Social Security Taxable Income Worksheet

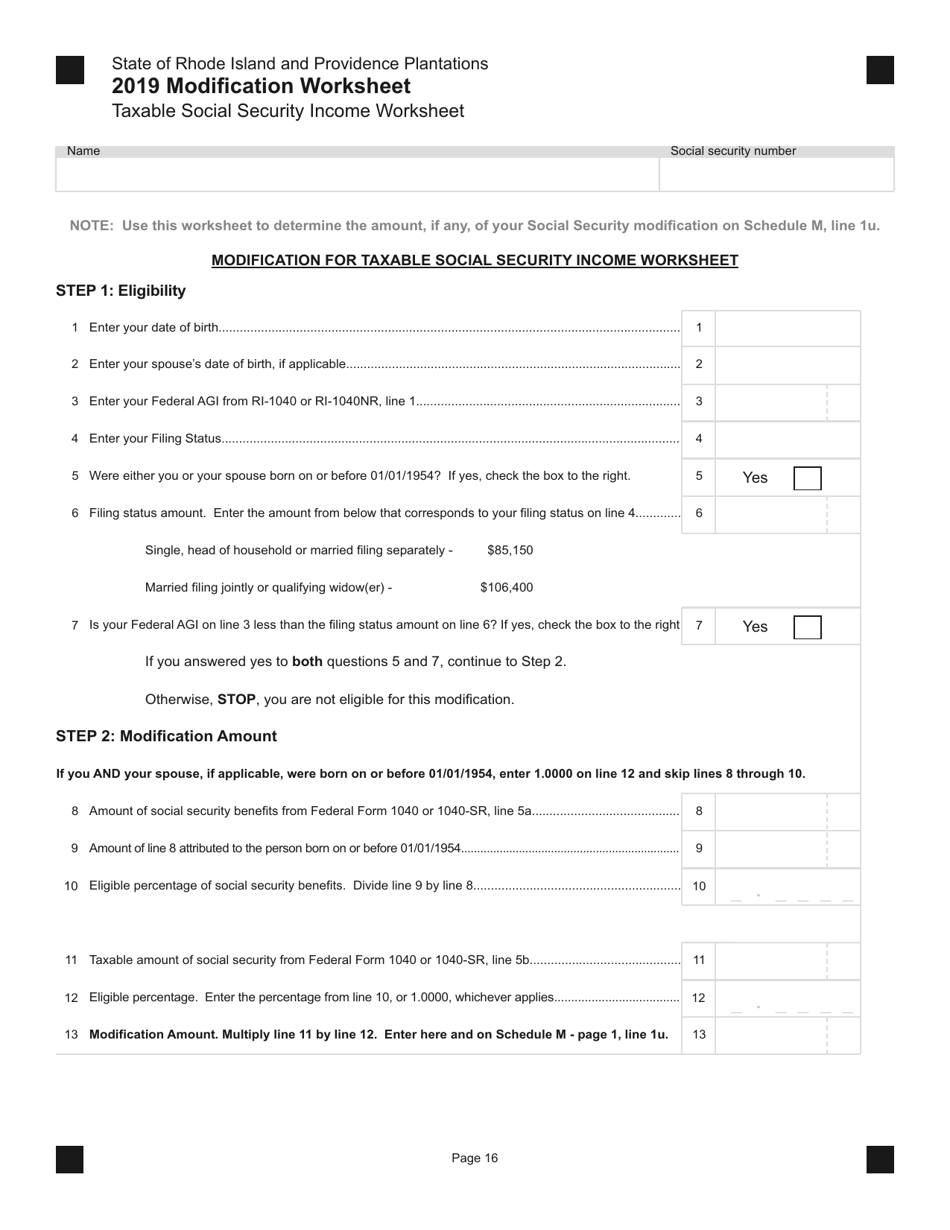

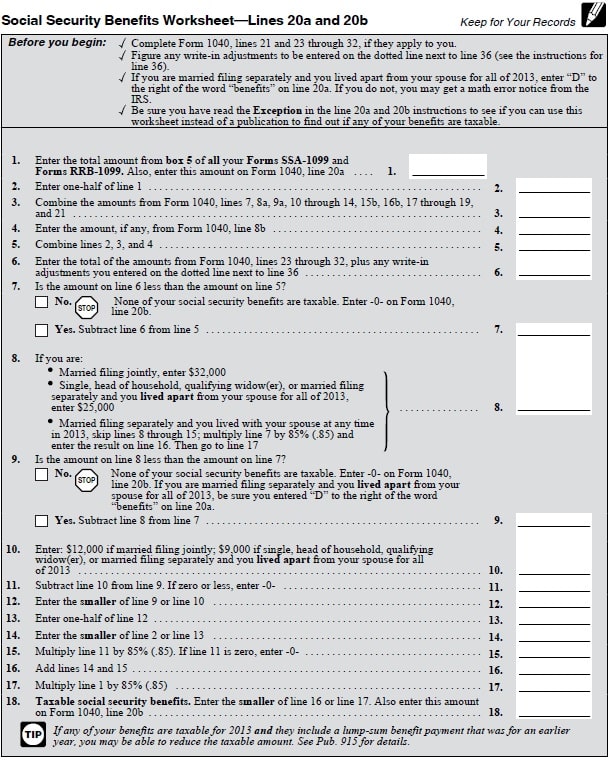

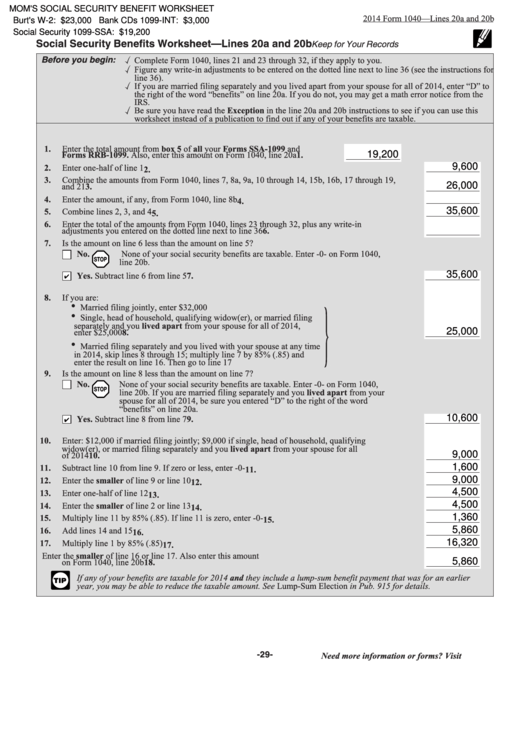

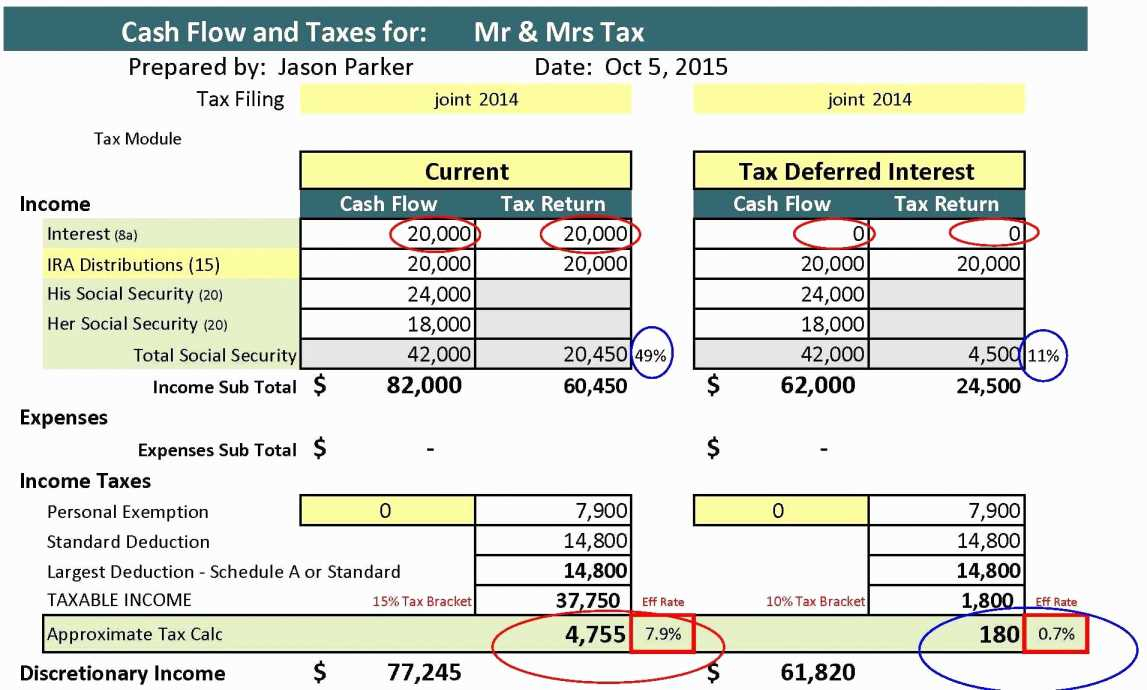

Social Security Taxable Income Worksheet - Social security benefits include monthly. Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax. Web jul 27, 2023 11:00 am edt. More than $44,000, up to 85 percent of your benefits may be taxable. Web social security taxable benefits worksheet (2022) worksheet 1. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that will be taxable but the worksheet isn’t the easiest to use. In many cases, the taxable portion is less than 50%. More than $34,000, up to 85 percent of your benefits may be taxable. Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Web social security taxable benefits worksheet (2022) worksheet 1. Web if your income is modest, it is likely that none of your social security benefits are taxable. More than $44,000, up to 85 percent of your benefits may be taxable. Calculating. Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that will be taxable but the worksheet isn’t the easiest to use. Web the taxable portion of social security benefits is never more than 85% of the net benefits the taxpayer received. Web generally, you can figure the taxable amount of. Web june 21, 2022 social security taxable benefits worksheet 2021 by jerry m how to file social security income on your federal taxes is social security. Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Web as your gross income increases, a higher percentage of your social security benefits become. As your gross income increases, a higher percentage of your social security benefits. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. More than $34,000, up to 85 percent of your benefits may be taxable. Web the taxable portion of social security. Web if your income is modest, it is likely that none of your social security benefits are taxable. You file a federal tax return as an individual and your combined income is between $25,000 and. Social security benefits include monthly. As your gross income increases, a higher percentage of your social security benefits. Web the taxable portion of social security. 2) the taxpayer repaid any benefits in 2019 and total repayments (box 4) were more than total benefits for 2019 (box. Web generally, you can figure the taxable amount of the benefits in are my social security or railroad retirement tier i benefits taxable?, on a worksheet in the. Web 2 nontaxable social security and/or railroad retirement board benefits received.. Web up to 50% of your social security benefits are taxable if: Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits.the taxact® program. Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Web. Web social security taxable benefits worksheet (2022) worksheet 1. Ssi (supplemental security income), ga (general assistance), and minnesota housing. Web up to 50% of your social security benefits are taxable if: Web june 21, 2022 social security taxable benefits worksheet 2021 by jerry m how to file social security income on your federal taxes is social security. Web jul 27,. Web generally, you can figure the taxable amount of the benefits in are my social security or railroad retirement tier i benefits taxable?, on a worksheet in the. Ssi (supplemental security income), ga (general assistance), and minnesota housing. Web the taxable portion of social security benefits is never more than 85% of the net benefits the taxpayer received. Web you. The irs reminds taxpayers receiving social security benefits that they may have to pay. Web up to 50% of your social security benefits are taxable if: Ssi (supplemental security income), ga (general assistance), and minnesota housing. Web social security taxable benefits worksheet (2022) worksheet 1. Web generally, you can figure the taxable amount of the benefits in are my social. Calculating taxable benefits before filling out this worksheet: Web if your income is modest, it is likely that none of your social security benefits are taxable. Web as your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of your total benefits.the taxact® program. Web the taxable portion of social security benefits is never more than 85% of the net benefits the taxpayer received. 2) the taxpayer repaid any benefits in 2019 and total repayments (box 4) were more than total benefits for 2019 (box. Web jul 27, 2023 11:00 am edt. Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that will be taxable but the worksheet isn’t the easiest to use. In many cases, the taxable portion is less than 50%. Web june 21, 2022 social security taxable benefits worksheet 2021 by jerry m how to file social security income on your federal taxes is social security. Ssi (supplemental security income), ga (general assistance), and minnesota housing. Web up to 50% of your social security benefits are taxable if: Web 2 nontaxable social security and/or railroad retirement board benefits received. Web between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. As your gross income increases, a higher percentage of your social security benefits. More than $34,000, up to 85 percent of your benefits may be taxable. Social security benefits include monthly. The irs reminds taxpayers receiving social security benefits that they may have to pay. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax. Web generally, you can figure the taxable amount of the benefits in are my social security or railroad retirement tier i benefits taxable?, on a worksheet in the. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. A new tax season has arrived. More than $44,000, up to 85 percent of your benefits may be taxable. Web the taxable portion of social security benefits is never more than 85% of the net benefits the taxpayer received. Web you can go through the 19 steps in the worksheet to calculate the amount of social security benefits that will be taxable but the worksheet isn’t the easiest to use. In many cases, the taxable portion is less than 50%. Web up to 50% of your social security benefits are taxable if: 2) the taxpayer repaid any benefits in 2019 and total repayments (box 4) were more than total benefits for 2019 (box. The irs reminds taxpayers receiving social security benefits that they may have to pay. Web between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. Web generally, you can figure the taxable amount of the benefits in are my social security or railroad retirement tier i benefits taxable?, on a worksheet in the. Calculating taxable benefits before filling out this worksheet: Web 2 nontaxable social security and/or railroad retirement board benefits received. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax. Web taxpayers receiving social security benefits may have to pay federal income tax on a portion of those benefits. Ssi (supplemental security income), ga (general assistance), and minnesota housing. As your gross income increases, a higher percentage of your social security benefits.2019 Rhode Island Taxable Social Security Worksheet Download

Is Social Security Tax Deductible

Form 1040 Social Security Tax Worksheet 2021 Tax Forms 1040 Printable

Social Security Calculator Spreadsheet Within Building Cost Estimate

6 Social Security Worksheet

IRS Instruction 943 20202021 Fill out Tax Template Online US Legal

Irs Social Security Tax Worksheet

Will Your Social Security Benefits Be Taxed? Worksheet Template Tips

Social Security Benefits Worksheets 2021

Social Security Worksheet For 1040a Nidecmege

Web If Your Income Is Modest, It Is Likely That None Of Your Social Security Benefits Are Taxable.

Web June 21, 2022 Social Security Taxable Benefits Worksheet 2021 By Jerry M How To File Social Security Income On Your Federal Taxes Is Social Security.

Web As Your Gross Income Increases, A Higher Percentage Of Your Social Security Benefits Become Taxable, Up To A Maximum Of 85% Of Your Total Benefits.the Taxact® Program.

Social Security Benefits Include Monthly.

Related Post: