Understanding Your Paycheck Worksheet

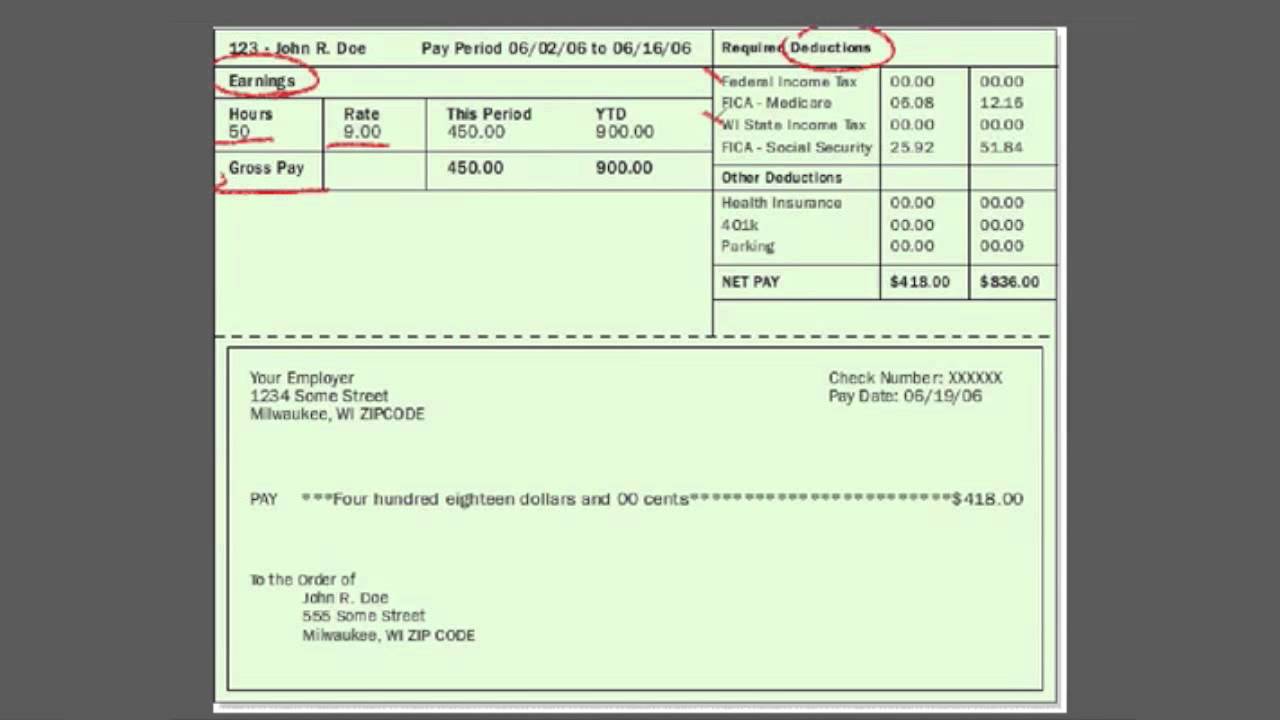

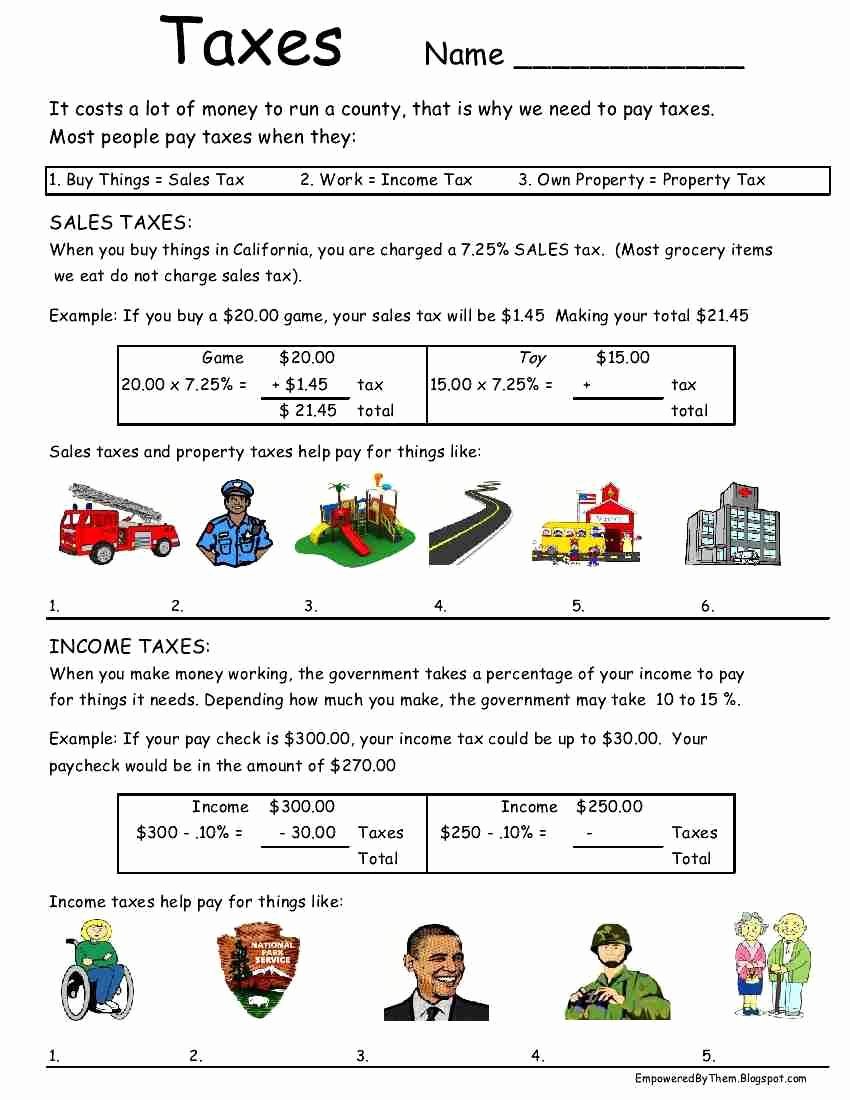

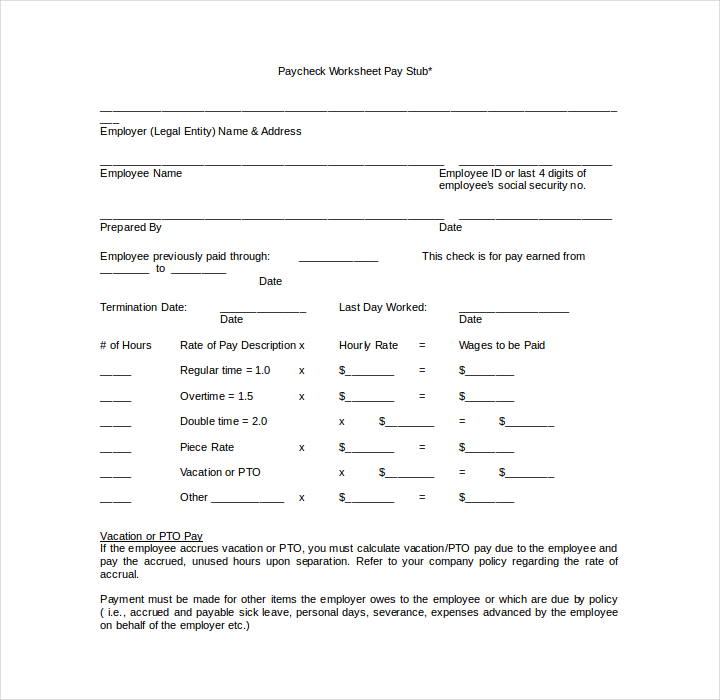

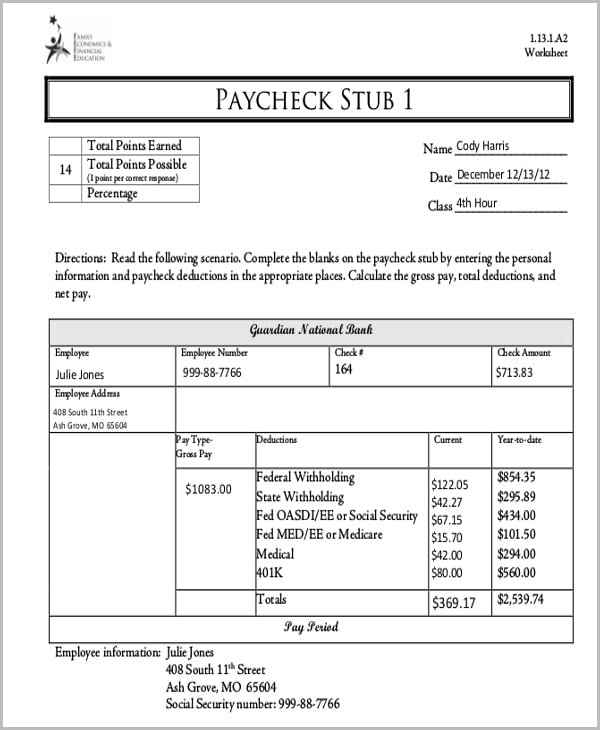

Understanding Your Paycheck Worksheet - Net income is what you actually receive after deductions. Each lesson includes the handouts and visuals needed to teach the lesson. $_____ social security deduction calculate joe’s medicare deduction, which is 1.45% of his gross pay. The first section of your paycheck will display your gross income. Most paychecks come with a “stub” (anattachment) that shows the total earnedand the deductions. Web ii tudent worksheet 1 of 2 calculating the numbers in your paycheck name: Web easy prep lesson uses realistic paystubs to teach students how to understand their paycheck including gross vs. People often confuse a paycheck and a pay stub. This figure represents your total earnings before any deductions. Big idea the amount of money you earn from your job is different from the amount of money you receive in your paycheck. Big idea understanding why and how taxes and other items are deducted from a worker’s paycheck is an important step toward gaining financial knowledge. The first section of your paycheck will display your gross income. How do taxes affect the money a person receives in their paycheck? Each lesson includes the handouts and visuals needed to teach the lesson. The. You might be wondering why money is being taken out of your pay and what exactly it's going toward. Money may also be deducted, or subtracted, from. $_____ social security deduction calculate joe’s medicare deduction, which is 1.45% of his gross pay. Objectives understand what taxes are deducted from our paychecks Perfect for personal finance, consumer math, economics, vocational, employment,. Essential questions what are taxes and why do we pay them? Is designed for use in high school personal finance classes. The lessons employ various teaching strategies to engage students so that they have opportunities to apply the concepts being taught. Web • list the elements of a pay stub • define withholdings • identify advantages and disadvantages of direct. Payroll taxes and income tax. People often confuse a paycheck and a pay stub. Each lesson includes the handouts and visuals needed to teach the lesson. Includes lesson complete with guided notes and practice worksheet plus a scavenger hunt activity in both digital and paper versions! Web updated nov 17, 2022 students analyze statements about taxes to better understand how. Web easy prep lesson uses realistic paystubs to teach students how to understand their paycheck including gross vs. This is what you earnedbefore any amounts were deducted. Essential questions what are taxes and why do we pay them? True (t) false (f) example or explanation for your choice 3. The biz kid$ learn about taxes and other deductions that are. Web lesson description students compute the gross pay for fictional john dough given his hourly wage and the number of hours worked. Web this is the math worksheet and answer key for it's payday. Pay stubs—the part of the paycheck that lists important information like withholdings, wages earned during the pay period and where your money is going—are important to. Each lesson includes the handouts and visuals needed to teach the lesson. The taxes and deductions on your pay stub may not always be easy to. Web displaying 8 worksheets for understanding your paycheck. Objectives understand what taxes are deducted from our paychecks Web ii tudent worksheet 1 of 2 calculating the numbers in your paycheck name: This is what you earnedbefore any amounts were deducted. $_____ (answer to #1) x.062= 3. Web top 10 tips for (1)understanding your paycheck examine your gross pay. Employers withhold (or deduct) some of their employees’ pay in order to cover. Web lesson description students compute the gross pay for fictional john dough given his hourly wage and the number of. Students receive a sample earnings statement and break down the different categories of information. The taxes and deductions on your pay stub may not always be easy to. $_____ (answer to #1) x.0145= 5. They compare gross pay with net pay. The lessons employ various teaching strategies to engage students so that they have opportunities to apply the concepts being. $_____ social security deduction calculate joe’s medicare deduction, which is 1.45% of his gross pay. Objectives understand what taxes are deducted from our paychecks Includes lesson complete with guided notes and practice worksheet plus a scavenger hunt activity in both digital and paper versions! Essential questions what are taxes and why do we pay them? The biz kid$ learn about. Payroll taxes and income tax. Episode synopsis what’s on your pay stub? Web displaying 8 worksheets for understanding your paycheck. Pay stubs—the part of the paycheck that lists important information like withholdings, wages earned during the pay period and where your money is going—are important to understand. A pay stub is generally broken down into three main sections: It includes your regular hourly or salaried pay, overtime. True (t) false (f) example or explanation for your choice 3. $ _____medicare deduction add all of joe’s deductions together to figure out the total amount taken out of each paycheck. This unit covers types of taxes withheld, deductions, net pay, and calculating gross pay. People often confuse a paycheck and a pay stub. Includes lesson complete with guided notes and practice worksheet plus a scavenger hunt activity in both digital and paper versions! $_____ (answer to #1) x.062= 3. Net pay, deductions, income taxes and more! Essential questions what are taxes and why do we pay them? This figure represents your total earnings before any deductions. They compare gross pay with net pay. The biz kid$ learn about taxes and other deductions that are taken out of your paycheck. The lessons employ various teaching strategies to engage students so that they have opportunities to apply the concepts being taught. People often confuse gross income and net income. Big idea understanding why and how taxes and other items are deducted from a worker’s paycheck is an important step toward gaining financial knowledge. Employers withhold (or deduct) some of their employees’ pay in order to cover. Web understanding why and how taxes and other items are deducted from a worker’s paycheck is an important step toward gaining financial knowledge. Web top 10 tips for (1)understanding your paycheck examine your gross pay. True (t) false (f) example or explanation for your choice earn 2. Web understanding your pay, benefits, and paycheck. Calculating the numbers in your paycheck knowing how to read the pay stub from your paycheck can help you manage your money. Web ii tudent worksheet 1 of 2 calculating the numbers in your paycheck name: They compare gross pay with net pay. Web updated nov 17, 2022 students analyze statements about taxes to better understand how taxes affect people’s paychecks. Students then break into groups of four and play the 'paycheck mystery word game'. Students receive a sample earnings statement and break down the different categories of information. Web lesson description students compute the gross pay for fictional john dough given his hourly wage and the number of hours worked. The first section of your paycheck will display your gross income. It includes your regular hourly or salaried pay, overtime. Web 2 days agothese templates simplify the process and enhance transparency, enabling you to understand your earnings comprehensively. Web this is the math worksheet and answer key for it's payday.maxresdefault.jpg

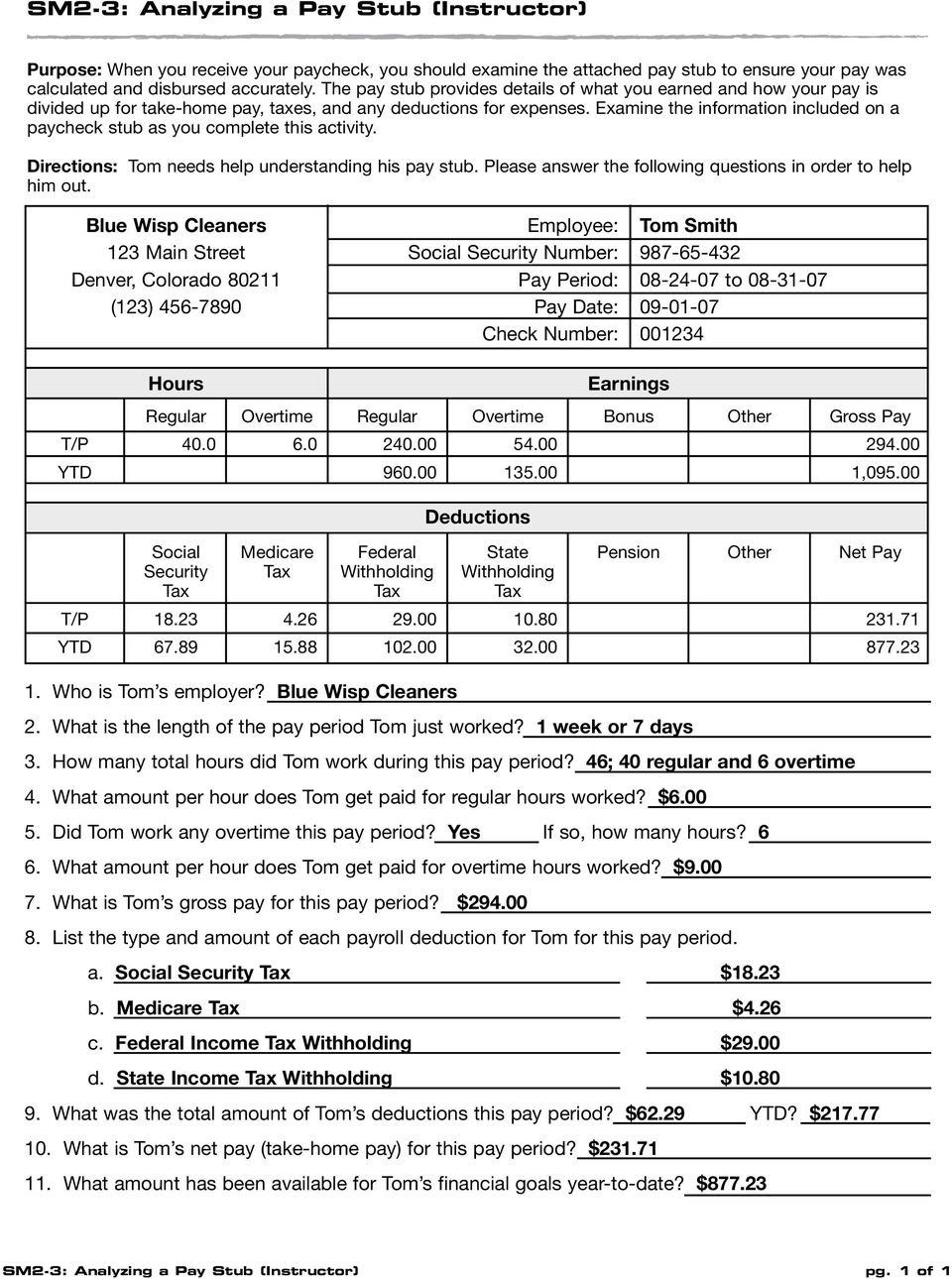

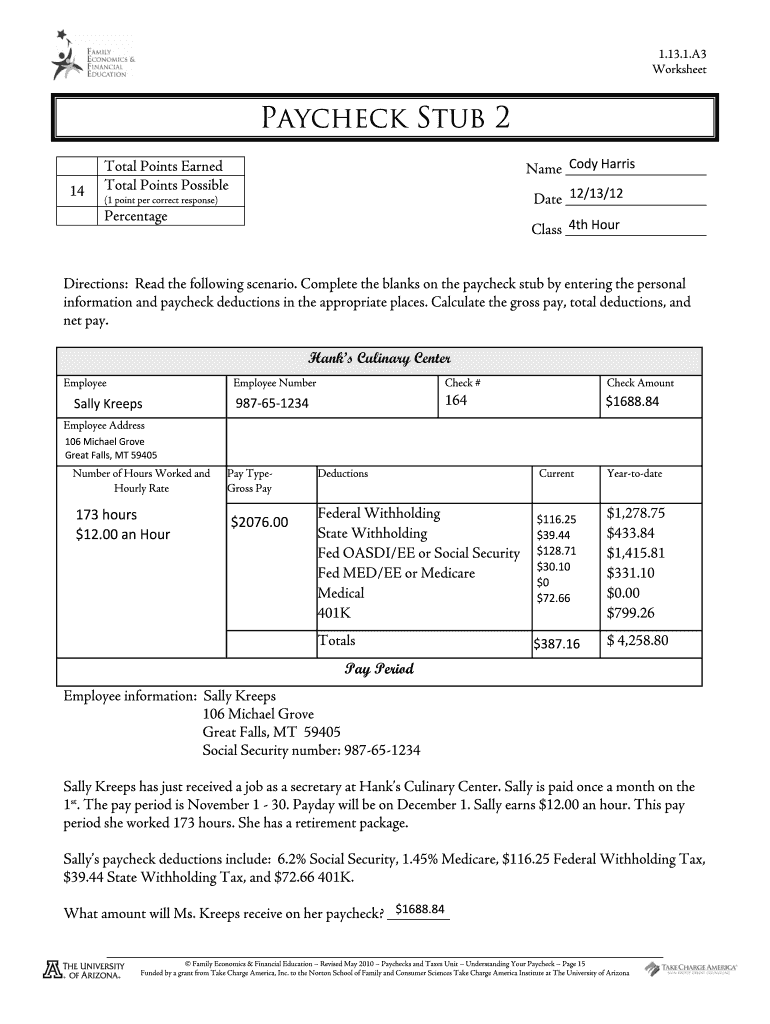

50 Reading A Pay Stub Worksheet Chessmuseum Template Library

️Understanding Paycheck Worksheet Free Download Gambr.co

Understanding Your Paycheck Worksheet

️Understanding Your Paycheck Worksheet Free Download Gmbar.co

36 Understanding Your Paycheck Worksheet support worksheet

Reading A Pay Stub Worksheet —

43 understanding your paycheck worksheet Worksheet Was Here

Understanding Your Paycheck Worksheet Answer Key Fill Online

️Understanding Your Paycheck Worksheet Answers Free Download Goodimg.co

Perfect For Personal Finance, Consumer Math, Economics, Vocational, Employment, And Business Classes.

Big Idea The Amount Of Money You Earn From Your Job Is Different From The Amount Of Money You Receive In Your Paycheck.

True (T) False (F) Example Or Explanation For Your Choice 3.

$_____ (Answer To #1) X.062= 3.

Related Post: