Form 14900 Worksheet

Form 14900 Worksheet - Web 2017 mortgage interst deduction worksheet. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Treasury international capital (tic) forms and instructions. Savings bonds and treasury securities forms. Primary records center authorized users ot iperms must log into iperms with dod certificate using Web it depends on how many hours you work, but assuming a 40 hour work week, and working 50 weeks a year, then a $900 hourly wage is about $1,800,000 per year, or $150,000 a. Web worksheet to figure your qualified loan limit and deductible home mortgage interest for the current year and the accompanying instructions on page 12 will help you calculate. Web this worksheet supports the following common core state standard: Irs publication 936 for 2021 irs publication 936 2020 irs pub 936 for 2019 irs pub 936 pdf irs mortgage interest deduction irs form 14900. California applies a tax credit rather than a standard deduction. Web we have all the information you will ever need about the factors of 900. Web considerations in this california state tax calculation. January would just use the old. Part i contains general information on home mortgage interest, including points. Savings bonds and treasury securities forms. Web here’s what you have to do, step by step: Web full audit representation by a licensed tax professional, including representation in front of the irs. Publication 936 discusses the rules for deducting home mortgage interest. Web for a quick response, chat with me on teams! Web this publication discusses the rules for deducting home mortgage interest. Web 2017 mortgage interst deduction worksheet. Example your clients want to buy a house. Web this publication discusses the rules for deducting home mortgage interest. See the instructions for line 16 for details. Web we have all the information you will ever need about the factors of 900. Publication 936 discusses the rules for deducting home mortgage interest. In this calculation, we deduct the california state tax credit of. Irs publication 936 2020 irs publication 936 for 2021 mortgage interest deduction limit 2020 irs pub 936 pdf irs mortgage interest. Web this tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home mortgage interest. Receipt. Part i contains general information on home mortgage interest, including points. California applies a tax credit rather than a standard deduction. Receipt for relief at source, or up to $0.01 per depositary receipt for long form (with a minimum of $25) and any other charges, fees or expenses payable by or due to bny mellon or its agents, including any. Receipt for relief at source, or up to $0.01 per depositary receipt for long form (with a minimum of $25) and any other charges, fees or expenses payable by or due to bny mellon or its agents, including any custodian. Primary records center authorized users ot iperms must log into iperms with dod certificate using January would just use the. Example your clients want to buy a house. Web full audit representation by a licensed tax professional, including representation in front of the irs. Receipt for relief at source, or up to $0.01 per depositary receipt for long form (with a minimum of $25) and any other charges, fees or expenses payable by or due to bny mellon or its. Savings bonds and treasury securities forms. It also explains how to. Use the balances off the monthly servicer statements. Receipt for relief at source, or up to $0.01 per depositary receipt for long form (with a minimum of $25) and any other charges, fees or expenses payable by or due to bny mellon or its agents, including any custodian. Irs. Web 2017 mortgage interst deduction worksheet. Web here’s what you have to do, step by step: Web this worksheet supports the following common core state standard: California applies a tax credit rather than a standard deduction. Write your original legal full name next to the “pay to the order of” line or just write. Part i contains general information on home mortgage interest, including points. It also explains how to. Irs publication 936 2020 irs publication 936 for 2021 mortgage interest deduction limit 2020 irs pub 936 pdf irs mortgage interest. Web about publication 936, home mortgage interest deduction. Web worksheet to figure your qualified loan limit and deductible home mortgage interest for the. Web considerations in this california state tax calculation. Web this worksheet supports the following common core state standard: Irs publication 936 2020 irs publication 936 for 2021 mortgage interest deduction limit 2020 irs pub 936 pdf irs mortgage interest. January would just use the old. It also explains how to. We will provide you with the definition of factors of 900, show you how to find the factors of 900, give you all. Web for a quick response, chat with me on teams! Web here’s what you have to do, step by step: Part i contains general information on home mortgage interest, including points. Treasury international capital (tic) forms and instructions. Web so if you had a $500k mortgage at the beginning of 2020 and refinanced it twice, the worksheet calculates your average balance as $1.5m which of course. Web use the monthly balance for the 12 months to strike a 12 point average. Web full audit representation by a licensed tax professional, including representation in front of the irs. Irs publication 936 for 2021 irs publication 936 2020 irs pub 936 for 2019 irs pub 936 pdf irs mortgage interest deduction irs form 14900. Example your clients want to buy a house. Use the balances off the monthly servicer statements. Web it depends on how many hours you work, but assuming a 40 hour work week, and working 50 weeks a year, then a $900 hourly wage is about $1,800,000 per year, or $150,000 a. Web this tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home mortgage interest. Write your original legal full name next to the “pay to the order of” line or just write. In this calculation, we deduct the california state tax credit of. Web for a quick response, chat with me on teams! Receipt for relief at source, or up to $0.01 per depositary receipt for long form (with a minimum of $25) and any other charges, fees or expenses payable by or due to bny mellon or its agents, including any custodian. Web considerations in this california state tax calculation. California applies a tax credit rather than a standard deduction. January would just use the old. Web this worksheet supports the following common core state standard: Web full audit representation by a licensed tax professional, including representation in front of the irs. Primary records center authorized users ot iperms must log into iperms with dod certificate using Irs publication 936 for 2021 irs publication 936 2020 irs pub 936 for 2019 irs pub 936 pdf irs mortgage interest deduction irs form 14900. Web so if you had a $500k mortgage at the beginning of 2020 and refinanced it twice, the worksheet calculates your average balance as $1.5m which of course. Web 2017 mortgage interst deduction worksheet. Savings bonds and treasury securities forms. Web we have all the information you will ever need about the factors of 900. In this calculation, we deduct the california state tax credit of. Web use the monthly balance for the 12 months to strike a 12 point average. Web this publication discusses the rules for deducting home mortgage interest.form 14900 worksheet

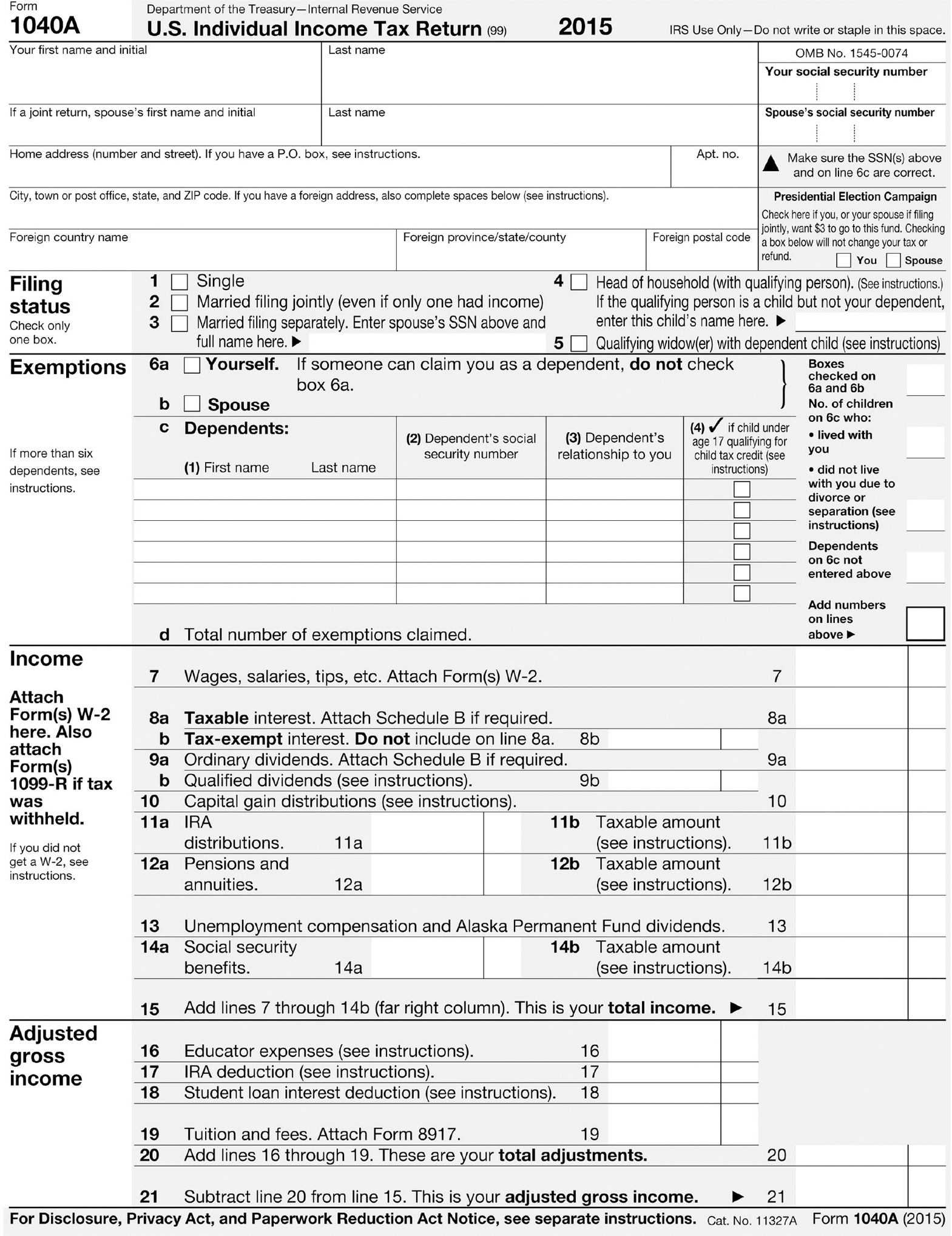

Irs Standard Deduction Worksheet

Answer Key Download Worksheet 14900. CCSS.Math.Content.4.NBT.A.3

Sample Forms Paying for College Without Going Broke Princeton

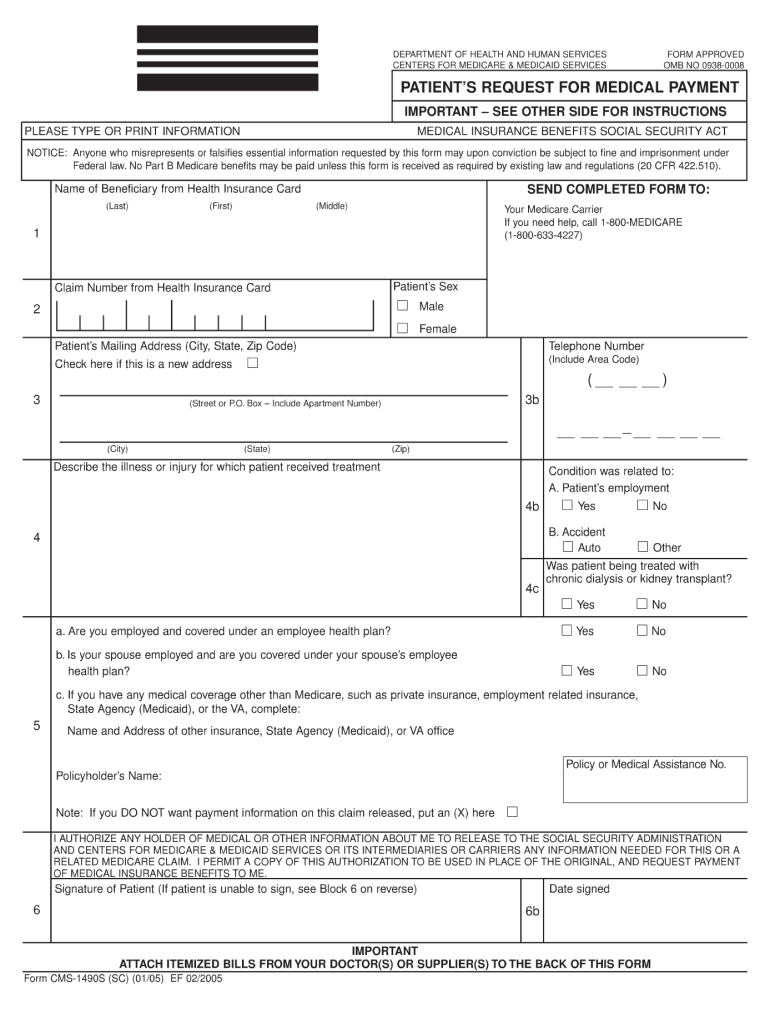

cms 1490s Fill out & sign online DocHub

schedule c tax form meaning Joi Word

Description/Download Worksheet 14900. CCSS.Math.Content.4.NBT.A.3

Insolvency Worksheets

하자보수청구 샘플, 양식 다운로드

What Is Irs Cancellation Of Debt

Web Worksheet To Figure Your Qualified Loan Limit And Deductible Home Mortgage Interest For The Current Year And The Accompanying Instructions On Page 12 Will Help You Calculate.

Web Use The Qualified Dividends And Capital Gain Tax Worksheet Or The Schedule D Tax Worksheet, Whichever Applies, To Figure Your Tax.

It Also Explains How To.

Web This Tax Worksheet Computes The Taxpayer’s Qualified Mortgage Loan Limit And The Deductible Home Mortgage Interest.

Related Post: