Qbi Calculation Worksheet

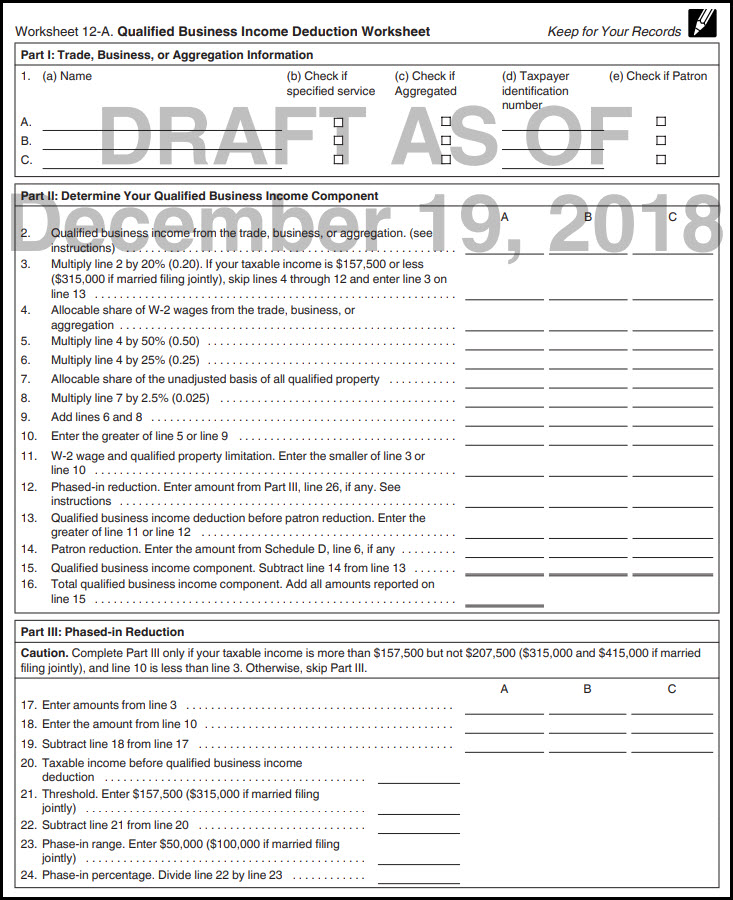

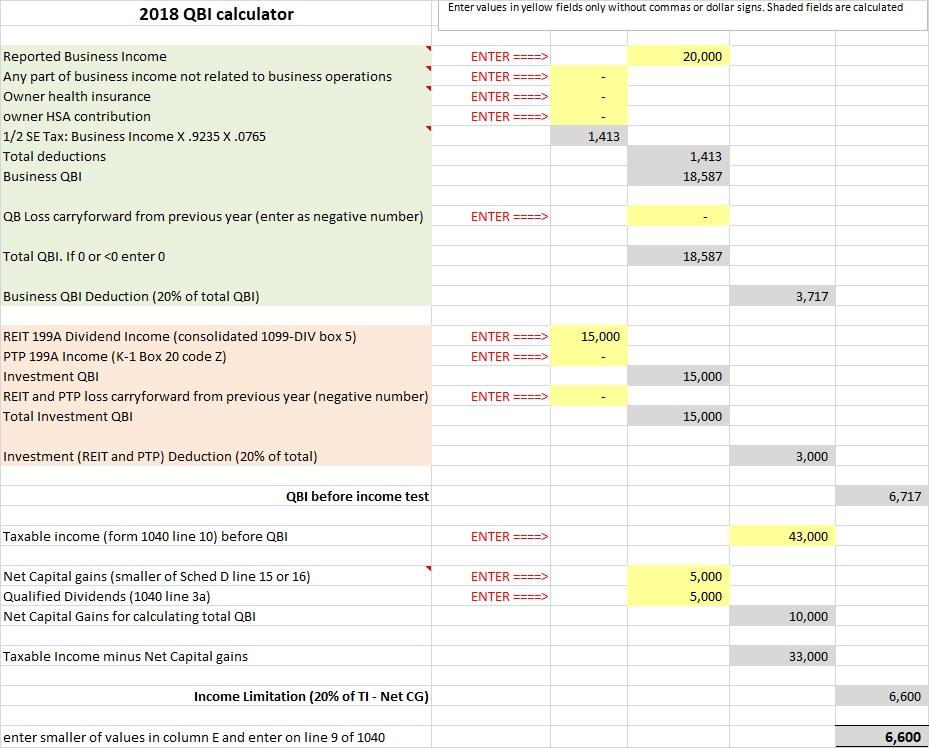

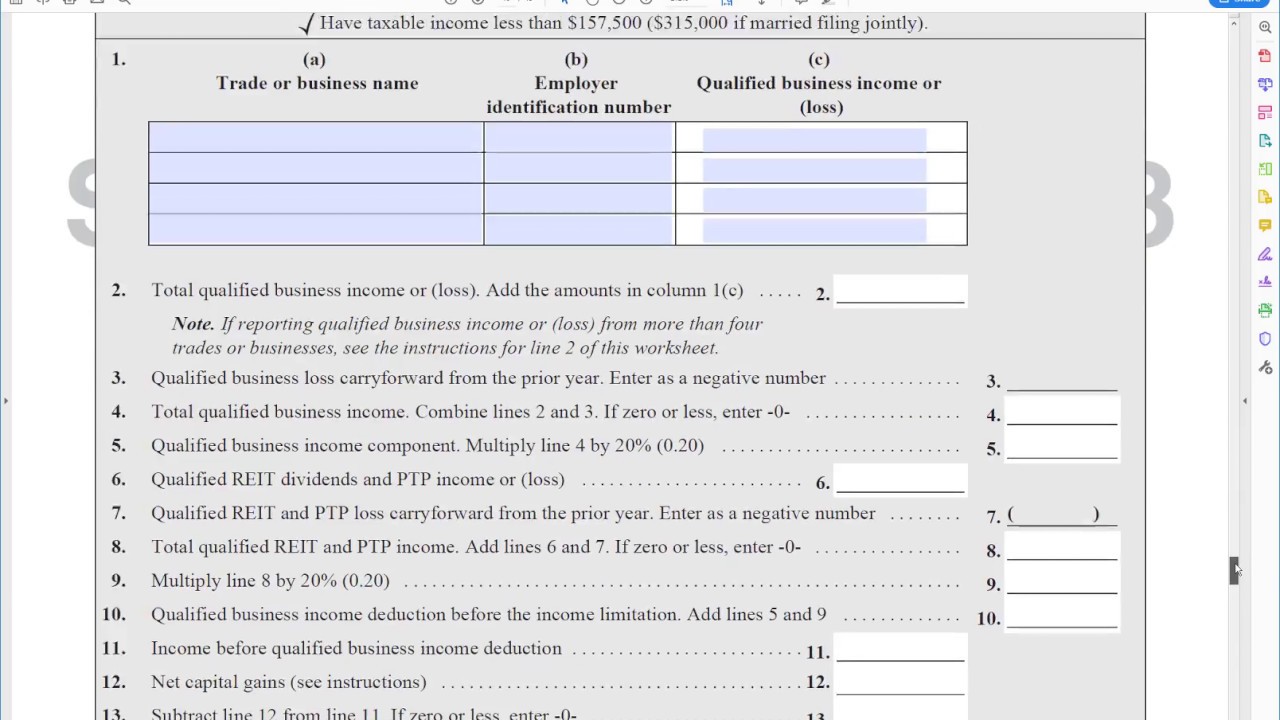

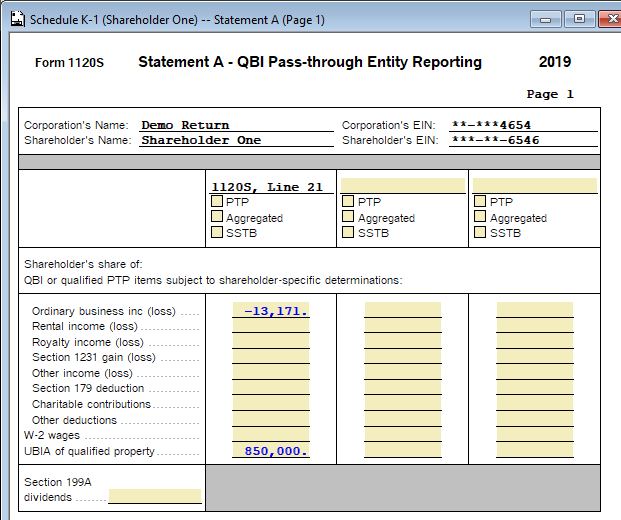

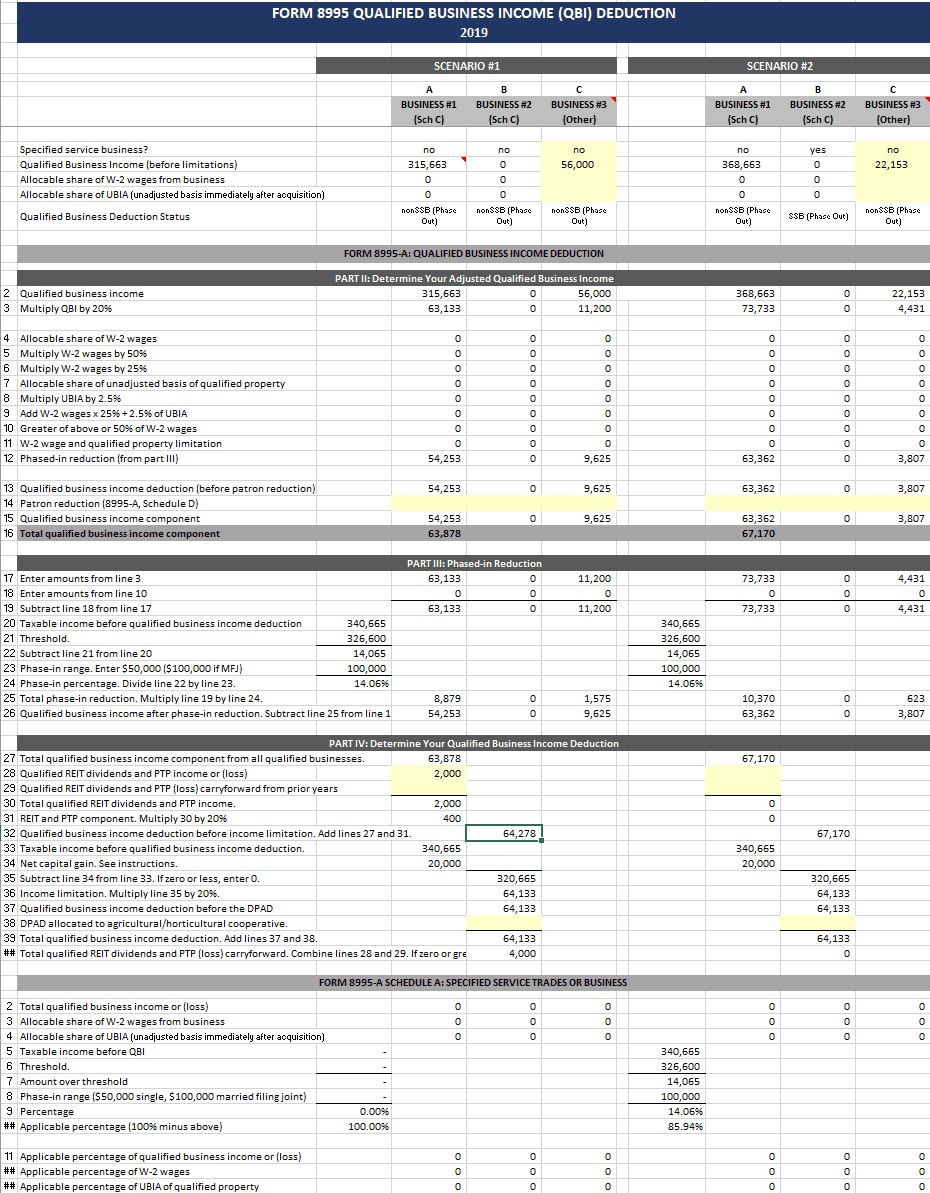

Qbi Calculation Worksheet - Combine lines 2 and 3. Include the following schedules (their specific instructions are shown later), as appropriate: Web go to delete a form: It appears as the last tab for each schedule in. Web calculations where does my qbi calculation appear in the return? (a) name (b) check ifspecified service (c) check ifaggregated (d) taxpayeridentificationnumber (e) check if patron part ii: It appears in the qbi folder in form view. Determine your qualified business income component 2. Partnership’s section 199a information worksheet. Web this worksheet is for taxpayers who: Determine whether your income is related to a qualified trade or business you must have ownership interest in a qualified trade or business to claim the qbi deduction. Delete that qbi component sheet. Web the qbi deduction worksheet is the main worksheet used to arrive at the bottom line qbi deduction and runs through the various computations: Combine lines 2. (a) name (b) check ifspecified service (c) check ifaggregated (d) taxpayeridentificationnumber (e) check if patron part ii: Web this worksheet is for taxpayers who: The best tax strategies may include a combination of business entities to optimize the tax results for the taxpayer. Web calculations where does my qbi calculation appear in the return? Don’t worry about which worksheet your. Located in the qbid folder in form view, this worksheet prints under the following conditions: A qualified business is a partnership, s corporation, or sole proprietorship. Find the qbi component form for the aggregated businesses. Determine your qualified business income component 2. The best tax strategies may include a combination of business entities to optimize the tax results for the. The worksheet also lists the activity from each screen k1qb1 in the k1 1065, 1041 folder. Include the following schedules (their specific instructions are shown later), as appropriate: Don’t worry about which worksheet your return qualifies for. Delete that qbi component sheet. Web there are two ways to calculate the qbi deduction: Web qbi, wages and qualified property reduced proportionately to the taxable income in excess of threshold amount vs. Web there are two ways to calculate the qbi deduction: Delete that qbi component sheet. Include the following schedules (their specific instructions are shown later), as appropriate: A qualified business is a partnership, s corporation, or sole proprietorship. Now, go to review and start the review routine. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. After you complete the required steps, lacerte will generate the correct forms for your return. Web the qbi deduction worksheet is the main worksheet used to arrive at the bottom line qbi deduction. Trade, business, or aggregation information 1. It appears in the qbi folder in form view. Web total qualified business income. Web there are two ways to calculate the qbi deduction: 25% wages & assets lesser of qbi (or defined taxable income) and wage/asset calculation for specified service business if in phaseout range Located in the qbid folder in form view, this worksheet prints under the following conditions: Delete that qbi component sheet. Don’t worry about which worksheet your return qualifies for. (a) name (b) check ifspecified service (c) check ifaggregated (d) taxpayeridentificationnumber (e) check if patron part ii: Combine lines 2 and 3. Web total qualified business income. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Determine your qualified business income component 2. Web comprehensive qualified business incomededuction worksheet part i: In the left menu, select the dropdown arrow next to tax tools and then under that select tools; Partnership’s section 199a information worksheet. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business income (qbi) deduction. Web there are two ways to calculate the qbi deduction: Web there are two ways to calculate the qbi deduction: Include the following schedules (their specific. All the information you need to help the program calculate the qbi deduction for you is contained in this article. Combine lines 2 and 3. Web there are two ways to calculate the qbi deduction: The best tax strategies may include a combination of business entities to optimize the tax results for the taxpayer. Don’t worry about which worksheet your return qualifies for. The form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041. After you complete the required steps, proseries will generate the correct worksheet for your return. Web this worksheet is for taxpayers who: After you complete the required steps, lacerte will generate the correct forms for your return. 25% wages & assets lesser of qbi (or defined taxable income) and wage/asset calculation for specified service business if in phaseout range Web go to delete a form: A qualified business is a partnership, s corporation, or sole proprietorship. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Find the qbi component form for the aggregated businesses. Partnership’s section 199a information worksheet. Include the following schedules (their specific instructions are shown later), as appropriate: It appears in the qbi folder in form view. Multiply line 4 by 20% (0.20). Now, go to review and start the review routine. In the left menu, select the dropdown arrow next to tax tools and then under that select tools; All the information you need to help the program calculate the qbi deduction for you is contained in this article. Web qbi, wages and qualified property reduced proportionately to the taxable income in excess of threshold amount vs. Combine lines 2 and 3. Web go to delete a form: The worksheet also lists the activity from each screen k1qb1 in the k1 1065, 1041 folder. Web comprehensive qualified business incomededuction worksheet part i: Web the qbi deduction worksheet is the main worksheet used to arrive at the bottom line qbi deduction and runs through the various computations: After you complete the required steps, proseries will generate the correct worksheet for your return. Using the simplified worksheet or the complex worksheet. Web the qualified business income component worksheet and qualified income deduction worksheet. The best tax strategies may include a combination of business entities to optimize the tax results for the taxpayer. Trade, business, or aggregation information 1. Web there are two ways to calculate the qbi deduction: Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Have taxable income of $157,500 or less ($315,000 or less if married filing jointly)have any business income (even from an sstb), reit dividends, or ptp income.are not a patron in a specified agricultural or horticultural cooperative. Web electing small business trusts (esbt).Qbi deduction calculator YuweiRio

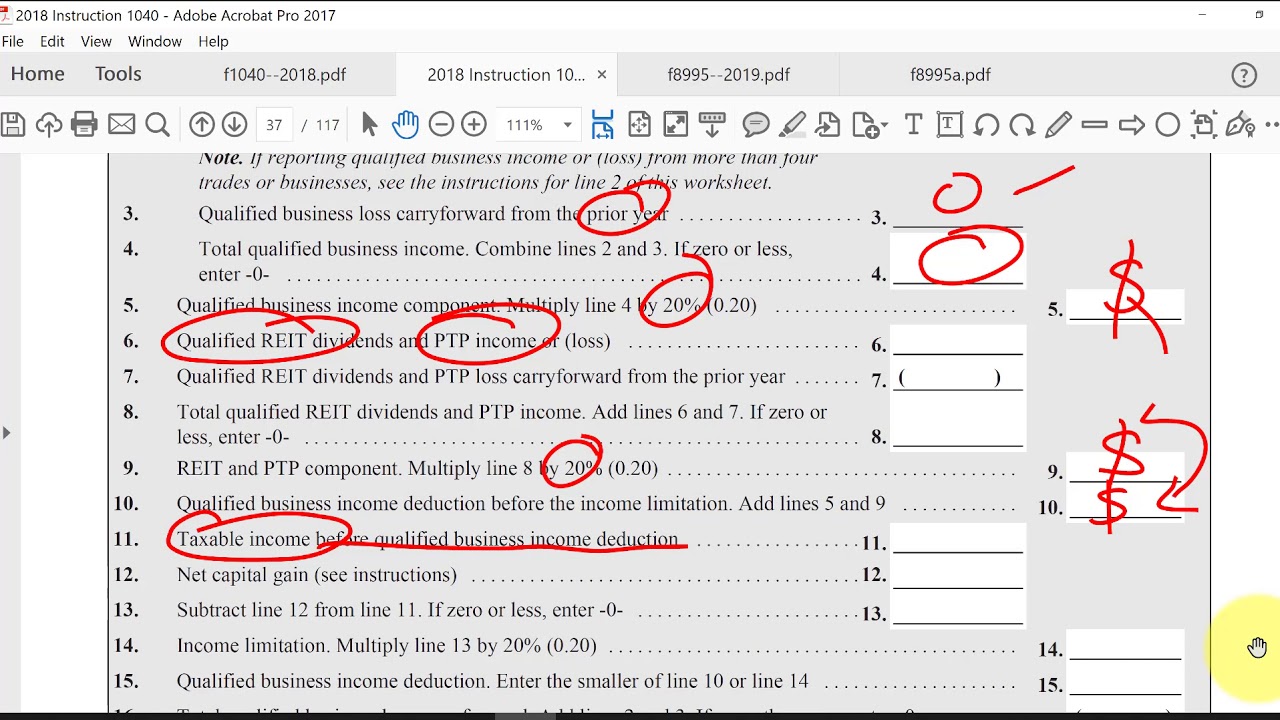

QBI Deduction (simplified calculation) YouTube

ProConnect Tax Online Complex Worksheet Section 199A Qualified

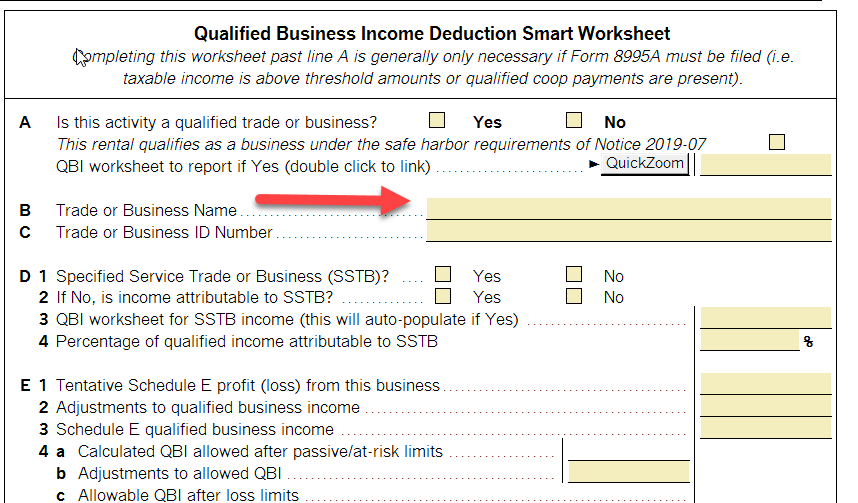

How to enter and calculate the qualified business Tax Pro Community

Re QBI not calculating on Schedule E's Tax Pro Community

Update On The Qualified Business Deduction For Individuals

Qualified Business Deduction Summary Form Charles Leal's Template

How to enter and calculate the qualified business Tax Pro Community

Quiz & Worksheet Determining QBI Deductions

The Best Tool for Tax Planning Physician on FIRE

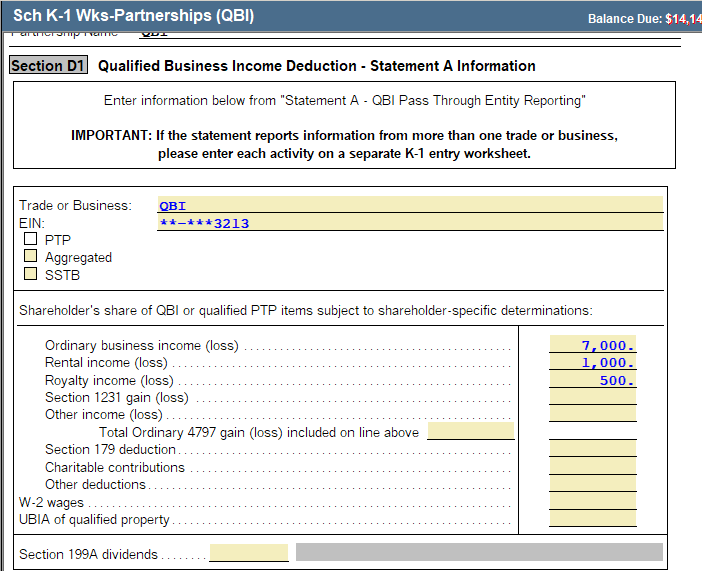

Partnership’s Section 199A Information Worksheet.

Now, Go To Review And Start The Review Routine.

Web Calculations Where Does My Qbi Calculation Appear In The Return?

A Qualified Business Is A Partnership, S Corporation, Or Sole Proprietorship.

Related Post: