use the general rule. Click here to review form. Here is a link to the simplified method worksheet for pensions and annuities from the irs. Web if the taxable amount is not indicated, advanced certified volunteers must calculate the taxable portion using the simplified method worksheet. Web murphlag returning member entered 1099r. Who must use the general rule. Web if the taxable amount is not indicated, advanced certified volunteers must calculate the taxable portion using the simplified method worksheet. Click here to review form. Generally, for a joint and survivor annuity, use the combined ages to calculate the taxable amount for the. Web murphlag returning member entered 1099r. The simplified method worksheet can be. Web murphlag returning member entered 1099r. Simplified method worksheet line 3 wants 'plan cost at annuity starting date'. Who must use the general rule. Use this publication if you receive pension or. 575, pension and annuity income. Web the simplified general rule worksheet. It will show any tax you had withheld. What is it, where do i find? Web the simplified method worksheet in the taxact ® program shows the calculation of the taxable amount from entries made in the retirement income section. Web if the taxable amount is not indicated, advanced certified volunteers must calculate the. Web april 16, 2022 6:44 pm. Here is a link to the simplified method worksheet for pensions and annuities from the irs. Web taxable amount may have to be determined using simplified method. 575, pension and annuity income. Qualified plans and section 403(b) plans. Simplified method worksheet line 3 wants 'plan cost at annuity starting date'. It will show any tax you had withheld. The irs may impose an early withdrawal penalty to discourage taxpayers from using their. Use this publication if you receive pension or. Web murphlag returning member entered 1099r. Qualified plans and section 403(b) plans. Who must use the general rule. 575, pension and annuity income. Web murphlag returning member entered 1099r. If you are using turbotax cd/download this. Simplified method worksheet line 3 wants 'plan cost at annuity starting date'. If you are using turbotax cd/download this. Who must use the general rule. What is it, where do i find? Qualified plans and section 403(b) plans. The simplified method worksheet can be. Web the simplified method worksheet in the taxact ® program shows the calculation of the taxable amount from entries made in the retirement income section. The irs may impose an early withdrawal penalty to discourage taxpayers from using their. Simplified method worksheet line 3 wants 'plan cost at annuity starting date'. If you are. Use this publication if you receive pension or. Click here to review form. Simplified method worksheet line 3 wants 'plan cost at annuity starting date'. Generally, for a joint and survivor annuity, use the combined ages to calculate the taxable amount for the. What is it, where do i find? 575, pension and annuity income. Web april 16, 2022 6:44 pm. Who must use the general rule. If your annuity starting date is after 1997, you must use the. Web the simplified method worksheet in the taxact ® program shows the calculation of the taxable amount from entries made in the retirement income section. The simplified method worksheet can be. It will show any tax you had withheld. Web if the taxable amount is not indicated, advanced certified volunteers must calculate the taxable portion using the simplified method worksheet. Web the simplified general rule worksheet. Qualified plans and section 403(b) plans. The irs may impose an early withdrawal penalty to discourage taxpayers from using their. Here is a link to the simplified method worksheet for pensions and annuities from the irs. Web taxable amount may have to be determined using simplified method. If you are using turbotax cd/download this. Web method is the simplified method, which is discussed in pub. Web the simplified general rule worksheet. The simplified method worksheet can be. If you are using turbotax cd/download this. If your annuity starting date is after 1997, you must use the. Web method is the simplified method, which is discussed in pub. Use this publication if you receive pension or. It will show any tax you had withheld. Web murphlag returning member entered 1099r. Web the simplified method worksheet in the taxact ® program shows the calculation of the taxable amount from entries made in the retirement income section. What is it, where do i find? Web if the taxable amount is not indicated, advanced certified volunteers must calculate the taxable portion using the simplified method worksheet. Web april 16, 2022 6:44 pm. Who must use the general rule. The irs may impose an early withdrawal penalty to discourage taxpayers from using their. Simplified method worksheet line 3 wants 'plan cost at annuity starting date'. 575, pension and annuity income.Simplified Method Worksheet 2020 1099r Unitary

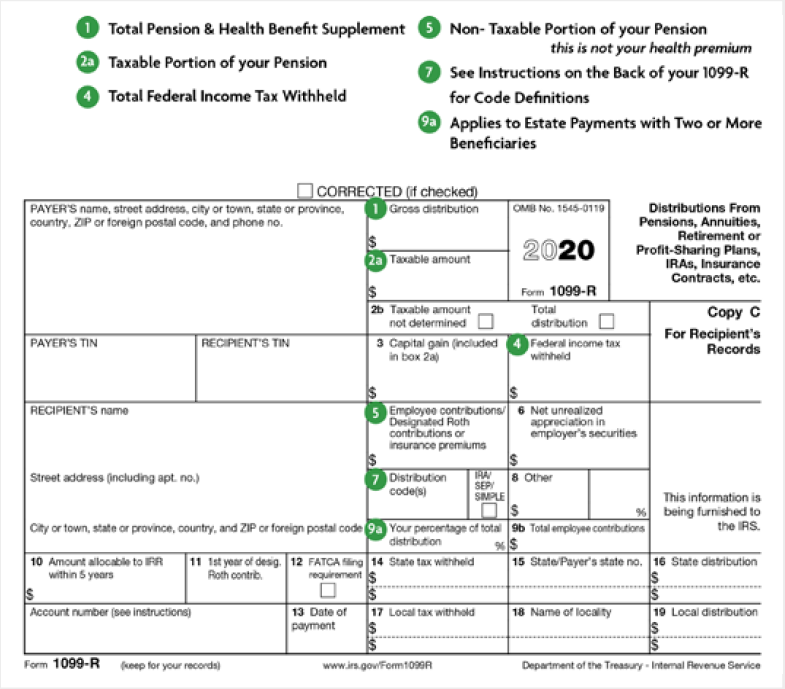

How to Calculate Taxable Amount on a 1099R for Life Insurance

1099 R Worksheet

1099 R Simplified Method Worksheet

1099 R Simplified Method Worksheet

1099 R Simplified Method Worksheet

1099 R Simplified Method Worksheet

rrb 1099 r simplified method worksheet

1099 R Simplified Method Worksheet

1099 R Worksheet

Here Is A Link To The Simplified Method Worksheet For Pensions And Annuities From The Irs.

Web Taxable Amount May Have To Be Determined Using Simplified Method.

Generally, For A Joint And Survivor Annuity, Use The Combined Ages To Calculate The Taxable Amount For The.

Qualified Plans And Section 403(B) Plans.

Related Post: