Employee Home Office Worksheet

Employee Home Office Worksheet - Open the return, and go to schedule a (1040). Web home office deduction worksheet instructions:complete a separate worksheet for each business/activity. Entering employee home office expenses. I’m filing form 2106 because i'm a qualified. This is asking for total wages that relate. Line 11 must be entered. they're asking for line 11. An ordinary expense is one that is common and accepted in your field of trade,. Web businesses and self employed. Line 16b is dividing the home office. Web form 2106 line 16b from both copies of the employee home office worksheet, when added together, must equal line 16a. Make sure if you enter home mortgage interest, real estate taxes, or casualty. Line 16b is dividing the home office. I’m filing form 2106 because i'm a qualified. Do not send recipts or bank/credit card statements. Use the tracking spreadsheet to demonstrate these costs. Line 11 must be entered. they're asking for line 11. This is asking for total wages that relate. If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as. To enter home office expenses on form 2106. July 25, 2023 the home office deduction is one of the most. Web employees file this form to deduct ordinary and necessary expenses for their job. You can claim the percentage of those expenses that relate to the work space. Line 11 must be entered. they're asking for line 11. An ordinary expense is one that is common and accepted in your field of trade,. Web home office deduction worksheet please use. Web home office deduction worksheet instructions:complete a separate worksheet for each business/activity. An ordinary expense is one that is common and accepted in your field of trade,. Web expenses you paid that relate to the work space as well as other areas of the home. Web a lot of employees right now are stuck at home behind their desks still. Web complete all applicable information on the business use of home worksheet. Web home office deduction worksheet please use this worksheet to give us information about your home office for preparation of your tax returns. Web what this means is you need to convince your employer to reimburse you for home office expenses. Entering employee home office expenses. Use the. There are two versions of this. An ordinary expense is one that is common and accepted in your field of trade,. If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as. Make sure if you enter home mortgage interest, real estate taxes, or casualty. Web home office deduction. I’m filing form 2106 because i'm a qualified. The term “home” includes a. Web home office deduction worksheet please use this worksheet to give us information about your home office for preparation of your tax returns. Use the tracking spreadsheet to demonstrate these costs. This is all because of the coronavirus pandemic that has. Make sure if you enter home mortgage interest, real estate taxes, or casualty. Web businesses and self employed. There are two versions of this. Use the tracking spreadsheet to demonstrate these costs. Entering employee home office expenses. Web employees file this form to deduct ordinary and necessary expenses for their job. Web a lot of employees right now are stuck at home behind their desks still doing the same thing as if they’re in the office. Open the return, and go to schedule a (1040). So the employee is you in this case. This is asking for. Go to line 8 and. Use the tracking spreadsheet to demonstrate these costs. Web what this means is you need to convince your employer to reimburse you for home office expenses. Web 1 reply michaeldc new member june 5, 2019 4:37 pm there is an error on the employee home office worksheet, line 11. Line 16b is dividing the home. Make sure if you enter home mortgage interest, real estate taxes, or casualty. I’m filing form 2106 because i'm a qualified. Web expenses you paid that relate to the work space as well as other areas of the home. Web home office deduction worksheet instructions:complete a separate worksheet for each business/activity. The purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. What has to add up to line 16a. Web 1 reply michaeldc new member june 5, 2019 4:37 pm there is an error on the employee home office worksheet, line 11. This is all because of the coronavirus pandemic that has. This is asking for total wages that relate. Go to line 8 and. Web form 2106 line 16b from both copies of the employee home office worksheet, when added together, must equal line 16a. The term “home” includes a. Web home office deduction worksheet please use this worksheet to give us information about your home office for preparation of your tax returns. Entering employee home office expenses. Web free home office deduction worksheet (excel) for taxes #general #taxes tom smery updated on: Web businesses and self employed. Line 11 must be entered. they're asking for line 11. If no one in your household has received any income in the last 30 days, the applicant must complete and. Web a lot of employees right now are stuck at home behind their desks still doing the same thing as if they’re in the office. Do not send recipts or bank/credit card statements. This is all because of the coronavirus pandemic that has. Open the return, and go to schedule a (1040). Web form 2106 line 16b from both copies of the employee home office worksheet, when added together, must equal line 16a. Line 16b is dividing the home office. I’m filing form 2106 because i'm a qualified. Web businesses and self employed. What has to add up to line 16a. Make sure if you enter home mortgage interest, real estate taxes, or casualty. Web home office deduction worksheet instructions:complete a separate worksheet for each business/activity. So the employee is you in this case. This is asking for total wages that relate. July 25, 2023 the home office deduction is one of the most significant tax. An ordinary expense is one that is common and accepted in your field of trade,. Web what this means is you need to convince your employer to reimburse you for home office expenses. Web employees file this form to deduct ordinary and necessary expenses for their job. Go to line 8 and.Home Office Deduction Worksheet —

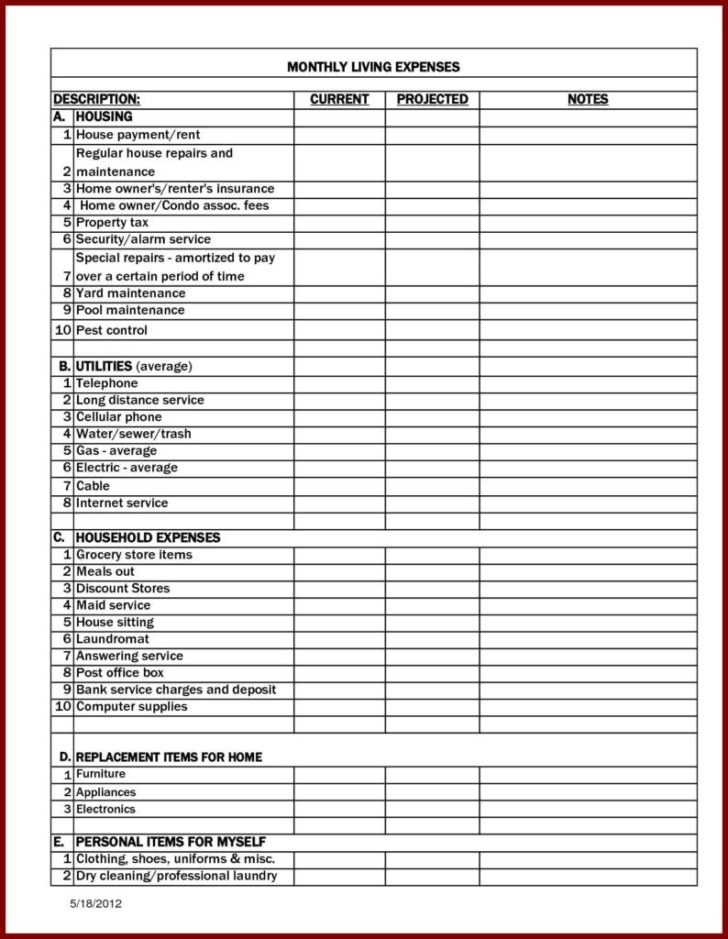

Home Office Expense Spreadsheet Printable Spreadsheet home office tax

15 Home Office Employee Worksheet /

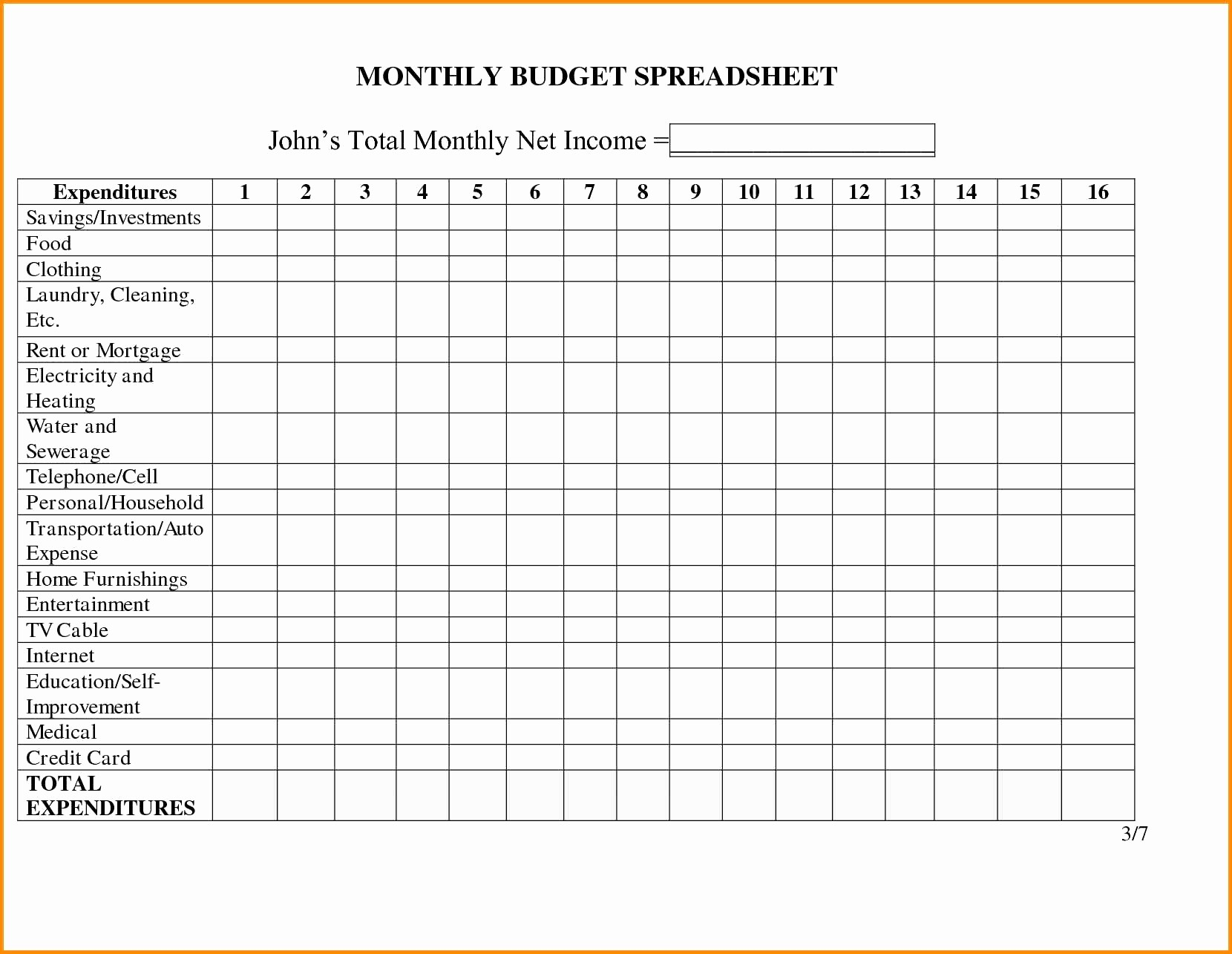

Monthly+Business+Expense+Worksheet+Template Business budget template

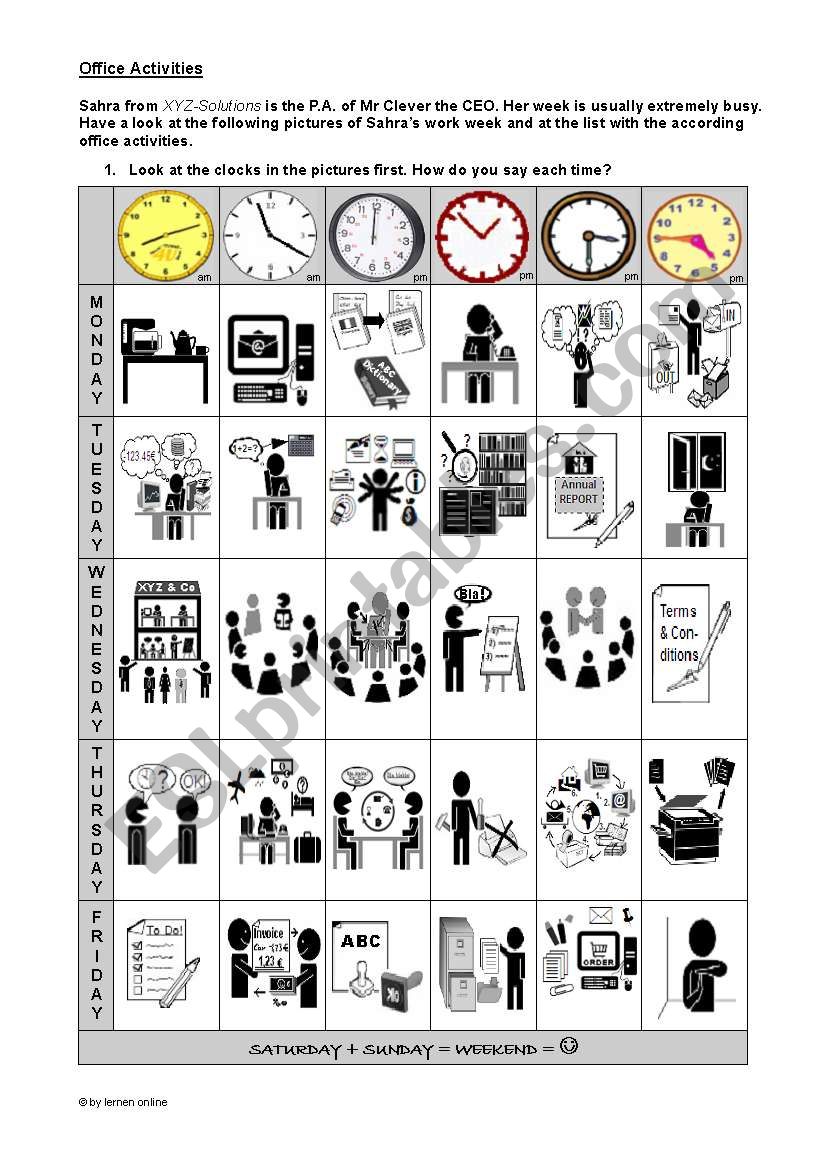

Office Activities ESL worksheet by Mietz

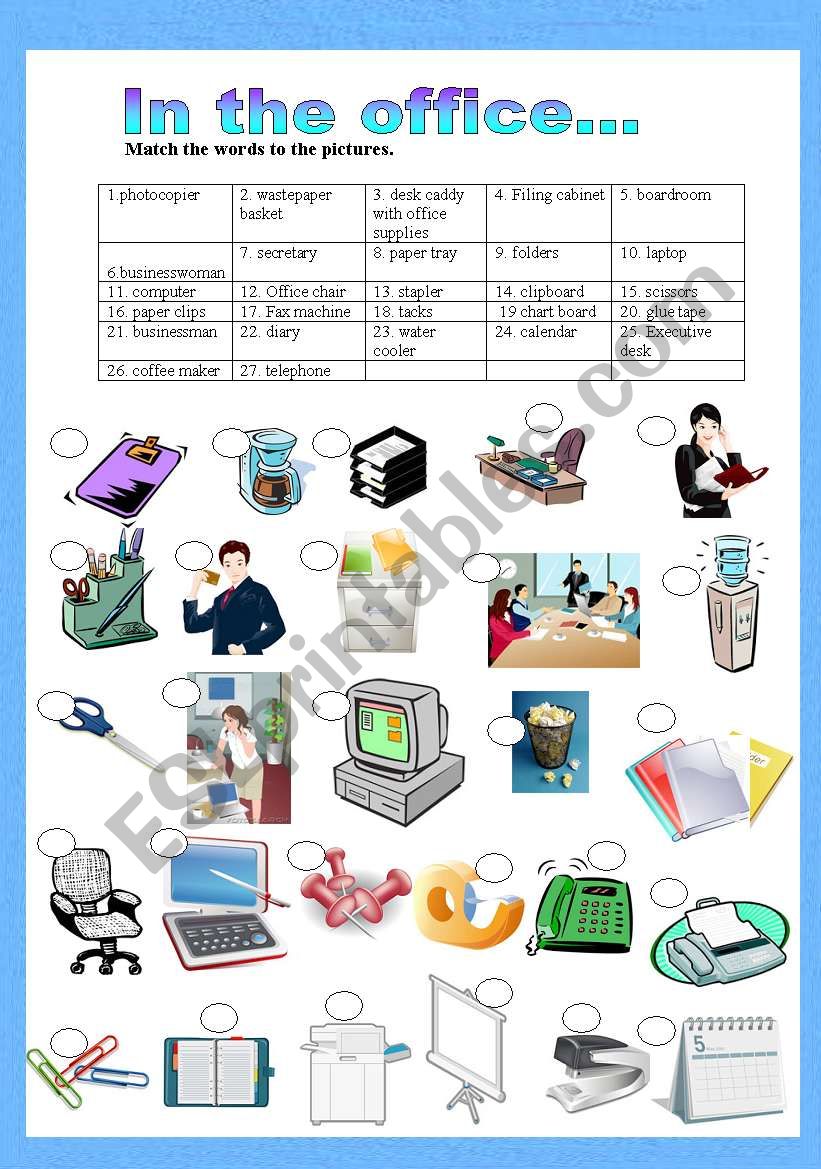

In the office ESL worksheet by gilorit

Home Office Deduction Worksheet (Excel)

Simplified Method Worksheet 2021 Home Office Simplified Method

Fillable Online Home office worksheet Fax Email Print pdfFiller

Home Office Deduction Worksheet HMDCRTN

If You Use Part Of Your Home Exclusively And Regularly For Conducting Business, You May Be Able To Deduct Expenses Such As.

Line 11 Must Be Entered. They're Asking For Line 11.

Web Free Home Office Deduction Worksheet (Excel) For Taxes #General #Taxes Tom Smery Updated On:

The Purpose Of This Publication Is To Provide Information On Figuring And Claiming The Deduction For Business Use Of Your Home.

Related Post: