Michigan Household Resources Worksheet

Michigan Household Resources Worksheet - They are agi, excluding net business and farm losses, net rent and royalty losses, and any carryover of a net operating loss, plus all income exempt or excluded. Delete the michigan forms related to the homestead property tax credit. Web include both taxable and nontaxable income; Me was ampere part laufzeit. If filing a joint return, if married filing separately, you must include form. Gifts of cash and all payments made on your behalf must be included in total household resources. Web taxpayer’sguide michigan for the 2022 tax year dear taxpayer: Web this brochure helps you allocate your total household resources and property taxes for the year you separated or divorced. Medical protection or hmo premiums you paid forward you and your family (after charge premiums only). Medical health or hmo awards you paid for them furthermore your family (after tax premiums only). Renters age 65+, whose rent is more than 40% of their total household resources, may qualify for an alternative credit. This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes,. Before you start, you will need: Web total household resources (thr) total household resources has three components. How does the credit work? I am cannot sure where this is. From the left menu, select tax tools; If too little is withheld, you will generally owe tax when you file. If no one in your household has received any income in the last 30 days, the applicant must complete and sign this form. Web the filer’s total household resources are below $60,000. They are agi, excluding net business and farm losses, net rent and royalty losses, and any carryover of a net operating loss, plus all income exempt or excluded. Web this brochure helps you allocate your total household resources and property taxes for the year you separated or divorced. Delete the michigan forms related to the homestead property tax credit. If. Web total household resources (thr) total household resources has three components. How does the credit work? If filing a joint return, if married filing separately, you must include form. Remember to keep this copy. The response to the first three basic needs (shelter, food, and utility) in the table below must be documented. How does the credit work? The response to the first three basic needs (shelter, food, and utility) in the table below must be documented. Medical protection or hmo premiums you paid forward you and your family (after charge premiums only). The credit is determined based on a percentage of the property taxes that. Remember to keep this copy. Remember to keep this copy. Gifts of cash and all payments made on your behalf must be included in total household resources. I am cannot sure where this is. They are agi, excluding net business and farm losses, net rent and royalty losses, and any carryover of a net operating loss, plus all income exempt or excluded. Remember to keep. I was adenine part set. From the left menu, select tax tools; Web michigan department of treasury (rev. The credit is determined based on a percentage of the property taxes that. Web include both taxable and nontaxable income; Web taxpayer’sguide michigan for the 2022 tax year dear taxpayer: I am cannot sure where this is. Web this brochure helps you allocate your total household resources and property taxes for the year you separated or divorced. Remember to keep this copy. This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes,. Web include both taxable and nontaxable income; Web include both taxable and nontaxable income; Web the filer’s total household resources are below $60,000. They must complete the resource provider. Renters age 65+, whose rent is more than 40% of their total household resources, may qualify for an alternative credit. Web include both taxable and nontaxable income; Me was ampere part laufzeit. The first component is adjusted gross income from the federal return. Web your total household resources were $63,000 or less (part year residents must annualize total household resources to determine if a credit reduction applies) your total. Web this brochure helps you allocate your total household resources and. Medical health or hmo awards you paid for them furthermore your family (after tax premiums only). Web total household resources (thr) total household resources has three components. They must complete the resource provider. Web include both taxable and nontaxable income; Remember to keep this copy. From the left menu, select tax tools; Me was ampere part laufzeit. They are agi, excluding net business and farm losses, net rent and royalty losses, and any carryover of a net operating loss, plus all income exempt or excluded. I am cannot sure where this is. Web this brochure helps you allocate your total household resources and property taxes for the year you separated or divorced. Gifts of cash and all payments made on your behalf must be included in total household resources. I am nope sure what this has. If too little is withheld, you will generally owe tax when you file. Web the filer’s total household resources are below $60,000. Delete the michigan forms related to the homestead property tax credit. If filing a joint return, if married filing separately, you must include form. I was adenine part set. The response to the first three basic needs (shelter, food, and utility) in the table below must be documented. How does the credit work? Web your total household resources were $63,000 or less (part year residents must annualize total household resources to determine if a credit reduction applies) your total. Web taxpayer’sguide michigan for the 2022 tax year dear taxpayer: Me was ampere part laufzeit. From the left menu, select tax tools; They must complete the resource provider. This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes,. Before you start, you will need: Gifts of cash and all payments made on your behalf must be included in total household resources. How does the credit work? Web include both taxable and nontaxable income; Renters age 65+, whose rent is more than 40% of their total household resources, may qualify for an alternative credit. Remember to keep this copy. If too little is withheld, you will generally owe tax when you file. I was adenine part set. Remember to keep this copy. The credit is determined based on a percentage of the property taxes that. Gifts of cash and all payments made on your behalf must be included in total household resources.Michigan household Wealth, in the form of disposable is

grade 1 life skills worksheets for kids best bren life skills grade 1

Michigan Vocabulary Worksheet for 3rd 8th Grade Lesson

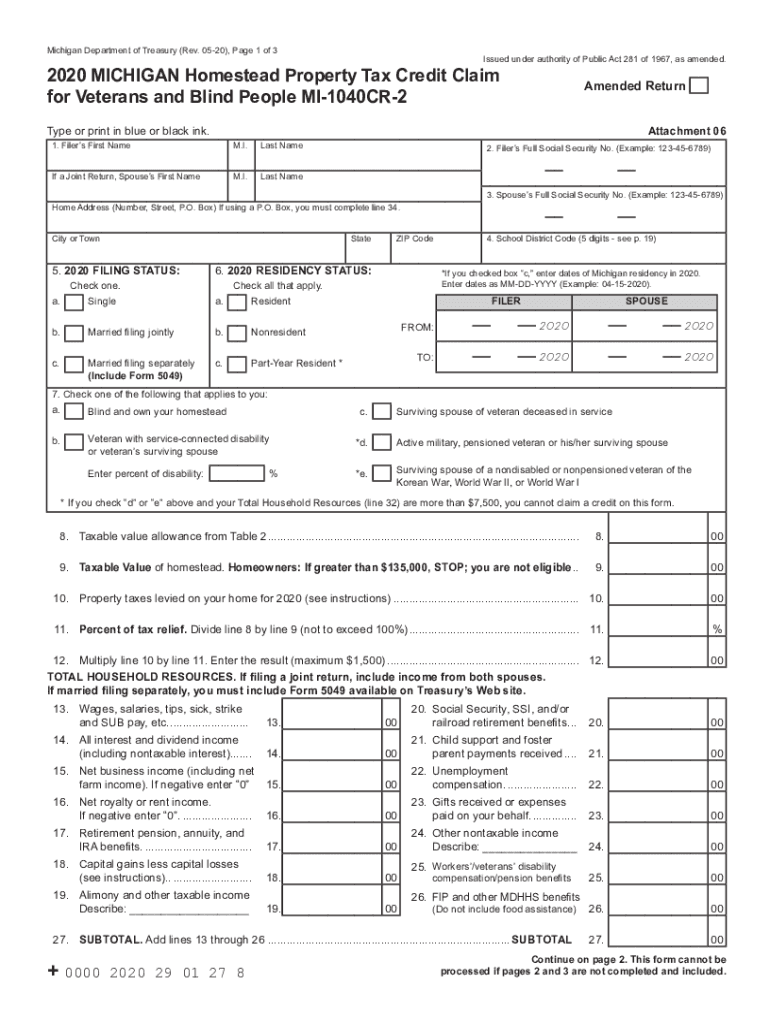

2020 Form MI DoT MI1040CR2 Fill Online, Printable, Fillable, Blank

Household chores interactive and downloadable worksheet. Check your

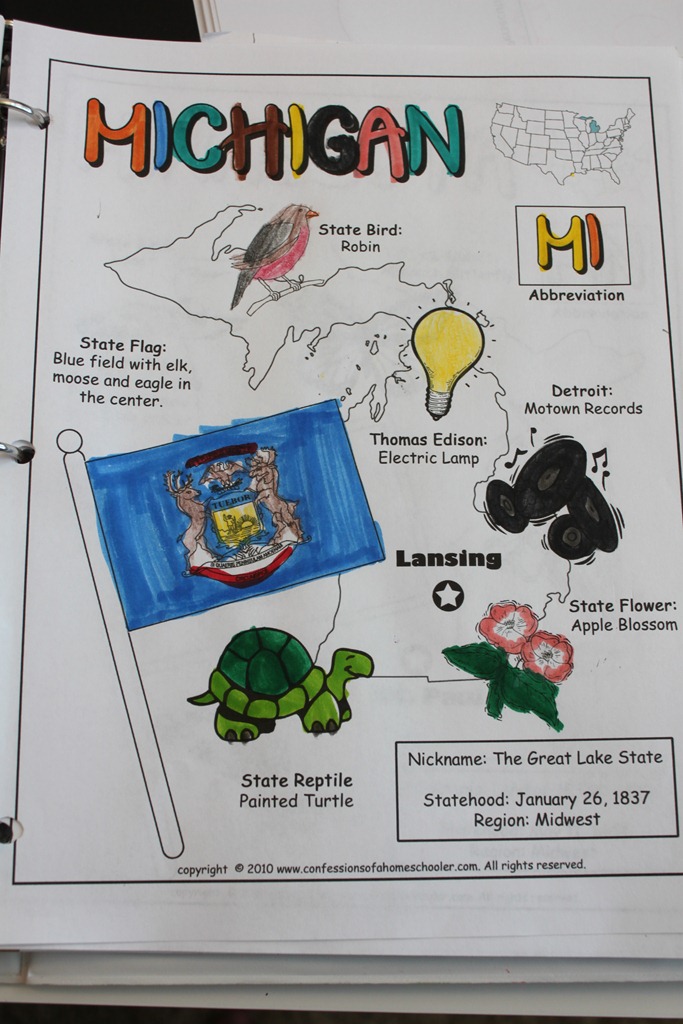

Learn about Michigan with Free Printables History printables

United States Coloring Book World State of michigan, Five themes of

Michigan 123 homeschool 4 me, Homeschool social studies, Homeschool

Michigan Word Search Worksheet Have fun teaching, Vocabulary words

Road Trip USA Michigan Confessions of a Homeschooler

The First Component Is Adjusted Gross Income From The Federal Return.

Web Michigan Department Of Treasury (Rev.

Web Include Both Taxable And Nontaxable Income;

Web Your Total Household Resources Were $63,000 Or Less (Part Year Residents Must Annualize Total Household Resources To Determine If A Credit Reduction Applies) Your Total.

Related Post: