Government Spending Worksheet Answer Key

Government Spending Worksheet Answer Key - A plan for the federal government's revenues and spending for the coming year. “balancing the budget” means the government borrows more money than itspends. Web quick and easy worksheet to review the governments influence on the economy (taxes, spending, borrowing). What they are, who pays them, what kinds exist, and what they’re used for. This lesson tackles a variety of topics related to government spending, including the federal budget, mandatory versus discretionary spending, and. Web government spending learning objectives. F government should spend money. Classroom activity have students meet in small groups to compile a list of activities in which they or their family members have. Read the list of government expenses below. Web this lesson teaches the basics of taxes: This is likewise one of the factors by obtaining the soft documents of this icivics government spending answers. Web quick and easy worksheet to review the governments influence on the economy (taxes, spending, borrowing). 1) government purchases of goods and services and 2) transfer payments. F government should spend money. Web directions part a access the online fred dashboard: By relying on borrowed money, the government. Students learn how people’s income is taxed, how great. Web learn test match created by jinbe terms in this set (51) tax a required payment to local, state, or national government revenue income received by a government from taxes. Web key components of this quiz/worksheet duo will include topics such as interest on. This is likewise one of the factors by obtaining the soft documents of this icivics government spending answers. Quick andeasy worksheet to review the governments influence on the economy (taxes, spending, borrowing). Included in this download are editable/pdf versions of the. Classroom activity have students meet in small groups to compile a list of activities in which they or their. Web key components of this quiz/worksheet duo will include topics such as interest on debt, the federal government's biggest expense, the size of the u.s. Web there are negative effects if the government operates at a surplus. This is likewise one of the factors by obtaining the soft documents of this icivics government spending answers. A plan for making and. 1) government purchases of goods and services and 2) transfer payments. Web made for middle school. Web there are negative effects if the government operates at a surplus. Students will be able to: A plan for making and spending money. Describe what a budget is. Read the list of government expenses below. Web learn test match created by jinbe terms in this set (51) tax a required payment to local, state, or national government revenue income received by a government from taxes. 1) government purchases of goods and services and 2) transfer payments. Web terms in this set (22) budget. Web key components of this quiz/worksheet duo will include topics such as interest on debt, the federal government's biggest expense, the size of the u.s. Web learn test match created by jinbe terms in this set (51) tax a required payment to local, state, or national government revenue income received by a government from taxes. Students will be able to:. Web there are negative effects if the government operates at a surplus. Web government spending learning objectives. A plan for the federal government's revenues and spending for the coming year. Students learn how people’s income is taxed, how great. Web made for middle school. Web this lesson teaches the basics of taxes: Web quick and easy worksheet to review the governments influence on the economy (taxes, spending, borrowing). Included in this download are editable/pdf. Students learn how people’s income is taxed, how great. Read the list of government expenses below. Web terms in this set (22) budget. Students will be able to: People agree about how thegovernment spending name : Included in this download are editable/pdf. This quiz and worksheet allow students to test the following skills: Describe what a budget is. 1) government purchases of goods and services and 2) transfer payments. Students learn how people’s income is taxed, how great. Compare the national budgeting process to the personal. By relying on borrowed money, the government. Included in this download are editable/pdf versions of the. Web made for middle school. Web directions part a access the online fred dashboard: Included in this download are editable/pdf. Classroom activity have students meet in small groups to compile a list of activities in which they or their family members have. People agree about how thegovernment spending name : Web learn test match created by jinbe terms in this set (51) tax a required payment to local, state, or national government revenue income received by a government from taxes. Web terms in this set (22) budget. Web key components of this quiz/worksheet duo will include topics such as interest on debt, the federal government's biggest expense, the size of the u.s. The decrease in personal income taxes increases disposable. The government cuts business and personal income taxes and increases its own spending. Each year, the u.s.government maps out how much money it expects to bring in and how much money it plans to spend. A plan for the federal government's revenues and spending for the coming year. Web quick and easy worksheet to review the governments influence on the economy (taxes, spending, borrowing). Web government spending learning objectives. Included in this download are editable/pdf versions of the. Students learn how people’s income is taxed, how great. “balancing the budget” means the government borrows more money than itspends. Web there are negative effects if the government operates at a surplus. Monetary policy is the tools. Then write each expense in the correct place in the chart. Web made for middle school. Web icivics government spending answer key pdf aug 10, 2022. High school economics taxes & government spending study guide & test with key includes a study guide with 40 questions and answer key and a. Classroom activity have students meet in small groups to compile a list of activities in which they or their family members have. Each year, the u.s.government maps out how much money it expects to bring in and how much money it plans to spend. Students will be able to: Web learn test match created by jinbe terms in this set (51) tax a required payment to local, state, or national government revenue income received by a government from taxes. Describe what a budget is. This is likewise one of the factors by obtaining the soft documents of this icivics government spending answers. Web government spending learning objectives.Government Spending Worksheet Answers Escolagersonalvesgui

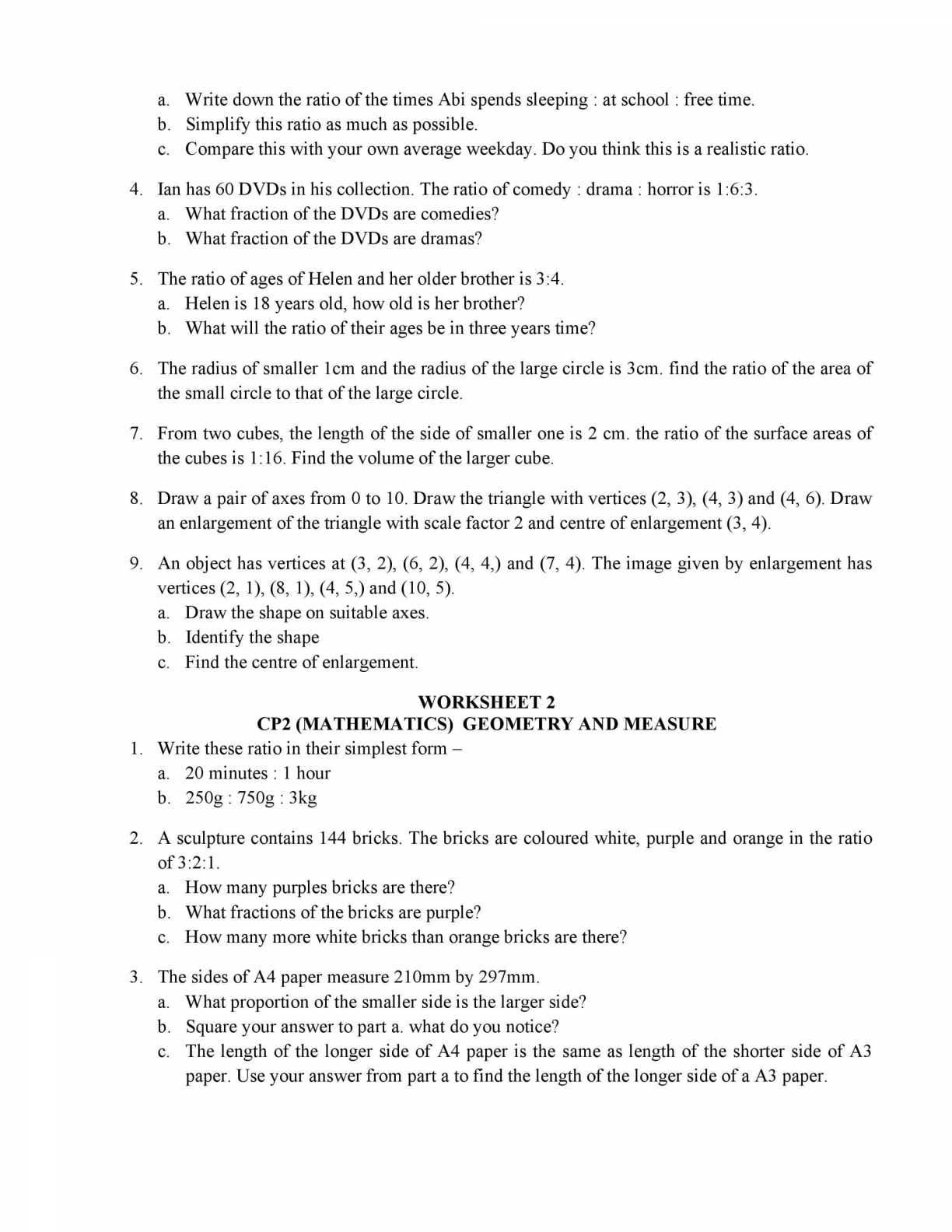

30 the Student Budget Worksheet Answers Education Template

Government Spending Worksheet Answers Worksheet List

Quiz & Worksheet Government Spending and Taxes as Fiscal Policy Tools

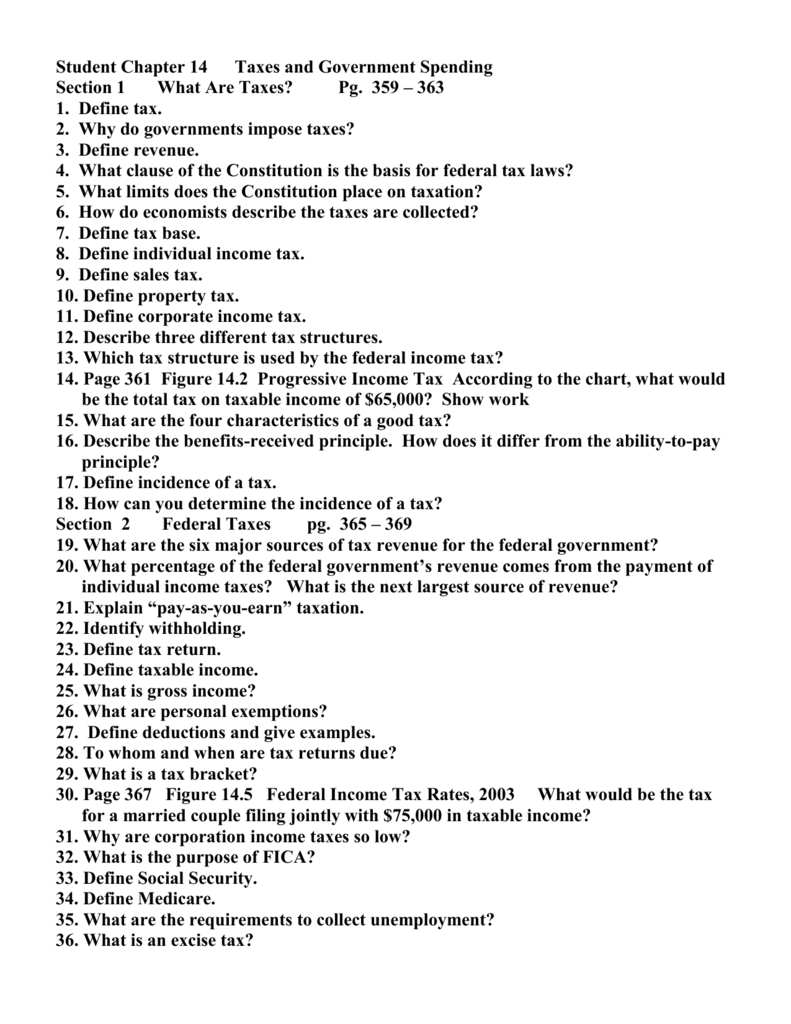

15+ Chapter 14 Taxes And Government Spending Worksheet Answers

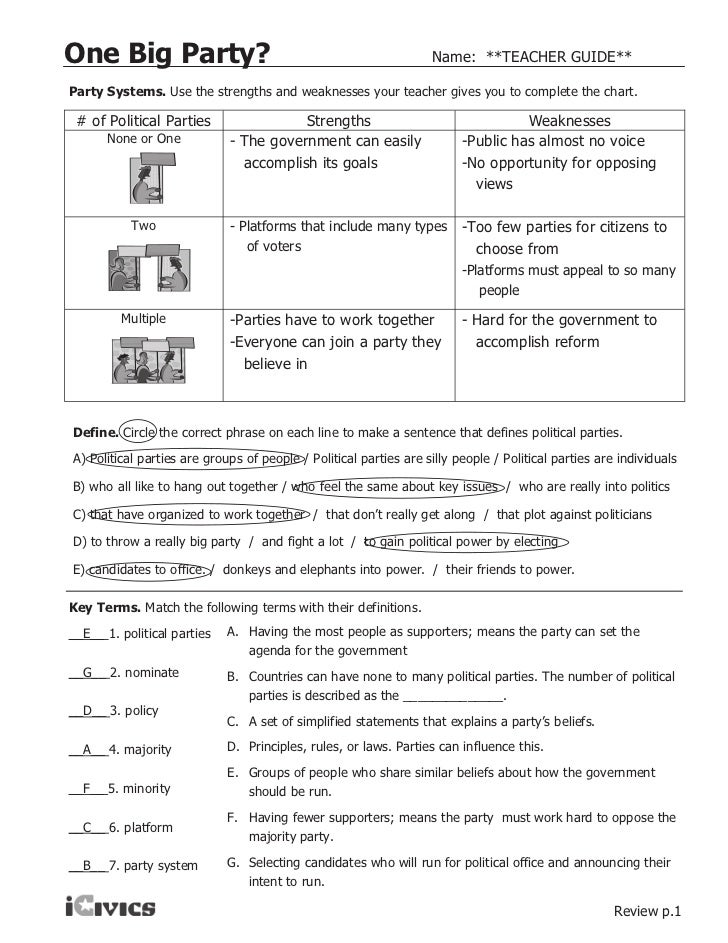

Icivics Worksheet P 1 Answers Limiting Ernment —

icivics worksheet p.1 answers

Review Of Government Spending Worksheet 2023 Alec Worksheet

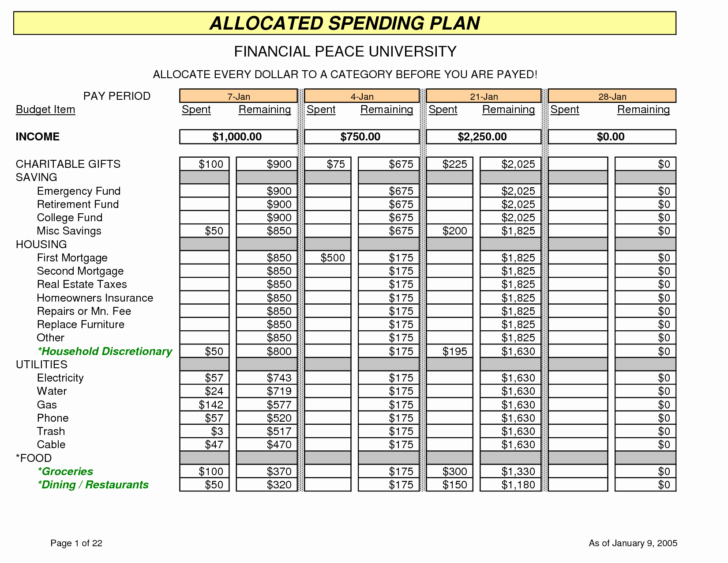

Spending Plan Worksheet —

39 government spending worksheet answers Worksheet Information

By Relying On Borrowed Money, The Government.

This Quiz And Worksheet Allow Students To Test The Following Skills:

What They Are, Who Pays Them, What Kinds Exist, And What They’re Used For.

Web Terms In This Set (22) Budget.

Related Post: