Small Business Tax Worksheet

Small Business Tax Worksheet - An expert does your return, start to finish. Are you a team of one? 5 steps to create a small business worksheet; The tax experts at block advisors will help you understand your small business taxes, starting with the small business tax preparation checklist for 2022. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 13 this would include an alarm at. Worksheet business insurance planning template; What counts as a business expense? Web pk ! ªê % [content_types].xml ¢ ( ìvmk 1 ½ ú ]ƒwnzj)^ç ¦ç6 z•¥±wx_hæ©ýï;+'¦ çî² íeå®vï½ùôì®·þu ñæðˆëz** : Pricing will vary based on individual circumstances. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re claiming all the tax deductions available to your small business. These deductions can reduce the amount of income subject to federal and state taxation. Return with. 525 taxable and nontaxable income. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. 538 accounting periods and methods. Learn how to do your taxes for your small business. 5 steps to create a small business worksheet; 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Bookkeeping let a professional handle your small business’ books.; Erica seppala editor feb 8, 2023 updated Data based on a 2020 survey conducted by the national society of. Payroll payroll services and support to keep you compliant.; 463 travel, gift, and car expenses. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Do your own personal taxes do personal taxes with expert help do business taxes with expert help do taxes with a cd/download. If you are an aspiring entrepreneur and. For additional help with this process, please see our video. Personal property taxes paid on business property are deductible.“personal” in this context refers to property that can be removed. Bookkeeping let a professional handle your small business’ books.; Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. This publication has information on. Are you a team of one? Do not include capital assets, which are items designed to last over a year and which exceed $300 in cost. There are seven federal income tax rates in 2022: 536 net operating losses (nols) for individuals, estates, and trusts. Return with form 1040 to report income as a sole proprietor. If you are an aspiring entrepreneur and are unsure of which tax publications may be relevant to you, please consult our. Rfpø ô骚o aøú„ lú ýîëv. Web small business tax prep file yourself or with a small business certified tax professional.; Worksheet business insurance planning template; Personal property taxes paid on business property are deductible.“personal” in this context refers to. Full service for personal taxes full service for business taxes. Small business tax worksheet template; Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible business expenses. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. To figure the overall gain or. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Return with form 1040 to report income as a sole proprietor. 547 casualties, disasters, and thefts. Small business worksheet in pdf; To avoid errors, a new download of the schedule a excel workbook should be done for each reporting period. Erica seppala editor feb 8, 2023 updated Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible business expenses. Personal property taxes paid on business property are deductible.“personal” in this context refers to property that can be removed. Web pk ! ªê % [content_types].xml ¢ ( ìvmk 1 ½ ú. Web introduction these instructions explain how to complete schedule d (form 1040). Among the taxpayers who should consult publication 505 are those who have dividend or capital gains income, owe alternative minimum tax, or have. Worksheet business insurance planning template; Web organize your finances for your small business with this free small business tax spreadsheet in excel. Web 18+ small business worksheet templates; An expert does your return, start to finish. What counts as a business expense? Download the schedule a excel workbook using the link below. 13 this would include an alarm at. Web get your documents ready. Learn how to do your taxes for your small business. Personal property taxes paid on business property are deductible.“personal” in this context refers to property that can be removed. Web small business forms and publications. Small business worksheet in pdf; 5 steps to create a small business worksheet; 525 taxable and nontaxable income. Web rocket lawyer can help your business avoid tax headaches. Pricing will vary based on individual circumstances. 583 starting a business and keeping records 538 accounting periods and methods. These deductions can reduce the amount of income subject to federal and state taxation. Small business worksheet in pdf; Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. 5 steps to create a small business worksheet; When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re claiming all the tax deductions available to your small business. Data based on a 2020 survey conducted by the national society of. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. 538 accounting periods and methods. According to the irs, business expenses must be both ordinary and necessary to be deductible. There are seven federal income tax rates in 2022: Web a companion publication, publication 505, tax withholding and estimated tax has more details, including worksheets and examples, to help taxpayers figure out whether they should pay estimated tax. Web introduction these instructions explain how to complete schedule d (form 1040). Web pk ! ªê % [content_types].xml ¢ ( ìvmk 1 ½ ú ]ƒwnzj)^ç ¦ç6 z•¥±wx_hæ©ýï;+'¦ çî² íeå®vï½ùôì®·þu ñæðˆëz** : Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible business expenses. Web small business forms and publications. What counts as a business expense?Self Employment Printable Small Business Tax Deductions Worksheet

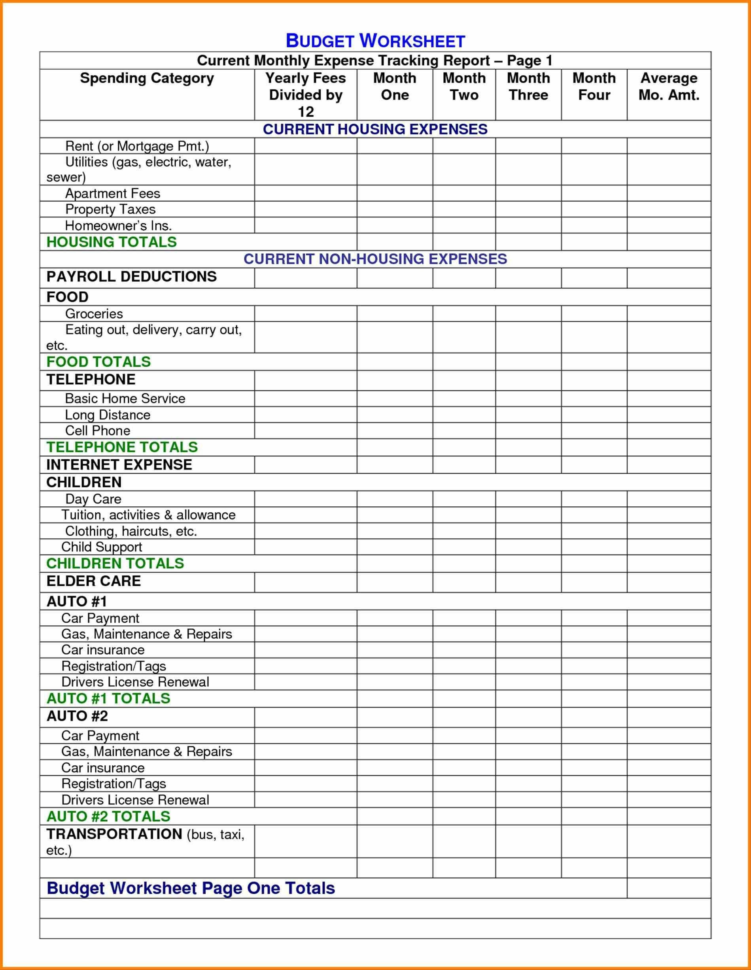

8 Best Images of Tax Preparation Organizer Worksheet Individual

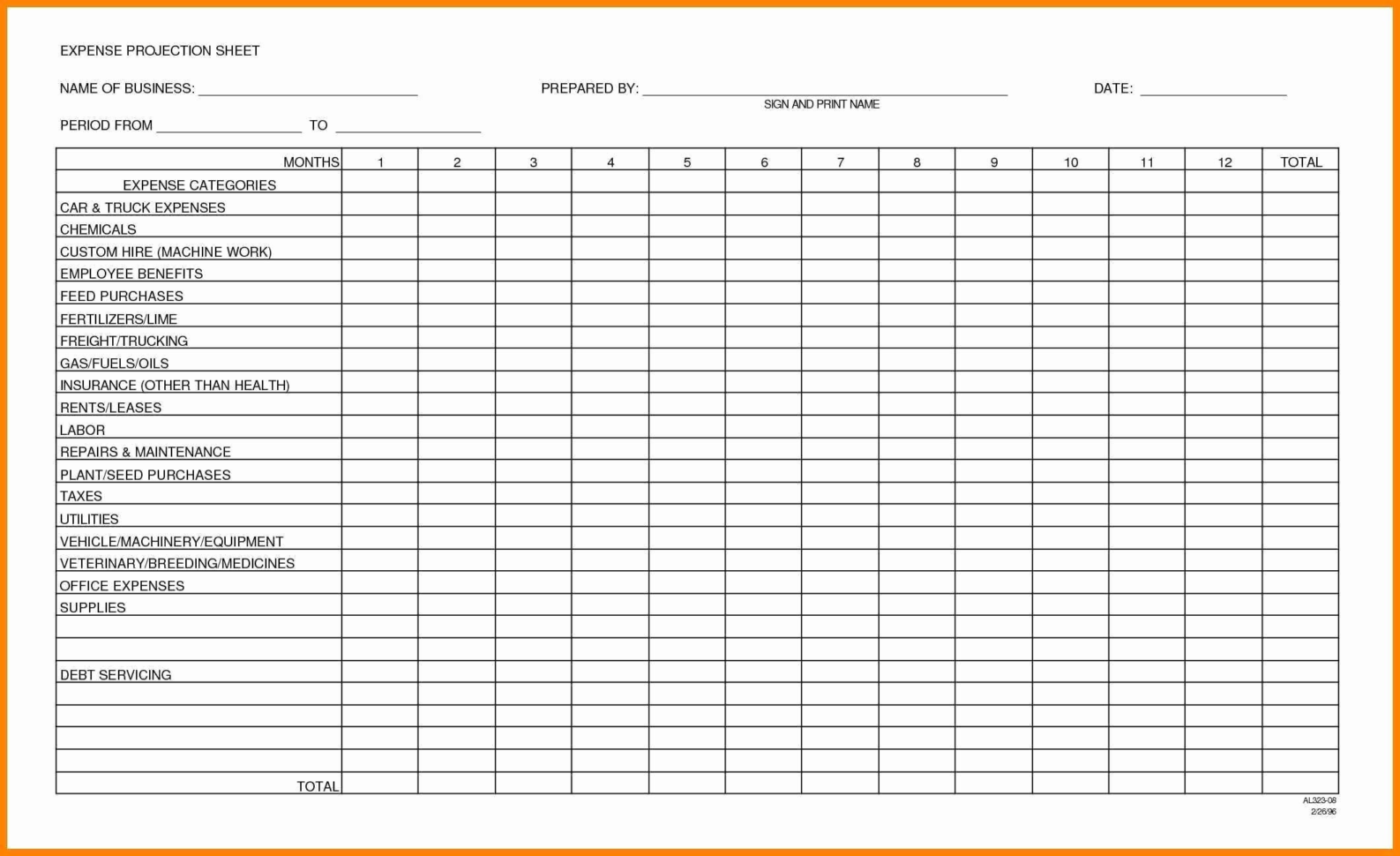

Small Business Expenses Spreadsheet With Small Business Tax Deductions

Tax Spreadsheet For Small Business for Small Business Tax Spreadsheet

10++ Small Business Tax Deductions Worksheet

Small Business Tax Kit Printable and Editable. Includes Business

Small Business Tax Spreadsheet Template Recent Small Business to

10++ Small Business Tax Deductions Worksheet

Self Employment Printable Small Business Tax Deductions Worksheet

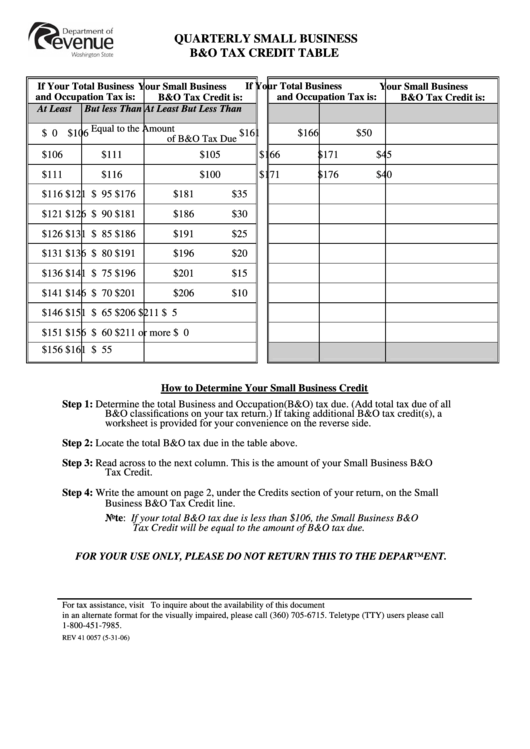

Form Rev 41 0057 Small Business B&o Tax Credit Worksheet Washington

Web Use This Printable Small Business Income And Expenses Template To Determine Your Net Income Over A Period Of Time.

An Expert Does Your Return, Start To Finish.

Web The Ultimate Small Business Tax Checklist This Checklist Will Help Ensure That You Pay Your Small Business Taxes Correctly, Get The Most Deductions, And File With Plenty Of Time To Spare.

This Publication Has Information On Business Income, Expenses, And Tax Credits That May Help You, As A Small Business Owner, File Your Income Tax Return.

Related Post: