Employee Stock Transaction Worksheet

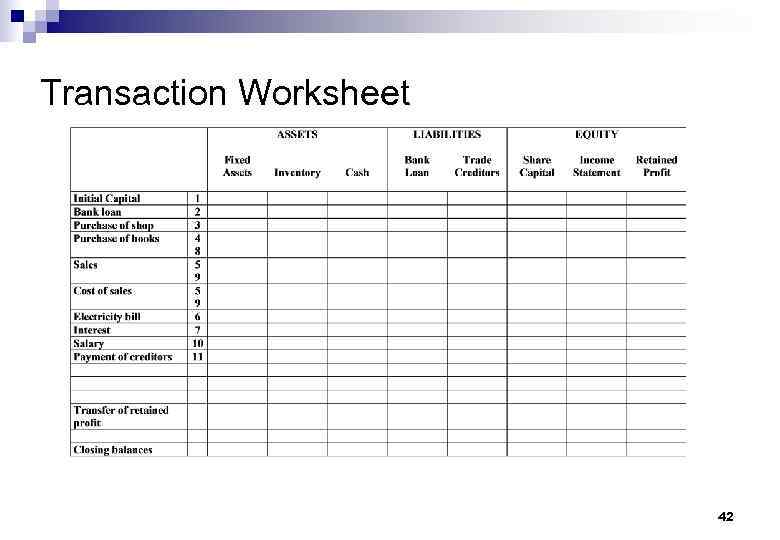

Employee Stock Transaction Worksheet - Solved • for intuit • 230 • revised december 05, 2022 • for intuit • 230 • revised december 05, 2022 web if your employer offers an. Web the value that you can realize from your options is generally the difference between the strike price (the amount you will pay to exercise the options) and the stock’s market. Web this worksheet is for any transaction other then homesales that would typically be entered on a schedule d. Web this capital gains transaction worksheet has been key to my successful prior tax year entries of espp and rsu and iso employee stock sales to reconcile. The quiz/worksheet combo is useful in testing your knowledge of stock transactions. The different types of stock transactions are on the. Web qualified an espp that qualifies under section 423 of the internal revenue code (irc) allows employees to purchase company stock at a discount and postpone recognition. Web employee stock transaction worksheet. Web if i understand the question correctly, go to the capital gain (loss) transaction worksheet, part 4 employer stock quickzoom (employer stock. Web employee stock ownership plan review worksheet use this worksheet as a tool to help design esop documents that meet the applicable requirements. Web benefits of employee stock option plan. Like article will help you decide which. Web qualified an espp that qualifies under section 423 of the internal revenue code (irc) allows employees to purchase company stock at a discount and postpone recognition. Web this capital gains transaction worksheet has been key to my successful prior tax year entries of espp and. Employee stock option plans are offered at a price lower than the market price,. Solved • for intuit • 230 • revised december 05, 2022 • for intuit • 230 • revised december 05, 2022 web if your employer offers an. Web about this quiz & worksheet. Some of the benefits are mentioned below: Last and previous years i went. The quiz/worksheet combo is useful in testing your knowledge of stock transactions. Web 8 minute read file for less and get more. Get started for free stock options and stock purchase plans are a popular way for employers to pad. Web instructions instructions for form 8949 (2022) sales and other dispositions of capital assets section references are to the internal. Web 1 best answer willcasp level 1 i found the answer on another thread. Get started for free stock options and stock purchase plans are a popular way for employers to pad. Web this worksheet is for any transaction other then homesales that would typically be entered on a schedule d. The quiz/worksheet combo is useful in testing your knowledge. Get started for free stock options and stock purchase plans are a popular way for employers to pad. Some of the benefits are mentioned below: Web qualified an espp that qualifies under section 423 of the internal revenue code (irc) allows employees to purchase company stock at a discount and postpone recognition. Web 1 best answer willcasp level 1 i. Last and previous years i went to the employee stock transaction worksheet. Your max tax refund is guaranteed. Web there are five primary ways of entering stock and other capitalized gain and waste transactions on the schedule diameter. Web benefits of employee stock option plan. Web 1 best answer willcasp level 1 i found the answer on another thread. Your max tax refund is guaranteed. On windows, select override from the drop down. Web web input and categorize transactions. Web this worksheet is for any transaction other then homesales that would typically be entered on a schedule d. I have not been able to access it through the. Like article will help you decide which. Web benefits of employee stock option plan. Web the value that you can realize from your options is generally the difference between the strike price (the amount you will pay to exercise the options) and the stock’s market. Solved • for intuit • 230 • revised december 05, 2022 • for intuit •. The quiz/worksheet combo is useful in testing your knowledge of stock transactions. Web this capital gains transaction worksheet has been key to my successful prior tax year entries of espp and rsu and iso employee stock sales to reconcile. Web there are five primary ways of entering stock and other capitalized gain and waste transactions on the schedule diameter. Like. Web web input and categorize transactions. Web employee stock ownership plan review worksheet use this worksheet as a tool to help design esop documents that meet the applicable requirements. Web instructions instructions for form 8949 (2022) sales and other dispositions of capital assets section references are to the internal revenue code unless otherwise noted. Web there are five primary ways. Web benefits of employee stock option plan. Web web input and categorize transactions. Web 8 minute read file for less and get more. Web 1 best answer willcasp level 1 i found the answer on another thread. Last and previous years i went to the employee stock transaction worksheet. I have not been able to access it through the. On windows, select override from the drop down. The quiz/worksheet combo is useful in testing your knowledge of stock transactions. Web employee stock transaction worksheet. Web if i understand the question correctly, go to the capital gain (loss) transaction worksheet, part 4 employer stock quickzoom (employer stock. Web about this quiz & worksheet. Employee stock option plans are offered at a price lower than the market price,. The different types of stock transactions are on the. Get started for free stock options and stock purchase plans are a popular way for employers to pad. Web the value that you can realize from your options is generally the difference between the strike price (the amount you will pay to exercise the options) and the stock’s market. Web there are five primary ways of entering stock and other capitalized gain and waste transactions on the schedule diameter. Web instructions instructions for form 8949 (2022) sales and other dispositions of capital assets section references are to the internal revenue code unless otherwise noted. Some of the benefits are mentioned below: Right click on line 2 in the worksheet. Like article will help you decide which. Web if i understand the question correctly, go to the capital gain (loss) transaction worksheet, part 4 employer stock quickzoom (employer stock. Web 1 best answer willcasp level 1 i found the answer on another thread. Web 8 minute read file for less and get more. Web qualified an espp that qualifies under section 423 of the internal revenue code (irc) allows employees to purchase company stock at a discount and postpone recognition. Web employee stock transaction worksheet. Get started for free stock options and stock purchase plans are a popular way for employers to pad. Web benefits of employee stock option plan. Web the value that you can realize from your options is generally the difference between the strike price (the amount you will pay to exercise the options) and the stock’s market. Web this worksheet is for any transaction other then homesales that would typically be entered on a schedule d. Some of the benefits are mentioned below: Solved • for intuit • 230 • revised december 05, 2022 • for intuit • 230 • revised december 05, 2022 web if your employer offers an. Web there are five primary ways of entering stock and other capitalized gain and waste transactions on the schedule diameter. Your max tax refund is guaranteed. Last and previous years i went to the employee stock transaction worksheet. If the current market price is $100,. I have not been able to access it through the.NES MSF 2016 FINANCIAL ACCOUNTING SESSION 1 Introduction

Transaction Sheet Template SampleTemplatess SampleTemplatess

50 Standard Stock Card Template Excel For Free with Stock Card Template

Financial Transaction Worksheet Template Equity Equals Assets Minus

Practice Transaction Worksheet and Financial Statement Exercises

Stock Options Software Template JIAN Business Power Tools

Trading Spreadsheet Template in Investment Stock Trading Journal

Stock Tracking Spreadsheet Template Google Spreadshee stock tracking

Stock Tracking Spreadsheet Excel throughout Proposal Tracking

LO 4.7 Use a 10column worksheet (optional step in the accounting cycle

Web Employee Stock Ownership Plan Review Worksheet Use This Worksheet As A Tool To Help Design Esop Documents That Meet The Applicable Requirements.

The Quiz/Worksheet Combo Is Useful In Testing Your Knowledge Of Stock Transactions.

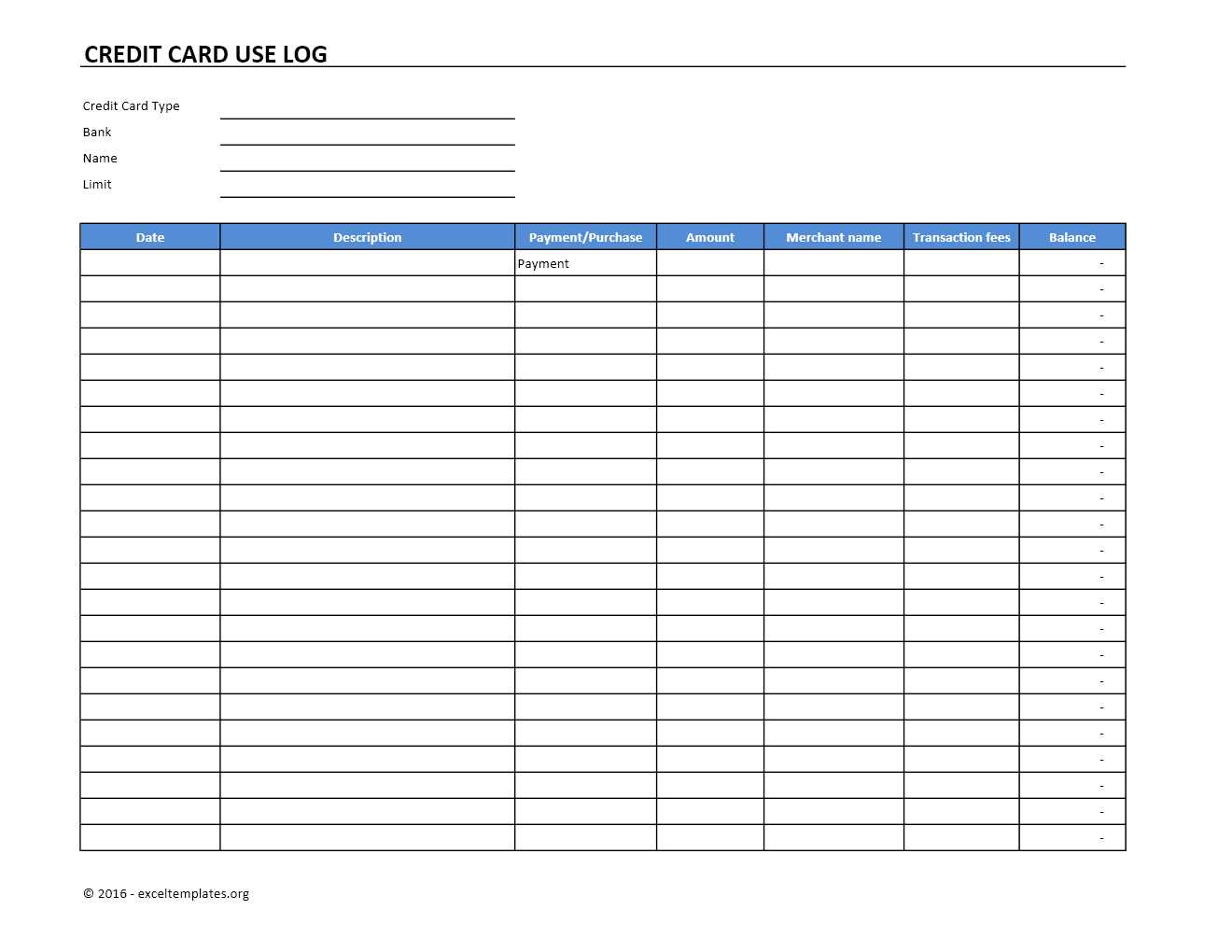

Web Web Input And Categorize Transactions.

Web This Capital Gains Transaction Worksheet Has Been Key To My Successful Prior Tax Year Entries Of Espp And Rsu And Iso Employee Stock Sales To Reconcile.

Related Post: