Minister Housing Allowance Worksheet

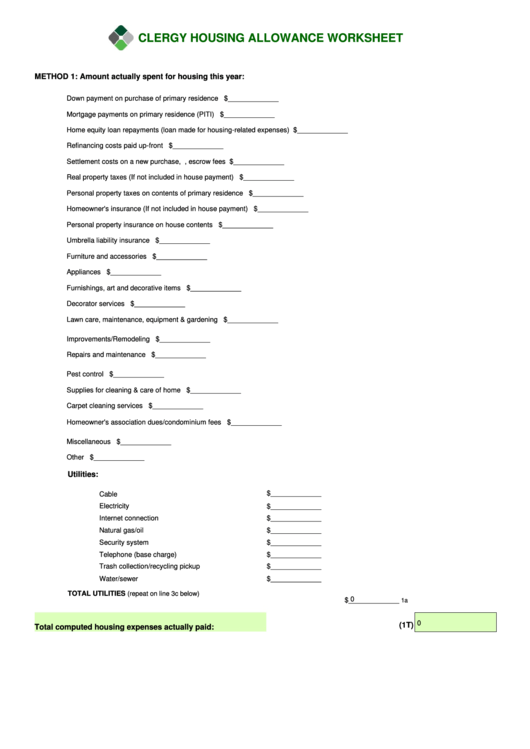

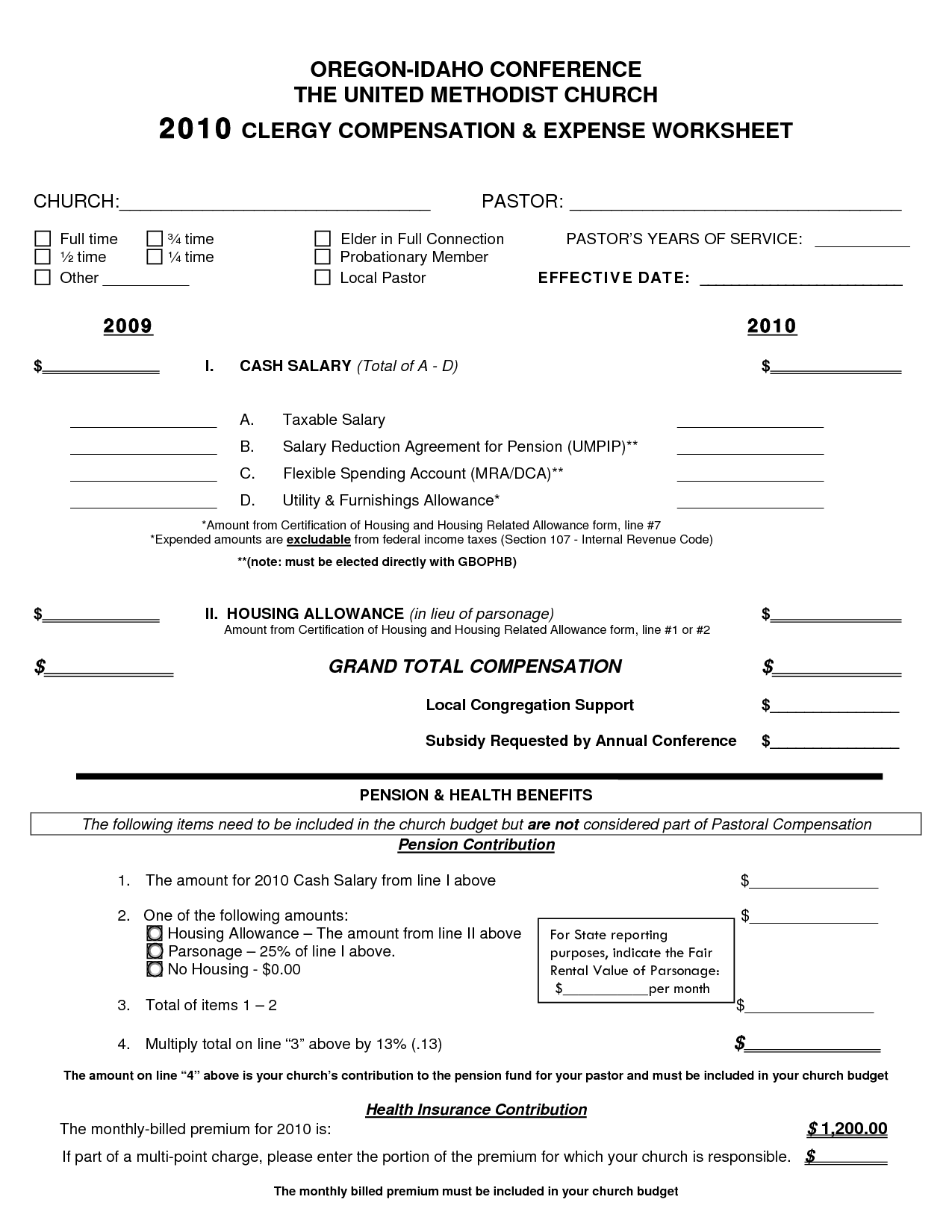

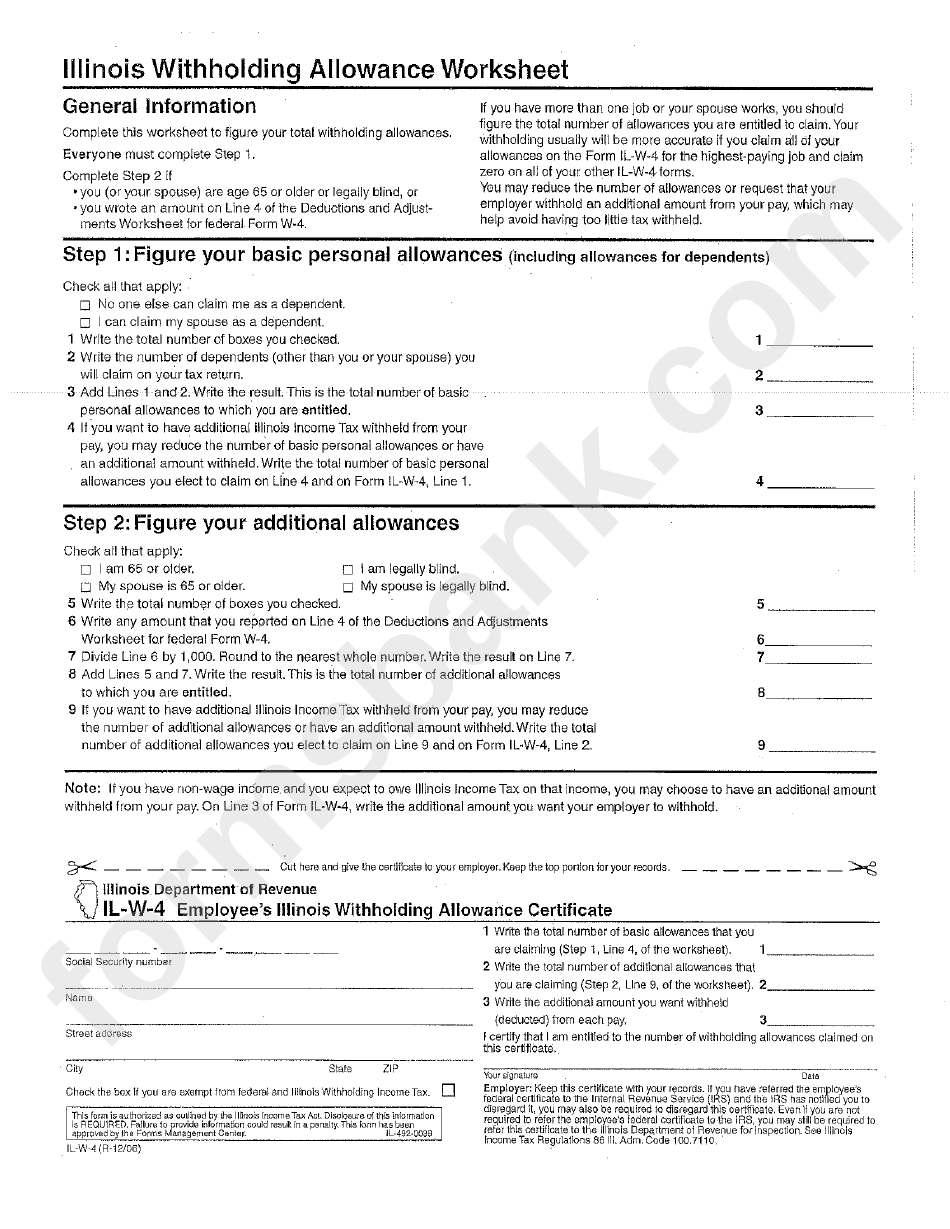

Minister Housing Allowance Worksheet - You should discuss your specific. Web clergy housing allowance worksheet tax return for year 200____ note: Web allowable housing expenses (expenses paid by minister from current income) estimated expenses utilities (gas, electricity, water) and trash collection actual $ ________ $. Web 2020 minister housing allowance worksheet mortgage payment *real estate taxes *homeowners insurance mortgage down payment & closing costs rent renter's. Or the fair market rental. _____________ m o u n. Web this worksheet is designed to help a clergyperson determine the amount that he or she may exclude from gross income pursuant to the provisions of section 107 of the internal. Not every staff member at the church can take this allowance. If you just want a real piece of paper to write on, click the download button above and print out the. The amount actually used to provide or rent a home; Web the more you know about housing allowance in your years as a minister, the more you may benefit from it in your retirement. This worksheet will help you determine your specific housing expenses when filing your annual tax. Down payment on purchase of primary residence $_____ mortgage. The minister must include the amount of the fair rental. You should. Down payment on purchase of primary residence $_____ mortgage. Amount actually spent for housing this year: Web clergy housing allowance worksheet tax return for year 200____ note: Web if you are a retired minister, you can exclude from your gross income the rental value of a home (plus utilities) furnished to you by your church as a part of your. The amount actually used to provide or rent a home; Web ministers housing allowance worksheet Amount actually spent for housing this year: Web get the most out of your minister’s housing allowance. This worksheet will help you determine your specific housing expenses when filing your annual tax. Web 2019 minister housing allowance worksheet download. Web the more you know about housing allowance in your years as a minister, the more you may benefit from it in your retirement. The minister must include the amount of the fair rental. Down payment on purchase of primary residence $_____ mortgage. Web this worksheet is designed to help a clergyperson determine. _____________ m o u n. Section 107 of the internal revenue code clearly allows only for “ministers of the gospel” to exclude some or all of their ministerial income as a housing allowance from income for federal income tax purposes. Web 2019 minister housing allowance worksheet mortgage payment *real estate taxes *homeowners insurance mortgage down payment & closing costs rent. Not every staff member at the church can take this allowance. Web the amount officially designated (in advance of payment) as a housing allowance; Web • a minister’s housing allowance is an exclusion for federal income taxes only. The amount actually used to provide or rent a home; You should discuss your specific. The housing allowance is for pastors/ministers only. Not every staff member at the church can take this allowance. Section 107 of the internal revenue code clearly allows only for “ministers of the gospel” to exclude some or all of their ministerial income as a housing allowance from income for federal income tax purposes. Downloadable.pdf housing allowance worksheet download. Web clergy. Web allowable housing expenses (expenses paid by minister from current income) estimated expenses utilities (gas, electricity, water) and trash collection actual $ ________ $. Web clergy housing allowance worksheet method 1: The minister must include the amount of the fair rental. Web if you are a retired minister, you can exclude from your gross income the rental value of a. Web clergy housing allowance worksheet tax return for year 200____ note: A minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income for income tax. Web clergy housing allowance worksheet method 1: Web the fair rental value of a parsonage or the housing allowance is excludable only for income tax purposes. Web 2019. This worksheet will help you determine your specific housing expenses when filing your annual tax. Web 2019 minister housing allowance worksheet mortgage payment *real estate taxes *homeowners insurance mortgage down payment & closing costs rent renter's. Web ministers who own their homes should take the following expenses into account in computing their housing allowance exclusion. Web get the most out. The housing allowance is for pastors/ministers only. Web 2019 minister housing allowance worksheet mortgage payment *real estate taxes *homeowners insurance mortgage down payment & closing costs rent renter's. Web 2020 minister housing allowance worksheet mortgage payment *real estate taxes *homeowners insurance mortgage down payment & closing costs rent renter's. Web • a minister’s housing allowance is an exclusion for federal income taxes only. Web ministers housing allowance worksheet The amount actually used to provide or rent a home; Web this worksheet is designed to help a clergyperson determine the amount that he or she may exclude from gross income pursuant to the provisions of section 107 of the internal. Downloadable.pdf housing allowance worksheet download. Downloadable excel housing allowance spreadsheet download. This worksheet will help you determine your specific housing expenses when filing your annual tax. Web clergy housing allowance worksheet method 1: Web the regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified. At guidestone ® , we help active. Web here are the recommended steps for the minister to take in order to maximize the exclusion: Web if you are a retired minister, you can exclude from your gross income the rental value of a home (plus utilities) furnished to you by your church as a part of your pay for past. Down payment on purchase of primary residence $_____ mortgage. The minister must include the amount of the fair rental. Web the fair rental value of a parsonage or the housing allowance is excludable only for income tax purposes. _____________ m o u n. A minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income for income tax. This worksheet will help you determine your specific housing expenses when filing your annual tax. Web the more you know about housing allowance in your years as a minister, the more you may benefit from it in your retirement. You should discuss your specific. Not every staff member at the church can take this allowance. Amount actually spent for housing this year: Contributions you make to a church. Downloadable excel housing allowance spreadsheet download. Web 2019 minister housing allowance worksheet mortgage payment *real estate taxes *homeowners insurance mortgage down payment & closing costs rent renter's. Web the amount officially designated (in advance of payment) as a housing allowance; Web ministers housing allowance worksheet If you just want a real piece of paper to write on, click the download button above and print out the. Web get the most out of your minister’s housing allowance. Web • a minister’s housing allowance is an exclusion for federal income taxes only. At guidestone ® , we help active. Web this worksheet is designed to help a clergyperson determine the amount that he or she may exclude from gross income pursuant to the provisions of section 107 of the internal. The amount actually used to provide or rent a home;Clergy Housing Allowance Worksheet

Managing Your Minister's Housing Allowance Expense Transaction Account

Clergy Housing Allowance Worksheets 2022

43 clergy housing allowance worksheet Worksheet Information

Where To Download clergy housing allowance worksheet [PDF] vcon.duhs

Fillable Clergy Housing Allowance Worksheet printable pdf download

20 Church Monthly Budget Worksheet /

Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

Web The Regulations Require That The Housing Allowance Be Designated Pursuant To Official Action Taken In Advance Of Such Payment By The Employing Church Or Other Qualified.

Web Ministers Who Own Their Homes Should Take The Following Expenses Into Account In Computing Their Housing Allowance Exclusion.

Web According To The Irs, The Housing Allowance Of A Retired Minister Counts Because It Is Paid As Compensation For Past Services.

Web The Fair Rental Value Of A Parsonage Or The Housing Allowance Is Excludable Only For Income Tax Purposes.

Related Post:

![Where To Download clergy housing allowance worksheet [PDF] vcon.duhs](https://i0.wp.com/1.bp.blogspot.com/_onWZ93zsnlQ/TQdtAF3rqiI/AAAAAAAAB1o/to4yzEpE110/s1600/parsonage%2Ballowance%2Bworksheet.jpg)