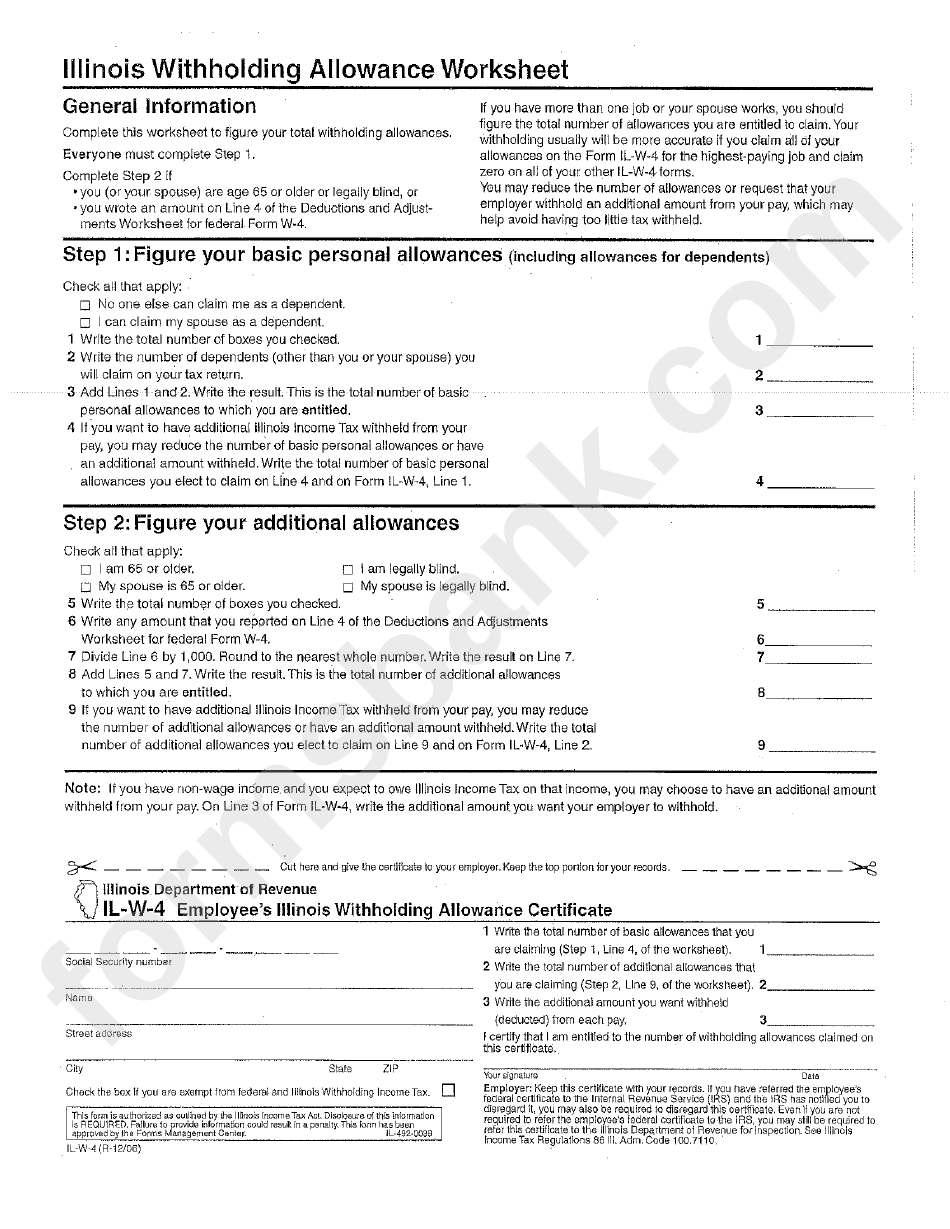

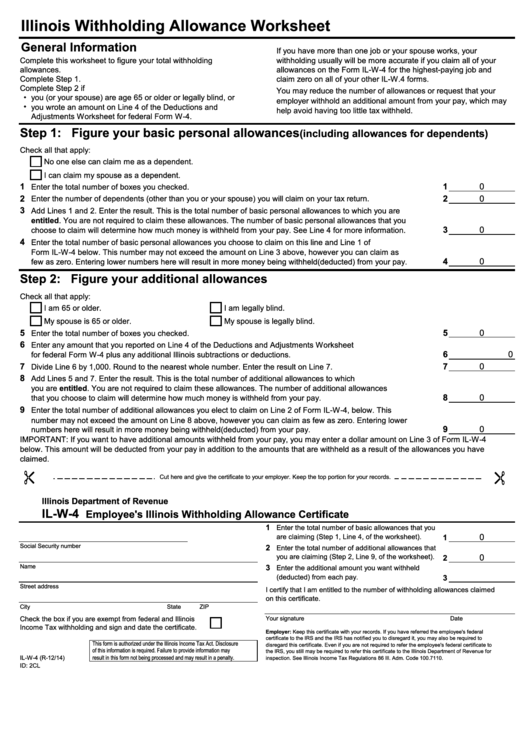

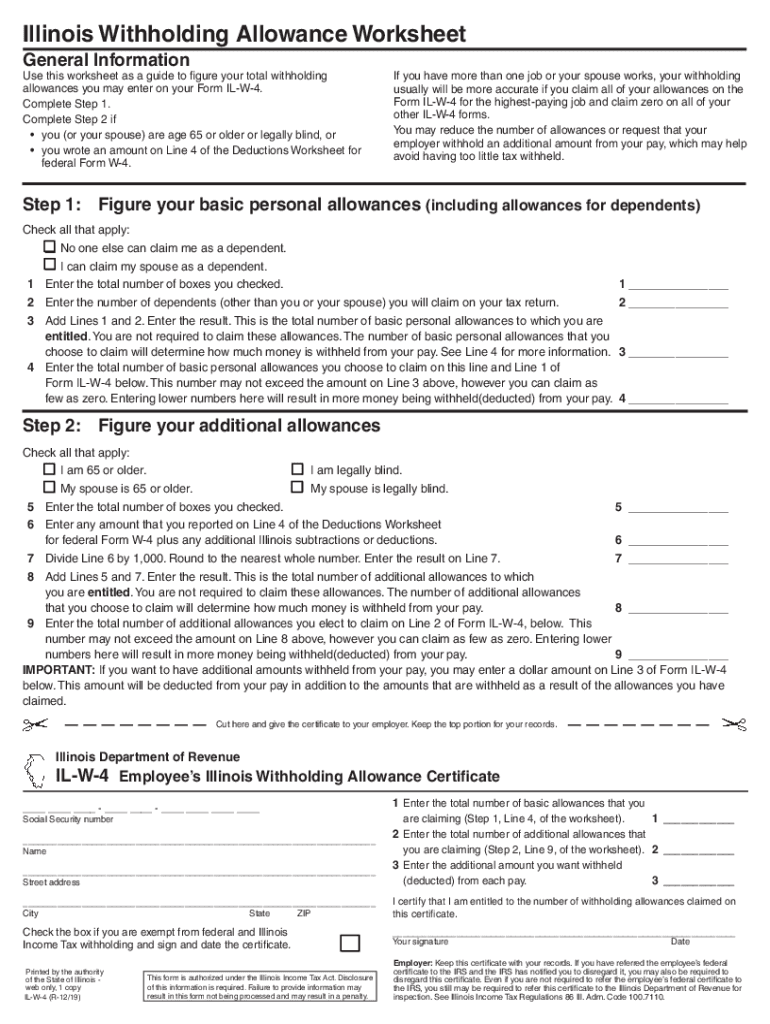

Illinois Withholding Allowance Worksheet

Illinois Withholding Allowance Worksheet - Web the income tax rate is 4.95 percent and the exemption allowance is $2,375. No one else can claim me as. Find the template from the library. You can also use the calculator at. Web illinois withholding allowance worksheet general information complete this worksheet to figure your total withholding allowances. Web for regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. For wages and other compensation, subtract any exemptions from the wages paid and multiply the result by. Web generally,the rate for withholding illinois income tax is 4.95 percent. Web illinois withholding allowance worksheet general information complete this worksheet to figure your total withholding allowances. Complete step 2 if • you (or your spouse) are. Web illinois withholding allowance worksheet general information complete this worksheet to figure your total withholding allowances. Web illinois withholding allowance worksheet part 1: Figure your basic personal allowances (including allowances for dependents) check all that apply: Web for regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. Web. For wages and other compensation, subtract any exemptions from the wages paid and multiply the result by. Figure your basic personal allowances (including allowances for dependents) check all that apply: Everyone must complete step 1. Web follow our easy steps to get your illinois withholding allowance worksheet how to fill it out ready rapidly: Complete step 2 if • you. Web illinois withholding allowance worksheet part 1: Web the income tax rate is 4.95 percent and the exemption allowance is $2,375. We last updated the employee's illinois withholding. You may use the tax tables in this booklet to determine how much tax you must withhold. Web illinois state income tax withholding. No one else can claim me. Upload illinois withholding allowance worksheet example from your device, the cloud, or a secure link. Web for regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. Web generally,the rate for withholding illinois income tax is 4.95 percent. Everyone must complete step 1. Web click on new document and choose the file importing option: Complete step 2 if you. You may use the tax tables in this booklet to determine how much tax you must withhold. Upload illinois withholding allowance worksheet example from your device, the cloud, or a secure link. Web illinois withholding allowance worksheet general information complete this worksheet to figure. Web illinois state income tax withholding. Complete step 2 if you. Web illinois withholding allowance worksheet general information complete this worksheet to figure your total withholding allowances. Web illinois withholding allowance worksheet step 1: No one else can claim me as. Web follow our easy steps to get your illinois withholding allowance worksheet how to fill it out ready rapidly: Web the income tax rate is 4.95 percent and the exemption allowance is $2,375. Web illinois withholding allowance worksheet part 1: Web illinois withholding allowance worksheet general information complete this worksheet to figure your total withholding allowances. Web illinois withholding allowance. If you have more than one job or your. Web generally,the rate for withholding illinois income tax is 4.95 percent. Web complete this form if you are an employee so that the employer can withhold correct amount of your income tax from your pay. Withholding income tax credits information and worksheets. You can also use the calculator at. Web follow our easy steps to get your illinois withholding allowance worksheet how to fill it out ready rapidly: Complete all required information in. No one else can claim me. Web for regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. You may use the tax tables in. Web for regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. Web the income tax rate is 4.95 percent and the exemption allowance is $2,375. We last updated the employee's illinois withholding. Web complete this form if you are an employee so that the employer can withhold correct. Web the income tax rate is 4.95 percent and the exemption allowance is $2,375. Complete all required information in. Figure your basic personal allowances (including allowances for dependents) check all that apply: Web generally,the rate for withholding illinois income tax is 4.95 percent. Find the template from the library. Upload illinois withholding allowance worksheet example from your device, the cloud, or a secure link. Web complete this form if you are an employee so that the employer can withhold correct amount of your income tax from your pay. Figure your basic personal allowances (including allowances for dependents) check all that apply: Withholding income tax credits information and worksheets. Web click on new document and choose the file importing option: Web for regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. Web follow our easy steps to get your illinois withholding allowance worksheet how to fill it out ready rapidly: No one else can claim me as. Web illinois withholding allowance worksheet general information complete this worksheet to figure your total withholding allowances. No one else can claim me. You may use the tax tables in this booklet to determine how much tax you must withhold. For wages and other compensation, subtract any exemptions from the wages paid and multiply the result by. Web illinois state income tax withholding. Complete step 2 if you. Web illinois withholding allowance worksheet part 1: If you have more than one job or your. You may use the tax tables in this booklet to determine how much tax you must withhold. Everyone must complete step 1. Complete all required information in. Web illinois withholding allowance worksheet general information complete this worksheet to figure your total withholding allowances. Find the template from the library. Web illinois withholding allowance worksheet step 1: Web illinois state income tax withholding. We last updated the employee's illinois withholding. Web illinois withholding allowance worksheet general information complete this worksheet to figure your total withholding allowances. Withholding income tax credits information and worksheets. Web follow our easy steps to get your illinois withholding allowance worksheet how to fill it out ready rapidly: Web generally,the rate for withholding illinois income tax is 4.95 percent. Web illinois withholding allowance worksheet general information complete this worksheet to figure your total withholding allowances. Web click on new document and choose the file importing option: Complete step 2 if you.️Illinois Withholding Allowance Worksheet Free Download Goodimg.co

Illinois Employee Withholding Form 2022 2023

Illinois Withholding Allowance Worksheet Form Il W 4 Download

Form IlW4 Illinois Withholding Allowance Worksheet printable pdf

Claiming W4 Claiming 2

How To Fill Out Withholding Allowance Worksheet Pdfescape Gettrip24

Illinois Withholding Allowance Worksheet 2022 Form Schedule Triply

Illinois Withholding Allowance Worksheet / How Many Tax Allowances

Illinois Withholding Allowance Worksheet Step 1 Line 4 Gettrip24

Illinois Withholding Allowance Worksheet 2022 Form Download Onenow

Upload Illinois Withholding Allowance Worksheet Example From Your Device, The Cloud, Or A Secure Link.

No One Else Can Claim Me As.

Complete Step 2 If • You (Or Your Spouse) Are.

Figure Your Basic Personal Allowances (Including Allowances For Dependents) Check All That Apply:

Related Post: