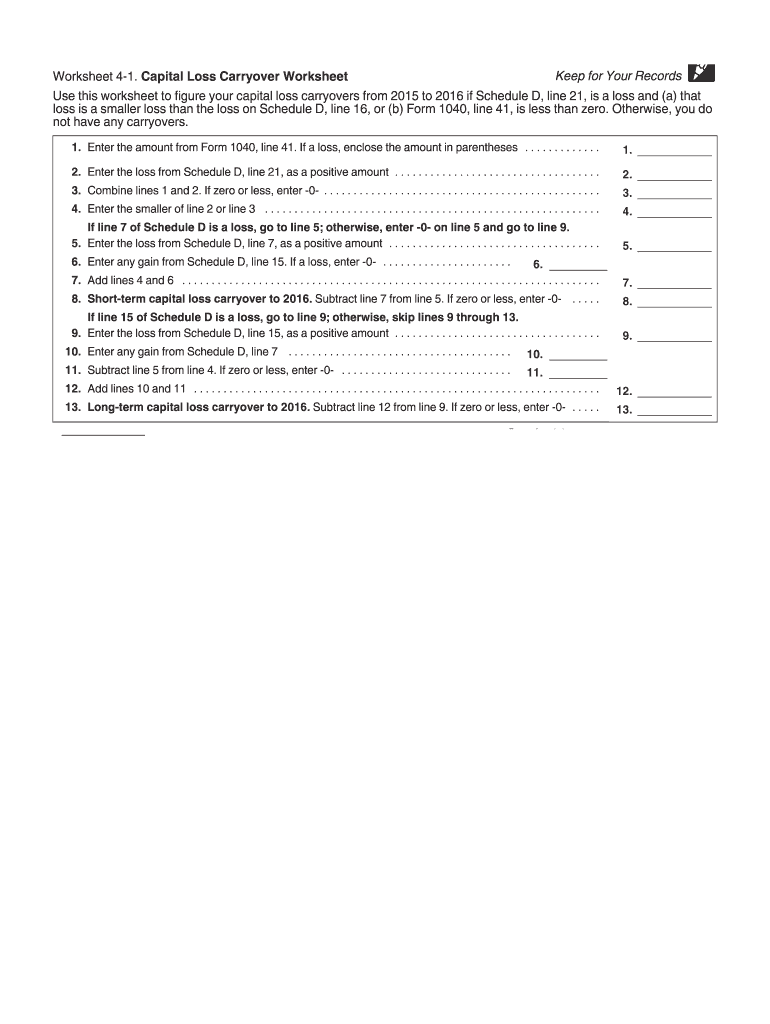

Capital Loss Carryover Worksheet

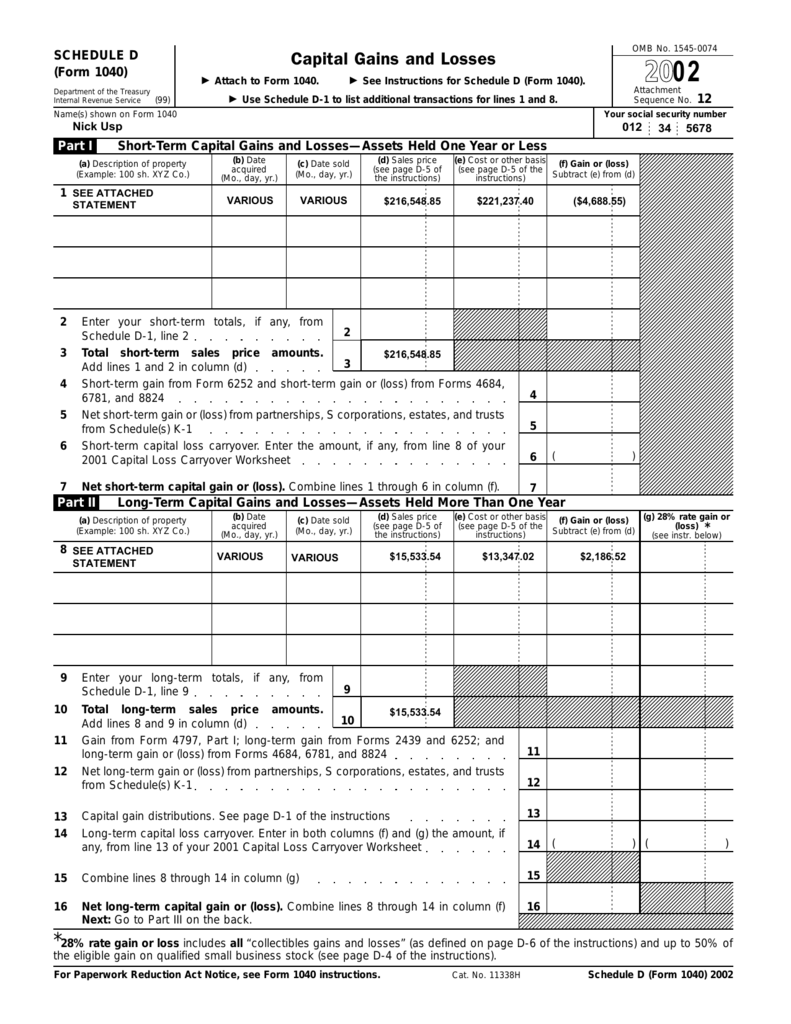

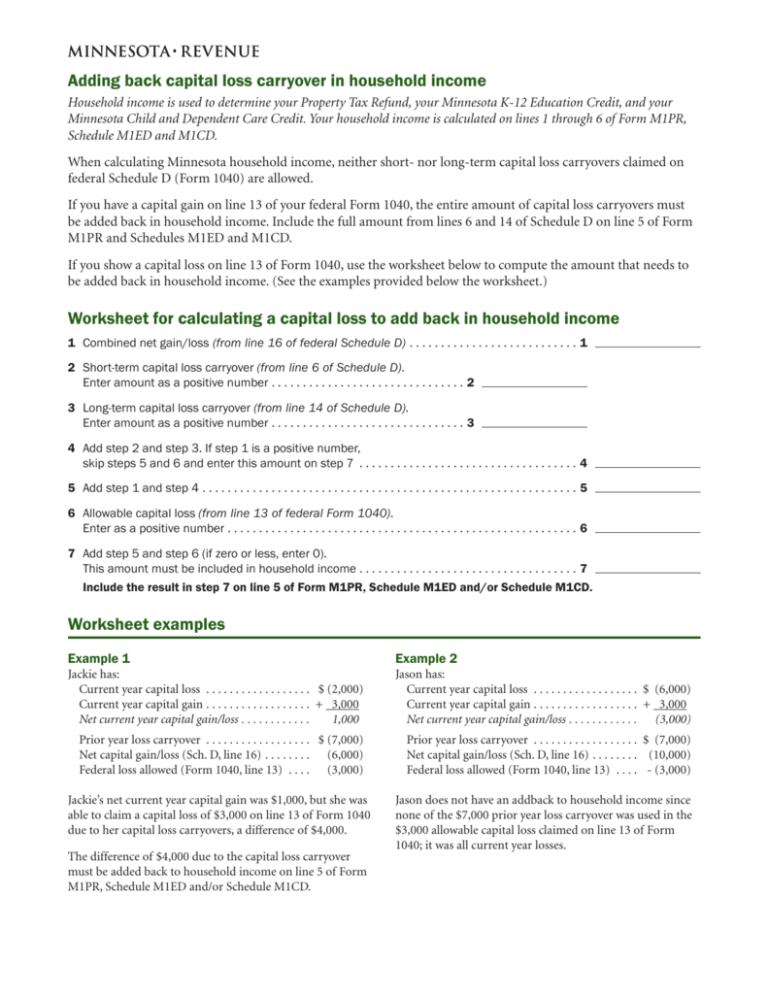

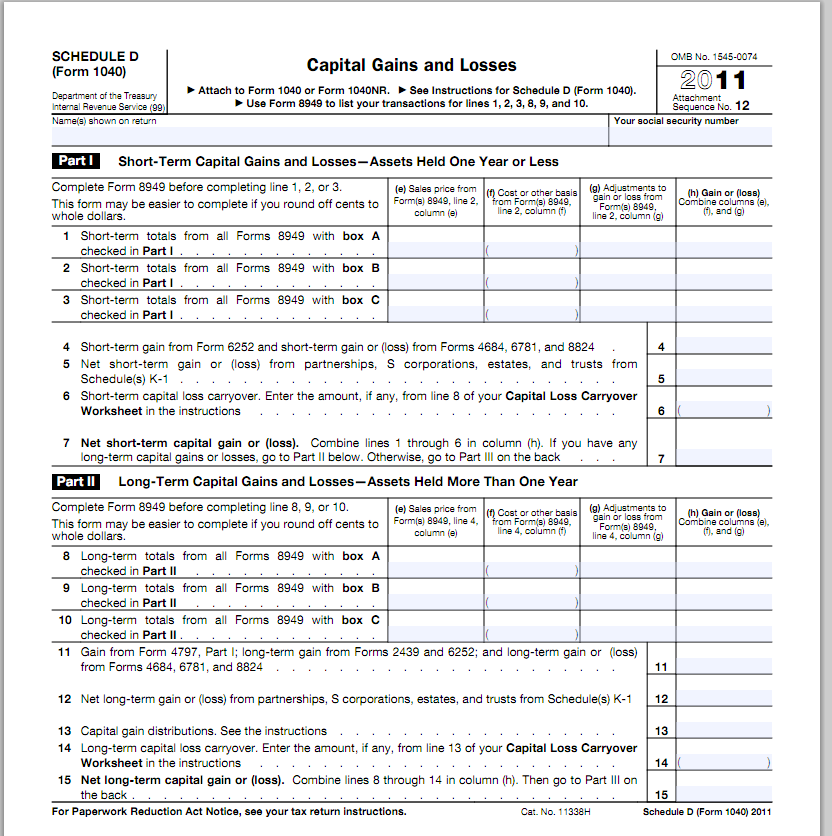

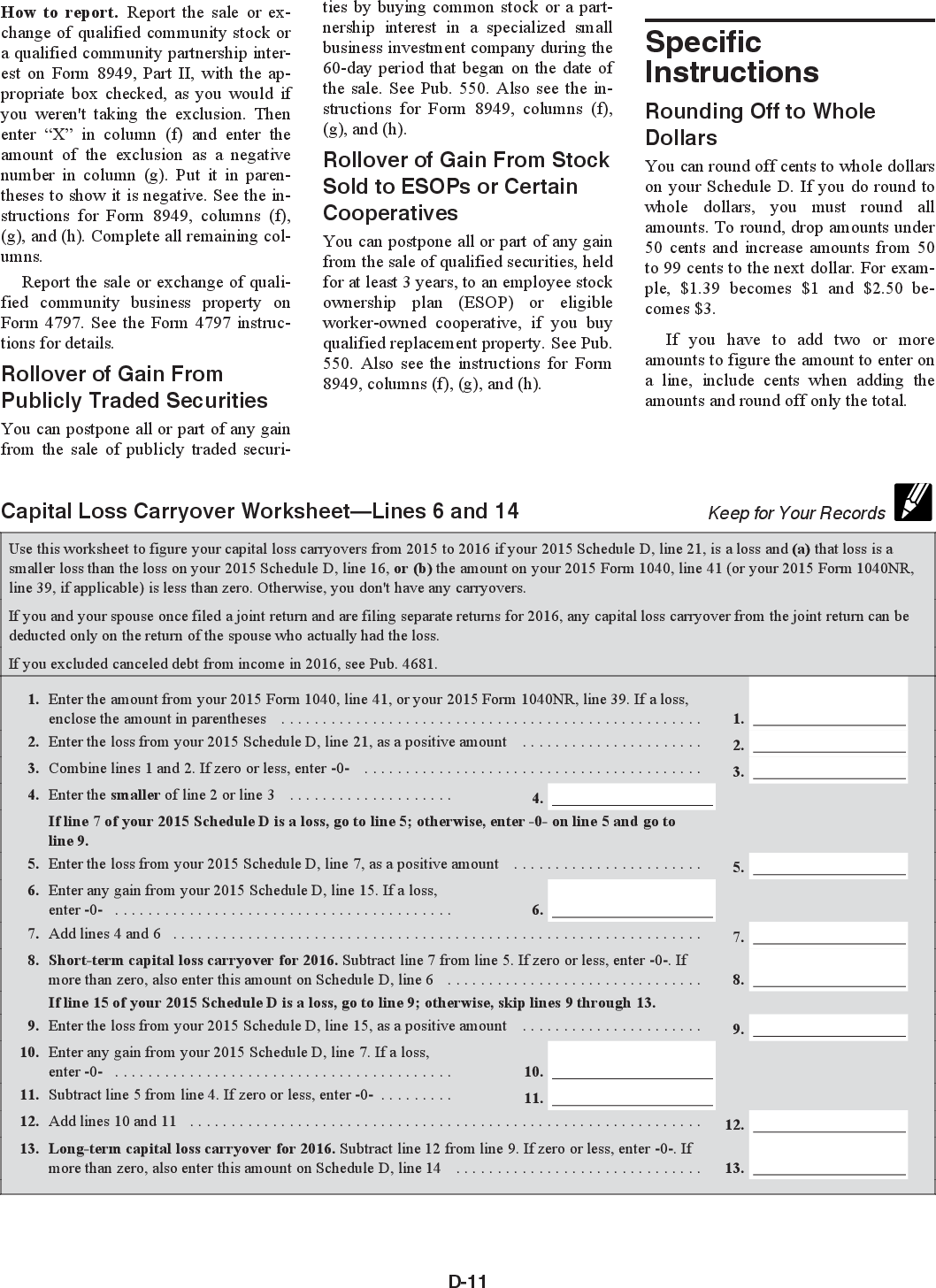

Capital Loss Carryover Worksheet - Web use the worksheet below to figure your capital loss carryover to 2023. Net capital losses (the amount that total capital. Web if you do not want to restart your 2022 return to get the amounts to match up as they should, you can make the adjustments in forms mode to the capital loss. Web it also includes links to worksheets you can use to determine the amount you can carry forward. Use the capital loss carryover. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of the following is true. Web you may use the capital loss carryover worksheet found in publication 550, investment income and expenses or in the instructions for schedule d (form 1040). Web these instructions explain how to complete schedule d (form 1040). Web up to $40 cash back the 2021 capital loss carryover form is used by individuals who have incurred capital losses in the previous tax year and want to carry forward those losses to. • that loss is a smaller loss. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Web use the worksheet at the end of these instructions to figure your capital loss carryover to 2022. If line 8 is a net capital loss, enter the smaller of the loss on line 8 or. Net capital losses (the amount that total. Web use the worksheet at the end of these instructions to figure your capital loss carryover to 2022. Web to figure out how to record a tax loss carryforward, you can use the capital loss carryover worksheet found on the irs’ instructions for schedule d (form 1040). Web you may use the capital loss carryover worksheet found in publication 550,. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of the following is true. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. How to deduct capital losses on your taxes here are the two main. Web. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss carryover. Web it also includes links to worksheets you can use to determine the amount you can carry forward. Line 9 if line 8 is a net capital loss, enter the smaller of the loss on. Subtract line 7 from line 5. Use get form or simply click on the template preview to open it in the editor. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of the following is true. Web to figure out how to record a tax. Web if you do not want to restart your 2022 return to get the amounts to match up as they should, you can make the adjustments in forms mode to the capital loss. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss carryover. Web you. Use the capital loss carryover. Subtract line 7 from line 5. Web use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a loss and one of the following is true. How to deduct capital losses on your taxes here are the two main. Web use the worksheet below to figure. Web capital loss carryover is the net amount of capital losses eligible to be carried forward into future tax years. Your carryover amount will therefore be any. Web up to $40 cash back the 2021 capital loss carryover form is used by individuals who have incurred capital losses in the previous tax year and want to carry forward those losses. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss carryover. Web if you do not want to restart your 2022 return to get the amounts to match up as they should, you can make the adjustments in forms mode to the capital loss. Web use. Web capital loss carryover is the net amount of capital losses eligible to be carried forward into future tax years. Your carryover amount will therefore be any. Use get form or simply click on the template preview to open it in the editor. Fill in all needed lines in the doc utilizing. Line 9 if line 8 is a net. Fill in all needed lines in the doc utilizing. Subtract line 7 from line 5. Web to figure out how to record a tax loss carryforward, you can use the capital loss carryover worksheet found on the irs’ instructions for schedule d (form 1040). Web use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a loss and one of the following is true. Web it also includes links to worksheets you can use to determine the amount you can carry forward. Line 9 if line 8 is a net capital loss, enter the smaller of the loss on line 8 or $3,000 ($1,500 if married or an. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of the following is true. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Net capital losses (the amount that total capital. Use get form or simply click on the template preview to open it in the editor. How to deduct capital losses on your taxes here are the two main. Web you may use the capital loss carryover worksheet found in publication 550, investment income and expenses or in the instructions for schedule d (form 1040). That loss is a smaller loss. Your carryover amount will therefore be any. Web use the worksheet at the end of these instructions to figure your capital loss carryover to 2022. Web if you do not want to restart your 2022 return to get the amounts to match up as they should, you can make the adjustments in forms mode to the capital loss. Web capital loss carryover is the net amount of capital losses eligible to be carried forward into future tax years. If line 8 is a net capital loss, enter the smaller of the loss on line 8 or. Web use the worksheet below to figure your capital loss carryover to 2023. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss carryover. Fill in all needed lines in the doc utilizing. Web use the worksheet below to figure your capital loss carryover to 2023. Web these instructions explain how to complete schedule d (form 1040). Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Net capital losses (the amount that total capital. How to deduct capital losses on your taxes here are the two main. Web if you do not want to restart your 2022 return to get the amounts to match up as they should, you can make the adjustments in forms mode to the capital loss. Web up to $40 cash back the 2021 capital loss carryover form is used by individuals who have incurred capital losses in the previous tax year and want to carry forward those losses to. Your carryover amount will therefore be any. • that loss is a smaller loss. Web it also includes links to worksheets you can use to determine the amount you can carry forward. Web you may use the capital loss carryover worksheet found in publication 550, investment income and expenses or in the instructions for schedule d (form 1040). Web capital loss carryover is the net amount of capital losses eligible to be carried forward into future tax years. Sale of property bought at various times. Use get form or simply click on the template preview to open it in the editor. Line 9 if line 8 is a net capital loss, enter the smaller of the loss on line 8 or $3,000 ($1,500 if married or an.Adding back capital loss carryover in household Worksheet

Capital Loss Carryover Worksheet slidesharedocs

California Capital Loss Carryover Worksheet

California Capital Loss Carryover Worksheet

Carryover Worksheet Form Fill Out and Sign Printable PDF Template

California Capital Loss Carryover Worksheet

Solved Capital loss carryover... What goes in the Regular Tax box

What Is A Federal Carryover Worksheet

What Is A Federal Carryover Worksheet

Capital Loss Carryover Worksheet slidesharedocs

Web To Figure Out How To Record A Tax Loss Carryforward, You Can Use The Capital Loss Carryover Worksheet Found On The Irs’ Instructions For Schedule D (Form 1040).

Subtract Line 7 From Line 5.

If Line 8 Is A Net Capital Loss, Enter The Smaller Of The Loss On Line 8 Or.

Click The Button Get Form To Open It And Begin Editing.

Related Post:

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)