Income Tax Preparation Worksheet

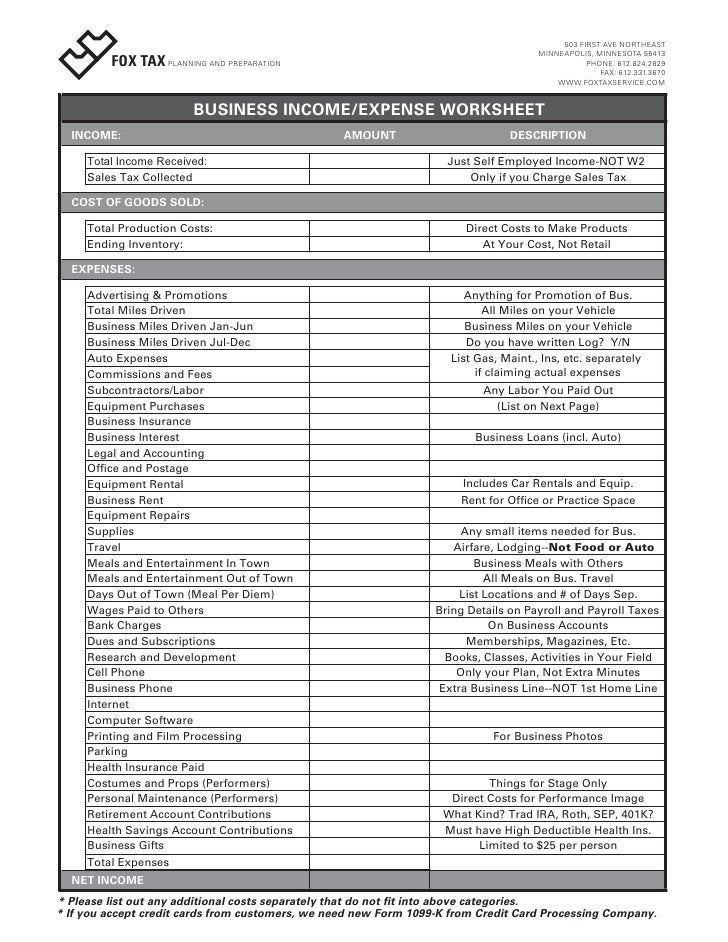

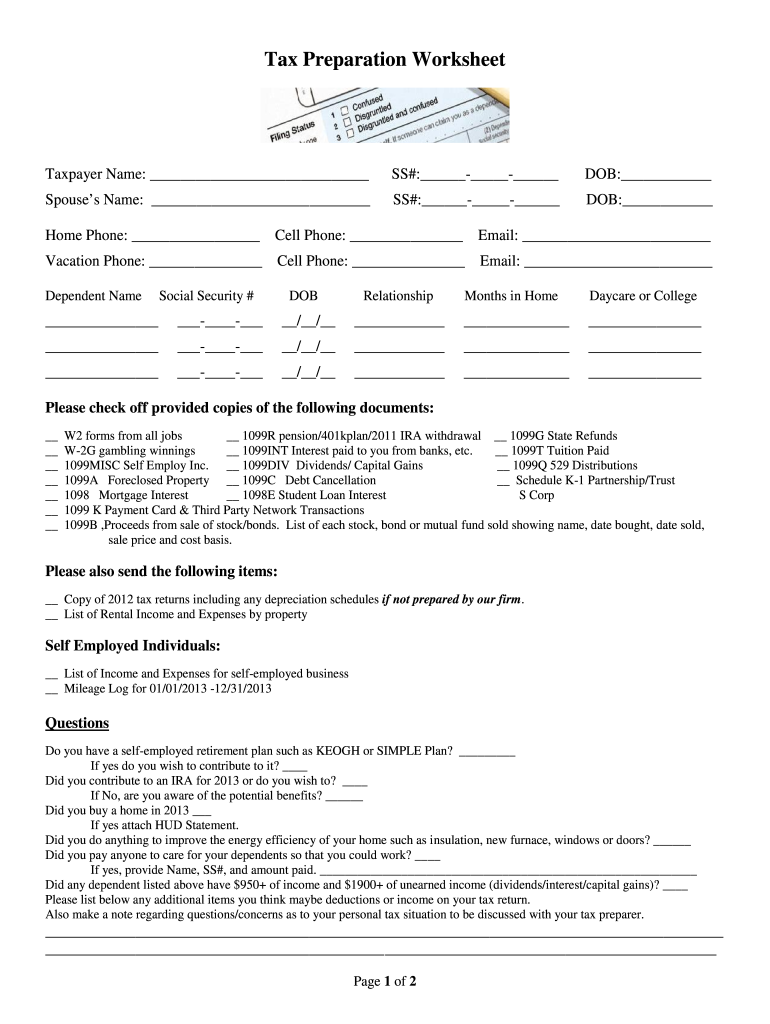

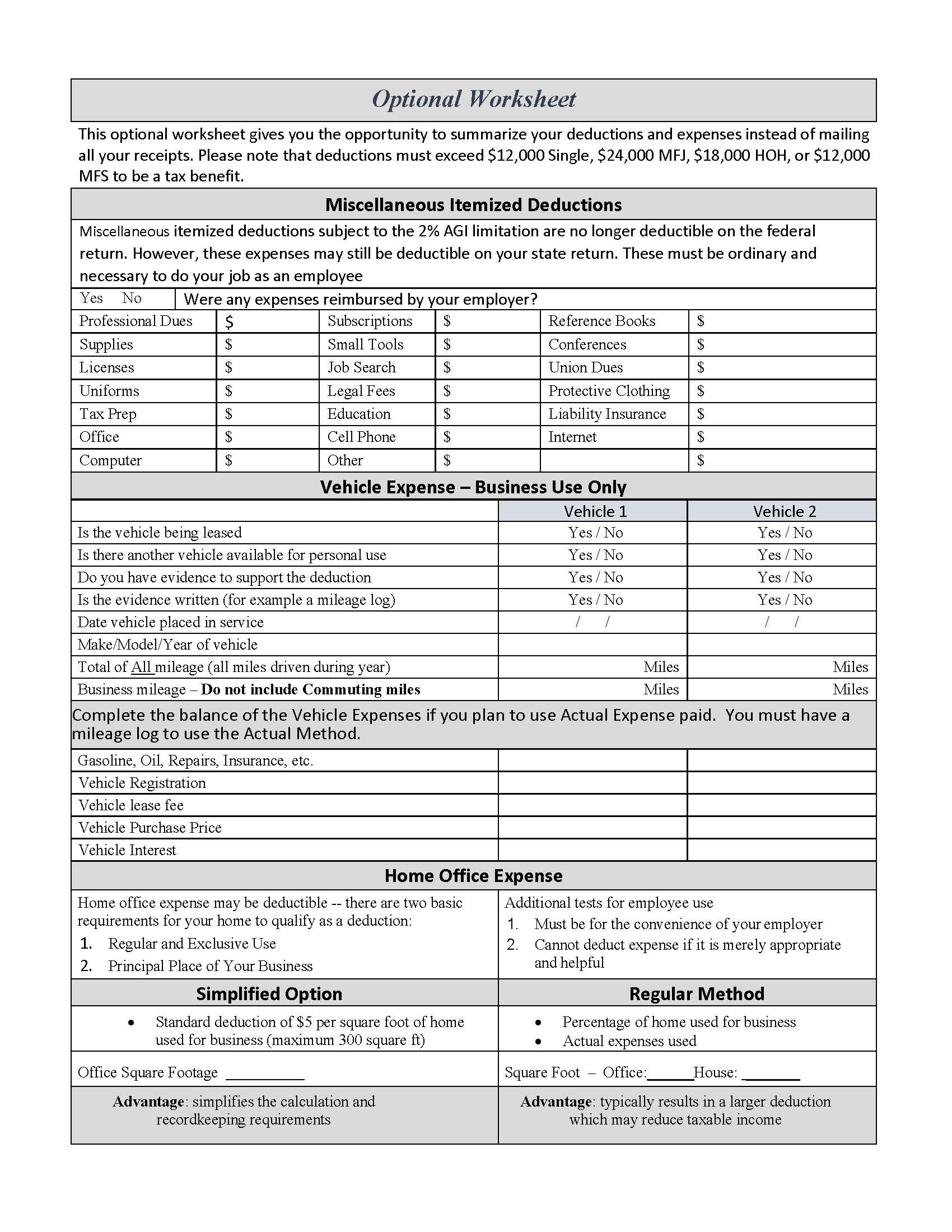

Income Tax Preparation Worksheet - Web form 1040 is used by u.s. (see the instructions for form 1040 for more information on the numbered schedules.) Table of contents before you begin before you start tax preparation personal information click to expand before you begin Please bring a voided check. Guided tax preparation provides free online tax preparation and filing at an irs partner site. Web if you are looking to find out if you will get a tax refund or if you owe money this year, here is a simple excel spreadsheet that can help you estimate federal and state income taxes before you file your return in 2021. Taxpayers whose agi is $73,000 or less qualify for a free federal tax return. Web these lists include common items and documentation generally required to prepare tax returns for individuals and families, business owners, self employed taxpayers and investors. Better yet, attach the list to a folder of your tax documents, and check items of as you add them to the folder. We have created several worksheets to aid you in the collection and categorization of receipts. (see the instructions for form 1040 for more information on the numbered schedules.) We have created several worksheets to aid you in the collection and categorization of receipts. Many of the materials that are part of the understanding taxes program can be downloaded as adobe acrobat™ pdfs. Income tax return and either doesn't file such a return or files only. Please bring a voided check. Our partners deliver this service at no cost to qualifying taxpayers. Taxpayers whose agi is $73,000 or less qualify for a free federal tax return. Web before you begin to prepare your income tax return, go through the following checklist. We have created several worksheets to aid you in the collection and categorization of receipts. Web form 1040 is used by u.s. In addition, you can download a powerpoint™ presentation that introduces each theme in the whys of taxes. Web some common ones include: Highlight the areas that apply to you, and make sure you have that information available. This proof is typically in the form For example, you can download teacher lesson plans, fact/info sheets, worksheets, and assessments. Web these lists include common items and documentation generally required to prepare tax returns for individuals and families, business owners, self employed taxpayers and investors. Taxpayers whose agi is $73,000 or less qualify for a free federal tax return. The individual income tax return organizer should be. For example, you can download teacher lesson plans, fact/info sheets, worksheets, and assessments. Our partners deliver this service at no cost to qualifying taxpayers. This proof is typically in the form Web tax preparation worksheets the successful completion of your personal tax return is largely based on having all of the necessary information at hand during your appointment. Web this. Income tax return and either doesn't file such a return or files only to get a refund of withheld income tax or estimated tax paid. Our partners deliver this service at no cost to qualifying taxpayers. The individual income tax return organizer should be used with the preparation of form 1040, u.s. Has your bank information changed? Web tax preparation. Web this downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax refunds, social security, unemployment, other income). Better yet, attach the list to a folder of your tax documents, and check items of as you add them to the folder. Web this tax organizer will assist you in gathering information necessary for the. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. Checking / savings (circle one) do you have health insurance? For this purpose, a person isn't a taxpayer if the person isn't required to file a u.s. Taxpayers whose agi is $73,000 or less qualify for a free federal tax return. For example, you. For state withholding, use the worksheets on this form. Many of the materials that are part of the understanding taxes program can be downloaded as adobe acrobat™ pdfs. Taxpayers whose agi is $73,000 or less qualify for a free federal tax return. Highlight the areas that apply to you, and make sure you have that information available. Web the purpose. 501 for details and examples. (see the instructions for form 1040 for more information on the numbered schedules.) What school district do you live in? Better yet, attach the list to a folder of your tax documents, and check items of as you add them to the folder. If you claim the earned income credit, please provide proof that your. The individual income tax return organizer should be used with the preparation of form 1040, u.s. You may claim exempt from withholding california income tax if you meet both of the following conditions for exemption: This proof is typically in the form 501 for details and examples. If you claim the earned income credit, please provide proof that your child is a resident of the united states. Taxpayers whose agi is $73,000 or less qualify for a free federal tax return. Please enter all pertinent 2020 information. Many of the materials that are part of the understanding taxes program can be downloaded as adobe acrobat™ pdfs. Web tax preparation worksheets the successful completion of your personal tax return is largely based on having all of the necessary information at hand during your appointment. Please bring a voided check. Web state income tax withheld with your estimated total annual tax. Web before you begin to prepare your income tax return, go through the following checklist. Web if you are looking to find out if you will get a tax refund or if you owe money this year, here is a simple excel spreadsheet that can help you estimate federal and state income taxes before you file your return in 2021. You can also download or print this page and check each item off as you collect your information. For this purpose, a person isn't a taxpayer if the person isn't required to file a u.s. There are over 300 ways to save taxes and are presented to you free of charge. What school district do you live in? Yes / no (see line #21) dependent name ssn# date of birth relationship lives at home? We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. Web some common ones include: If you claim the earned income credit, please provide proof that your child is a resident of the united states. (see the instructions for form 1040 for more information on the numbered schedules.) Table of contents before you begin before you start tax preparation personal information click to expand before you begin Checking / savings (circle one) do you have health insurance? Web form 1040 is used by u.s. This proof is typically in the form For this purpose, a person isn't a taxpayer if the person isn't required to file a u.s. Web some common ones include: Web this tax organizer will assist you in gathering information necessary for the preparation of your 2020 tax return. You may claim exempt from withholding california income tax if you meet both of the following conditions for exemption: Many of the materials that are part of the understanding taxes program can be downloaded as adobe acrobat™ pdfs. Yes / no (see line #21) dependent name ssn# date of birth relationship lives at home? Our partners deliver this service at no cost to qualifying taxpayers. Provide it to your client to get started with tax planning and. In addition, you can download a powerpoint™ presentation that introduces each theme in the whys of taxes. Web it provides two ways for taxpayers to prepare and file their federal income tax online for free:Tax Preparation Tax Preparation Worksheet

Tax Preparation Worksheet Pdf Fill Out and Sign Printable PDF

Tax Preparation Worksheet —

Tax Worksheet

8 Best Images of Tax Preparation Organizer Worksheet Individual

Tax preparation checklist pdf Fill out & sign online DocHub

Otis Worksheet +18 Tax Organizer Worksheet 2018 Ideas

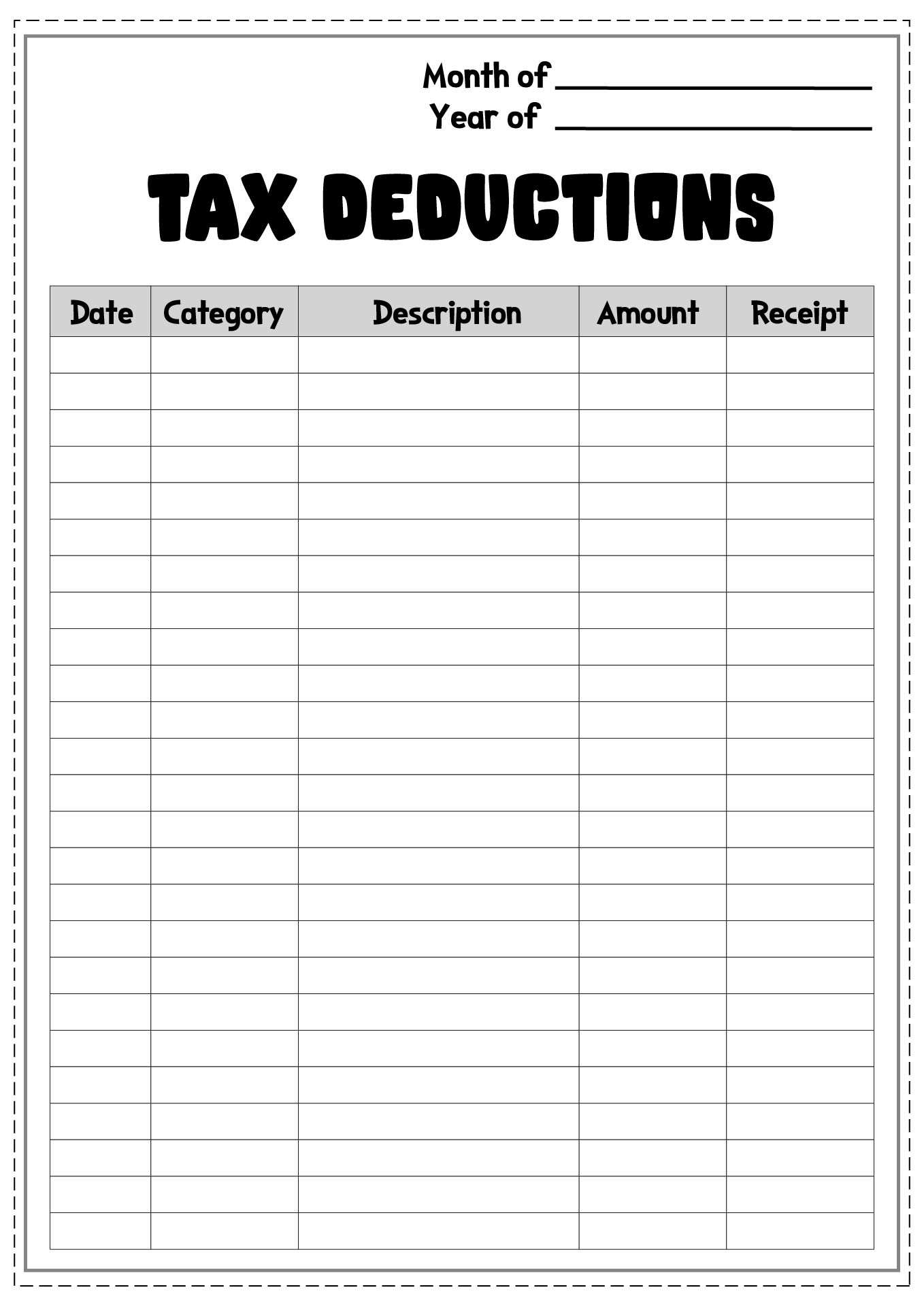

Printable Yearly Itemized Tax Deduction Worksheet Fill Online

8 Best Images of Tax Preparation Organizer Worksheet Individual

Tax Deduction Worksheet Realtors Fill Online, Printable, Fillable

Highlight The Areas That Apply To You, And Make Sure You Have That Information Available.

Taxpayers Whose Agi Is $73,000 Or Less Qualify For A Free Federal Tax Return.

Web This Downloadable File Contains Worksheets For, Wages And Pensions, Ira Distributions, Interest And Dividends, Miscellaneous Income (Tax Refunds, Social Security, Unemployment, Other Income).

The Individual Income Tax Return Organizer Should Be Used With The Preparation Of Form 1040, U.s.

Related Post: