Housing Allowance Worksheet

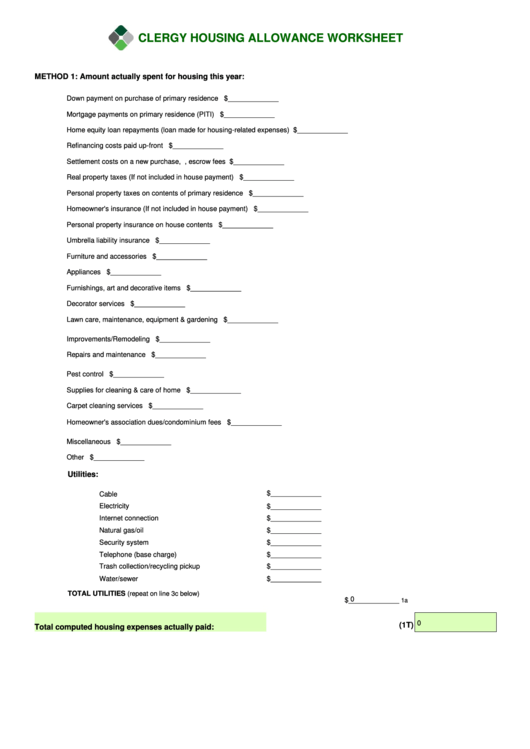

Housing Allowance Worksheet - Web complete the worksheet below in order to determine the amount that you may exclude from you gross income. For a printable version, click here. A specific dollar amount or percentage of salary must be designated, in. This support service is available at a flat rate of. Pick the template you want in the library of legal forms. Assuming there is sufficient documentation, the amount indicated on line 4 is the amount that may be excluded from gross income as a housing allowance pursuant to the provisions of section 107 of the. Ministers who own their homes should take the following. Web total 2020 housing expenses + 10% for unexpected expenses fair market rental value 2020 officially designated housing allowance *if not included in mortgage payment. Owned by or rented by the church. Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). For excel users who want to personalize their calculations or save them for the future, click the. For a printable version, click here. Clergy financial resources also offers pro advisor support for your housing and other tax questions. Owned by or rented by the church. Web in order to take a housing allowance, there needs to be proper documentation: Ministers who own their homes should take the following. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Web do you still have questions? Web if you moved during the 2022 tax year and incurred housing expenses in more than one foreign location as a result, complete the limit on housing expenses worksheet,. This action should be taken in. _____ for the period _____, 20___ to _____, 20____ date. Web the fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes. Amount actually spent for housing this year: Down payment on purchase of primary residence mortgage payments on primary residence (piti) home equity. Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). This worksheet will help you determine your specific housing expenses when filing your annual tax return. Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). _____ for the period. Web total 2020 housing expenses + 10% for unexpected expenses fair market rental value 2020 officially designated housing allowance *if not included in mortgage payment. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Down payment on purchase of primary residence mortgage payments on primary residence (piti) home equity loan. _____ for the. Owned by or rented by the church. Web do you still have questions? Down payment on purchase of primary residence mortgage payments on primary residence (piti) home equity loan. Ministers who own their homes should take the following. Web housing allowance understand that i assume full responsibility for compliance with irs regulations and understand the need to keep an accurate. This support service is available at a flat rate of. Web if your pastor owns a home, have the church designate a portion of the pastor’s 2023 compensation as a housing allowance. Web fill out housing allowance worksheet within a couple of clicks by using the recommendations listed below: Web if you moved during the 2022 tax year and incurred. This worksheet will help you determine your specific housing expenses when filing your annual tax return. _____ for the period _____, 20___ to _____, 20____ date. Web complete the worksheet below in order to determine the amount that you may exclude from you gross income. Web 2019 minister housing allowance excel worksheet download. This support service is available at a. Web do you still have questions? For a printable version, click here. Web if you moved during the 2022 tax year and incurred housing expenses in more than one foreign location as a result, complete the limit on housing expenses worksheet, later,. Web housing allowance understand that i assume full responsibility for compliance with irs regulations and understand the need. Web housing allowance understand that i assume full responsibility for compliance with irs regulations and understand the need to keep an accurate record of housing. Amount actually spent for housing this year: Web get the most out of your minister’s housing allowance. Ministers who own their homes should take the following. This action should be taken in. Web if you moved during the 2022 tax year and incurred housing expenses in more than one foreign location as a result, complete the limit on housing expenses worksheet, later,. For excel users who want to personalize their calculations or save them for the future, click the. Web housing allowance understand that i assume full responsibility for compliance with irs regulations and understand the need to keep an accurate record of housing. Pick the template you want in the library of legal forms. Web in order to take a housing allowance, there needs to be proper documentation: Web attachment c housing allowance estimate worksheet expense item estimate • utilities (electricity, heat, water, trash pickup, and local telephone) $ _____ •. Web 2019 minister housing allowance excel worksheet download. Web complete the worksheet below in order to determine the amount that you may exclude from you gross income. _____ for the period _____, 20___ to _____, 20____ date. Web total 2020 housing expenses + 10% for unexpected expenses fair market rental value 2020 officially designated housing allowance *if not included in mortgage payment. Web fill out housing allowance worksheet within a couple of clicks by using the recommendations listed below: Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Owned by or rented by the church. Web keep in mind, the estimated housing allowance for ministers living in a rented home should be the lesser of the “fair rental value of home” or the “total estimated housing. Amount actually spent for housing this year: Web housing allowance a licensed, commissioned, or ordained minister who performs ministerial services as an employee may be able to exclude from gross income. Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Web if your pastor owns a home, have the church designate a portion of the pastor’s 2023 compensation as a housing allowance. Web the fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes. This support service is available at a flat rate of. Web in order to take a housing allowance, there needs to be proper documentation: For a printable version, click here. Ministers who own their homes should take the following. Web fill out housing allowance worksheet within a couple of clicks by using the recommendations listed below: Web housing allowance a licensed, commissioned, or ordained minister who performs ministerial services as an employee may be able to exclude from gross income. This support service is available at a flat rate of. Web complete the worksheet below in order to determine the amount that you may exclude from you gross income. Pick the template you want in the library of legal forms. Owned by or rented by the church. _____ for the period _____, 20___ to _____, 20____ date. Web attachment c housing allowance estimate worksheet expense item estimate • utilities (electricity, heat, water, trash pickup, and local telephone) $ _____ •. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Amount actually spent for housing this year: A specific dollar amount or percentage of salary must be designated, in. Web do you still have questions? Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities).43 clergy housing allowance worksheet Worksheet Information

30++ Housing Allowance Worksheet

Fillable Clergy Housing Allowance Worksheet printable pdf download

Housing Allowance Form FBMI

lacolmenadesigners Can A Minister Deduct 2Nd Home Housing Allowance

Housing Allowance Worksheet 2021

Housing Allowance Worksheet 2022

Construction Allowance Spreadsheet regarding Building New Home Budget

️Housing Allowance Worksheet Free Download Goodimg.co

Housing Allowance Worksheet 2021 Form Fill Out and Sign Printable PDF

Web Get The Most Out Of Your Minister’s Housing Allowance.

Web The Fair Rental Value Of A Parsonage Or The Housing Allowance Can Be Excluded From Income Only For Income Tax Purposes.

Ministers Who Own Their Homes Should Take The Following.

Web Keep In Mind, The Estimated Housing Allowance For Ministers Living In A Rented Home Should Be The Lesser Of The “Fair Rental Value Of Home” Or The “Total Estimated Housing.

Related Post: