Home Office Deduction Worksheet

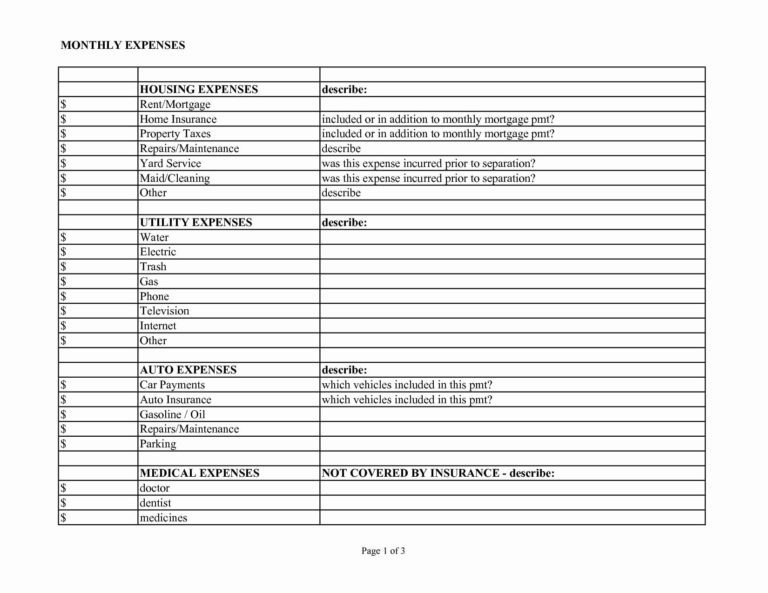

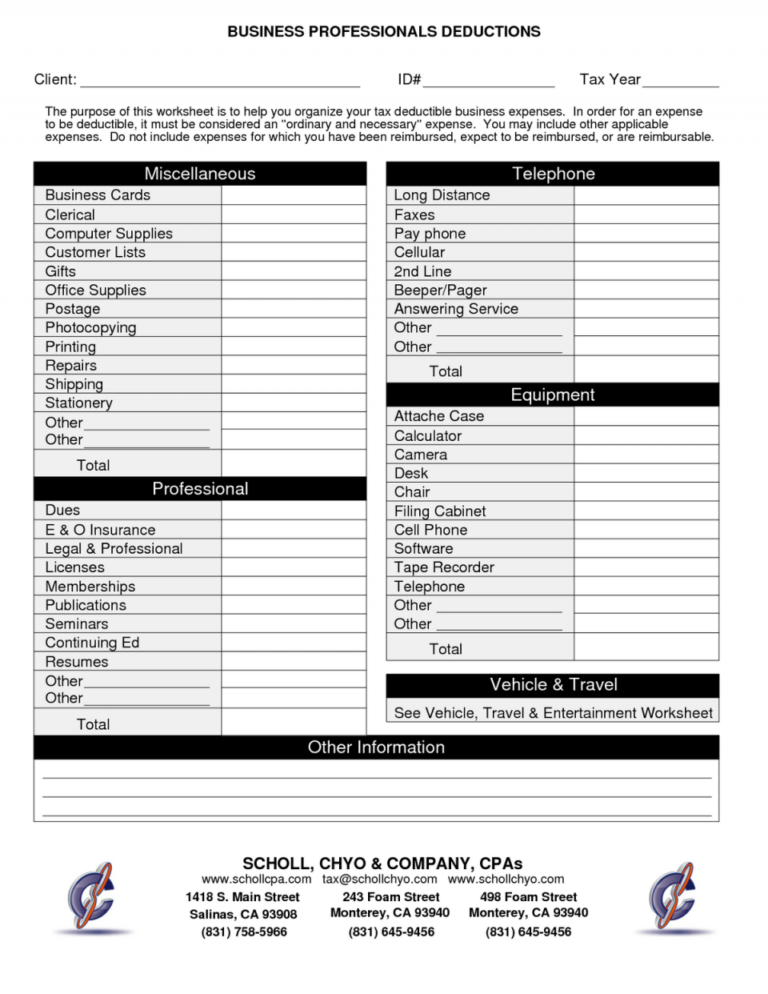

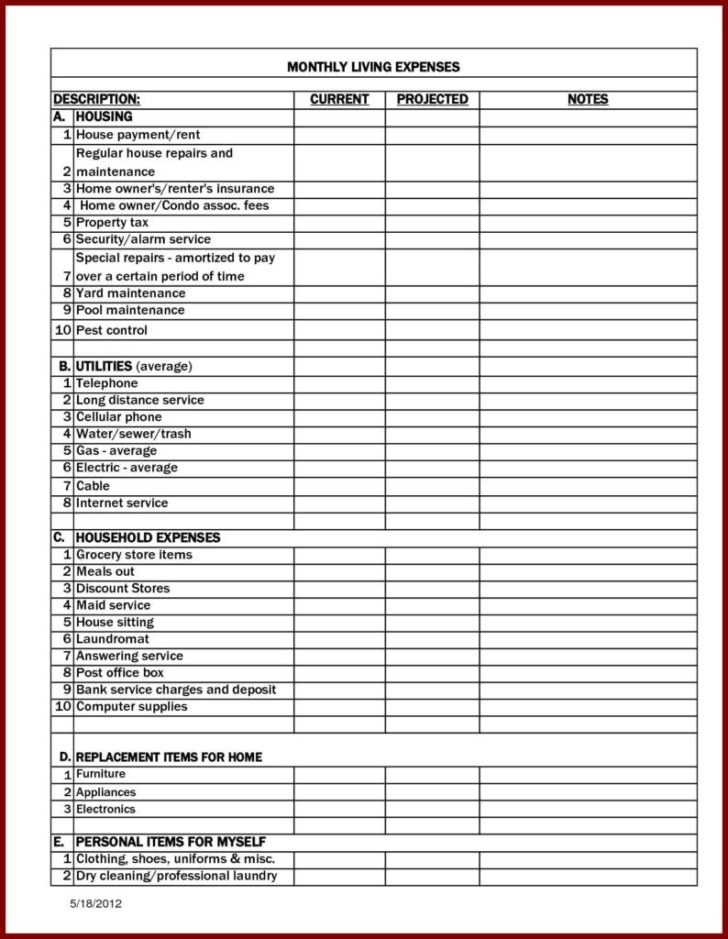

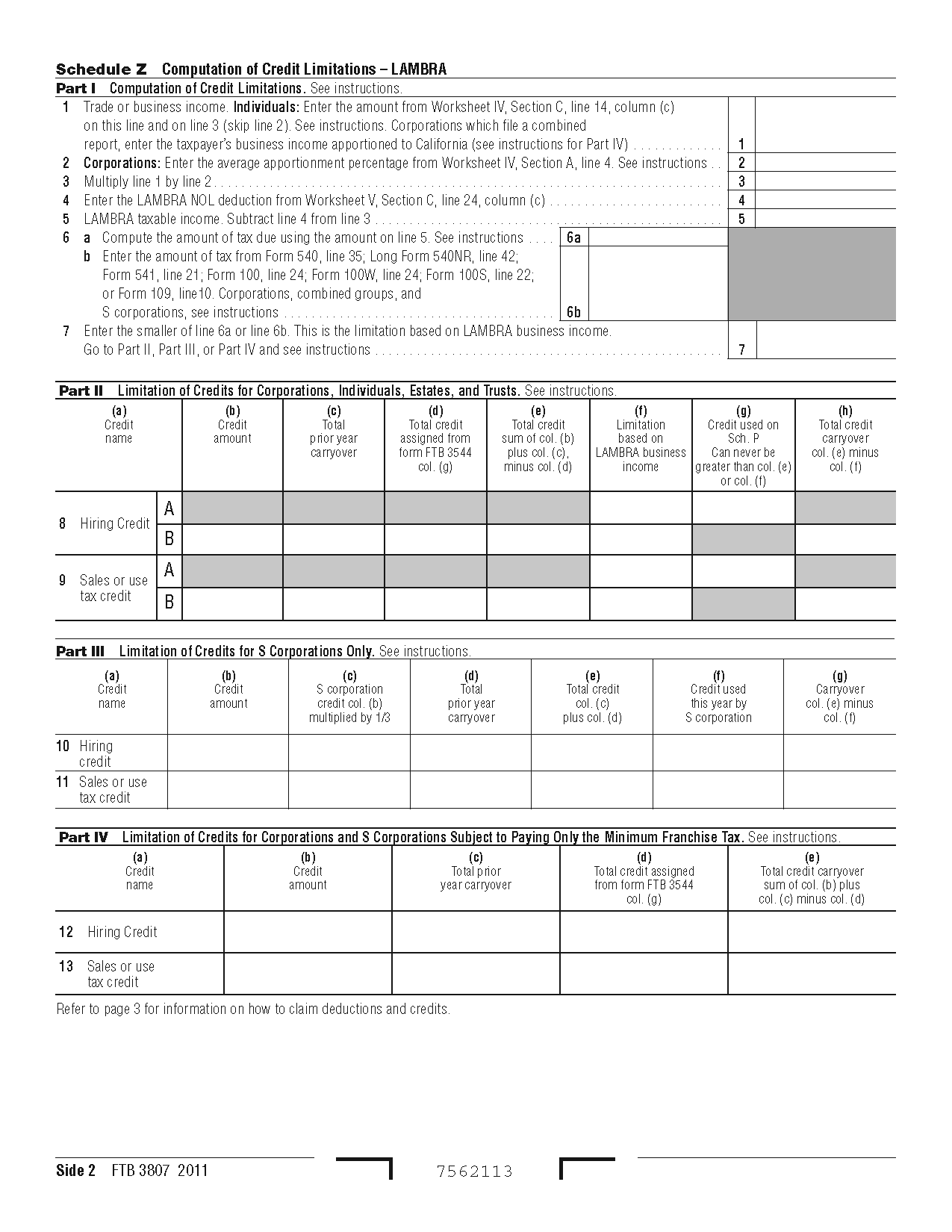

Home Office Deduction Worksheet - They include mortgage interest, insurance, utilities, repairs, maintenance, depreciation and rent. Web the home office tax deduction covers expenses for the business use of your home, including mortgage interest, rent, insurance, utilities, repairs, and depreciation. This worksheet will help you track direct and indirect expenses for the home office deduction. Web expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Please download, open in adobe, complete and securely upload the pdf to your client portal. There are two versions of this worksheet; ** indirect expenses are required for keeping up and running your entire home. Web your office is 10% (1 ÷ 10) of the total area of your home. Examples include your utility bills, mortgage interest or rent, Go to www.irs.gov/form8829 for instructions and the latest information. The best home office deduction worksheet for excel [free template] dragging down the exclusion. Do not send recipts or bank/credit card statements. Web home office deduction at a glance. If you work from home, you should know these important tax implications of setting up a home office. If your business qualifies for the home. Web there are two ways to take a deduction for your home office space. Web *direct expenses benefit the business part of your home. A non‐fillable pdf (what you are viewing now) and an online digital form. There are certain expenses taxpayers can deduct. There are two versions of this worksheet; The best home office deduction worksheet for excel [free template] dragging down the exclusion. Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Web $54.95 state filing fee $39.95 2 taxslayer premium learn more on taxslayer's website federal filing fee $0 state filing fee $0 3 Do not send recipts or bank/credit card. The irs wants to give you some of your money back, but uncle sam loves documentation. If your business qualifies for the home. Web the home office deduction form 8829 is available to both homeowners and renters. Web expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). **. If your business qualifies for the home. The term “home” includes a house, apartment, condominium, mobile home, boat, or similar property which provides basic living accommodations. Use this spreadsheet to prepare for tax time or to show your costs for your employer! Web there are two ways to take a deduction for your home office space. Please do not email. Web home office deduction worksheet please use this worksheet to give us information about your home office for preparation of your tax returns. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. If you work from home you can deduct a percentage of your mortgage or rent, insurance, taxes, utilities. This worksheet will help you track direct and indirect expenses for the home office deduction. Web home office deduction worksheet instructions:complete a separate worksheet for each business/activity. Do not send recipts or bank/credit card statements. See tutorial below home office blog post download the free spreadsheet Web the home office deduction form 8829 is available to both homeowners and renters. See tutorial below home office blog post download the free spreadsheet If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as mortgage interest, insurance, utilities, repairs, and depreciation for that area. Please download, open in adobe, complete and securely upload the pdf to your client portal. Web is. Web home office deduction worksheet instructions:complete a separate worksheet for each business/activity. For example, pretend your apartement a 800 honest feet, and your workstation is 80 square dogs. See tutorial below home office blog post download the free spreadsheet Web *direct expenses benefit the business part of your home. They include mortgage interest, insurance, utilities, repairs, maintenance, depreciation and rent. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. A non‐fillable pdf (what you are viewing now) and an online digital form. Web *direct expenses benefit the business part of your home. If you work from home, you should know these important tax implications of setting up a home office.. Web home office deduction worksheet there are two calculation methods to determine the home office deduction; Web the home office tax deduction covers expenses for the business use of your home, including mortgage interest, rent, insurance, utilities, repairs, and depreciation. If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as mortgage interest, insurance, utilities, repairs, and depreciation for that area. Do not send recipts or bank/credit card statements. The irs wants to give you some of your money back, but uncle sam loves documentation. If you work from home, you should know these important tax implications of setting up a home office. If your business qualifies for the home. Web home office deduction worksheet please use this worksheet to give us information about your home office for preparation of your tax returns. Table of contents do i qualify for the home office tax deduction? A non‐fillable pdf (what you are viewing now) and an online digital form. Web home office deduction at a glance. Taxpayers must meet specific requirements to claim home expenses as a deduction. Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Use a separate form 8829 for each home you used for business during the year. Web because there’s a cost to running a business, you’re allowed to deduct direct expenses related to your home office costs from your taxable income. ** indirect expenses are required for keeping up and running your entire home. The term “home” includes a house, apartment, condominium, mobile home, boat, or similar property which provides basic living accommodations. Examples include your utility bills, mortgage interest or rent, There are certain expenses taxpayers can deduct. The purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. There are certain expenses taxpayers can deduct. Web $54.95 state filing fee $39.95 2 taxslayer premium learn more on taxslayer's website federal filing fee $0 state filing fee $0 3 Web home office deduction worksheet please use this worksheet to give us information about your home office for preparation of your tax returns. The term “home” includes a house, apartment, condominium, mobile home, boat, or similar property which provides basic living accommodations. Taxpayers must meet specific requirements to claim home expenses as a deduction. If you work from home you can deduct a percentage of your mortgage or rent, insurance, taxes, utilities and more! You can deduct $5 per square foot, up to $1,500 or 300 square feet, per year for your exclusive. Examples include your utility bills, mortgage interest or rent, Cost of painting or repairs made to the specific area or room used for business, installation of a bookshelf, etc. The worksheet below collects all of the information necessary to calculate both methods, allowing us to. Use a separate form 8829 for each home you used for business during the year. The best home office deduction worksheet for excel [free template] dragging down the exclusion. Web home office deduction worksheet please use this worksheet to give us information about your home office for preparation of your tax returns. Do not send recipts or bank/credit card statements. Web the home office deduction form 8829 is available to both homeowners and renters. See tutorial below home office blog post download the free spreadsheetHome Office Deduction Worksheet —

Home Office Deduction Worksheet —

Home Office Deduction Worksheet —

CPA Prepared Home Office Deduction Worksheet Etsy

10 HomeBased Business Tax Worksheet /

Home Office Deduction Worksheet HMDCRTN

FREE Home Office Deduction Worksheet (Excel) For Taxes

Home Office Tax Deduction What to Know Fast Capital 360®

Home Office Tax Deduction What to Know Fast Capital 360®

Home Office Deduction Worksheet (Excel)

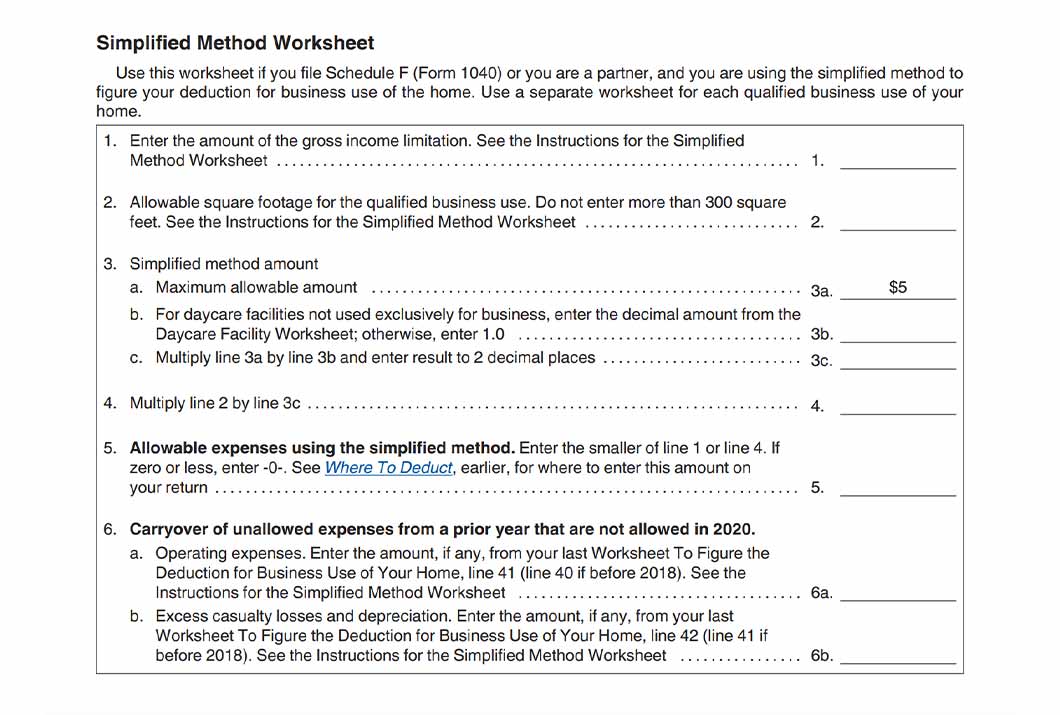

Standard Deduction Of $5 Per Square Foot Of Home Used For Business (Maximum 300 Square Feet).

Web Irs Form 8829 Is One Of Two Ways To Claim A Home Office Deduction On Your Business Taxes.

For Example, Pretend Your Apartement A 800 Honest Feet, And Your Workstation Is 80 Square Dogs.

Web There Are Two Ways To Take A Deduction For Your Home Office Space.

Related Post: