Business Tax Expenses Worksheet

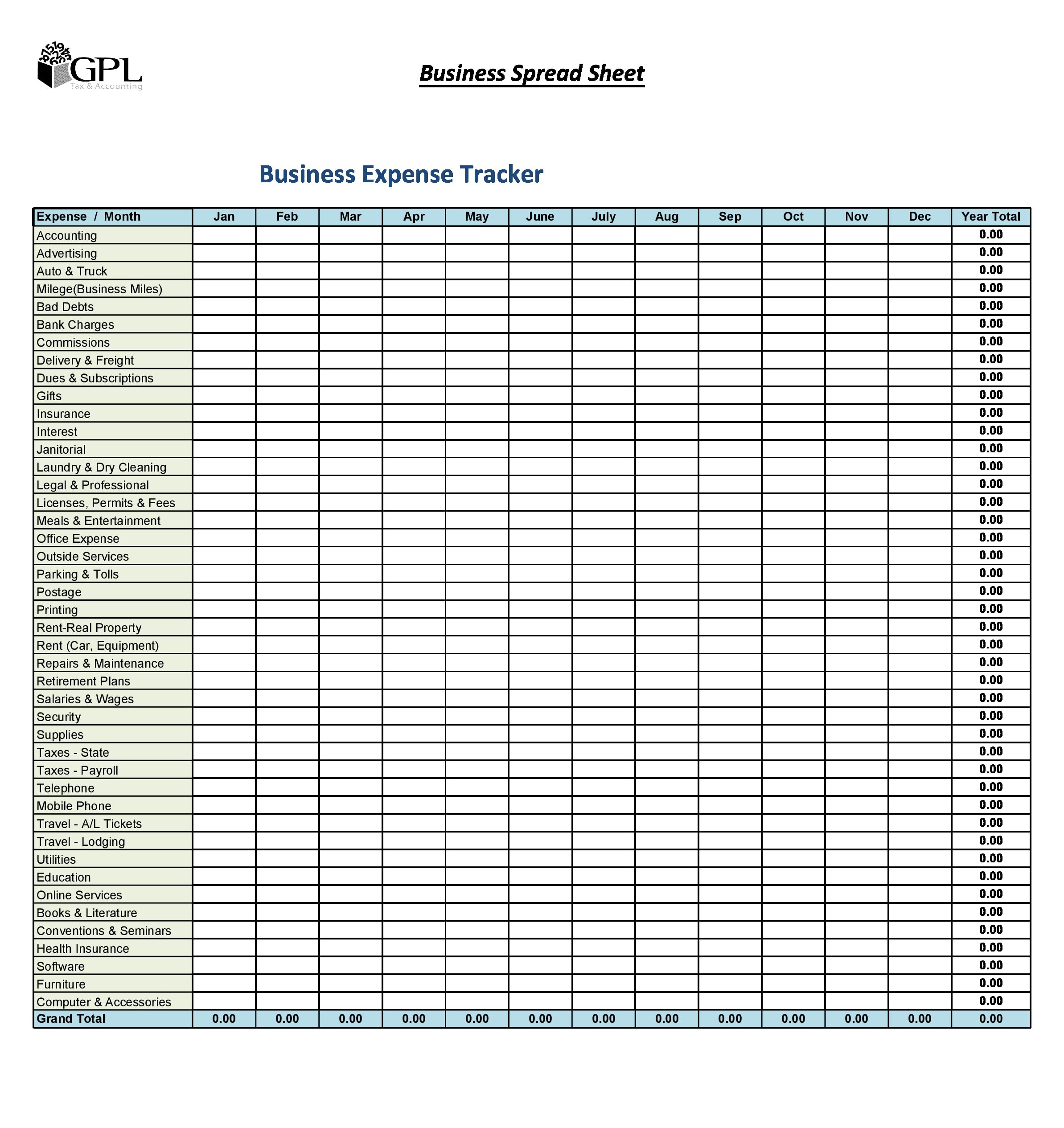

Business Tax Expenses Worksheet - Rated #1 in the expense industry. Business expenses only enter expenses. Web between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. Web we have created a business income & expense template that will help you navigate organizing your business activity so that tax time is a breeze. Web capital gains and losses are taxed differently from income like wages, interest, rents, or royalties, which are taxed at your federal income tax rate (up to 37%. Fuel surcharge do your records agree yes! Let’s take a look at some of the key benefits of using a microsoft excel spreadsheet for your. Web this handout provides a simple worksheet for business owners to track expenses. Web 4 reasons to use an excel spreadsheet for business expenses. Web at tax time you'll need to gather and categorize these business expenses to complete your tax return properly. Rated #1 in the expense industry. Web we have created a business income & expense template that will help you navigate organizing your business activity so that tax time is a breeze. Ad cloud based expense software for business' of all sizes. There is a smarter way to manage business expenses, take a trial of concur® expense Web if this. Web capital gains and losses are taxed differently from income like wages, interest, rents, or royalties, which are taxed at your federal income tax rate (up to 37%. Web microsoft excel | google sheets. Web if this business is a corporation or partnership, do not use this section. Web this handout provides a simple worksheet for business owners to track. There is a smarter way to manage business expenses, take a trial of concur® expense After you have calculated the. Fuel surcharge do your records agree yes! Web check out our tax business expense worksheet selection for the very best in unique or custom, handmade pieces from our shops. Web between $32,000 and $44,000, you may have to pay income. Web capital gains and losses are taxed differently from income like wages, interest, rents, or royalties, which are taxed at your federal income tax rate (up to 37%. Web a small business expense report template is a tool to track daily or weekly expenses. Ad cloud based expense software for business' of all sizes. There are seven federal income tax. It can be used as a ledger or as a summary for business owners to complete. More than $44,000, up to 85% of your benefits may be taxable. There is a smarter way to manage business expenses, take a trial of concur® expense Web microsoft excel | google sheets. Web a small business expense report template is a tool to. Fuel surcharge do your records agree yes! You can add cost, administrative expenses, vendor payments, reimbursable. Use the worksheet for those types of businesses. Web between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for. Web this handout provides a simple worksheet for business owners to track expenses. Rated #1 in the expense industry. It can be used as a ledger or as a summary for business owners to complete. After you have calculated the. There is a smarter way to manage business expenses, take a trial of concur® expense Web check out our tax business expense worksheet selection for the very best in unique or custom, handmade pieces from our shops. Web this handout provides a simple worksheet for business owners to track expenses. Web capital gains and losses are taxed differently from income like wages, interest, rents, or royalties, which are taxed at your federal income tax rate. Web we have created a business income & expense template that will help you navigate organizing your business activity so that tax time is a breeze. Web capital gains and losses are taxed differently from income like wages, interest, rents, or royalties, which are taxed at your federal income tax rate (up to 37%. Rated #1 in the expense industry.. Ad cloud based expense software for business' of all sizes. Use the worksheet for those types of businesses. There is a smarter way to manage business expenses, take a trial of concur® expense Web 4 reasons to use an excel spreadsheet for business expenses. Rated #1 in the expense industry. Web check out our tax business expense worksheet selection for the very best in unique or custom, handmade pieces from our shops. This task becomes easier if you have them listed in a computer or. Use the worksheet for those types of businesses. Web microsoft excel | google sheets. There is a smarter way to manage business expenses, take a trial of concur® expense Web capital gains and losses are taxed differently from income like wages, interest, rents, or royalties, which are taxed at your federal income tax rate (up to 37%. More than $44,000, up to 85% of your benefits may be taxable. Web this handout provides a simple worksheet for business owners to track expenses. Web we have created a business income & expense template that will help you navigate organizing your business activity so that tax time is a breeze. Web 4 reasons to use an excel spreadsheet for business expenses. (this worksheet can handle these deductions for you — more on. There is a smarter way to manage business expenses, take a trial of concur® expense Rated #1 in the expense industry. Let’s take a look at some of the key benefits of using a microsoft excel spreadsheet for your. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Business expenses only enter expenses. Rated #1 in the expense industry. Fuel surcharge do your records agree yes! Ad cloud based expense software for business' of all sizes. You can add cost, administrative expenses, vendor payments, reimbursable. There are seven federal income tax rates in. Let’s take a look at some of the key benefits of using a microsoft excel spreadsheet for your. It can be used as a ledger or as a summary for business owners to complete. Web at tax time you'll need to gather and categorize these business expenses to complete your tax return properly. Use the worksheet for those types of businesses. More than $44,000, up to 85% of your benefits may be taxable. After you have calculated the. Business expenses only enter expenses. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Web check out our tax business expense worksheet selection for the very best in unique or custom, handmade pieces from our shops. Web capital gains and losses are taxed differently from income like wages, interest, rents, or royalties, which are taxed at your federal income tax rate (up to 37%. Ad cloud based expense software for business' of all sizes. This task becomes easier if you have them listed in a computer or. (this worksheet can handle these deductions for you — more on. Use worksheet 3 to determine your quarterly instalments (if you are eligible). There is a smarter way to manage business expenses, take a trial of concur® expense30 Best Business Expense Spreadsheets (100 Free) TemplateArchive

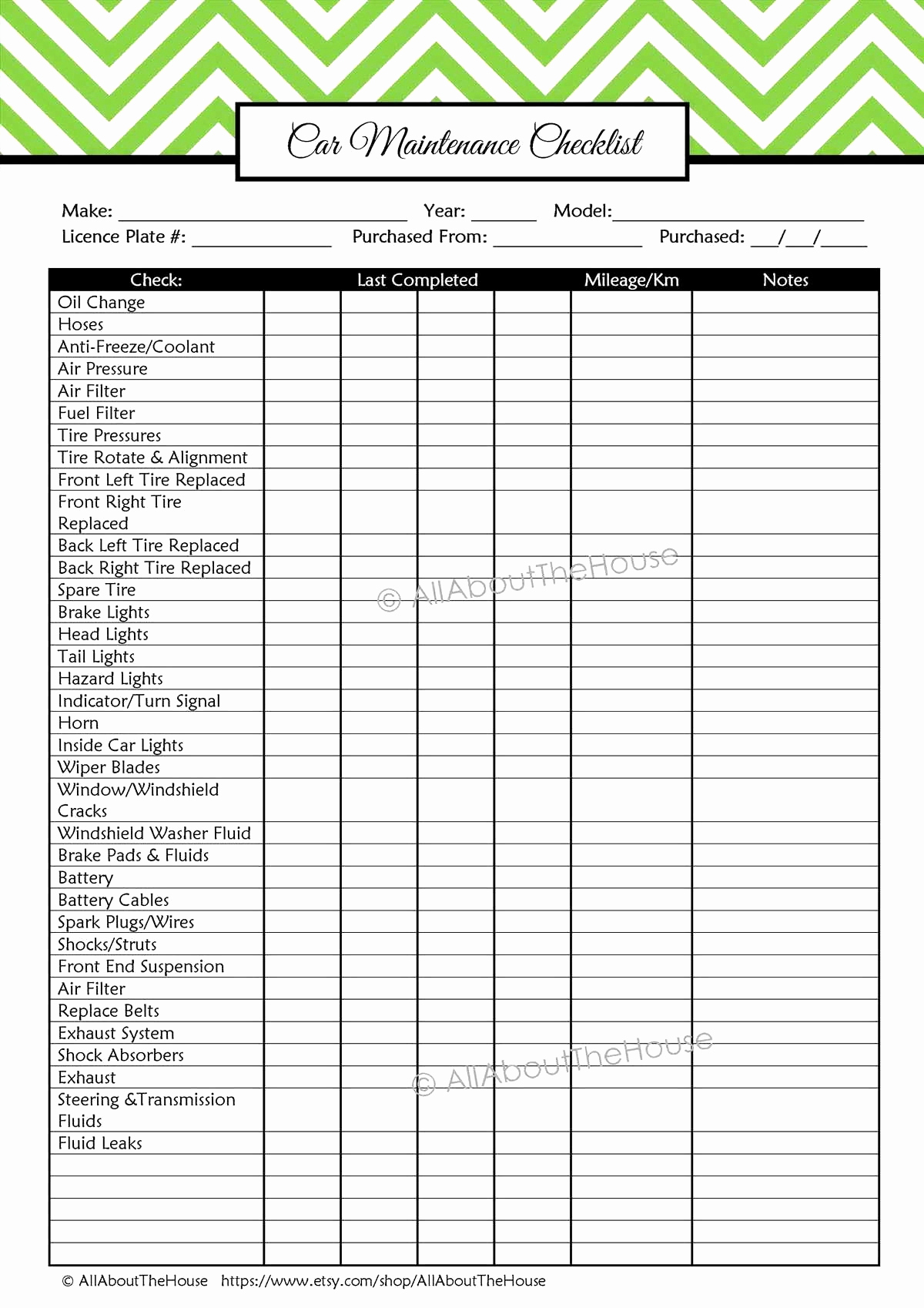

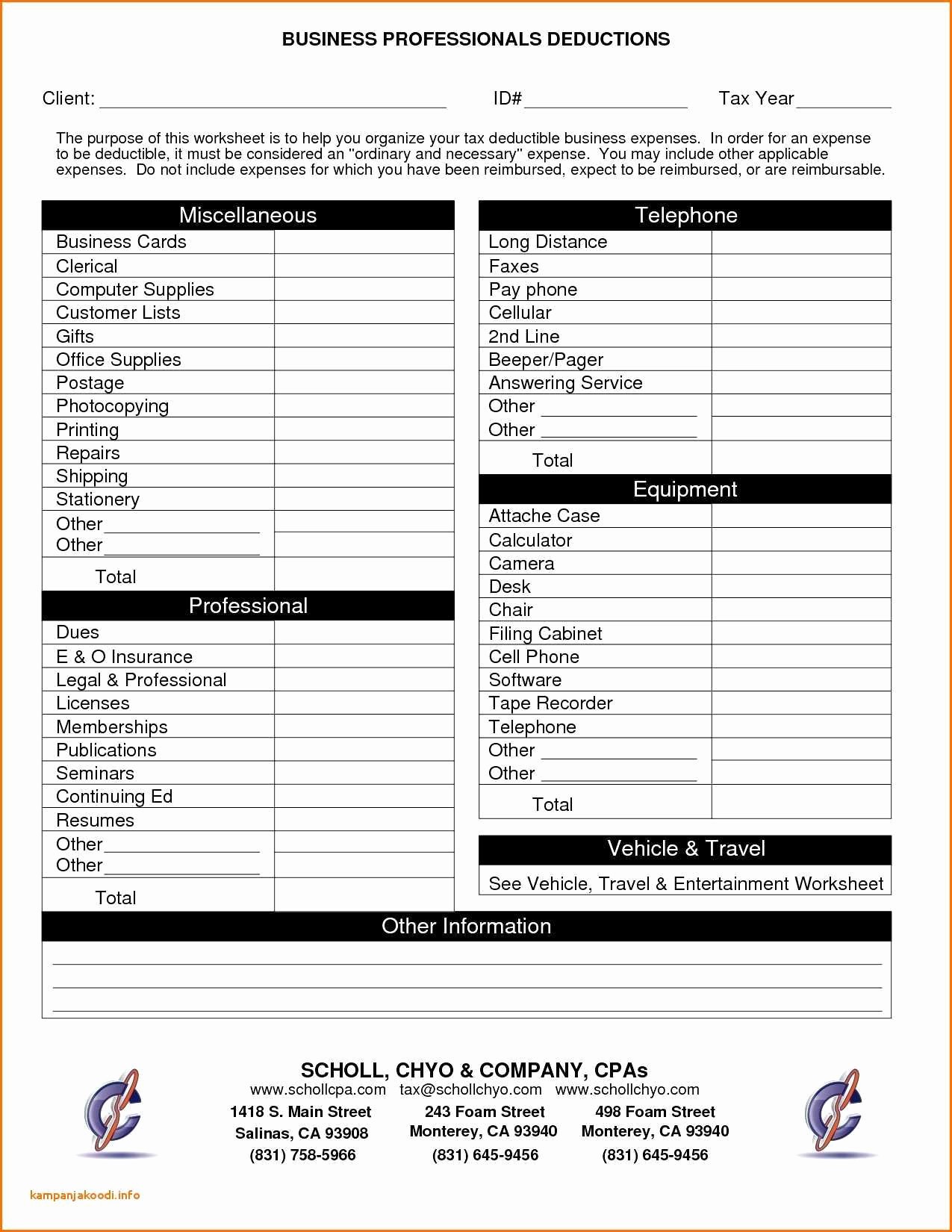

business tax worksheet

30 Best Business Expense Spreadsheets (100 Free) TemplateArchive

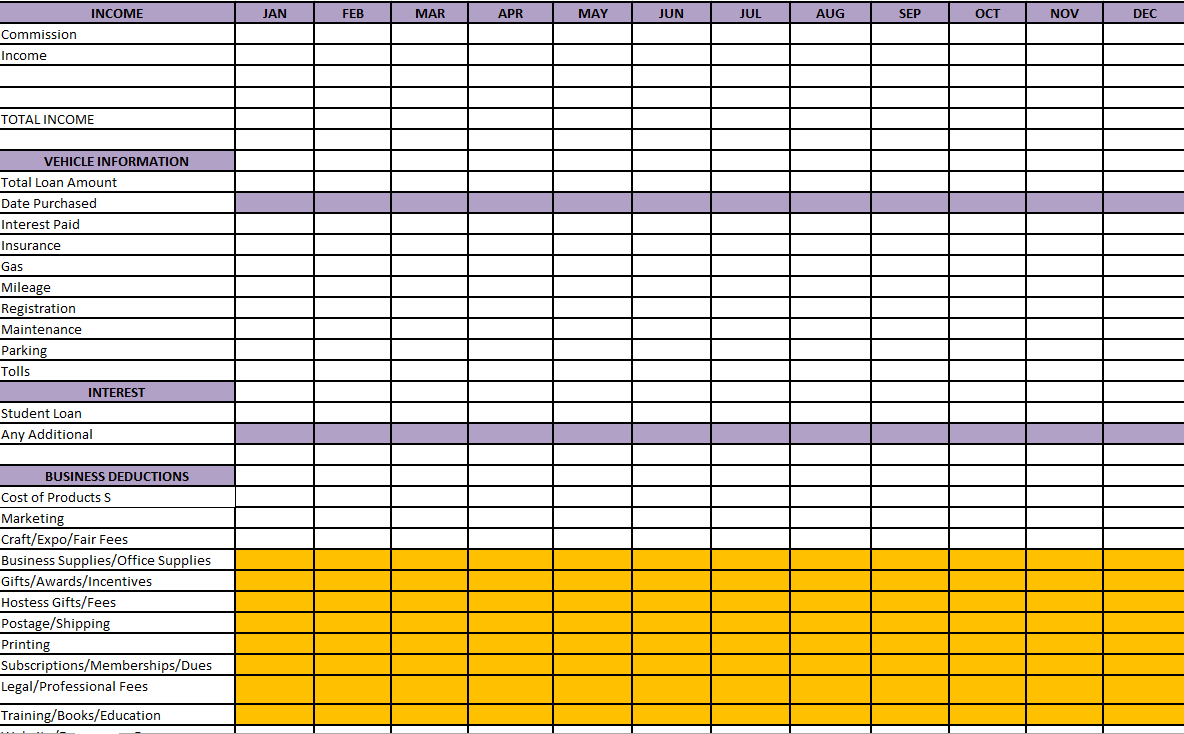

Business Expense Spreadsheet For Taxes Awesome 50 Inspirational and

Small Business Deductions Worksheet petermcfarland.us

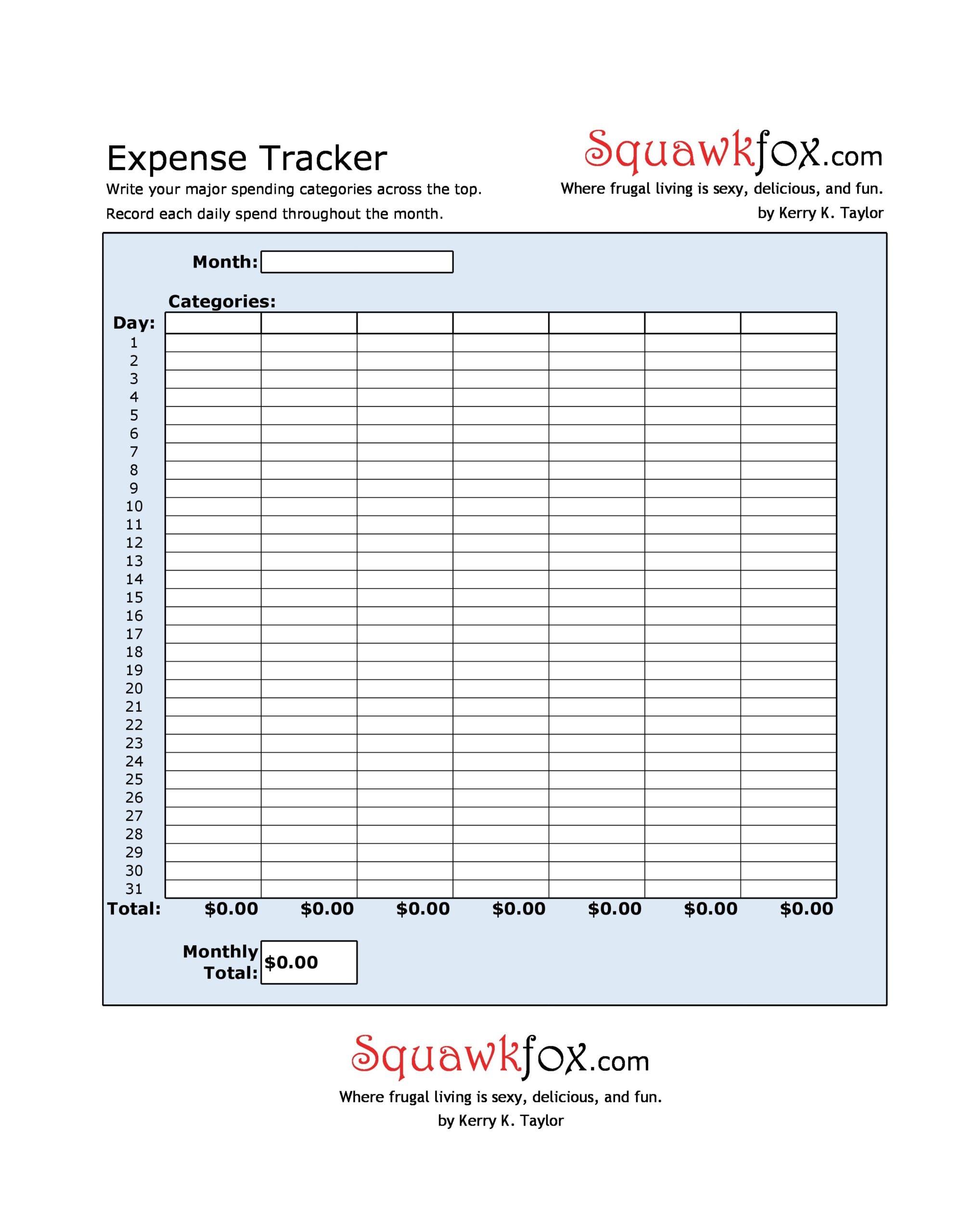

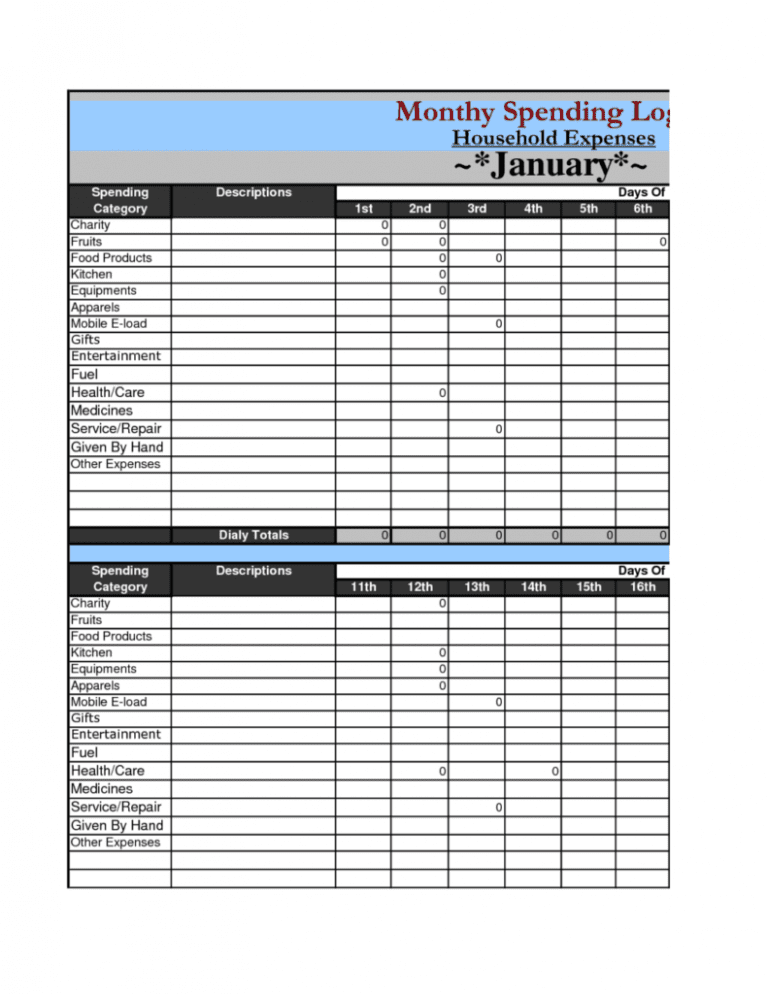

monthly business expense worksheet template —

Small Business Tax Deductions Worksheets

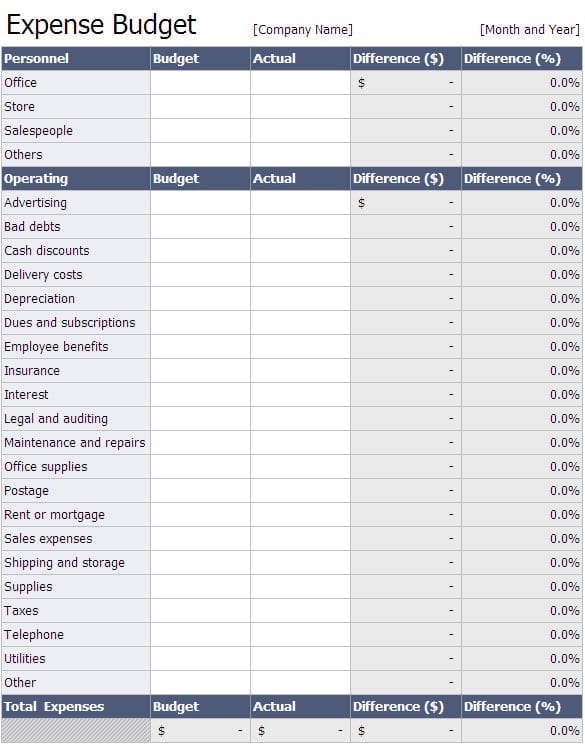

Business Expenses Spreadsheet Template —

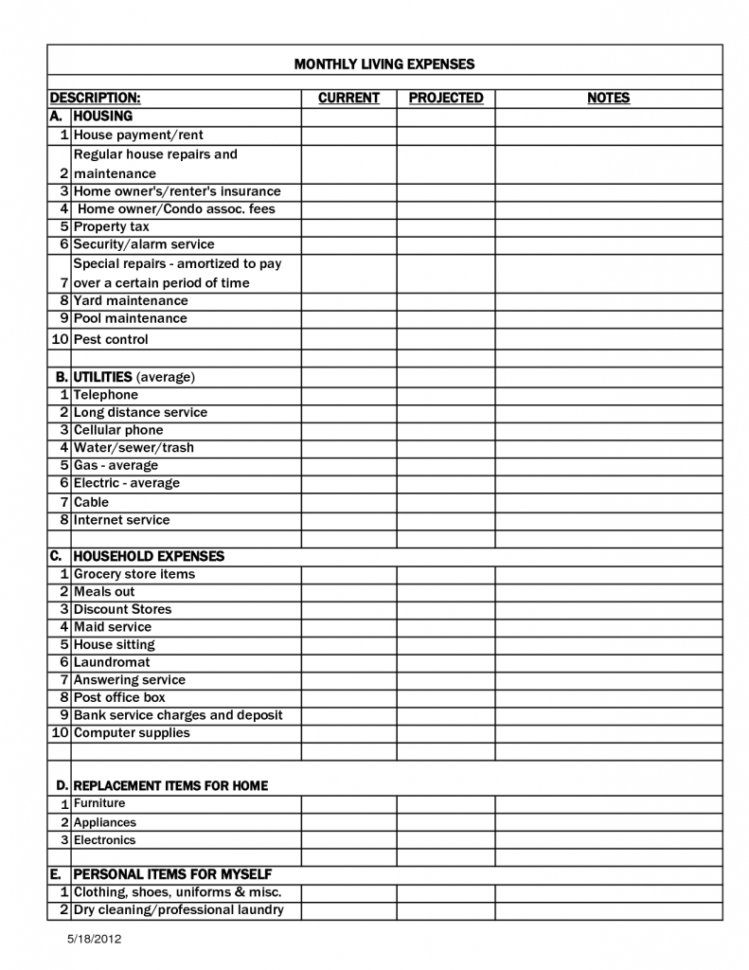

Monthly Living Expenses Spreadsheet Pertaining To Expenses Sheet

And Expense Statement Template —

You Can Add Cost, Administrative Expenses, Vendor Payments, Reimbursable.

Web We Have Created A Business Income & Expense Template That Will Help You Navigate Organizing Your Business Activity So That Tax Time Is A Breeze.

Web Microsoft Excel | Google Sheets.

Rated #1 In The Expense Industry.

Related Post: