941X Worksheet 1 Excel

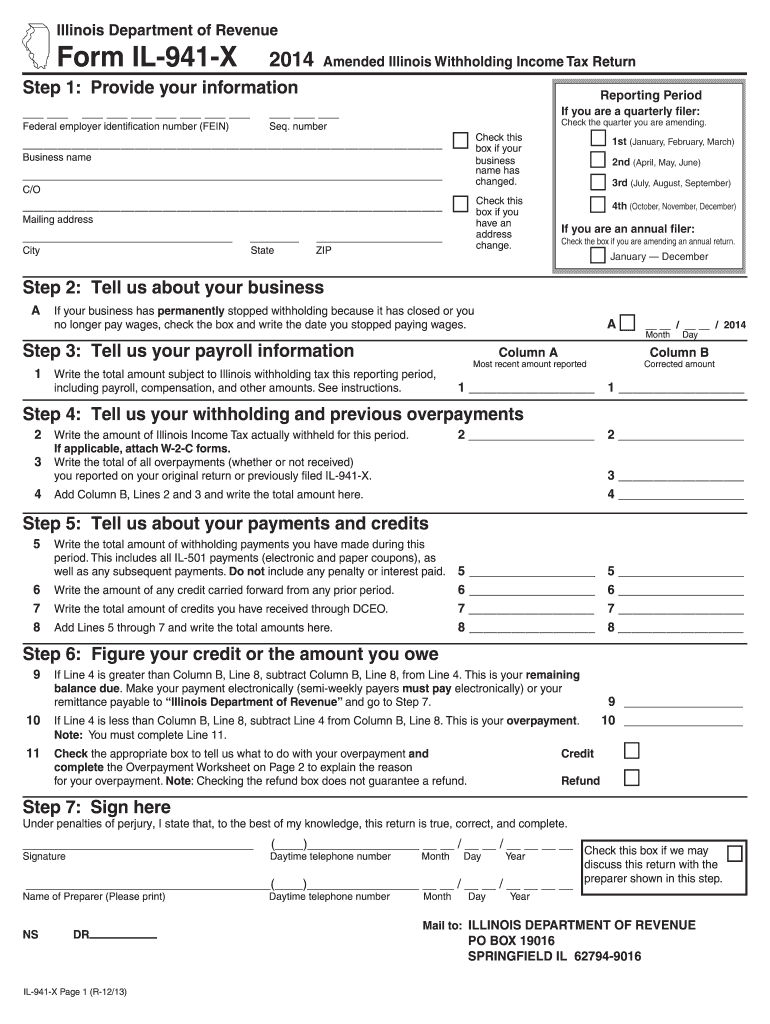

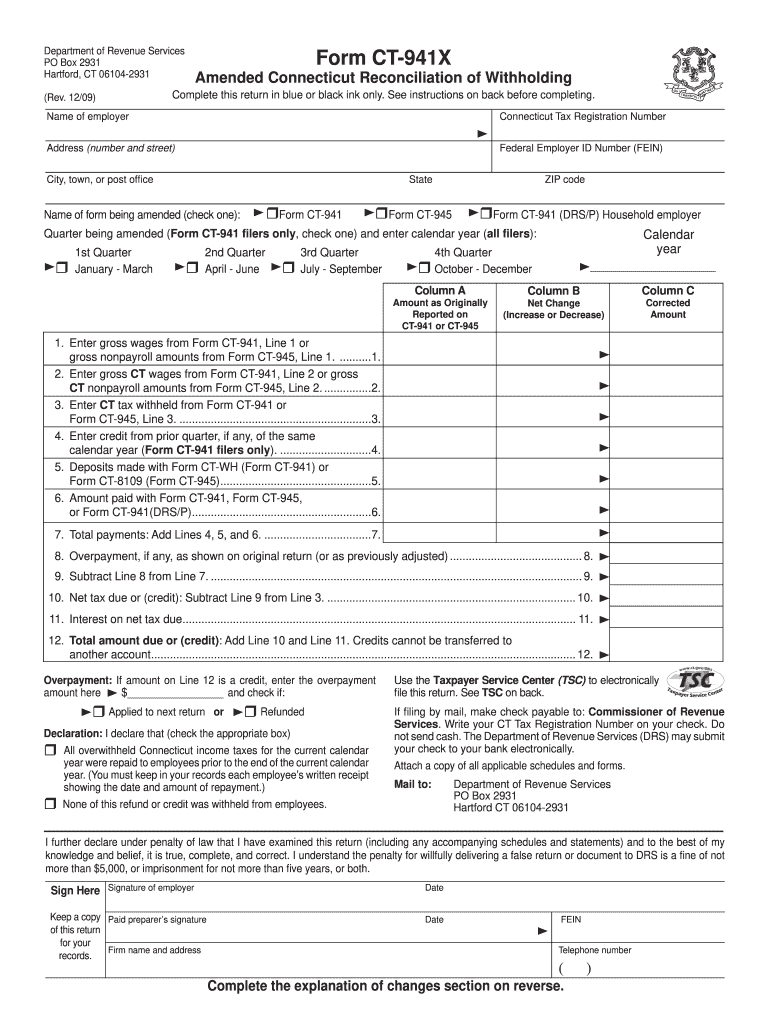

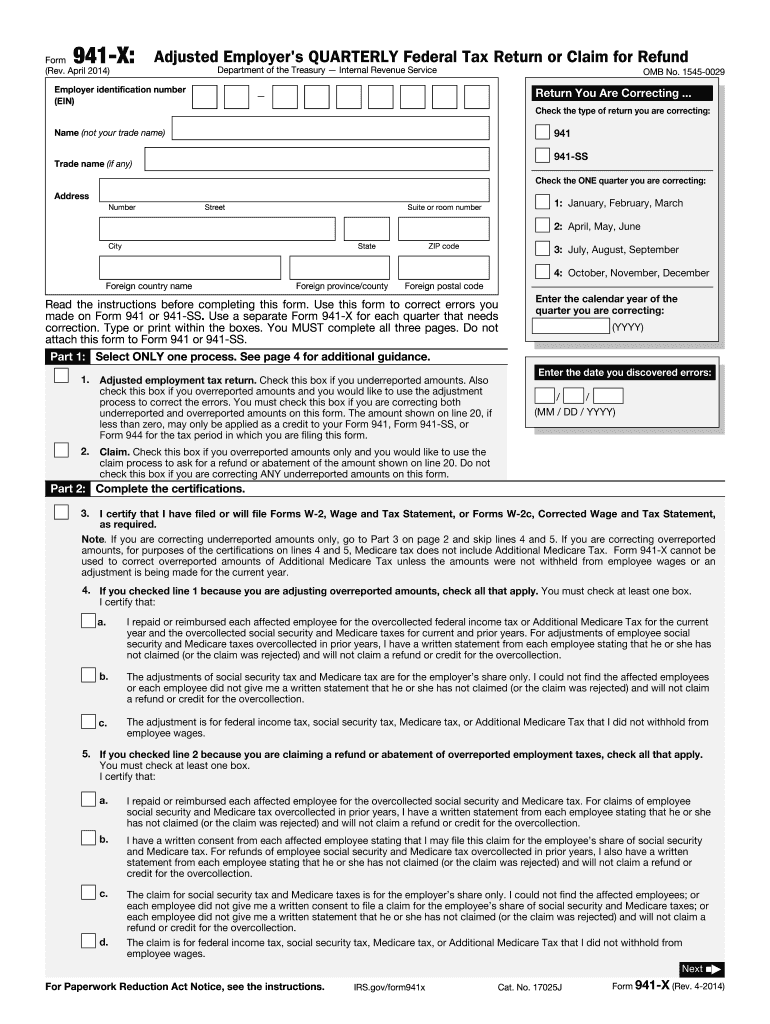

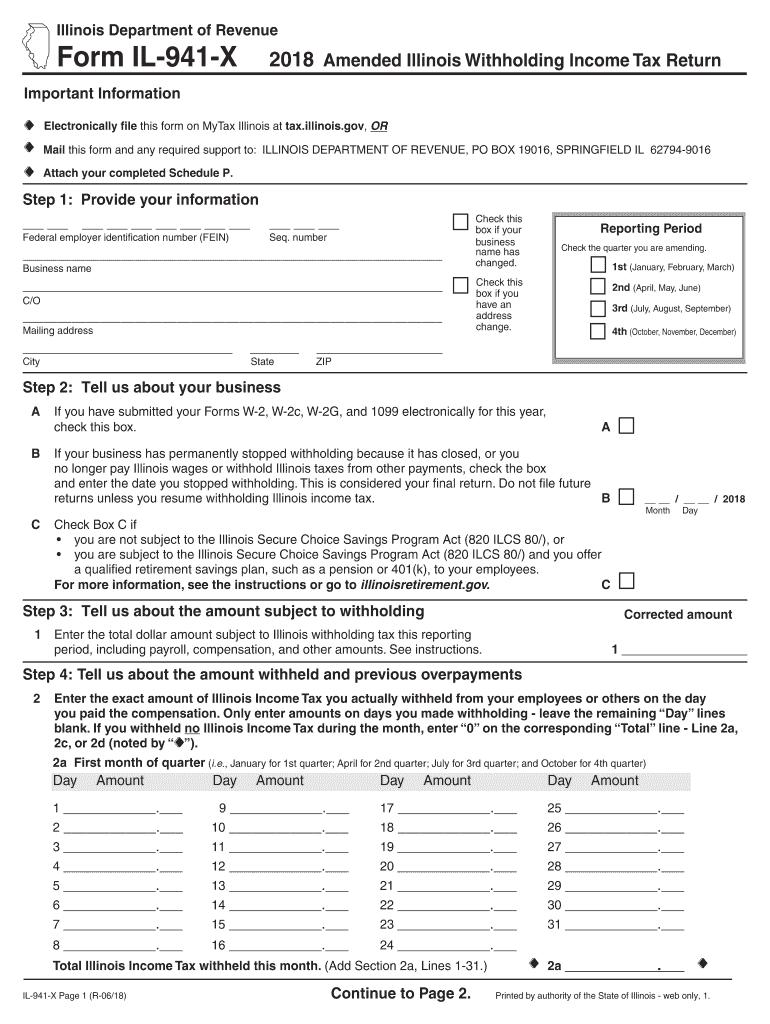

941X Worksheet 1 Excel - Use this form to correct. Click the link to load the. Use worksheet 2 to figure the credit for leave taken after march 31, 2021, and. Web features form 941 worksheet 1 if you are an employer who files the quarterly employment tax form to the irs, you should be aware of worksheet 1. I do a few small payrolls tax forms. Sign it in a few clicks draw your. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Determine refundable and nonrefundable tax credits for quarters 2, 3, and. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and need to make changes. Thus, any employer who files the quarterly. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021. Edit your form 941 excel template online type text, add images, blackout confidential details, add comments, highlights and more. Web features form 941 worksheet 1 if you are an employer who files the quarterly employment tax form to the. Click the link to load the. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Get ready for this year's tax season quickly and safely with pdffiller! Sign it in a few clicks draw your. Use worksheet 2 to figure the credit for leave taken after march. Thus, any employer who files the quarterly. Sign it in a few clicks draw your. Use worksheet 2 to figure the credit for leave taken after march 31, 2021, and. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021. An employer is required to file an irs 941x. I'm looking for an excel sheet or other software that i can use to calculate. Instead of worksheet 1, worksheet 2 needs to be generated and completed to flow the ertc. An employer is required to file an irs 941x in the event of an error on a. Edit your form 941 excel template online type text, add images, blackout. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and need to make changes. Use get form or simply click on the template preview to open it in the editor. Sign it in a few clicks draw your. Web features form 941 worksheet 1 if you. Determine refundable and nonrefundable tax credits for quarters 2, 3, and. Web use worksheet 1 to figure the credit for leave taken after march 31, 2020, and before april 1, 2021. I do a few small payrolls tax forms. Web the 941 ertc worksheets for the 2q 2021 have changed. Web reference worksheet 4 if you claimed the employee retention. Edit your form 941 excel template online type text, add images, blackout confidential details, add comments, highlights and more. Use get form or simply click on the template preview to open it in the editor. Thus, any employer who files the quarterly. Make sure you locate irs form 941, employer’s quarterly federal tax return, where you typically report your income. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and need to make changes. Edit your form 941 excel template online type text, add images, blackout confidential details, add comments, highlights and more. Click the link to load the. Instead of worksheet 1, worksheet 2 needs. Web features form 941 worksheet 1 if you are an employer who files the quarterly employment tax form to the irs, you should be aware of worksheet 1. Instead of worksheet 1, worksheet 2 needs to be generated and completed to flow the ertc. I'm looking for an excel sheet or other software that i can use to calculate. Web. Sign it in a few clicks draw your. Use get form or simply click on the template preview to open it in the editor. Use worksheet 2 to figure the credit for leave taken after march 31, 2021, and. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and. Sign it in a few clicks draw your. I do a few small payrolls tax forms. Click the link to load the. Web features form 941 worksheet 1 if you are an employer who files the quarterly employment tax form to the irs, you should be aware of worksheet 1. Use this form to correct. April, may, june read the separate instructions before completing this form. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021. Determine refundable and nonrefundable tax credits for quarters 2, 3, and. Edit your form 941 excel template online type text, add images, blackout confidential details, add comments, highlights and more. Web the 941 ertc worksheets for the 2q 2021 have changed. Thus, any employer who files the quarterly. Instead of worksheet 1, worksheet 2 needs to be generated and completed to flow the ertc. Use get form or simply click on the template preview to open it in the editor. Web use worksheet 1 to figure the credit for leave taken after march 31, 2020, and before april 1, 2021. Get ready for this year's tax season quickly and safely with pdffiller! Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Make sure you locate irs form 941, employer’s quarterly federal tax return, where you typically report your income tax, social security. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and need to make changes. An employer is required to file an irs 941x in the event of an error on a. Use worksheet 2 to figure the credit for leave taken after march 31, 2021, and. An employer is required to file an irs 941x in the event of an error on a. Thus, any employer who files the quarterly. Web use worksheet 1 to figure the credit for leave taken after march 31, 2020, and before april 1, 2021. Sign it in a few clicks draw your. Use this form to correct. Click the link to load the. April, may, june read the separate instructions before completing this form. Web reference worksheet 4 if you claimed the employee retention credit for wages paid after june 30, 2021, and before january 1, 2022, and need to make changes. I do a few small payrolls tax forms. Determine refundable and nonrefundable tax credits for quarters 2, 3, and. I'm looking for an excel sheet or other software that i can use to calculate. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021. Edit your form 941 excel template online type text, add images, blackout confidential details, add comments, highlights and more. Get ready for this year's tax season quickly and safely with pdffiller! Use worksheet 2 to figure the credit for leave taken after march 31, 2021, and. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond.941x Worksheet 1 Excel

941x Worksheet 1 Excel

941x Worksheet 1 Excel

941x Worksheet 1 Excel

941x Worksheet 1 Excel

941x Worksheet 1

941x Worksheet 1 Excel

941x Worksheet 1

941x Worksheet 1 Excel

941x Worksheet 1 Excel

Web Features Form 941 Worksheet 1 If You Are An Employer Who Files The Quarterly Employment Tax Form To The Irs, You Should Be Aware Of Worksheet 1.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Web The 941 Ertc Worksheets For The 2Q 2021 Have Changed.

Make Sure You Locate Irs Form 941, Employer’s Quarterly Federal Tax Return, Where You Typically Report Your Income Tax, Social Security.

Related Post: