Partnership Basis Worksheet

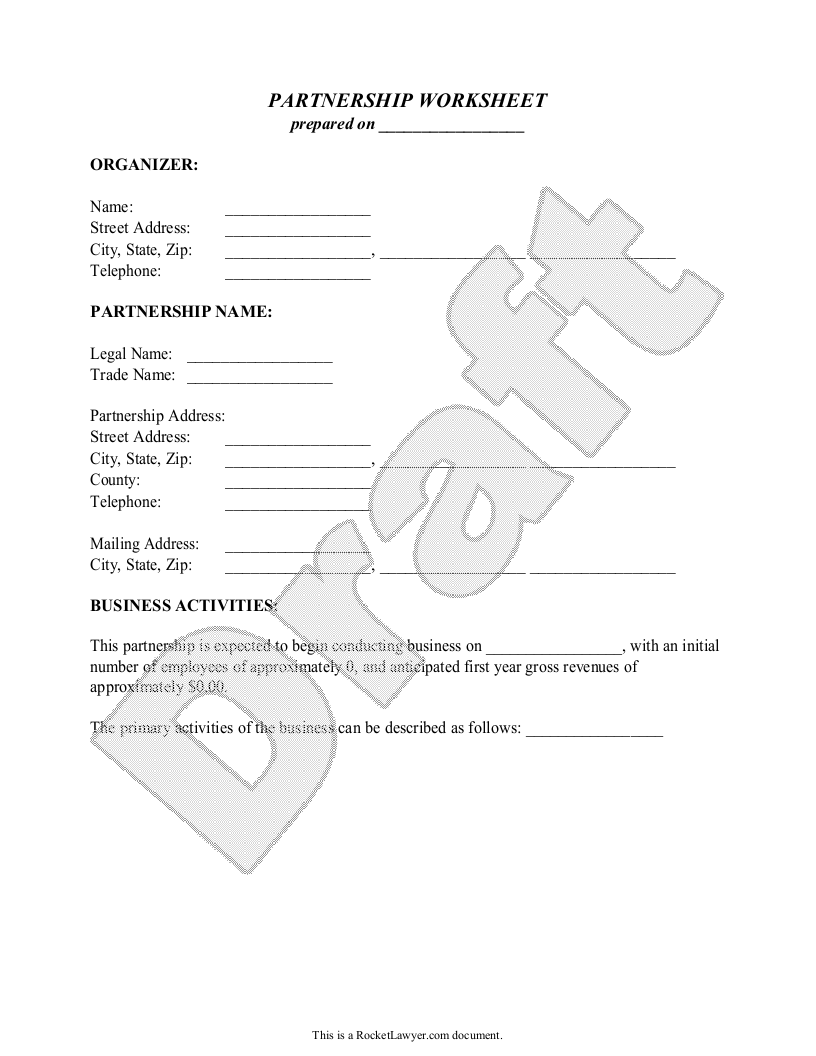

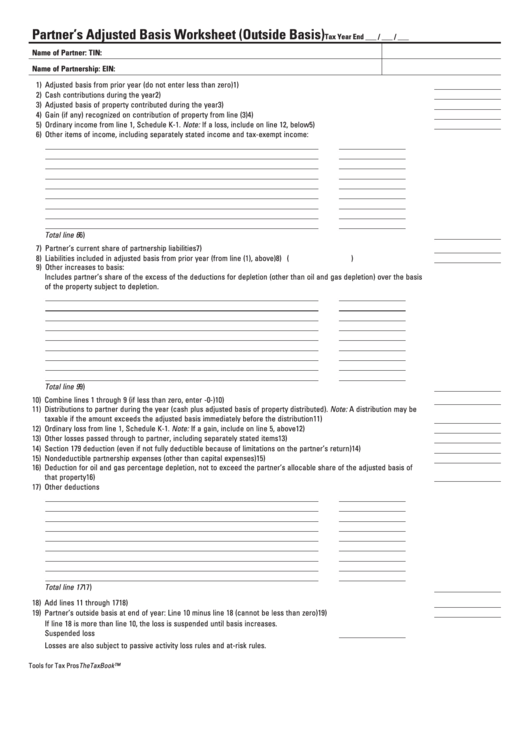

Partnership Basis Worksheet - Web partner’s outside basis calculation. Web a partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis during the current year. Increased by positive basis adjustments (cash, property contributions, income/gain) irc § 705(a)(1). Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. The basis of an interest in a. Washington — the irs released today an early draft of the instructions to form 1065, u.s. Web first, a partnership has two types of tax basis: Web partner's basis worksheet faqs click the following links to read answers to common questions about processing partner's basis worksheets. How does the partner's basis. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. Basis is the amount of your investment in property for tax purposes. Inside basis focuses on individual assets, while outside basis has to do with each partner’s. Partner basis and debt basis are entered. The basis of an interest in a. The partner’s outside basis is used to determine gain or loss on the disposition of the partnership interest and may limit the. Web yes, basis worksheet calculations are available in the 1040 package. Web first, a partnership has two types of tax basis: Web worksheet for tracking the basis of a partner’s interest. Web partnership is a relationship between two or more persons who join together to carry on a trade, business, or investment activity. Web partner’s outside basis calculation. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. This template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Web worksheet for tracking the basis of a partner’s interest in the partnership. Web first, a partnership has two types of tax basis: Web yes, basis worksheet calculations are available in the 1040 package. Increased by positive basis adjustments. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Web partner’s outside basis calculation. Web first, a partnership has two types of tax basis: The partner’s outside basis is used to determine gain or loss on the disposition of the partnership interest and may limit the. The stock. This template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital account plus his share of partnership liabilities. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the partnership is found in. How does the partner's basis. The basis of. Web partnership is a relationship between two or more persons who join together to carry on a trade, business, or investment activity. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the partnership is found in. Web partner's basis worksheet faqs click the following links to. Web a partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. Web worksheet for tracking the basis of a partner’s interest in the partnership basis is the amount of your investment in property for tax purposes. Partner basis and debt basis are entered on the k1p screen, on the tabs basis wkst and basis wkst. The partner’s outside basis is used to determine gain or loss on the disposition of the partnership interest and may limit the. Here is the worksheet for adjusting the basis of a partner's interest in the partnership. Web partnership is a relationship between two or more persons who join together to carry on a trade, business, or investment activity. Web. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Here is the worksheet for adjusting the basis of a partner's interest in the partnership. Return of partnership income pdf,. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and. Basis is the amount of your investment in property for tax purposes. Inside basis and outside basis. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. Here is the worksheet for adjusting the basis of a partner's interest in the partnership. Web a partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. Web first, a partnership has two types of tax basis: Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the partnership is found in. Web worksheet for tracking the basis of a partner’s interest in the partnership basis is the amount of your investment in property for tax purposes. The stock basis and debt basis amounts are entered on the k1s screen, on the tabs basis (7203) and basis, cont. Web partner's basis worksheet faqs click the following links to read answers to common questions about processing partner's basis worksheets. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership is found in the partner's. Web on october 22, the irs made its opening foray into the expanded 2020 tax basis capital reporting requirement that will apply to all partnerships. Increased by positive basis adjustments (cash, property contributions, income/gain) irc § 705(a)(1). Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Washington — the irs released today an early draft of the instructions to form 1065, u.s. How does the partner's basis. The basis of an interest in a. Each partner has a basis in his partnership. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. Washington — the irs released today an early draft of the instructions to form 1065, u.s. The partner’s outside basis is used to determine gain or loss on the disposition of the partnership interest and may limit the. Web partner’s outside basis calculation. Web worksheet for tracking the basis of a partner’s interest in the partnership. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. Web partner's basis worksheet faqs click the following links to read answers to common questions about processing partner's basis worksheets. Web on october 22, the irs made its opening foray into the expanded 2020 tax basis capital reporting requirement that will apply to all partnerships. Inside basis focuses on individual assets, while outside basis has to do with each partner’s. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the partnership is found in. The basis of an interest in a. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership is found in the partner's. Return of partnership income pdf,. The stock basis and debt basis amounts are entered on the k1s screen, on the tabs basis (7203) and basis, cont. Web first, a partnership has two types of tax basis: This template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital account plus his share of partnership liabilities.Free Partnership Worksheet Free to Print, Save & Download

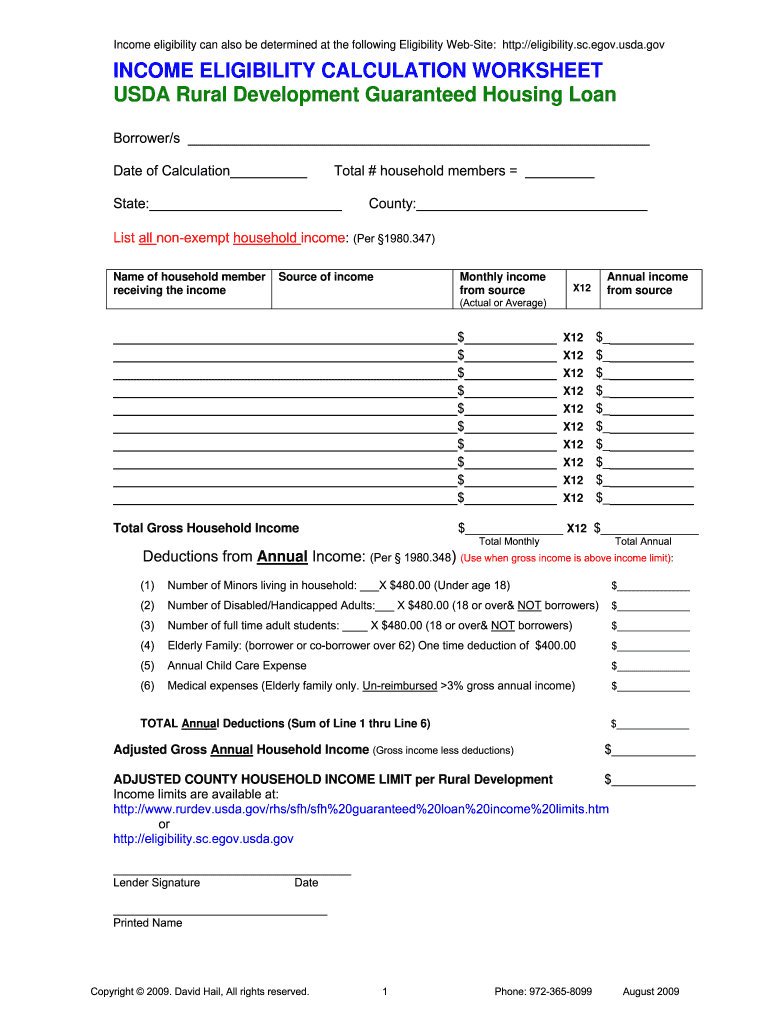

Business & Partnership(1120S & 1065)

Access Free partnership basis calculation worksheet ? vcon.duhs.edu.pk

Partners ESL worksheet by monsediva

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

Partnership Basis Worksheet Excel Fill Online, Printable, Fillable

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

Quiz & Worksheet Federal Tax Implications of Basis of Partners

Partnership Basis Calculation Worksheet Studying Worksheets

Fillable Partner'S Adjusted Basis Worksheet (Outside Basis) Template

Web Partnership Is A Relationship Between Two Or More Persons Who Join Together To Carry On A Trade, Business, Or Investment Activity.

Web Use The Basis Wks Screen, Partner’s Adjusted Basis Worksheet, To Calculate A Partner’s New Basis After Increases And/Or Decreases Are Made To Basis During The Current Year.

Here Is The Worksheet For Adjusting The Basis Of A Partner's Interest In The Partnership.

Partner Basis And Debt Basis Are Entered On The K1P Screen, On The Tabs Basis Wkst And Basis Wkst (Cont.).

Related Post: