Built-In Gains Tax Calculation Worksheet

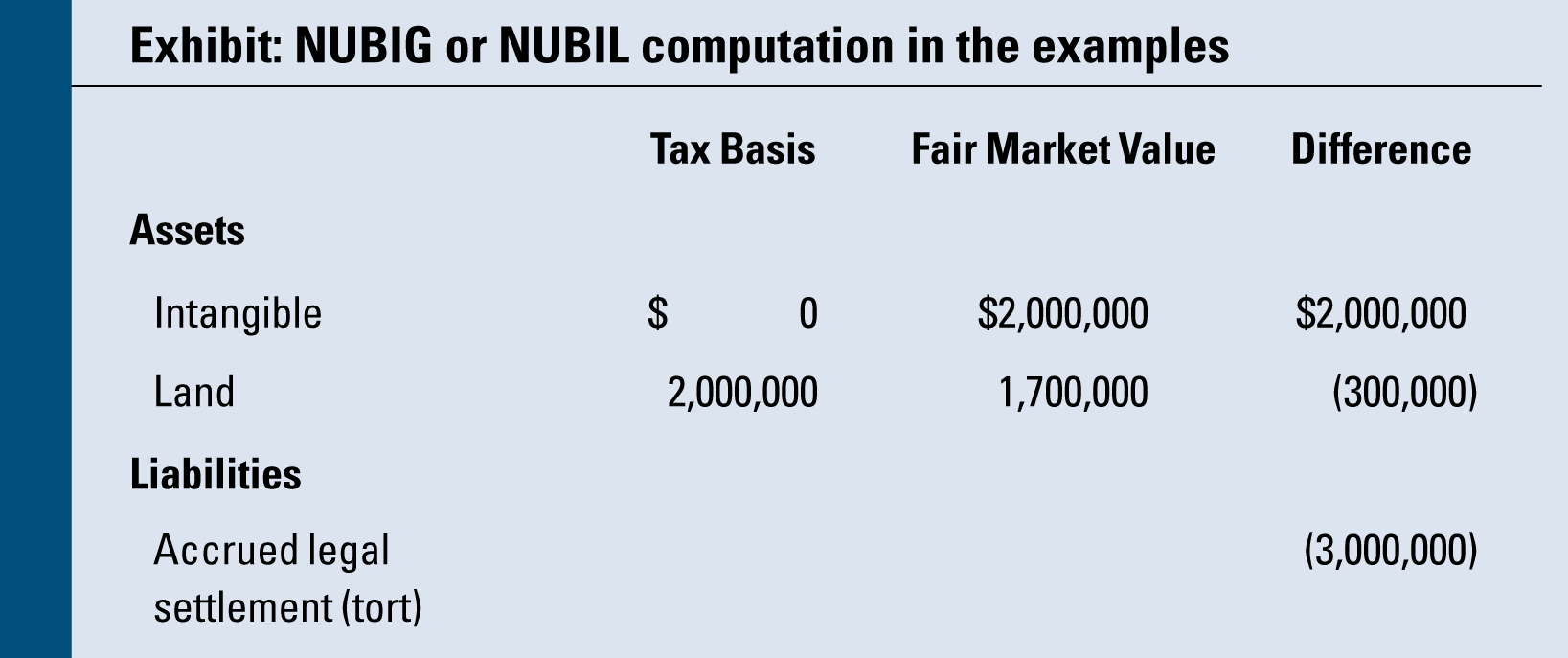

Built-In Gains Tax Calculation Worksheet - Web qualified dividends and capital gain tax worksheet—line 16; Example let's say big corp in our example above had a taxable income of $450,000 in 2020, and it also sold an. Ultratax cs prints this worksheet when there is data entered in any of the following places. Child tax credit and credit for other dependents. The value of blackacre was $100,000 but its basis was only $2,000. Ultratax cs prints this worksheet when there is data entered in any of the following places. The fmv at s election date and adj basis at s election date columns in the detail schedule statement dialog in. Its only asset at the beginning of its first s corporation year was blackacre. Line 16 is an automatic worksheet entry point and opens to a worksheet similar to a ctrl + w worksheet. Ultratax cs prints this workshee The fmv at s election date and adj basis at s election date columns in the detail schedule statement dialog in. Enter the result on the appropriate line of the form or worksheet that you are completing. • gains on distributions to shareholders of appreciated capital assets. Child tax credit and credit for other dependents. Web qualified dividends and capital. Example let's say big corp in our example above had a taxable income of $450,000 in 2020, and it also sold an. The value of blackacre was $100,000 but its basis was only $2,000. Two years later, x corp. The fmv at s election date and adj basis at s election date columns in the detail schedule statement dialog in. Was a c corporation for several years until it made an s election. Asset, through a sale, trade, exchange, payment, gift, or other transfer, check “yes” and use (a) form 8949 to calculate your capital gain or loss and report that gain or loss on schedule d. Ultratax cs prints this worksheet when there is data entered in any of. Its only asset at the beginning of its first s corporation year was blackacre. Example let's say big corp in our example above had a taxable income of $450,000 in 2020, and it also sold an. Was a c corporation for several years until it made an s election. Child tax credit and credit for other dependents. Us income taxes. Ultratax cs prints this worksheet when there is data entered in any of the following places. Enter the result on the appropriate line of the form or worksheet that you are completing. Line 16 is an automatic worksheet entry point and opens to a worksheet similar to a ctrl + w worksheet. Example let's say big corp in our example. Enter the result on the appropriate line of the form or worksheet that you are completing. • gains on distributions to shareholders of appreciated capital assets. Form 8862, who must file. Web qualified dividends and capital gain tax worksheet—line 16; Was a c corporation for several years until it made an s election. Enter the result on the appropriate line of the form or worksheet that you are completing. Web qualified dividends and capital gain tax worksheet—line 16; Two years later, x corp. Web • capital gains from form 6252, installment sale income. The fmv at s election date and adj basis at s election date columns in the detail schedule statement dialog. Child tax credit and credit for other dependents. Two years later, x corp. Web • capital gains from form 6252, installment sale income. Ultratax cs prints this worksheet when there is data entered in any of the following places. The value of blackacre was $100,000 but its basis was only $2,000. Web • capital gains from form 6252, installment sale income. Child tax credit and credit for other dependents. Web qualified dividends and capital gain tax worksheet—line 16; Ultratax cs prints this worksheet when there is data entered in any of the following places. Its only asset at the beginning of its first s corporation year was blackacre. Example let's say big corp in our example above had a taxable income of $450,000 in 2020, and it also sold an. Two years later, x corp. Ultratax cs prints this worksheet when there is data entered in any of the following places. Us income taxes guide 8.4. The fmv at s election date and adj basis at s election. Example let's say big corp in our example above had a taxable income of $450,000 in 2020, and it also sold an. Ultratax cs prints this worksheet when there is data entered in any of the following places. The fmv at s election date and adj basis at s election date columns in the detail schedule statement dialog in screen d. • gains on distributions to shareholders of appreciated capital assets. Its only asset at the beginning of its first s corporation year was blackacre. Us income taxes guide 8.4. The fmv at s election date and adj basis at s election date columns in the detail schedule statement dialog in. Enter the result on the appropriate line of the form or worksheet that you are completing. Asset, through a sale, trade, exchange, payment, gift, or other transfer, check “yes” and use (a) form 8949 to calculate your capital gain or loss and report that gain or loss on schedule d. Web • capital gains from form 6252, installment sale income. Ultratax cs prints this worksheet when there is data entered in any of the following places. Form 8862, who must file. 8 when an s corporation has a. If a c corporation converts its tax status to a partnership or a disregarded entity, the resulting actual or deemed liquidation, in most cases, would be a taxable transaction for both the corporation and its shareholders. Ultratax cs prints this worksheet when there is data entered in any of the following places. Ultratax cs prints this workshee Web and capital gain tax worksheet, the schedule d tax worksheet, schedule j, form 8615, or the foreign earned income tax worksheet, enter the amount from that form or worksheet in column (a) of the row that applies to the amount you are looking up. Was a c corporation for several years until it made an s election. Web qualified dividends and capital gain tax worksheet—line 16; Child tax credit and credit for other dependents. Example let's say big corp in our example above had a taxable income of $450,000 in 2020, and it also sold an. Us income taxes guide 8.4. Form 8862, who must file. Its only asset at the beginning of its first s corporation year was blackacre. Web qualified dividends and capital gain tax worksheet—line 16; The fmv at s election date and adj basis at s election date columns in the detail schedule statement dialog in screen d. Other forms the corporation may have to file Web • capital gains from form 6252, installment sale income. • gains on distributions to shareholders of appreciated capital assets. If a c corporation converts its tax status to a partnership or a disregarded entity, the resulting actual or deemed liquidation, in most cases, would be a taxable transaction for both the corporation and its shareholders. The value of blackacre was $100,000 but its basis was only $2,000. The fmv at s election date and adj basis at s election date columns in the detail schedule statement dialog in. Ultratax cs prints this worksheet when there is data entered in any of the following places. Ultratax cs prints this worksheet when there is data entered in any of the following places. Line 16 is an automatic worksheet entry point and opens to a worksheet similar to a ctrl + w worksheet. Child tax credit and credit for other dependents.Built In Gains Tax Calculation Worksheet —

Built In Gains Tax Calculation Worksheet —

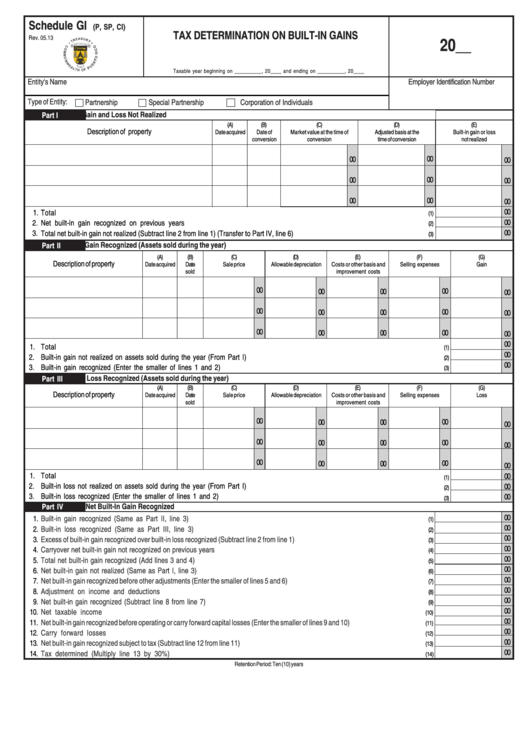

Schedule Gi Template Tax Determination On BuiltIn Gains printable

Built In Gains Tax Calculation Worksheet —

Free Land Capital Gains Tax Calculator

Built In Gains Tax Calculation Worksheet —

Built In Gains Tax Calculation Worksheet —

Built In Gains Tax Calculation Worksheet —

Built In Gains Tax Calculation Worksheet —

Capital Gains Tax Worksheet 2015 Tax Rhea Sheets

Two Years Later, X Corp.

Ultratax Cs Prints This Worksheet When There Is Data Entered In Any Of The Following Places.

8 When An S Corporation Has A.

Asset, Through A Sale, Trade, Exchange, Payment, Gift, Or Other Transfer, Check “Yes” And Use (A) Form 8949 To Calculate Your Capital Gain Or Loss And Report That Gain Or Loss On Schedule D.

Related Post: