Home Sales Worksheet

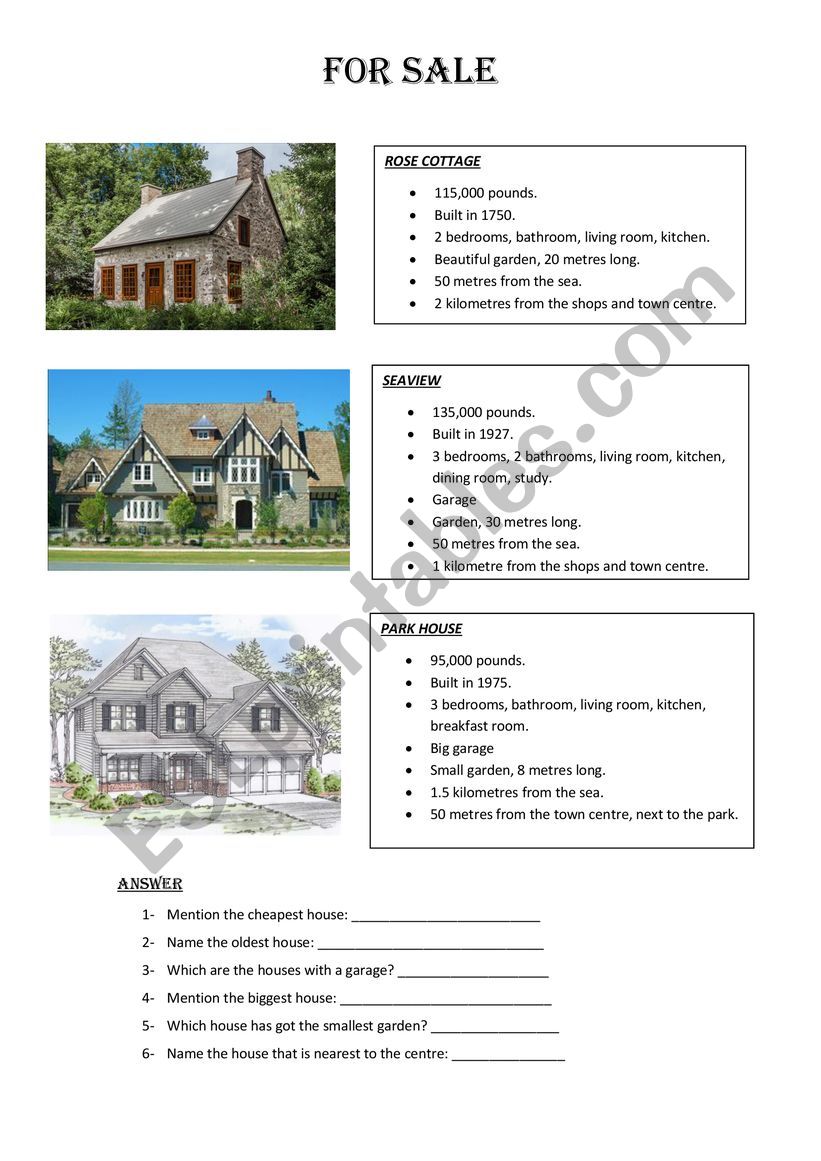

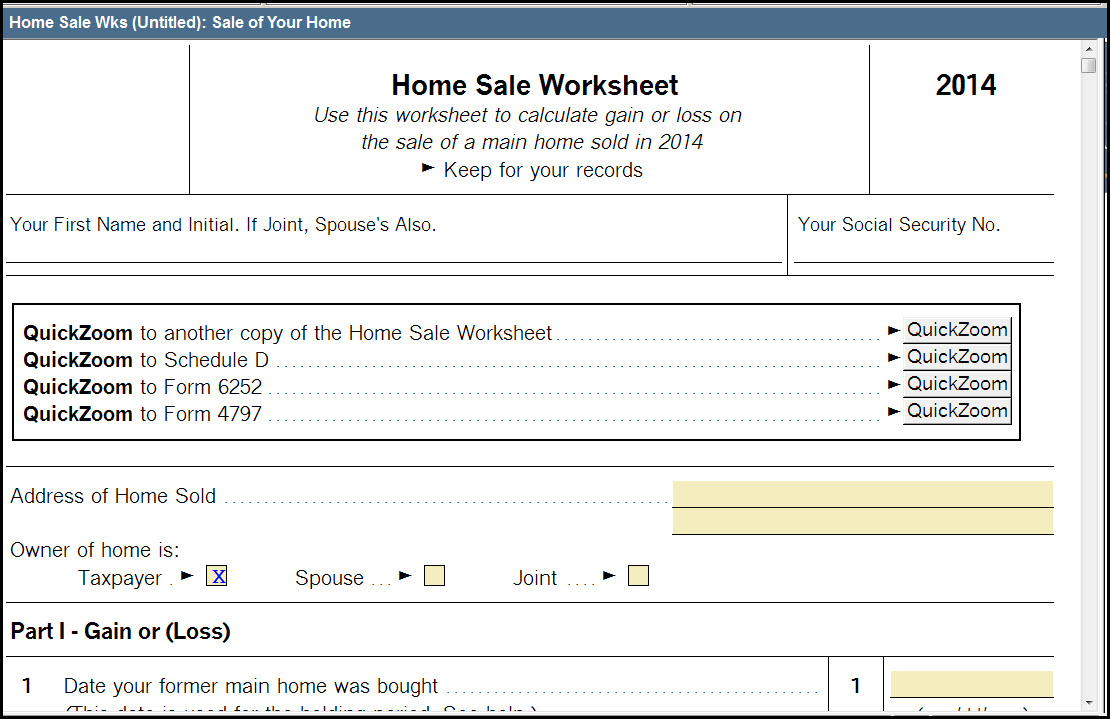

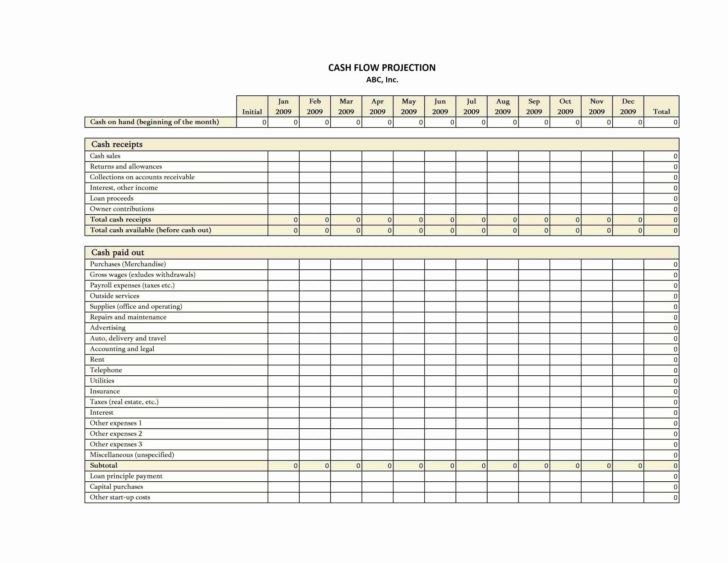

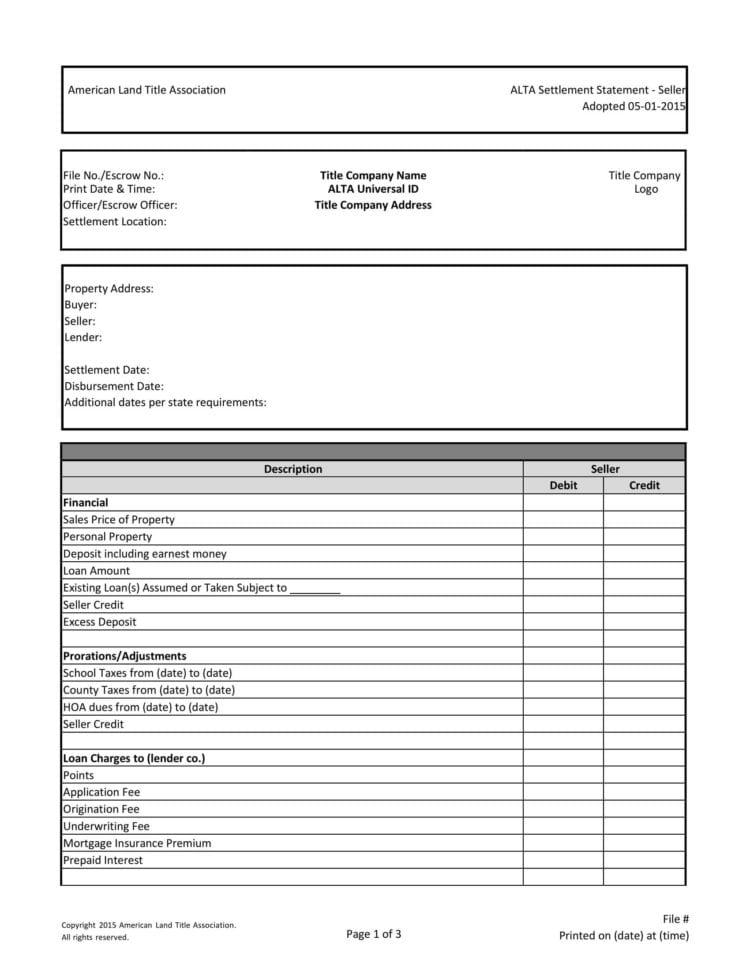

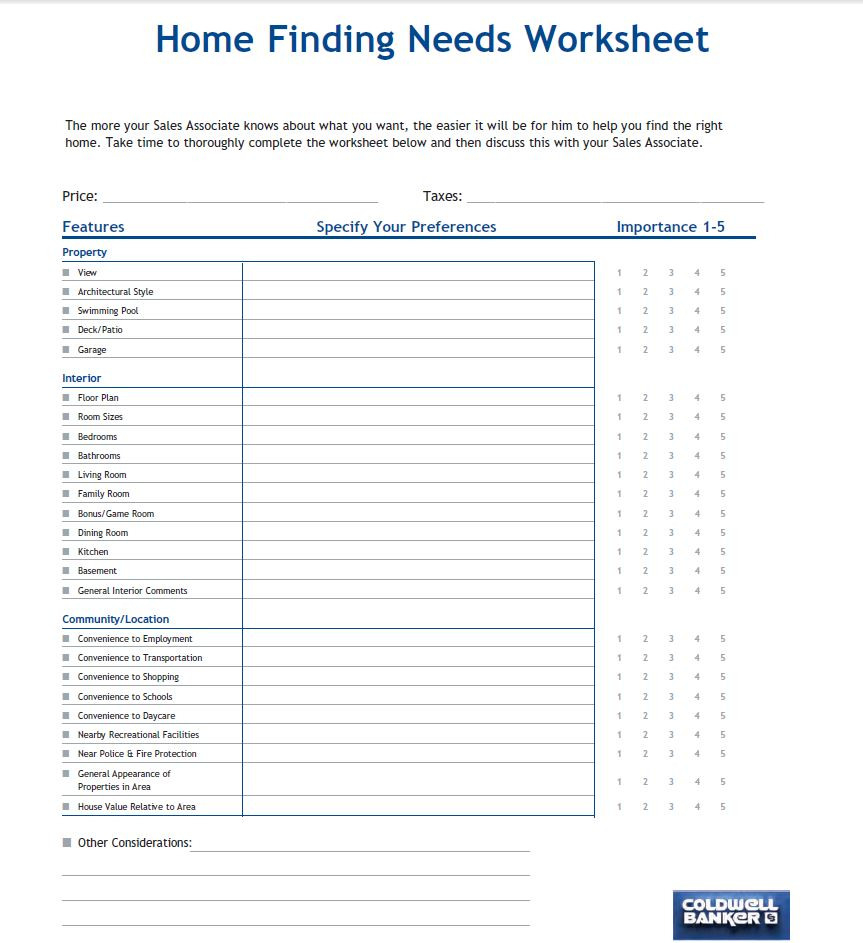

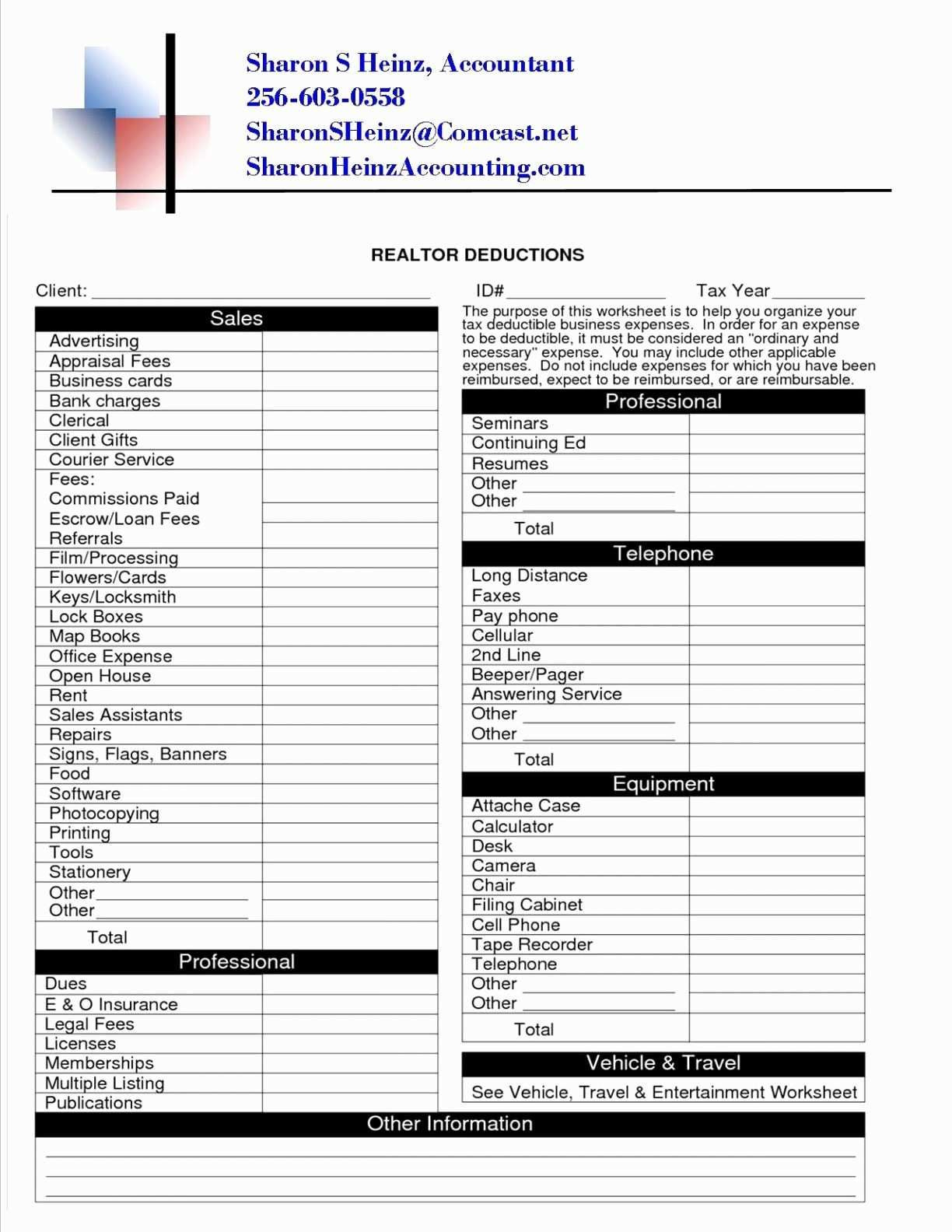

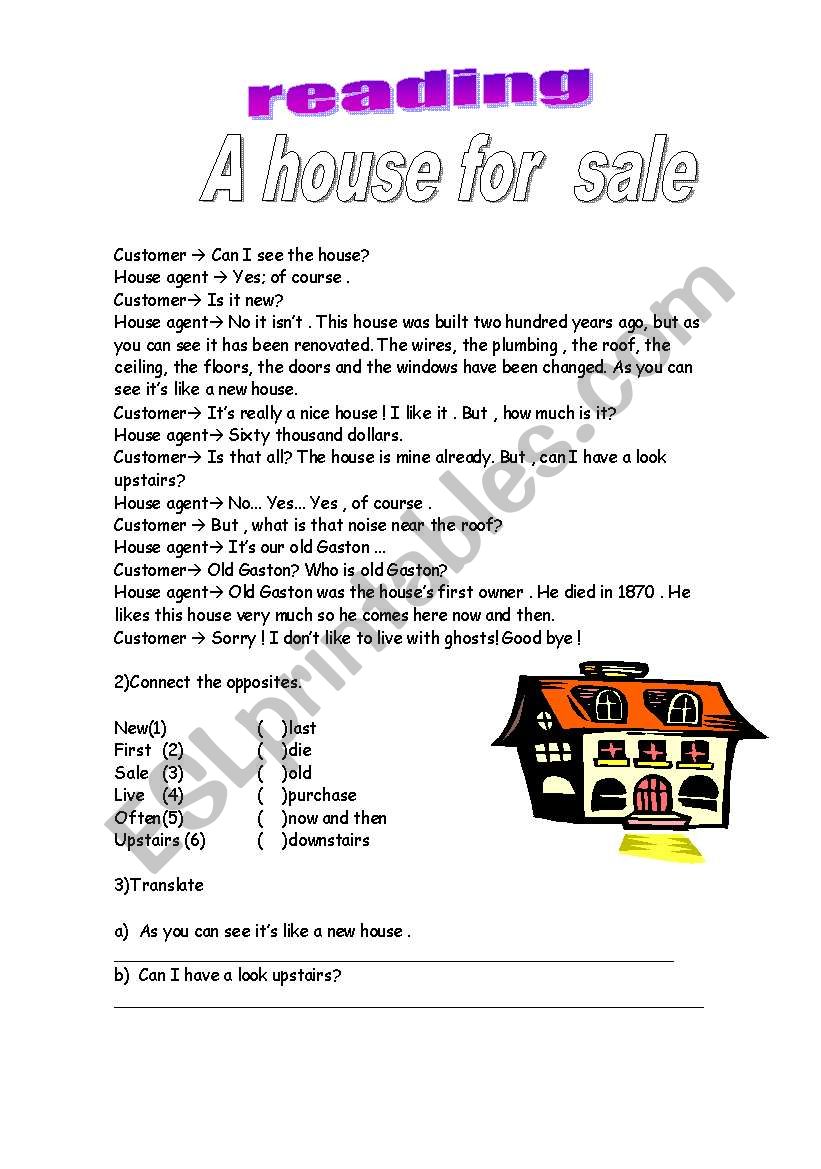

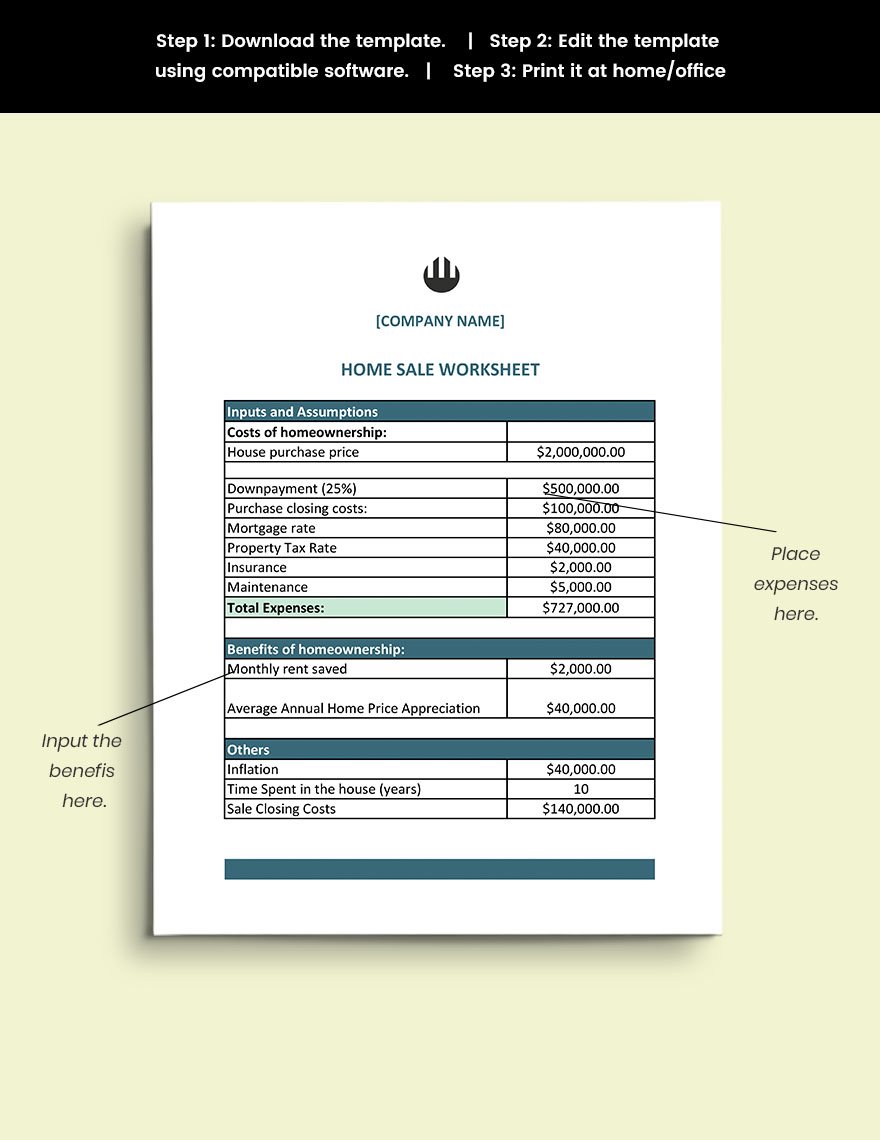

Home Sales Worksheet - You will have the opportunity to download/print your tax return(s) and include all government and turbotax worksheets after you pay for the software but before you file. Web publication 523, selling your home provides rules and worksheets. Web gain from the sale of your home from your income and avoid paying taxes on it. Web a home purchase worksheet can help you gather information to decide if you can buy a home. Lawdepot.com has been visited by 100k+ users in the past month A net sheet is a spreadsheet that estimates how much money you can expect to net in a home sale. If you need help, go to our printing your return and individual forms faq. You may take the exclusion, whether maximum or partial, only on the sale of a home that is your principal residence, meaning your main home. Casualty loss amounts and other decreases. Web make three copies of all pages of worksheet 2. Web the state line 9.99 ac will be the perfect investment for a future home or cabin site. The cost paid to acquire the home. The average home currently for sale in 67068 is around 2,023 years old and 0 ft². How do i fix this? Online navigation instructions from within your taxact online return, click print center in the. Determine if you have a gain or loss on the sale of your home, 2. How do i fix this? Web sale of home worksheet how to compute gain or loss worksheet the process is the same for single family homes, condominiums, mobile homes, and all other types of homes. This publication also has worksheets for calculations relating to the. Online navigation instructions you need to view the worksheet as a print pdf; • if married filing jointly, compute gain or loss for both taxpayers together. An individual has only one main home at a time. How many days in the last 5 years was the home your. It'll help you suss out your wants and needs so you're prepared. Qualifying for the exclusion in general, to qualify for the section 121 exclusion, you must meet both the ownership test and the use test. D.any mortgage points or other loan charges you. Make yours for free and save, print & download. Web can i find a printable form of the home sale worksheet? Fixing that leaky faucet or replacing the. You might also be putting cash into the property to get it ready to sell: The exclusion is increased to $500,000 for a married couple filing jointly. Web sale of main home worksheet; Qualifying for the exclusion in general, to qualify for the section 121 exclusion, you must meet both the ownership test and the use test. Basic info about. How many days in the last 5 years was the home your. If you need help, go to our printing your return and individual forms faq. Lawdepot.com has been visited by 100k+ users in the past month Qualifying for the exclusion in general, to qualify for the section 121 exclusion, you must meet both the ownership test and the use. A.any sales commissions (for example, a real estate agent's sales commission). Rocketlawyer.com has been visited by 100k+ users in the past month Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable gain of the entries made in the return: Free download this home sale worksheet template design in apple numbers,. Please be sure to include sales tax. Web real estate net sheets: Web sale of main home worksheet; Web hi, i completed the home sale worksheet and the info properly went to the 8949, and the amounts made it to schedule d. This tract is a short 20 mile drive south of wichita, ks. The cost paid to acquire the home. Rocketlawyer.com has been visited by 100k+ users in the past month These listings range from $630,000 in the lower quartile to $630,000 in the upper quartile. Determine if you have a gain or loss on the sale of your home, 2. Web widowed 1) sell marital home within two years of the death. Assets with disposition losses cannot be linked to the home sale worksheet. The average home currently for sale in 67068 is around 2,023 years old and 0 ft². How many days in the last 5 years was the home your main home? D.any mortgage points or other loan charges you. Please complete the fillable fields specific to your community and. Then take your handiwork to your real estate agent, who'll be overjoyed by your. D.any mortgage points or other loan charges you. Web search the most complete ninnescah, ks real estate listings for sale. Selling and buying a house is a big decision. The exclusion is increased to $500,000 for a married couple filing jointly. A net sheet is a spreadsheet that estimates how much money you can expect to net in a home sale. Assets with disposition losses cannot be linked to the home sale. Basic information about your home: Web publication 523, selling your home provides rules and worksheets. Please be sure to include sales tax. You will have the opportunity to download/print your tax return(s) and include all government and turbotax worksheets after you pay for the software but before you file. The average home currently for sale in 67068 is around 2,023 years old and 0 ft². The only way i see that i can do that is to manually complete the upper portion of sch d regarding the sale, but then i end up with two houses sales on. This publication also has worksheets for calculations relating to the sale of your home. It'll help you suss out your wants and needs so you're prepared to enter the market confidently. Community discussions taxes investors & landlords u0344096 level 2 home sale worksheet link should be blank. Casualty loss amounts and other decreases. Rocketlawyer.com has been visited by 100k+ users in the past month Online navigation instructions from within your taxact online return, click print center in the left column. Web real estate net sheets: Basic info about the sale: Casualty loss amounts and other decreases. Web can i find a printable form of the home sale worksheet? Free download this home sale worksheet template design in apple numbers, word, google docs, excel, google sheets format. Web the median list price is $630,000 or $0 / ft². This tract is a short 20 mile drive south of wichita, ks. 3) neither the taxpayer nor the taxpayer’s late spouse took the exclusion on another home sold less than two years before the date of the current home sale. The cost paid to acquire the home. Web the state line 9.99 ac will be the perfect investment for a future home or cabin site. The average home currently for sale in 67068 is around 2,023 years old and 0 ft². The only way i see that i can do that is to manually complete the upper portion of sch d regarding the sale, but then i end up with two houses sales on. If you’re planning to sell a house, we have the best template that you can take advantage of. How many days in the last 5 years was the home your. Web publication 523, selling your home provides rules and worksheets. Web the cash program used home calculation worksheet helps you calculate the total home sales. Please complete the fillable fields specific to your community and the home.Houses for sale ESL worksheet by emi7717

Entering A Sale of Home With Section 121 Exclusion Accountants Community

Sale Of Main Home Worksheet —

Home Sale Worksheet (Template With Sample)

Home Sale Worksheet (Template With Sample) Sale house, Worksheets

Sale Of Home Worksheet —

Sale Of Main Home Worksheet —

Sale Of Main Home Worksheet —

a house for sale ESL worksheet by eugeniapaxeco

Free Free Home Sale Worksheet Template Google Sheets, Excel, Apple

Web Hi, I Completed The Home Sale Worksheet And The Info Properly Went To The 8949, And The Amounts Made It To Schedule D.

How Do I Fix This?

Web Under Irs Guidelines, If The Amount You Realize From The Sale Of A Home Is More Than Your Adjusted Basis In The Property, Then You Have A Capital Gain.

An Individual Has Only One Main Home At A Time.

Related Post: