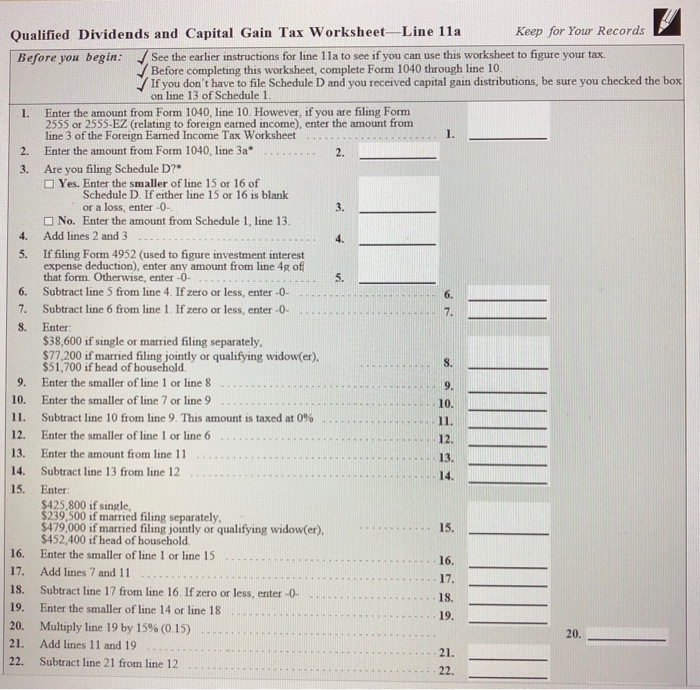

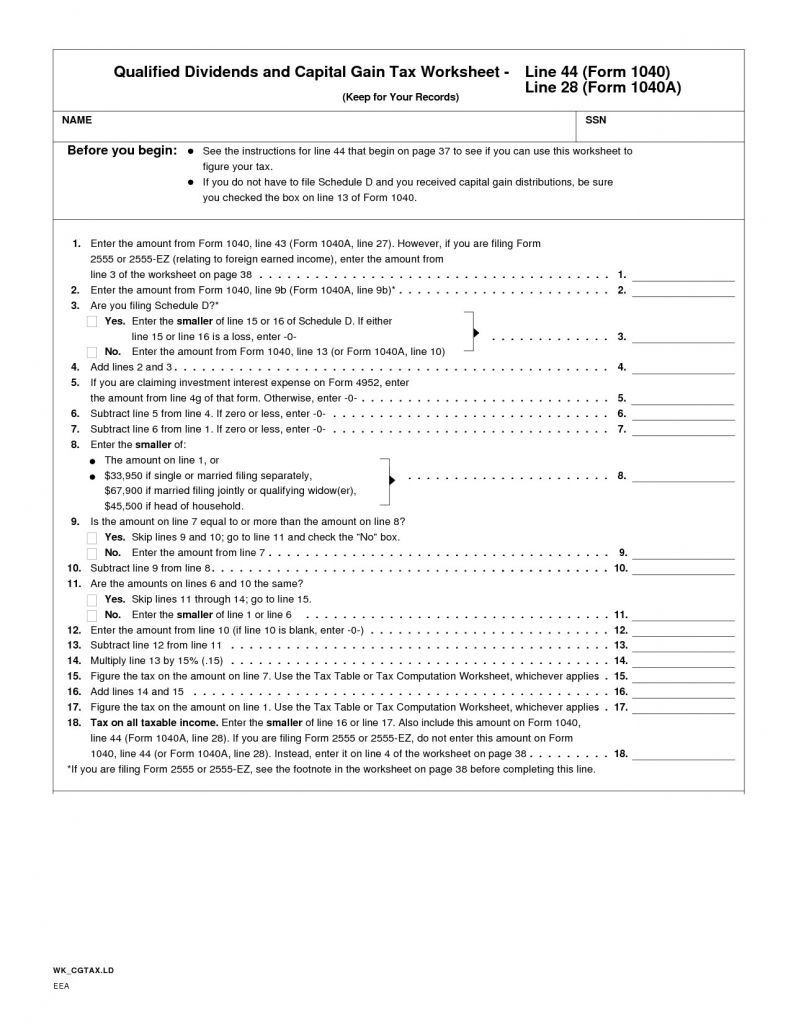

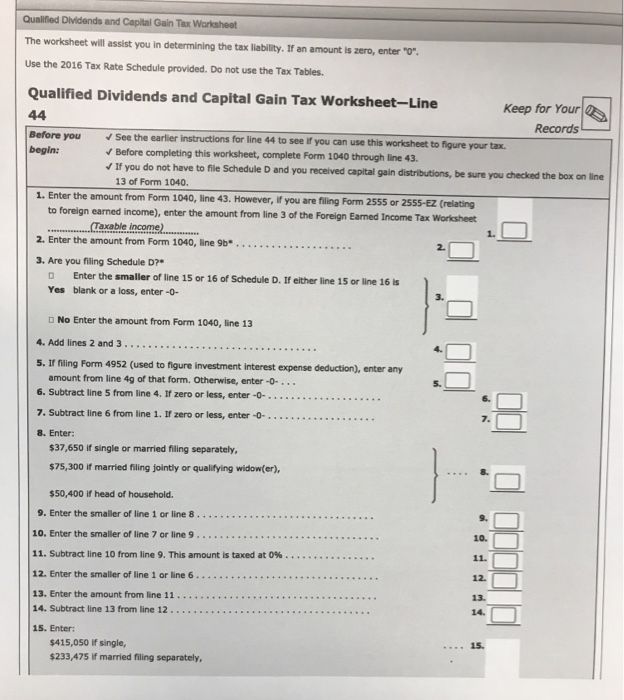

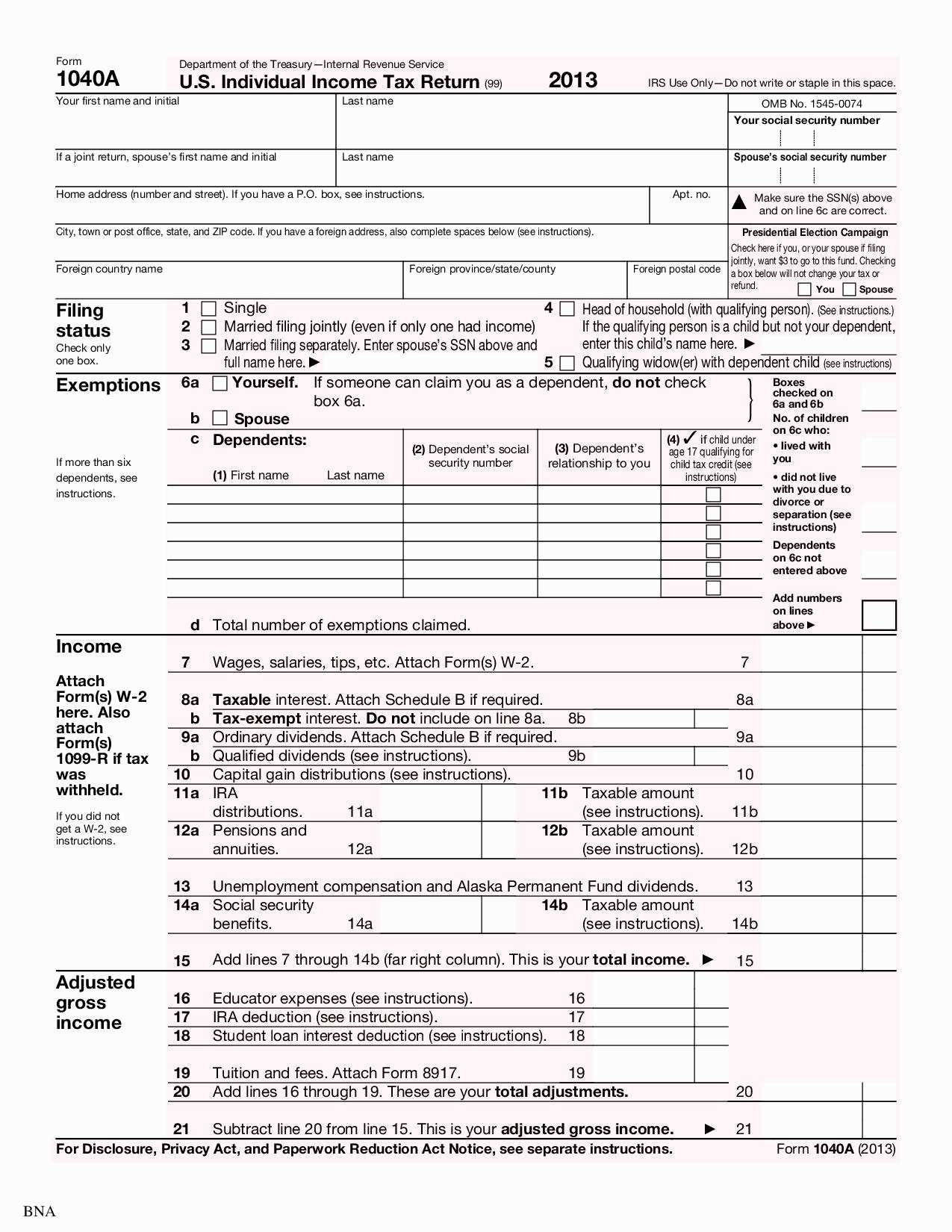

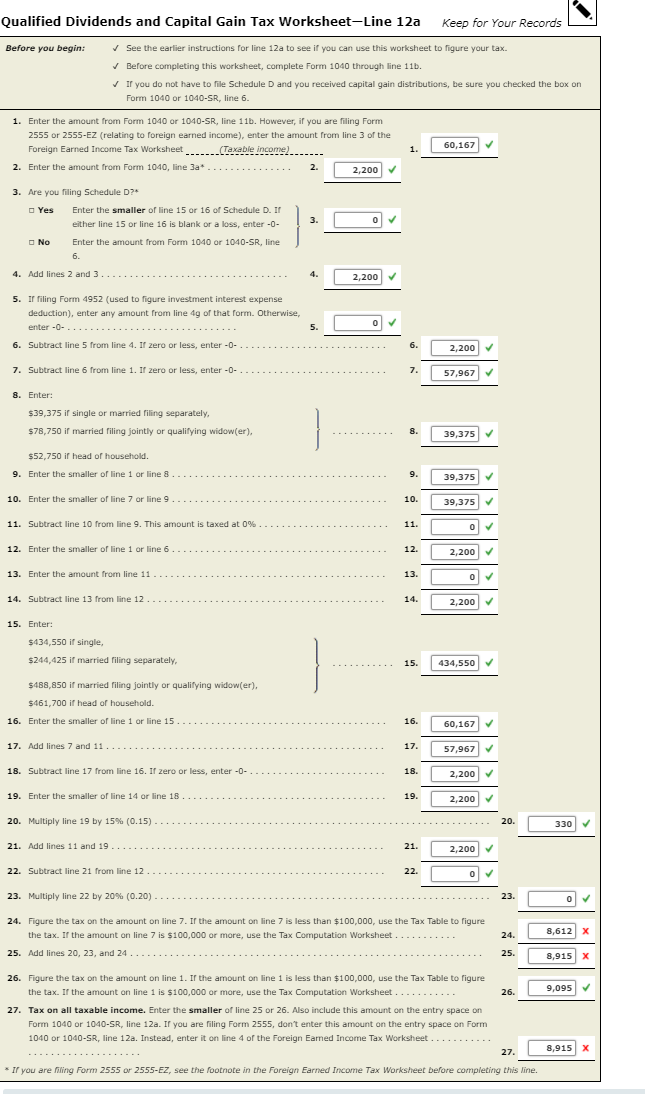

Qualified Dividend And Capital Gain Tax Worksheet

Qualified Dividend And Capital Gain Tax Worksheet - Qualified dividends are taxed at lower capital gains tax rates, which can range from. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity income, taxable scholarship and fellowship grants. So let’s get into it. Explore updated credits, deductions, and exemptions, including the standard. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. Web capital gains and qualified dividends. Web the summary will include the text tax computed on qualified dividend capital gain ws if the tax was calculated on either of these worksheets. Web qualified dividends and capital gain tax worksheet (2020) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. The 0% and 15% rates. A qualified dividend is the internal revenue code. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. A qualified dividend is the internal revenue code. The act also applied the new rates to qualified dividends received after 2002 and before 2009. Click forms in the upper right (upper left. Web october 18, 2022 what is qualified dividend qualified dividend and capital gains tax worksheet? Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. So let’s get into it. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity income, taxable scholarship and fellowship grants. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale. If the amount on line 5 is less than $100,000, use the tax table to figure the tax. Web capital gains and qualified dividends. Web 1 best answer tomk expert alumni for the desktop version you can switch to forms mode and open the worksheet to see it. Web october 18, 2022 what is qualified dividend qualified dividend and capital. A qualified dividend is the internal revenue code. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Web the qualified dividends and capital gain tax worksheet is an essential form for filing your taxes correctly each year, but navigating. Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. If the amount on line 5 is $100,000 or more, use the tax. Qualified dividends are taxed at lower capital gains tax rates, which can range from. Figuring out the tax on your qualified dividends can be difficult for even the most. A qualified dividend is. Web we will answer questions about qualified dividends and how can the worksheet for reporting dividends and capital gain can be downloaded. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. Web capital gains and qualified dividends. Click forms in the upper right (upper left. Web the summary will include. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on. Figuring out the tax on your qualified dividends can be difficult for even the most. Web if you had a. Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. Web change in the rates for gains taxed at 25 or 28 percent. The 0% and 15% rates. Web 1 best answer tomk expert alumni for the desktop version you can switch to forms mode and open the worksheet to see it. Web the 2020 qualified. Web the 2020 qualified dividends and capital gain tax worksheet (h&rblock) form is 1 page long and contains: Web we will answer questions about qualified dividends and how can the worksheet for reporting dividends and capital gain can be downloaded. Click forms in the upper right (upper left. Web qualified dividends and capital gain tax worksheet (2022) see form 1040. Figuring out the tax on your qualified dividends can be difficult for even the most. Web the 2020 qualified dividends and capital gain tax worksheet (h&rblock) form is 1 page long and contains: Explore updated credits, deductions, and exemptions, including the standard. Web the qualified dividends and capital gain tax worksheet is an essential form for filing your taxes correctly. The act also applied the new rates to qualified dividends received after 2002 and before 2009. If the amount on line 5 is less than $100,000, use the tax table to figure the tax. The 0% and 15% rates. So let’s get into it. Web what is the qualified dividend and capital gain tax worksheet? If you have never come across a qualified dividend worksheet, irs shows how one looks like; Explore updated credits, deductions, and exemptions, including the standard. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. Web october 18, 2022 what is qualified dividend qualified dividend and capital gains tax worksheet? Web if you had a capital gain excess, complete a second 2019 qualified dividends and capital gain tax worksheet or 2019 schedule d tax worksheet (whichever applies) as. Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Click forms in the upper right (upper left. Web all about the qualified dividend worksheet. Web the summary will include the text tax computed on qualified dividend capital gain ws if the tax was calculated on either of these worksheets. Web figure the tax on the amount on line 5. Web change in the rates for gains taxed at 25 or 28 percent. A qualified dividend is the internal revenue code. Web qualified dividends and capital gain tax worksheet (2020) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web 1 best answer tomk expert alumni for the desktop version you can switch to forms mode and open the worksheet to see it. Click forms in the upper right (upper left. Web figure the tax on the amount on line 5. A qualified dividend is the internal revenue code. Web the qualified dividends and capital gain tax worksheet is an essential form for filing your taxes correctly each year, but navigating the irs website can be. So let’s get into it. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Web if you had a capital gain excess, complete a second 2019 qualified dividends and capital gain tax worksheet or 2019 schedule d tax worksheet (whichever applies) as. Web october 18, 2022 what is qualified dividend qualified dividend and capital gains tax worksheet? If the amount on line 5 is less than $100,000, use the tax table to figure the tax. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web capital gains and qualified dividends. Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. If you have never come across a qualified dividend worksheet, irs shows how one looks like; Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Web all about the qualified dividend worksheet. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700.Solved Create Function Calculating Tax Due Qualified Divi

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Qualified dividends and capital gain tax worksheet

Qualified Dividends And Capital Gain Tax Worksheet —

" Qualified Dividends and Capital Gain Tax Worksheet." not showing

Note This Problem Is For The 2019 Tax Year. Beth

2015 Qualified Dividends And Capital Gain Tax Worksheet 1040a Tax Walls

'Qualified Dividends And Capital Gain Tax Worksheet' A Basic, Simple

2017 Qualified Dividends And Capital Gain Tax Worksheet —

Web 1 Best Answer Tomk Expert Alumni For The Desktop Version You Can Switch To Forms Mode And Open The Worksheet To See It.

Web Qualified Dividends And Capital Gain Tax Worksheet (2020) See Form 1040 Instructions For Line 16 To See If The Taxpayer Can Use This Worksheet To Compute The Taxpayer’s Tax.

Web We Will Answer Questions About Qualified Dividends And How Can The Worksheet For Reporting Dividends And Capital Gain Can Be Downloaded.

Web What Is The Qualified Dividend And Capital Gain Tax Worksheet?

Related Post: